LICENSE TO CASH IN? - Weed

LICENSE TO CASH IN? - Weed

LICENSE TO CASH IN? - Weed

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

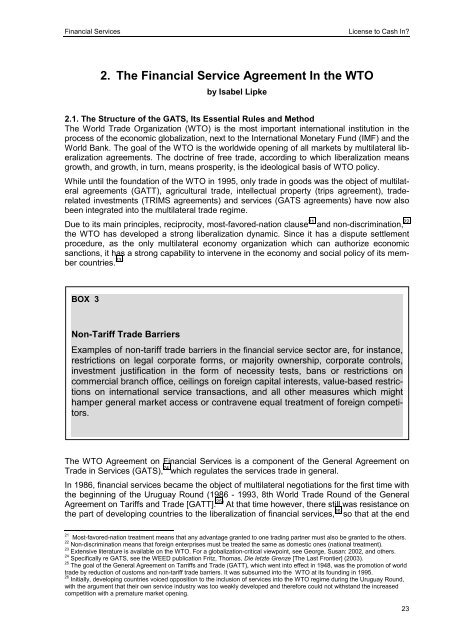

Financial ServicesLicense to Cash In?2. The Financial Service Agreement In the W<strong>TO</strong>by Isabel Lipke2.1. The Structure of the GATS, Its Essential Rules and MethodThe World Trade Organization (W<strong>TO</strong>) is the most important international institution in theprocess of the economic globalization, next to the International Monetary Fund (IMF) and theWorld Bank. The goal of the W<strong>TO</strong> is the worldwide opening of all markets by multilateral liberalizationagreements. The doctrine of free trade, according to which liberalization meansgrowth, and growth, in turn, means prosperity, is the ideological basis of W<strong>TO</strong> policy.While until the foundation of the W<strong>TO</strong> in 1995, only trade in goods was the object of multilateralagreements (GATT), agricultural trade, intellectual property (trips agreement), traderelatedinvestments (TRIMS agreements) and services (GATS agreements) have now alsobeen integrated into the multilateral trade regime.Due to its main principles, reciprocity, most-favored-nation clause 21 and non-discrimination, 22the W<strong>TO</strong> has developed a strong liberalization dynamic. Since it has a dispute settlementprocedure, as the only multilateral economy organization which can authorize economicsanctions, it has a strong capability to intervene in the economy and social policy of its membercountries. 23.BOX 3Non-Tariff Trade BarriersExamples of non-tariff trade barriers in the financial service sector are, for instance,restrictions on legal corporate forms, or majority ownership, corporate controls,investment justification in the form of necessity tests, bans or restrictions oncommercial branch office, ceilings on foreign capital interests, value-based restrictionson international service transactions, and all other measures which mighthamper general market access or contravene equal treatment of foreign competitors.The W<strong>TO</strong> Agreement on Financial Services is a component of the General Agreement onTrade in Services (GATS), 24 which regulates the services trade in general.In 1986, financial services became the object of multilateral negotiations for the first time withthe beginning of the Uruguay Round (1986 - 1993, 8th World Trade Round of the GeneralAgreement on Tariffs and Trade [GATT]. 25) At that time however, there still was resistance onthe part of developing countries to the liberalization of financial services, 26 so that at the end21 Most-favored-nation treatment means that any advantage granted to one trading partner must also be granted to the others.22 Non-discrimination means that foreign enterprises must be treated the same as domestic ones (national treatment).23 Extensive literature is available on the W<strong>TO</strong>. For a globalization-critical viewpoint, see George, Susan: 2002, and others.24 Specifically re GATS, see the WEED publication Fritz, Thomas, Die letzte Grenze [The Last Frontier] (2003).25 The goal of the General Agreement on Tarriffs and Trade (GATT), which went into effect in 1948, was the promotion of worldtrade by reduction of customs and non-tariff trade barriers. It was subsumed into the W<strong>TO</strong> at its founding in 1995.26 Initially, developing countries voiced opposition to the inclusion of services into the W<strong>TO</strong> regime during the Uruguay Round,with the argument that their own service industry was too weakly developed and therefore could not withstand the increasedcompetition with a premature market opening.23