LICENSE TO CASH IN? - Weed

LICENSE TO CASH IN? - Weed

LICENSE TO CASH IN? - Weed

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

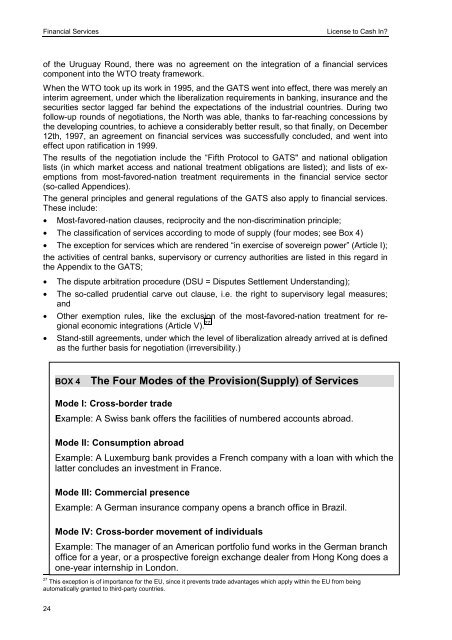

Financial ServicesLicense to Cash In?of the Uruguay Round, there was no agreement on the integration of a financial servicescomponent into the W<strong>TO</strong> treaty framework.When the W<strong>TO</strong> took up its work in 1995, and the GATS went into effect, there was merely aninterim agreement, under which the liberalization requirements in banking, insurance and thesecurities sector lagged far behind the expectations of the industrial countries. During twofollow-up rounds of negotiations, the North was able, thanks to far-reaching concessions bythe developing countries, to achieve a considerably better result, so that finally, on December12th, 1997, an agreement on financial services was successfully concluded, and went intoeffect upon ratification in 1999.The results of the negotiation include the “Fifth Protocol to GATS" and national obligationlists (in which market access and national treatment obligations are listed); and lists of exemptionsfrom most-favored-nation treatment requirements in the financial service sector(so-called Appendices).The general principles and general regulations of the GATS also apply to financial services.These include:• Most-favored-nation clauses, reciprocity and the non-discrimination principle;• The classification of services according to mode of supply (four modes; see Box 4)• The exception for services which are rendered “in exercise of sovereign power” (Article I);the activities of central banks, supervisory or currency authorities are listed in this regard inthe Appendix to the GATS;• The dispute arbitration procedure (DSU = Disputes Settlement Understanding);• The so-called prudential carve out clause, i.e. the right to supervisory legal measures;and• Other exemption rules, like the exclusion of the most-favored-nation treatment for regionaleconomic integrations (Article V). 27• Stand-still agreements, under which the level of liberalization already arrived at is definedas the further basis for negotiation (irreversibility.)BOX 4The Four Modes of the Provision(Supply) of ServicesMode I: Cross-border tradeExample: A Swiss bank offers the facilities of numbered accounts abroad.Mode II: Consumption abroadExample: A Luxemburg bank provides a French company with a loan with which thelatter concludes an investment in France.Mode III: Commercial presenceExample: A German insurance company opens a branch office in Brazil.Mode IV: Cross-border movement of individualsExample: The manager of an American portfolio fund works in the German branchoffice for a year, or a prospective foreign exchange dealer from Hong Kong does aone-year internship in London.27 This exception is of importance for the EU, since it prevents trade advantages which apply within the EU from beingautomatically granted to third-party countries.24