Samply Resume Equity Trader - Panoramic Resumes, LLC

Samply Resume Equity Trader - Panoramic Resumes, LLC

Samply Resume Equity Trader - Panoramic Resumes, LLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

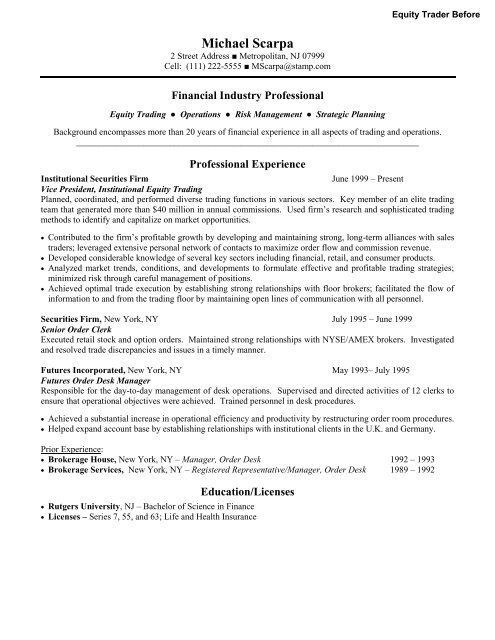

<strong>Equity</strong> <strong>Trader</strong> BeforeMichael Scarpa2 Street Address ■ Metropolitan, NJ 07999Cell: (111) 222-5555 ■ MScarpa@stamp.comFinancial Industry Professional<strong>Equity</strong> Trading ● Operations ● Risk Management ● Strategic PlanningBackground encompasses more than 20 years of financial experience in all aspects of trading and operations._____________________________________________________________________________Professional ExperienceInstitutional Securities FirmJune 1999 – PresentVice President, Institutional <strong>Equity</strong> TradingPlanned, coordinated, and performed diverse trading functions in various sectors. Key member of an elite tradingteam that generated more than $40 million in annual commissions. Used firm’s research and sophisticated tradingmethods to identify and capitalize on market opportunities. Contributed to the firm’s profitable growth by developing and maintaining strong, long-term alliances with salestraders; leveraged extensive personal network of contacts to maximize order flow and commission revenue. Developed considerable knowledge of several key sectors including financial, retail, and consumer products. Analyzed market trends, conditions, and developments to formulate effective and profitable trading strategies;minimized risk through careful management of positions. Achieved optimal trade execution by establishing strong relationships with floor brokers; facilitated the flow ofinformation to and from the trading floor by maintaining open lines of communication with all personnel.Securities Firm, New York, NY July 1995 – June 1999Senior Order ClerkExecuted retail stock and option orders. Maintained strong relationships with NYSE/AMEX brokers. Investigatedand resolved trade discrepancies and issues in a timely manner.Futures Incorporated, New York, NY May 1993– July 1995Futures Order Desk ManagerResponsible for the day-to-day management of desk operations. Supervised and directed activities of 12 clerks toensure that operational objectives were achieved. Trained personnel in desk procedures. Achieved a substantial increase in operational efficiency and productivity by restructuring order room procedures. Helped expand account base by establishing relationships with institutional clients in the U.K. and Germany.Prior Experience: Brokerage House, New York, NY – Manager, Order Desk 1992 – 1993 Brokerage Services, New York, NY – Registered Representative/Manager, Order Desk 1989 – 1992Education/Licenses Rutgers University, NJ – Bachelor of Science in Finance Licenses – Series 7, 55, and 63; Life and Health Insurance

<strong>Equity</strong> <strong>Trader</strong> AfterMICHAEL SCARPA2 Street Address • Metropolitan, NJ 07999 • 101.222.5555 • MScarpa@stamp.comFINANCIAL INDUSTRY PROFESSIONALHighly accomplished equity trader with a stellar client service recordUnchallenged track record for individual daily trading volumeExperienced: Over 20 years in the financial industry working in all aspects of trading and operations with expertise inkey sectors including financial, retail and consumer products. An effective communicator and astute problem-solver withstrong decision-making and managerial abilities.Income Producing: A proven track record of increasing revenue through market knowledge, keen analytical ability, andstrong relationships with colleagues. Maintained a profitable, above average customer retention rate of 80%.AREAS OF EXPERTISE<strong>Equity</strong> Trading • Capital Accountability • Strategic Planning • Risk Management • Operations ManagementPROFESSIONAL EXPERIENCEVICE PRESIDENT, INSTITUTIONAL EQUITY TRADINGInstitutional Securities Firm, New York, NYJune 1999 to PresentPlanned, coordinated, and performed diverse trading functions in various sectors. Utilized firm’s research andsophisticated trading methods to identify and capitalize on market opportunities and minimize risk. Elevated to an elite trading team that subsequently generated in excess of $40 million in annual commissions. Contributed to the firm’s profitable growth by developing and maintaining strong, long-term alliances with salestraders representing the industry’s largest and most savvy hedge fund managers. Leveraged extensive personal network of contacts to maximize order flow and commission revenue. Built a reputation for conducting business with the highest ethical standards and respect for client financial interests. Analyzed market trends, conditions, and developments to formulate effective and profitable trading strategies;minimized risk through careful management of positions. Achieved optimal trade execution by establishing strong relationships with floor brokers Facilitated information flow to and from the trading floor by maintaining open lines of communication with all staff.SENIOR ORDER CLERKSecurities Firm, New York, NY July 1995 – June 1999 Initiated and successfully negotiated a 6% fee with a new execution firm resulting in an annual savings of 50%.FUTURES ORDER DESK MANAGER,Futures Incorporated, New York, NY May 1993 – July 1995 Restructured order room procedures, reducing “grace period” time by 50% from three to one and one half minutes.MANAGER, ORDER DESK, Brokerage House, New York, NY 1992 - 1993MANAGER, ORDER DESK, Brokerage Services, New York, NY 1989 - 1992EDUCATION AND CREDENTIALSBachelor of Science degree, Finance, Rutgers University, NJLicenses: Series 7, 55, and 63; Life and Health Insurance