The Evolving Role of China and India in the Global ... - ResearchGate

The Evolving Role of China and India in the Global ... - ResearchGate

The Evolving Role of China and India in the Global ... - ResearchGate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

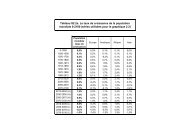

P.R. Lane, S.L. SchmuklerTable 1 Composition <strong>of</strong> foreign assets <strong>and</strong> liabilities, 2004<strong>Ch<strong>in</strong>a</strong><strong>India</strong>Assets Liabilities Assets LiabilitiesPortfolio equity 0.3 2.9 0.1 9.1FDI 1.9 25.7 1.3 6.4Private debt 13.3 11.9 2.6 17.0Reserves 31.8 18.3Total 47.3 40.5 22.3 32.6Variables are expressed as a percentage <strong>of</strong> GDP. Source: Authors’ calculations, based on data setconstructed by Lane <strong>and</strong> Milesi–Ferretti (2007).300%250%200%150%100%50%0%<strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong><strong>Ch<strong>in</strong>a</strong><strong>India</strong>1985198619871988198919901991199219931994199519961998199920002001200220032004300%250%200%150%100%50%0%East Asia <strong>and</strong> G7G7East Asia1985198619871988198919901991199219931994199519961998199920002001200220032004300%250%200%150%100%50%0%Eastern Europe <strong>and</strong> Lat<strong>in</strong> AmericaLat<strong>in</strong> AmericaEastern Europe1985198619871988198919901991199219931994199519961998199920002001200220032004Fig. 2 International f<strong>in</strong>ancial <strong>in</strong>tegration. Sum <strong>of</strong> foreign assets <strong>and</strong> liabilities expressed as a ratio to GDP.East Asia is <strong>the</strong> average <strong>of</strong> Indonesia, Korea, Malaysia, <strong>and</strong> Thail<strong>and</strong>. G7 is <strong>the</strong> average <strong>of</strong> Canada,France, Germany, Italy, Japan, UK, <strong>and</strong> USA. Lat<strong>in</strong> America is <strong>the</strong> average <strong>of</strong> Argent<strong>in</strong>a, Brazil, Chile,<strong>and</strong> Mexico. Eastern Europe is <strong>the</strong> average <strong>of</strong> Czech Republic, Hungary, <strong>and</strong> Pol<strong>and</strong>. <strong>The</strong> series for <strong>the</strong>regions are weighted averages where <strong>the</strong> weights are <strong>the</strong> countries’ GDPs as a fraction <strong>of</strong> <strong>the</strong> region’sGDP. Source: Authors’ calculations draw<strong>in</strong>g on <strong>the</strong> data set constructed by Lane <strong>and</strong> Milesi-Ferretti(2007)

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial systemTable 2 Asymmetries <strong>in</strong> <strong>the</strong> <strong>in</strong>ternational balance sheet, 2004<strong>Ch<strong>in</strong>a</strong><strong>India</strong>Net Portfolio Equity −2.6 −9.0Net FDI −23.8 −5.0Net Equity −26.5 −14.1Net Private Debt 1.5 −14.6Reserves 31.8 18.3Net Debt 33.3 3.7Variables are expressed as a percentage <strong>of</strong> GDP. Net private debt equals non-reserve debt assets m<strong>in</strong>usdebt liabilities. Source: Authors’ calculations, based on dataset constructed by Lane <strong>and</strong> Milesi–Ferretti(2007).Third, <strong>the</strong> net foreign asset positions <strong>of</strong> <strong>the</strong>se countries are more positive than mightbe expected for countries at <strong>the</strong>ir level <strong>of</strong> development.2 <strong>The</strong> domestic f<strong>in</strong>ancial sector <strong>and</strong> <strong>in</strong>ternational f<strong>in</strong>ancial <strong>in</strong>tegration<strong>The</strong> stylized facts described <strong>in</strong> <strong>the</strong> previous section can be expla<strong>in</strong>ed by developments<strong>and</strong> policies related to <strong>Ch<strong>in</strong>a</strong>’s <strong>and</strong> <strong>India</strong>’s domestic f<strong>in</strong>ancial sectors. Tounderst<strong>and</strong> <strong>the</strong> l<strong>in</strong>ks between <strong>the</strong> domestic sector <strong>and</strong> cross-border asset trade <strong>and</strong><strong>in</strong>ternational balance sheets, we summarize very succ<strong>in</strong>ctly <strong>the</strong> trends <strong>in</strong> three <strong>in</strong>terrelatedaspects <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial sector: f<strong>in</strong>ancial liberalization <strong>and</strong> exchange ratepolicies; <strong>the</strong> evolution (<strong>and</strong> state) <strong>of</strong> <strong>the</strong> domestic f<strong>in</strong>ancial sector; <strong>and</strong> <strong>the</strong> patterns <strong>in</strong>sav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment. We conduct <strong>the</strong> analysis by turn<strong>in</strong>g to <strong>the</strong> particulardevelopments <strong>in</strong> <strong>the</strong> f<strong>in</strong>ancial sectors <strong>of</strong> each country.2.1 <strong>Ch<strong>in</strong>a</strong><strong>Ch<strong>in</strong>a</strong> has adopted a gradualist approach to f<strong>in</strong>ancial liberalization, <strong>in</strong>clud<strong>in</strong>g <strong>the</strong>capital account, as summarized <strong>in</strong> Appendix Table 3. Dur<strong>in</strong>g <strong>the</strong> 1980s <strong>and</strong> 1990s,<strong>the</strong> ma<strong>in</strong> focus was on promot<strong>in</strong>g <strong>in</strong>ward direct <strong>in</strong>vestment flows (FDI). Investmentby foreigners <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>’s stock markets has been permitted s<strong>in</strong>ce 1992 throughmultiple share classes, but access is still restricted. Debt <strong>in</strong>flows have been especiallyrestricted, as have been private capital outflows. This has allowed <strong>the</strong> state to control<strong>the</strong> domestic bank<strong>in</strong>g sector by, for example, sett<strong>in</strong>g ceil<strong>in</strong>gs on <strong>in</strong>terest rates.<strong>Ch<strong>in</strong>a</strong>’s f<strong>in</strong>ancial liberalization policies have been <strong>in</strong>tr<strong>in</strong>sically l<strong>in</strong>ked to itsexchange rate regime. Dur<strong>in</strong>g 1995–2005, <strong>the</strong> renm<strong>in</strong>bi (RMB) was de facto peggedto <strong>the</strong> US dollar. A stable value <strong>of</strong> <strong>the</strong> exchange rate has been viewed as a domesticnom<strong>in</strong>al anchor <strong>and</strong> an <strong>in</strong>strument to promote trade <strong>and</strong> FDI. <strong>The</strong> tw<strong>in</strong> goals <strong>of</strong>ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g a stable exchange rate <strong>and</strong> an autonomous monetary policy havecontributed to <strong>the</strong> ongo<strong>in</strong>g retention <strong>of</strong> extensive capital controls.<strong>The</strong>se policies have had a large impact on <strong>Ch<strong>in</strong>a</strong>’s <strong>in</strong>ternational balance sheet. On<strong>the</strong> liabilities side, <strong>the</strong> scale <strong>of</strong> private capital <strong>in</strong>flows can partly be attributed tospeculative <strong>in</strong>flows <strong>in</strong> anticipation <strong>of</strong> RMB appreciation (Prasad <strong>and</strong> Wei 2007). 6 To6 Prasad <strong>and</strong> Wei (2007) highlight that unrecorded capital <strong>in</strong>flows have been grow<strong>in</strong>g <strong>in</strong> recent years, asforeign <strong>in</strong>vestors seek to evade limits on <strong>the</strong>ir ability to acquire RMB assets <strong>in</strong> anticipation <strong>of</strong> futurecurrency appreciation.

P.R. Lane, S.L. SchmuklerTop Reserve Asset HoldersTop Non-Reserve Asset Holders1 Japan2 <strong>Ch<strong>in</strong>a</strong>3 Taiwan (<strong>Ch<strong>in</strong>a</strong>)4 Korea5 <strong>India</strong>6 Hong Kong (<strong>Ch<strong>in</strong>a</strong>)7 Russia8 S<strong>in</strong>gapore9 US10 MalaysiaO<strong>the</strong>rs6.0%3.3%21.7%16.0%34.9%1 US2 UK3 Germany4 France5 Japan67 Ne<strong>the</strong>rl<strong>and</strong>s8 Switzerl<strong>and</strong>9 Italy10 Irel<strong>and</strong>23 <strong>Ch<strong>in</strong>a</strong>49 <strong>India</strong>O<strong>the</strong>rs0.6%0.1%8.6%18.5%14.3%22.7%0% 10% 20% 30% 40%0% 5% 10% 15% 20% 25%Top Portfolio Equity Liability HoldersTop FDI Liablity Holders1 US23 UK4 Japan5 Irel<strong>and</strong>6 France7 Switzerl<strong>and</strong>8 Germany9 Ne<strong>the</strong>rl<strong>and</strong>s10 Canada22 <strong>India</strong>24 <strong>Ch<strong>in</strong>a</strong>O<strong>the</strong>rs0.6%0.6%14.3%20.6%20.1%1 US2 Luxembourg3 France4 UK5 Germany6 Ne<strong>the</strong>rl<strong>and</strong>s7 <strong>Ch<strong>in</strong>a</strong>8 Belgium9 Hong Kong (<strong>Ch<strong>in</strong>a</strong>)10 Spa<strong>in</strong>36 <strong>India</strong>O<strong>the</strong>rs0.4%4.1%7.8%22.0%31.7%0% 5% 10% 15% 20% 25%0% 10% 20% 30%Top Debt Liability HoldersShare <strong>of</strong> World GDP1 US2 UK3 Germany4 France5 Italy6 Japan7 Ne<strong>the</strong>rl<strong>and</strong>s8 Spa<strong>in</strong>9 Irel<strong>and</strong>10 Belgium22 <strong>Ch<strong>in</strong>a</strong>32 <strong>India</strong>O<strong>the</strong>rs21.5%17.0%0.6%0.3% 23.7%1 United States2 Japan3 Germany4 United K<strong>in</strong>gdom5 France6 <strong>Ch<strong>in</strong>a</strong>7 Italy8 Spa<strong>in</strong>9 Canada10 <strong>India</strong>O<strong>the</strong>rs1.7%4.7%11.2%28.3%28.5%0% 5% 10% 15% 20% 25%0% 5% 10% 15% 20% 25% 30%Fig. 3 Top foreign asset <strong>and</strong> liability holders, 2004. <strong>The</strong> figures show <strong>the</strong> hold<strong>in</strong>gs <strong>of</strong> foreign assets <strong>and</strong>liabilities, by type <strong>of</strong> asset <strong>and</strong> liability, <strong>of</strong> <strong>the</strong> ten largest holders, <strong>Ch<strong>in</strong>a</strong>, <strong>India</strong>, <strong>and</strong> <strong>the</strong> sum <strong>of</strong> all <strong>the</strong> o<strong>the</strong>rcountries, as a percentage <strong>of</strong> total hold<strong>in</strong>gs <strong>of</strong> that type <strong>of</strong> asset or liability. It also shows <strong>the</strong> share <strong>of</strong> worldGDP <strong>of</strong> <strong>the</strong> ten largest economies <strong>and</strong> <strong>India</strong>. Hold<strong>in</strong>gs are expressed as a percentage <strong>of</strong> <strong>the</strong> sum <strong>of</strong> <strong>the</strong>hold<strong>in</strong>gs <strong>of</strong> all <strong>the</strong> countries <strong>in</strong> <strong>the</strong> data set. Numbers next to hold<strong>in</strong>gs show position <strong>in</strong> world rank<strong>in</strong>g.Source: Authors’ calculations draw<strong>in</strong>g on <strong>the</strong> data set constructed by Lane <strong>and</strong> Milesi-Ferretti (2007)avoid currency appreciation, <strong>the</strong> counterpart <strong>of</strong> high capital <strong>in</strong>flows has been <strong>the</strong>rapid accumulation <strong>of</strong> external reserves <strong>and</strong> expansion <strong>in</strong> monetary aggregates. Inturn, <strong>the</strong> susta<strong>in</strong>ability <strong>of</strong> reserves accumulation has been facilitated by <strong>the</strong>regulation <strong>of</strong> <strong>in</strong>terest rates that has kept <strong>the</strong> cost <strong>of</strong> sterilization down (Bai 2006).<strong>The</strong> gradual liberalization <strong>of</strong> <strong>the</strong> domestic f<strong>in</strong>ancial sector has been accompanied by asharp deepen<strong>in</strong>g <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial development <strong>in</strong>dicators <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> dur<strong>in</strong>g <strong>the</strong> last

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial system15 years. However, <strong>the</strong> bank<strong>in</strong>g sector rema<strong>in</strong>s excessively focused on lend<strong>in</strong>g to stateownedenterprises <strong>and</strong> does not appear to be an adequate provider <strong>of</strong> credit to privateenterprises <strong>and</strong> households. An <strong>in</strong>terest rate ceil<strong>in</strong>g also distorts <strong>the</strong> behavior <strong>of</strong> banks<strong>and</strong> limits <strong>the</strong> attractiveness <strong>of</strong> banks to domestic <strong>and</strong> foreign <strong>in</strong>vestors (Bai 2006).Despite <strong>the</strong>se deficiencies, <strong>the</strong> most important supplier <strong>of</strong> external f<strong>in</strong>ance to firms isstill <strong>the</strong> bank<strong>in</strong>g sector. O<strong>the</strong>r important channels are FDI—especially for privatesector enterprises—<strong>and</strong> <strong>the</strong> state budget for state-owned enterprises (Allen et al. 2007).With respect to domestic capital markets, <strong>the</strong> Ch<strong>in</strong>ese corporate bond marketrema<strong>in</strong>s underdeveloped, while <strong>the</strong> large overhang <strong>of</strong> government-owned sharesimplies that tradable shares are only about one-third <strong>of</strong> total stock marketcapitalization. In addition, equity pric<strong>in</strong>g is perceived as open to manipulation.Fur<strong>the</strong>rmore, corporate governance <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> rema<strong>in</strong>s far from <strong>in</strong>ternational st<strong>and</strong>ards.This contrasts with <strong>the</strong> focus <strong>of</strong> <strong>the</strong> Ch<strong>in</strong>ese government on guarantee<strong>in</strong>gsafety for direct <strong>in</strong>vestment. <strong>The</strong> difference <strong>in</strong> <strong>the</strong> protection <strong>of</strong> foreigners’ propertyrights between direct <strong>and</strong> portfolio <strong>in</strong>vestments has made FDI much more attractivethan portfolio equity for foreign <strong>in</strong>vestors want<strong>in</strong>g to participate <strong>in</strong> <strong>the</strong> Ch<strong>in</strong>esemarket. 7<strong>The</strong> evolution <strong>of</strong> <strong>the</strong> domestic f<strong>in</strong>ancial sector helps expla<strong>in</strong> some elements <strong>of</strong><strong>Ch<strong>in</strong>a</strong>’s <strong>in</strong>tegration <strong>in</strong>to <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancial system. In particular, <strong>the</strong> problems<strong>in</strong> <strong>the</strong> bank<strong>in</strong>g system (<strong>the</strong> concentration <strong>of</strong> its loan book on state-owned enterprises,<strong>the</strong> significant number <strong>of</strong> non-perform<strong>in</strong>g loans, <strong>and</strong> solvency concerns) havelimited <strong>the</strong> will<strong>in</strong>gness <strong>of</strong> <strong>the</strong> authorities to allow Ch<strong>in</strong>ese banks to raise externalfunds or act as <strong>the</strong> broker for <strong>the</strong> acquisition <strong>of</strong> foreign assets by domestic entities(Setser 2006). 8 In addition, <strong>the</strong> distorted nature <strong>of</strong> <strong>the</strong> Ch<strong>in</strong>ese stock market meansthat portfolio equity <strong>in</strong>flows would have been limited even under a more liberalexternal account regime. Similarly, <strong>the</strong> domestic bond market is also at a veryprimitive stage <strong>of</strong> development, while <strong>the</strong> capacity <strong>of</strong> domestic entities to undertake<strong>in</strong>ternational bond issues rema<strong>in</strong>s heavily circumscribed.Ano<strong>the</strong>r channel l<strong>in</strong>k<strong>in</strong>g <strong>the</strong> domestic f<strong>in</strong>ancial system with <strong>the</strong> <strong>in</strong>ternationalbalance sheet is through domestic sav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment, with <strong>the</strong> net difference <strong>in</strong>turn determ<strong>in</strong><strong>in</strong>g <strong>the</strong> current account balance. Kuijs (2005, 2006) argues that <strong>the</strong>extraord<strong>in</strong>arily high aggregate sav<strong>in</strong>gs rate <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> is primarily driven by corporatesav<strong>in</strong>gs. 9 <strong>The</strong> high level <strong>of</strong> enterprise sav<strong>in</strong>g required to f<strong>in</strong>ance high levels <strong>of</strong><strong>in</strong>vestment has been facilitated by a low-dividend policy. In <strong>the</strong> extreme case <strong>of</strong>many state-owned enterprises, <strong>the</strong>re are no dividends at all. In some cases, <strong>the</strong>7 This is not to deny that poor protection <strong>of</strong> <strong>in</strong>tellectual property rights <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> means that much <strong>of</strong> <strong>the</strong><strong>in</strong>ward FDI is conf<strong>in</strong>ed to labor-<strong>in</strong>tensive sectors that do not rely on proprietary technologies.8 An <strong>in</strong>terest<strong>in</strong>g exception is that domestic residents are permitted to hold dollar deposits <strong>in</strong> domesticbanks. In 2001, follow<strong>in</strong>g a fur<strong>the</strong>r relaxation, a substantial portion <strong>of</strong> <strong>the</strong>se dollar deposits were employedto <strong>in</strong>vest <strong>in</strong> B-shares on <strong>the</strong> Ch<strong>in</strong>ese stock market, denom<strong>in</strong>ated <strong>in</strong> foreign currency. See Zhao (2006) <strong>and</strong>Ma <strong>and</strong> McCauley (2002).9 O<strong>the</strong>rs have focused on <strong>the</strong> role <strong>of</strong> household sav<strong>in</strong>gs. But <strong>in</strong> 2005, household sav<strong>in</strong>gs have been similarto that <strong>of</strong> o<strong>the</strong>r develop<strong>in</strong>g countries. For <strong>in</strong>stance, while <strong>the</strong> household sav<strong>in</strong>gs rate <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> may havebeen higher than those <strong>of</strong> OECD economies, it was actually lower than <strong>in</strong> <strong>India</strong>.

P.R. Lane, S.L. Schmuklerreluctance to distribute pr<strong>of</strong>its reflects uncerta<strong>in</strong>ty about ownership structures <strong>and</strong> <strong>the</strong>weak state <strong>of</strong> corporate governance. 10In addition to a low dividend policy, two more factors help expla<strong>in</strong> high enterprisesav<strong>in</strong>g <strong>and</strong> <strong>in</strong>vestment. <strong>The</strong> first is <strong>the</strong> high share <strong>of</strong> <strong>the</strong> <strong>in</strong>dustry sector <strong>in</strong> GDP,associated with higher sav<strong>in</strong>g <strong>and</strong> <strong>in</strong>vestment because <strong>of</strong> its capital <strong>in</strong>tensity. <strong>The</strong>second is <strong>the</strong> ris<strong>in</strong>g pr<strong>of</strong>its <strong>of</strong> Ch<strong>in</strong>ese enterprises <strong>in</strong> <strong>the</strong> last 10 years. <strong>The</strong>se can beexpla<strong>in</strong>ed <strong>in</strong> part by <strong>the</strong> <strong>in</strong>creas<strong>in</strong>g importance <strong>of</strong> private firms <strong>and</strong> <strong>the</strong> <strong>in</strong>creasedefficiency <strong>of</strong> state-owned enterprises (Kuijs 2006).On <strong>the</strong> <strong>in</strong>vestment side, <strong>the</strong> reliance on self-f<strong>in</strong>anc<strong>in</strong>g, <strong>and</strong> <strong>the</strong> lack <strong>of</strong>accountability to shareholders plausibly pushes up <strong>the</strong> <strong>in</strong>vestment rate, withcorporate <strong>in</strong>siders pursu<strong>in</strong>g projects that would not pass <strong>the</strong> return thresholdsdem<strong>and</strong>ed by commercial sources <strong>of</strong> external f<strong>in</strong>ance. 11 In addition, for state-ownedenterprises, access to directed credit from <strong>the</strong> bank<strong>in</strong>g sector allows <strong>the</strong>se firms toma<strong>in</strong>ta<strong>in</strong> higher <strong>in</strong>vestment rates than would o<strong>the</strong>rwise be possible. Fur<strong>the</strong>rmore,restrictions on capital outflows mean that enterprise <strong>in</strong>vestment has largely beenrestricted to domestic projects.In sum, <strong>the</strong> underdevelopment <strong>of</strong> <strong>the</strong> domestic f<strong>in</strong>ancial system may help expla<strong>in</strong><strong>the</strong> high rates <strong>of</strong> both sav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>. <strong>The</strong> net impact on <strong>the</strong> currentaccount is <strong>in</strong> pr<strong>in</strong>ciple ambiguous, s<strong>in</strong>ce f<strong>in</strong>ancial development could reduce bothsav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment rates. However, <strong>the</strong> cross-country empirical evidence<strong>in</strong>dicates that domestic f<strong>in</strong>ancial deepen<strong>in</strong>g lowers <strong>the</strong> sav<strong>in</strong>gs rate <strong>and</strong> <strong>in</strong>creases<strong>in</strong>vestment. 12 Especially <strong>in</strong> comb<strong>in</strong>ation with an open capital account, it is plausiblethat higher-quality domestic f<strong>in</strong>ancial <strong>in</strong>termediation could place greater downwardpressure on sav<strong>in</strong>gs than <strong>in</strong>vestment. In particular, <strong>in</strong>ternational capital funneledthrough domestic banks <strong>and</strong> domestic f<strong>in</strong>ancial markets to high-return domesticprojects may compensate for a reduction <strong>in</strong> <strong>in</strong>vestment <strong>in</strong> those <strong>in</strong>efficiententerprises that are protected by <strong>the</strong> current f<strong>in</strong>ancial system. Moreover, a betterf<strong>in</strong>ancial system could stimulate consumption (by provid<strong>in</strong>g more credit) <strong>and</strong> reduce<strong>the</strong> need for ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g high sav<strong>in</strong>gs levels (ei<strong>the</strong>r for precautionary motives or t<strong>of</strong><strong>in</strong>ance future consumption).2.2 <strong>India</strong><strong>India</strong> suffered a severe f<strong>in</strong>ancial crisis <strong>in</strong> <strong>the</strong> early 1990s, which subsequently led toa broad series <strong>of</strong> reforms. <strong>The</strong> goal was to spur <strong>India</strong>n growth by foster<strong>in</strong>g trade,FDI, <strong>and</strong> portfolio equity flows <strong>and</strong>, at <strong>the</strong> same time, avoid debt flows that wereperceived as be<strong>in</strong>g potentially destabiliz<strong>in</strong>g. In <strong>the</strong> subsequent years, <strong>India</strong> hasundergone extensive but selective liberalization, as summarized <strong>in</strong> Appendix Table 4.But substantial capital controls rema<strong>in</strong> <strong>in</strong> place.10 However, <strong>the</strong> recently-established State Asset Supervision <strong>and</strong> Adm<strong>in</strong>istration Commission (SASAC) isseek<strong>in</strong>g to assert greater control <strong>of</strong> state-owned enterprises, <strong>in</strong>clud<strong>in</strong>g a dem<strong>and</strong> for greater dividendpayments. Naughton (2006) provides an analysis <strong>of</strong> <strong>the</strong> political struggle over control <strong>and</strong> <strong>in</strong>come rights <strong>in</strong><strong>the</strong> state-owned sector.11 Moreover, <strong>the</strong> lack <strong>of</strong> f<strong>in</strong>ancial <strong>in</strong>termediation distorts <strong>in</strong>vestment patterns, with young or pre-natalfirms starved <strong>of</strong> f<strong>in</strong>ance while mature firms <strong>in</strong>efficiently deploy excess cash flows.12 See International Monetary Fund (2005).

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial system<strong>The</strong> discouragement <strong>of</strong> external debt has restricted <strong>the</strong> ability <strong>of</strong> domestic entitiesto issue bonds on <strong>in</strong>ternational markets <strong>and</strong> <strong>the</strong> entry <strong>of</strong> foreign <strong>in</strong>vestors to <strong>the</strong>domestic bond market. 13 Moreover, <strong>the</strong>re are restrictions on purchases by foreigners<strong>in</strong> <strong>the</strong> corporate <strong>and</strong> government bond markets. Hence, <strong>the</strong> market for private bondsrema<strong>in</strong>s underdeveloped.By contrast, <strong>the</strong> approach to equity <strong>in</strong>flows has been much more liberal. Whereasrestrictions on FDI <strong>in</strong>flows have been progressively relaxed, <strong>the</strong> dist<strong>in</strong>ctivecharacteristic <strong>of</strong> equity flows <strong>in</strong>to <strong>India</strong> is not <strong>the</strong> direct <strong>in</strong>vestment, ra<strong>the</strong>r <strong>the</strong>relatively high level <strong>of</strong> portfolio equity f<strong>in</strong>anc<strong>in</strong>g. <strong>India</strong>’s broad domestic<strong>in</strong>stitutional <strong>in</strong>vestor base has facilitated <strong>the</strong> entry <strong>of</strong> foreign <strong>in</strong>stitutional <strong>in</strong>vestors(FIIs) that are permitted to take partial stakes <strong>in</strong> equity <strong>of</strong> quoted <strong>India</strong>n enterprises.As a consequence <strong>of</strong> <strong>the</strong>se restrictions on external transactions <strong>and</strong> o<strong>the</strong>r measures todevelop equity markets, <strong>the</strong> composition <strong>of</strong> capital <strong>in</strong>flows has shifted toward higherequity to debt ratios <strong>of</strong> capital <strong>in</strong>flows <strong>and</strong> firms’ f<strong>in</strong>ancial structures.In terms <strong>of</strong> capital outflows, <strong>the</strong> current constra<strong>in</strong>ts on asset allocation mean that<strong>of</strong>ficial reserves are <strong>the</strong> predom<strong>in</strong>ant component <strong>of</strong> foreign assets. As <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>, <strong>the</strong>de-facto exchange rate/monetary regime seeks to ma<strong>in</strong>ta<strong>in</strong> a stable value <strong>of</strong> <strong>the</strong> rupeeaga<strong>in</strong>st <strong>the</strong> dollar, which provides a nom<strong>in</strong>al anchor <strong>and</strong> is viewed as promot<strong>in</strong>gtrade <strong>and</strong> <strong>in</strong>vestment. <strong>The</strong> exchange rate regime has been supported by capitalcontrols, which have allowed some degree <strong>of</strong> monetary autonomy to be comb<strong>in</strong>edwith <strong>the</strong> exchange rate target.Ano<strong>the</strong>r channel l<strong>in</strong>k<strong>in</strong>g <strong>the</strong> domestic f<strong>in</strong>ancial system with <strong>the</strong> <strong>in</strong>ternationalbalance sheet is through domestic sav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment. <strong>India</strong>’s current sav<strong>in</strong>g rateis similar to that <strong>of</strong> most o<strong>the</strong>r Asian economies; on <strong>the</strong> <strong>in</strong>vestment side, private<strong>in</strong>vestment has risen steadily, while public <strong>in</strong>vestment has been decl<strong>in</strong><strong>in</strong>g s<strong>in</strong>ce <strong>the</strong>1980s. In compar<strong>in</strong>g <strong>in</strong>vestment levels <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong>, Mishra (2006) highlightsthat an important difference is that <strong>India</strong>’s sectoral growth pattern is more orientedtoward services <strong>and</strong> is <strong>the</strong>reby less <strong>in</strong>tensive <strong>in</strong> physical capital, although this mightbe poised to change. 14As is <strong>the</strong> case <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>, it is plausible that fur<strong>the</strong>r development <strong>of</strong> <strong>the</strong> domesticf<strong>in</strong>ancial sector may prompt a decl<strong>in</strong>e <strong>in</strong> household <strong>and</strong> corporate sav<strong>in</strong>gs rates, <strong>in</strong>response to greater availability <strong>of</strong> credit from <strong>the</strong> f<strong>in</strong>ancial system. Even morestrongly than <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>, fur<strong>the</strong>r f<strong>in</strong>ancial development may also stimulate anexpansion <strong>in</strong> <strong>in</strong>vestment, <strong>in</strong> view <strong>of</strong> <strong>the</strong> credit constra<strong>in</strong>ts faced especially by small<strong>and</strong>medium-sized enterprises. In addition, f<strong>in</strong>ancial development that is accompaniedby fur<strong>the</strong>r capital account liberalization will also stimulate a greater level <strong>of</strong>cross-border asset trade, with <strong>the</strong> acquisition <strong>of</strong> foreign assets by domestichouseholds <strong>and</strong> enterprises <strong>and</strong> <strong>the</strong> domestic f<strong>in</strong>ancial system <strong>in</strong>termediat<strong>in</strong>g<strong>in</strong>ternational capital flows to domestic entities.13 Patnaik <strong>and</strong> Shah (2006) also highlight that <strong>the</strong> composition <strong>of</strong> external debt has shifted <strong>in</strong> recent years,with private debt <strong>and</strong> <strong>of</strong>ficial government external debt <strong>in</strong> decl<strong>in</strong>e but <strong>the</strong> quasi-sovereign debt <strong>of</strong>parastatals <strong>in</strong>creas<strong>in</strong>g. A part <strong>of</strong> <strong>the</strong> quasi-sovereign debt is <strong>the</strong> State Bank <strong>of</strong> <strong>India</strong> debt, which isguaranteed by <strong>the</strong> government. <strong>The</strong> o<strong>the</strong>r part is non-resident <strong>India</strong>n deposits <strong>in</strong> banks, which are notguaranteed, but <strong>the</strong> State has no track record <strong>of</strong> allow<strong>in</strong>g non-trivial banks to fail.14 Kochhar et al. (2006) argue that <strong>the</strong> next phase <strong>of</strong> <strong>India</strong>n development may require a higher level <strong>of</strong>physical <strong>in</strong>vestment to absorb low-skilled labor <strong>and</strong> improve public <strong>in</strong>frastructure.

P.R. Lane, S.L. Schmukler3 Impact on <strong>the</strong> global f<strong>in</strong>ancial systemKeep<strong>in</strong>g <strong>in</strong> m<strong>in</strong>d <strong>the</strong> framework set above, this section addresses a series <strong>of</strong> issuesthat have emerged concern<strong>in</strong>g <strong>the</strong> impact <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> on <strong>the</strong> global f<strong>in</strong>ancialsystem. We group <strong>the</strong>se issues <strong>in</strong>to three broad questions that have already capturedattention <strong>and</strong>, where relevant, highlight <strong>the</strong> differential impact <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> ondeveloped <strong>and</strong> develop<strong>in</strong>g countries.3.1 How important are <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> as a dest<strong>in</strong>ation for external capital?<strong>The</strong> level <strong>and</strong> composition <strong>of</strong> <strong>Ch<strong>in</strong>a</strong>’s <strong>and</strong> <strong>India</strong>’s external liabilities are likely tochange, especially as domestic f<strong>in</strong>ancial reform <strong>and</strong> external liberalization deepen.As a benchmark, an <strong>in</strong>creas<strong>in</strong>g share <strong>of</strong> <strong>the</strong>se countries <strong>in</strong> world GDP <strong>and</strong> worldf<strong>in</strong>ancial market capitalization should naturally see <strong>in</strong>creas<strong>in</strong>g capital <strong>in</strong>flows to<strong>the</strong>se countries. In addition, we may expect to see some rebalanc<strong>in</strong>g <strong>in</strong> <strong>the</strong>composition <strong>of</strong> external liabilities. For <strong>Ch<strong>in</strong>a</strong>, reform <strong>of</strong> <strong>the</strong> domestic bank<strong>in</strong>gsystem <strong>and</strong> <strong>the</strong> development <strong>of</strong> its equity <strong>and</strong> bond markets may reduce its heavyreliance on FDI <strong>in</strong>flows as alternative options become more viable. A reduction <strong>in</strong><strong>the</strong> relative importance <strong>of</strong> FDI may also be supported by moves to limit <strong>the</strong>generosity <strong>of</strong> <strong>the</strong> current <strong>in</strong>centives <strong>of</strong>fered to foreign direct <strong>in</strong>vestors, which wouldattenuate FDI directly <strong>and</strong> through its attendant impact on round-tripp<strong>in</strong>g activity. 15F<strong>in</strong>ally, <strong>the</strong> expansion <strong>of</strong> domestic capital markets <strong>and</strong> reform <strong>of</strong> <strong>the</strong> bank<strong>in</strong>g systemwould also allow foreign-owned firms to draw on domestic fund<strong>in</strong>g sources.With regard to <strong>India</strong>, recent moves to fur<strong>the</strong>r liberalize <strong>the</strong> FDI regime may<strong>in</strong>crease <strong>the</strong> relative importance <strong>of</strong> FDI <strong>in</strong>flows. However, <strong>the</strong> ability <strong>of</strong> <strong>India</strong> toattract FDI also depends on more widespread <strong>in</strong>stitutional reforms that improve <strong>the</strong><strong>in</strong>vestment environment for foreign <strong>in</strong>vestors <strong>and</strong> encourage <strong>the</strong>m to channel FDI<strong>in</strong>to <strong>the</strong> country. A major barrier regard<strong>in</strong>g <strong>the</strong> liberalization <strong>of</strong> debt <strong>in</strong>flows could bethat open<strong>in</strong>g up <strong>the</strong> capital account may threaten <strong>the</strong> government’s ability to f<strong>in</strong>anceits fiscal deficits at a low <strong>in</strong>terest cost. Under <strong>the</strong>se conditions, fur<strong>the</strong>r liberalizationmay be delayed until <strong>the</strong> domestic fiscal situation is fur<strong>the</strong>r reformed.3.2 How important are <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> as <strong>in</strong>ternational <strong>in</strong>vestors?<strong>The</strong> rapid pace <strong>of</strong> reserve accumulation can be <strong>in</strong>terpreted, at <strong>the</strong> economic level, as<strong>the</strong> byproduct <strong>of</strong> a development strategy that seeks to promote export-led growth bysuppress<strong>in</strong>g appreciation <strong>of</strong> <strong>the</strong> nom<strong>in</strong>al exchange rate. For <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world, thishas represented a beneficial terms-<strong>of</strong>-trade shock, with <strong>the</strong> <strong>in</strong>crease <strong>in</strong> manufactur<strong>in</strong>gexports from <strong>Ch<strong>in</strong>a</strong> lead<strong>in</strong>g to a reduction <strong>in</strong> relative prices <strong>and</strong> help<strong>in</strong>g to moderateglobal <strong>in</strong>flation. For suppliers <strong>of</strong> <strong>in</strong>puts to <strong>Ch<strong>in</strong>a</strong>, <strong>the</strong> <strong>in</strong>crease <strong>in</strong> export activity hasgenerated an <strong>in</strong>crease <strong>in</strong> dem<strong>and</strong>, aid<strong>in</strong>g producers <strong>of</strong> components <strong>in</strong> o<strong>the</strong>r Asiancountries <strong>and</strong> commodity producers around <strong>the</strong> world.15 While current policy is strongly pro-FDI, one reason to believe that FDI <strong>in</strong>centives could be scaled backis provided by <strong>the</strong> <strong>in</strong>creas<strong>in</strong>g political concerns about excessive FDI <strong>in</strong>flows. At one level, this relates to<strong>the</strong> dem<strong>and</strong>s <strong>of</strong> farmers whose l<strong>and</strong> has been appropriated to provide <strong>in</strong>dustrial sites for direct <strong>in</strong>vestors<strong>and</strong> o<strong>the</strong>rs (ma<strong>in</strong>ly local real estate developers). At ano<strong>the</strong>r level, domestic firms that compete with foreigndirect <strong>in</strong>vestors compla<strong>in</strong> about <strong>the</strong> favorable treatment accorded to external <strong>in</strong>vestors.

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial systemOn <strong>the</strong> f<strong>in</strong>ancial front, <strong>the</strong> high level <strong>of</strong> reserves acts as a subsidy that lowers <strong>the</strong>cost <strong>of</strong> external f<strong>in</strong>ance for <strong>the</strong> issuers <strong>of</strong> reserve assets—primarily, <strong>the</strong> US. In turn,this helps to keep <strong>in</strong>terest rates lower than o<strong>the</strong>rwise <strong>in</strong> <strong>the</strong>se economies. Regard<strong>in</strong>g<strong>the</strong> impact on o<strong>the</strong>r develop<strong>in</strong>g countries, <strong>the</strong> low global <strong>in</strong>terest rates associatedwith high reserve hold<strong>in</strong>gs have also translated <strong>in</strong>to a compression <strong>of</strong> spreads onemerg<strong>in</strong>g market debt, with <strong>the</strong> “search for yield” rais<strong>in</strong>g <strong>the</strong> attractiveness <strong>of</strong>emerg<strong>in</strong>g market dest<strong>in</strong>ations to <strong>in</strong>ternational <strong>in</strong>vestors (International MonetaryFund 2006a, b).<strong>The</strong>re are several reasons to believe that <strong>the</strong> pace <strong>of</strong> reserve accumulation willstart to decelerate. First, <strong>the</strong> accumulation <strong>of</strong> reserves comes at a significantopportunity cost <strong>in</strong> terms <strong>of</strong> alternative uses for <strong>the</strong>se funds. 16 S<strong>in</strong>ce <strong>the</strong>se countriescomfortably exceed <strong>the</strong> reserve levels that are required to cover imports <strong>and</strong> debtobligations, <strong>the</strong> opportunity cost may be high relative to <strong>the</strong> <strong>in</strong>surance ga<strong>in</strong>s frombuild<strong>in</strong>g up reserves as a precaution aga<strong>in</strong>st f<strong>in</strong>ancial risks. Second, to <strong>the</strong> extent that<strong>in</strong>flows are not sterilized, <strong>the</strong> <strong>in</strong>crease <strong>in</strong> domestic liquidity associated with reserveaccumulation threatens <strong>the</strong> possibility <strong>of</strong> an asset <strong>and</strong> real estate price boom <strong>and</strong>misdirected lend<strong>in</strong>g <strong>in</strong> <strong>the</strong> domestic economy. Third, it is <strong>in</strong>creas<strong>in</strong>gly appreciated <strong>in</strong><strong>Ch<strong>in</strong>a</strong> <strong>the</strong> potential benefits to rebalanc<strong>in</strong>g output growth toward exp<strong>and</strong><strong>in</strong>gdomestic consumption, which would raise liv<strong>in</strong>g st<strong>and</strong>ards even faster <strong>and</strong> avoid<strong>the</strong> external protectionist pressures that have been build<strong>in</strong>g up <strong>in</strong> <strong>the</strong> US <strong>and</strong> Europe.Fourth, <strong>the</strong> move to a more flexible exchange rate system might reduce <strong>the</strong> pressureon <strong>the</strong> monetary authority to <strong>in</strong>tervene <strong>in</strong> <strong>the</strong> foreign exchange market to ma<strong>in</strong>ta<strong>in</strong> ade-facto fixed currency peg.If reserve accumulation were to slow down, this would have several ramifications,o<strong>the</strong>r th<strong>in</strong>gs constant. <strong>The</strong> removal <strong>of</strong> <strong>the</strong> <strong>in</strong>terest rate subsidy would raise <strong>the</strong> cost <strong>of</strong>capital for <strong>the</strong> primary issuers <strong>of</strong> reserve assets. In turn, depend<strong>in</strong>g on <strong>the</strong> policyresponse, this may contribute to a reversal <strong>in</strong> global liquidity conditions, which mayalso adversely affect <strong>the</strong> supply <strong>of</strong> capital to emerg<strong>in</strong>g market economies. However,<strong>the</strong> f<strong>in</strong>al effects <strong>of</strong> changes <strong>in</strong> reserve accumulation on <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancialsystem are difficult to estimate <strong>and</strong> depend on <strong>the</strong> o<strong>the</strong>r changes that occur alongwith <strong>the</strong> deceleration <strong>in</strong> reserve accumulation, <strong>the</strong> external net positions, <strong>and</strong> <strong>the</strong>ircontribution to global imbalances. For example, look<strong>in</strong>g only at reserves does nottake <strong>in</strong>to account <strong>the</strong> amount <strong>of</strong> capital absorbed by <strong>the</strong>se countries from <strong>the</strong><strong>in</strong>ternational f<strong>in</strong>ancial system <strong>and</strong> how that affects global returns.To mitigate <strong>the</strong> opportunity cost <strong>of</strong> reserve accumulation, countries may alsodecide to redirect <strong>the</strong> excess reserves toward a more diversified portfolio <strong>of</strong><strong>in</strong>ternational f<strong>in</strong>ancial assets, which might <strong>in</strong>clude <strong>the</strong> liberalization <strong>of</strong> controls onoutward <strong>in</strong>vestment by o<strong>the</strong>r domestic entities. 17 For <strong>in</strong>stance, Genberg et al. (2005)support <strong>the</strong> creation <strong>of</strong> an Asian Investment Corporation that would pool some <strong>of</strong> <strong>the</strong>reserves held by Asian central banks <strong>and</strong> manage <strong>the</strong>m on a commercial basis,16 As an illustration, Summers (2006) assumes that <strong>the</strong>se countries could earn a six percent social returnon domestic <strong>in</strong>vestments; Rodrik (2006) compares <strong>the</strong> yield on reserves to <strong>the</strong> borrow<strong>in</strong>g costs faced by<strong>the</strong>se countries.17 Indeed, some redeployment <strong>of</strong> reserves has already occurred. For <strong>in</strong>stance, <strong>Ch<strong>in</strong>a</strong> transferred $60 billion<strong>in</strong> reserves <strong>in</strong> 2004–2005 to <strong>in</strong>crease <strong>the</strong> capital base <strong>of</strong> several state-owned banks. See also <strong>the</strong> discussion<strong>in</strong> European Central Bank (2006).

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial systemdollar. As such, <strong>the</strong> renm<strong>in</strong>bi might start to play a role <strong>of</strong> one <strong>of</strong> <strong>the</strong> few worldreserve currencies <strong>in</strong> <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancial system, so long as <strong>the</strong> capitalcontrols are removed <strong>and</strong> <strong>the</strong> f<strong>in</strong>ancial system consolidates. Similarly, <strong>the</strong> rupeecould <strong>in</strong>crease <strong>in</strong> importance as a partial anchor for o<strong>the</strong>r South Asian currencies.F<strong>in</strong>ally, we note that part <strong>of</strong> <strong>the</strong> cross-border capital flows observed for <strong>Ch<strong>in</strong>a</strong> <strong>and</strong><strong>India</strong> reflect round-tripp<strong>in</strong>g activities by which domestic entities seek to takeadvantage <strong>of</strong> <strong>the</strong> tax <strong>and</strong> o<strong>the</strong>r advantages <strong>of</strong>fered to foreign <strong>in</strong>vestors, <strong>in</strong> a context<strong>of</strong> high capital controls. To <strong>the</strong> extent that such differential treatment is elim<strong>in</strong>ated <strong>in</strong><strong>the</strong> future through fur<strong>the</strong>r f<strong>in</strong>ancial liberalization, <strong>the</strong> gross scale <strong>of</strong> <strong>the</strong> <strong>in</strong>ternationalbalance sheets as currently measured would shr<strong>in</strong>k.3.3 What is <strong>the</strong> contribution <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> to global imbalances?<strong>The</strong> net foreign asset positions <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> have improved sharply <strong>in</strong> recentyears <strong>and</strong> are currently small <strong>in</strong> global terms. Moreover, <strong>the</strong> Ch<strong>in</strong>ese current accountsurplus has cont<strong>in</strong>ued to <strong>in</strong>crease, although <strong>India</strong> has returned to runn<strong>in</strong>g a smallcurrent account deficit. In this sub-section, we discuss whe<strong>the</strong>r <strong>the</strong>se patterns mayturn out to be transitory.Based on a comb<strong>in</strong>ation <strong>of</strong> a calibrated <strong>the</strong>oretical model <strong>and</strong> non-structuralcross-country regressions, Dollar <strong>and</strong> Kraay (2006) argue that liberalization <strong>of</strong> <strong>the</strong>external account <strong>and</strong> cont<strong>in</strong>ued progress <strong>in</strong> economic <strong>and</strong> <strong>in</strong>stitutional reform shouldresult <strong>in</strong> average current account deficits <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> <strong>of</strong> 2 to 5% <strong>of</strong> GDP over <strong>the</strong> next20 years, with <strong>the</strong> net foreign liability position possibly reach<strong>in</strong>g 40% <strong>of</strong> GDP by2025. 20 Indeed, any general neoclassical approach would predict that <strong>Ch<strong>in</strong>a</strong> shouldbe a net liability nation, s<strong>in</strong>ce productivity growth <strong>and</strong> <strong>in</strong>stitutional progress <strong>in</strong> acapital-poor country <strong>of</strong>fer<strong>in</strong>g high rates <strong>of</strong> return should at <strong>the</strong> same time boost<strong>in</strong>vestment <strong>and</strong> reduce sav<strong>in</strong>gs. While no similar study exists for <strong>India</strong>, similarreason<strong>in</strong>g applies—greater capital account openness <strong>and</strong> cont<strong>in</strong>ued reform shouldmean that <strong>India</strong> might run persistently higher current account deficits dur<strong>in</strong>g itsconvergence process.If <strong>the</strong> neoclassical predictions about <strong>the</strong> impact <strong>of</strong> <strong>in</strong>stitutional reform <strong>and</strong> capitalaccount liberalization <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> take hold, a susta<strong>in</strong>ed current accountdeficit <strong>of</strong> <strong>the</strong> order <strong>of</strong> 5% <strong>of</strong> GDP per annum would soon become significant <strong>in</strong>terms <strong>of</strong> its global impact. Clearly, <strong>the</strong> global impact <strong>of</strong> current account deficits <strong>of</strong>this absolute magnitude would represent a major call on global net capital flows. Ofcourse, <strong>the</strong> feasibility <strong>of</strong> deficits <strong>of</strong> this magnitude requires that <strong>the</strong>re are countries <strong>in</strong><strong>the</strong> rest <strong>of</strong> <strong>the</strong> world that are will<strong>in</strong>g to take large net creditor positions. If this is not<strong>the</strong> case, <strong>the</strong> desired sav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment trends will translate <strong>in</strong>to higher world<strong>in</strong>terest rates ra<strong>the</strong>r than large external imbalances.Although a neoclassical approach predicts that <strong>the</strong>se countries could run muchlarger current account deficits, <strong>the</strong>re is substantial disagreement about <strong>the</strong>sepredictions. Critics argue that <strong>the</strong> neoclassical predictions do not take <strong>in</strong>to accountseveral factors that are unique to <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>and</strong> expla<strong>in</strong> <strong>the</strong> recent past <strong>and</strong>20 <strong>The</strong> natural evolution is that <strong>the</strong> scale <strong>of</strong> current account deficits will taper <strong>of</strong>f <strong>and</strong>, if <strong>the</strong>se countriesbecome rich relative to <strong>the</strong> rest <strong>of</strong> <strong>the</strong> world, this phase may be followed by a period <strong>in</strong> which <strong>the</strong>secountries become net lenders to <strong>the</strong> next wave <strong>of</strong> emerg<strong>in</strong>g economies. See also Summers (2006).

P.R. Lane, S.L. Schmuklerdist<strong>in</strong>ctive nature. Importantly, several studies suggest that sav<strong>in</strong>gs rates are likely torema<strong>in</strong> high <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong>. For <strong>in</strong>stance, Fehr et al. (2007) <strong>in</strong>terpret <strong>Ch<strong>in</strong>a</strong>’srecent sav<strong>in</strong>gs behavior as <strong>in</strong>dicative <strong>of</strong> a low rate <strong>of</strong> time preference <strong>and</strong> suggestthat <strong>Ch<strong>in</strong>a</strong> will rema<strong>in</strong> a large net saver. Based on household survey data, Chamon<strong>and</strong> Prasad (2005) make demographic projections <strong>and</strong> predict higher householdsav<strong>in</strong>g rates over <strong>the</strong> next couple <strong>of</strong> decades. F<strong>in</strong>ally, Kuijs (2006) argues thatstructural factors mean that sav<strong>in</strong>gs <strong>and</strong> <strong>in</strong>vestment rates <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> will decl<strong>in</strong>e onlymildly <strong>in</strong> <strong>the</strong> decades ahead. With respect to <strong>India</strong>, Mishra (2006) argues that <strong>in</strong> <strong>the</strong>future <strong>the</strong> upward trend <strong>of</strong> <strong>India</strong>n sav<strong>in</strong>g rates will cont<strong>in</strong>ue. For <strong>in</strong>stance, <strong>India</strong>’swork<strong>in</strong>g age population as a percentage <strong>of</strong> total population is expected to peak <strong>in</strong>2035, much later than for o<strong>the</strong>r Asian economies.While demographic considerations may mean that sav<strong>in</strong>gs rates are unlikely toplummet, it is plausible that fur<strong>the</strong>r domestic f<strong>in</strong>ancial development <strong>and</strong> capitalaccount liberalization will <strong>in</strong>duce a downward adjustment <strong>in</strong> <strong>the</strong> sav<strong>in</strong>gs rate. For<strong>in</strong>stance, Chamon <strong>and</strong> Prasad (2005) po<strong>in</strong>t out that <strong>the</strong> sav<strong>in</strong>gs rate (especially foryounger households) could decl<strong>in</strong>e if <strong>the</strong> grow<strong>in</strong>g dem<strong>and</strong> for consumer durableswere to be f<strong>in</strong>anced through <strong>the</strong> development <strong>of</strong> consumer credit. This would bere<strong>in</strong>forced by <strong>the</strong> liberalization <strong>of</strong> controls on capital flows, which would providegreater competition <strong>in</strong> <strong>the</strong> domestic f<strong>in</strong>ancial sector <strong>and</strong> more opportunities for riskdiversification, lead<strong>in</strong>g to more lend<strong>in</strong>g <strong>and</strong> less sav<strong>in</strong>gs. In addition, <strong>the</strong>re are recent<strong>in</strong>dications that <strong>Ch<strong>in</strong>a</strong> plans a range <strong>of</strong> policy <strong>in</strong>itiatives to raise <strong>the</strong> domestic level <strong>of</strong>consumption. 21 Moreover, <strong>in</strong> both countries, improvements <strong>in</strong> social <strong>in</strong>surancesystems <strong>and</strong> <strong>the</strong> provision <strong>of</strong> public services would reduce over time <strong>the</strong> self<strong>in</strong>surancemotivation <strong>of</strong> high sav<strong>in</strong>gs rates.To project <strong>the</strong> net position, it is important to also consider <strong>the</strong> prospects for <strong>the</strong>level <strong>of</strong> <strong>in</strong>vestment. In <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong>, a comb<strong>in</strong>ation <strong>of</strong> an improvement <strong>in</strong>domestic f<strong>in</strong>ancial <strong>in</strong>termediation <strong>and</strong> capital account liberalization would raise <strong>the</strong>attractiveness <strong>of</strong> <strong>the</strong>se countries as a dest<strong>in</strong>ation for external capital <strong>and</strong> enhance <strong>the</strong>ability <strong>of</strong> domestic private firms to pursue expansion plans. 22 In <strong>the</strong> <strong>India</strong>n case, aprimary driver <strong>of</strong> larger current account deficits could be a higher rate <strong>of</strong> public<strong>in</strong>vestment, <strong>in</strong> view <strong>of</strong> <strong>the</strong> deficiencies <strong>in</strong> <strong>the</strong> current state <strong>of</strong> its public <strong>in</strong>frastructure.In terms <strong>of</strong> net positions, Dooley et al. (2003) argue that it is possible torationalize persistent current account surpluses by appeal<strong>in</strong>g to <strong>the</strong> reduction <strong>in</strong>country risk that may be associated with <strong>the</strong> ma<strong>in</strong>tenance <strong>of</strong> a net creditor position.However, even if such an externality effect is present, it may not survive aliberalization <strong>of</strong> controls on capital flows, <strong>in</strong> view <strong>of</strong> <strong>the</strong> powerful private <strong>in</strong>centivesto <strong>in</strong>vest more <strong>and</strong> save less.In sum, our projection is that, all else equal, a comb<strong>in</strong>ation <strong>of</strong> fur<strong>the</strong>r domesticf<strong>in</strong>ancial development <strong>and</strong> capital account liberalization will unleash forces that<strong>in</strong>duce larger net resources flows <strong>in</strong>to <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong>. While this projection seems21 See <strong>the</strong> media coverage <strong>of</strong> <strong>the</strong> March 2006 Party Congress.22 In view <strong>of</strong> <strong>the</strong> high level <strong>of</strong> <strong>in</strong>efficient <strong>in</strong>vestment <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>, it is plausible that corporate governancereforms <strong>and</strong> higher dividend payouts (toge<strong>the</strong>r with domestic f<strong>in</strong>ancial deepen<strong>in</strong>g <strong>and</strong> externalliberalization) could lead to a reduction <strong>in</strong> <strong>the</strong> absolute level <strong>of</strong> <strong>in</strong>vestment <strong>in</strong> t<strong>and</strong>em with a decl<strong>in</strong>e <strong>in</strong><strong>the</strong> level <strong>of</strong> enterprise sav<strong>in</strong>gs. With an <strong>in</strong>crease <strong>in</strong> market-driven <strong>in</strong>vestment <strong>and</strong> a decl<strong>in</strong>e <strong>in</strong> sav<strong>in</strong>gs, <strong>the</strong>prediction <strong>of</strong> an <strong>in</strong>creased current account deficit would still hold.

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial systemquite robust as a qualitative level, we recognize that o<strong>the</strong>r forces may operate <strong>in</strong> <strong>the</strong>o<strong>the</strong>r direction. In particular, a stall<strong>in</strong>g <strong>of</strong> <strong>the</strong> reform process <strong>in</strong> ei<strong>the</strong>r country wouldreduce <strong>the</strong> impetus for greater net <strong>in</strong>flows. Moreover, even if market-oriented reformcont<strong>in</strong>ues, <strong>the</strong> relative pace <strong>of</strong> demographic change <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong>, at a later date, <strong>in</strong><strong>India</strong> will be an important force toward a more positive net external position.However, even <strong>in</strong> that case, <strong>the</strong> composition <strong>of</strong> capital flows will be radicallydifferent than <strong>the</strong> current pattern, with <strong>the</strong> net balance <strong>the</strong> product <strong>of</strong> much largergross <strong>in</strong>flows <strong>and</strong> gross outflows.4 ConclusionsIn this paper, we have studied <strong>the</strong> impact <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> on <strong>the</strong> <strong>in</strong>ternationalf<strong>in</strong>ancial system by exam<strong>in</strong><strong>in</strong>g <strong>and</strong> compar<strong>in</strong>g both countries, analyz<strong>in</strong>g differentaspects <strong>of</strong> <strong>the</strong>ir <strong>in</strong>ternational f<strong>in</strong>ancial <strong>in</strong>tegration, <strong>and</strong> l<strong>in</strong>k<strong>in</strong>g <strong>the</strong> patterns <strong>in</strong> <strong>the</strong>ir<strong>in</strong>ternational balance sheets to policies regard<strong>in</strong>g <strong>the</strong>ir domestic f<strong>in</strong>ancial systems.Given <strong>the</strong> evolution <strong>and</strong> probable changes <strong>in</strong> <strong>the</strong>ir domestic f<strong>in</strong>ancial sectors, thisanalysis is relevant <strong>in</strong> project<strong>in</strong>g <strong>the</strong> future evolution <strong>of</strong> <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancialsystem.<strong>The</strong> ma<strong>in</strong> current <strong>in</strong>ternational f<strong>in</strong>ancial impact <strong>of</strong> <strong>India</strong> <strong>and</strong> particularly <strong>Ch<strong>in</strong>a</strong> hasbeen <strong>in</strong> <strong>the</strong>ir accumulation <strong>of</strong> unusually high levels <strong>of</strong> foreign reserves. Ano<strong>the</strong>r salientaspect <strong>of</strong> <strong>the</strong>ir <strong>in</strong>tegration is <strong>the</strong> asymmetry <strong>in</strong> <strong>the</strong> composition <strong>of</strong> <strong>the</strong>ir gross assets <strong>and</strong>liabilities. <strong>The</strong>ir assets are low-return foreign reserves, which are liquid <strong>and</strong> protect <strong>the</strong>maga<strong>in</strong>st adverse shocks, but <strong>the</strong>y carry a high opportunity cost. <strong>The</strong>ir liabilities are FDI,debt, <strong>and</strong> portfolio equity, which typically yield higher rates <strong>of</strong> return. FDI has beenrelatively more important <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>, with portfolio <strong>in</strong>vestment tak<strong>in</strong>g a lead role <strong>in</strong> <strong>India</strong>.Despite recent attention <strong>and</strong> concerns regard<strong>in</strong>g <strong>the</strong>ir effects on develop<strong>in</strong>g countries,<strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> do not seem to have been crowd<strong>in</strong>g out <strong>in</strong>vestment elsewhere <strong>and</strong>,despite a recent acceleration <strong>in</strong> activity, are not yet major accumulators <strong>of</strong> non-reserveforeign assets. A strik<strong>in</strong>g aspect <strong>of</strong> <strong>the</strong>ir <strong>in</strong>tegration has been <strong>the</strong> reduction <strong>in</strong> <strong>the</strong>ir netliability positions, defy<strong>in</strong>g neoclassical predictions that <strong>the</strong>y should be runn<strong>in</strong>g largecurrent account deficits given <strong>the</strong>ir level <strong>of</strong> development. Whe<strong>the</strong>r <strong>the</strong> shift <strong>in</strong> <strong>Ch<strong>in</strong>a</strong>’s<strong>and</strong> <strong>India</strong>’s net positions is transient or permanent is a central issue <strong>in</strong> assess<strong>in</strong>g <strong>the</strong>ireffect on <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancial system.<strong>The</strong> evolution <strong>of</strong> <strong>Ch<strong>in</strong>a</strong>’s <strong>and</strong> <strong>India</strong>’s domestic f<strong>in</strong>ancial systems (<strong>in</strong>clud<strong>in</strong>g <strong>the</strong>irexchange rate <strong>and</strong> capital account liberalization policies) is essential to underst<strong>and</strong><strong>the</strong>ir impact on <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancial system. As both <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> are likelyto undergo fur<strong>the</strong>r f<strong>in</strong>ancial development <strong>and</strong> liberalization, <strong>the</strong>se countries are set tohave an ever-<strong>in</strong>creas<strong>in</strong>g role <strong>in</strong> <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancial system. We project that <strong>the</strong>nature <strong>of</strong> <strong>the</strong>ir <strong>in</strong>ternational f<strong>in</strong>ancial <strong>in</strong>tegration is likely to be reshaped. At onelevel, <strong>the</strong> composition <strong>of</strong> <strong>the</strong> <strong>in</strong>ternational balance sheet will become lessasymmetric—with a greater accumulation <strong>of</strong> non-reserve foreign assets <strong>and</strong> a morebalanced distribution <strong>of</strong> foreign liabilities between FDI, portfolio equity, <strong>and</strong> debt.This rebalanc<strong>in</strong>g should be good news for develop<strong>in</strong>g countries that may receive agreater share <strong>of</strong> <strong>the</strong> outward <strong>in</strong>vestment flows from <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong>. At ano<strong>the</strong>rlevel, <strong>the</strong>re is a strong (but not undisputed) prospect that <strong>the</strong>se countries mightexperience a susta<strong>in</strong>ed period <strong>of</strong> substantial current account deficits. In view <strong>of</strong> <strong>the</strong>ir

P.R. Lane, S.L. Schmukler<strong>in</strong>creas<strong>in</strong>g share <strong>in</strong> global output, <strong>the</strong> prospective current account deficits <strong>of</strong> <strong>Ch<strong>in</strong>a</strong><strong>and</strong> <strong>India</strong> may be a central element <strong>in</strong> <strong>the</strong> next phase <strong>of</strong> <strong>the</strong> “global imbalances”debate. If this scenario plays out, o<strong>the</strong>r potential borrowers will receive smaller netcapital flows <strong>and</strong>/or face a higher cost <strong>of</strong> capital.<strong>The</strong> future developments are, as always, difficult to predict <strong>and</strong> will depend ono<strong>the</strong>r factors (like dist<strong>in</strong>ct demographic trajectories <strong>and</strong> economic reforms), domesticpolicy options, <strong>and</strong> <strong>the</strong> <strong>in</strong>ternational environment. Key aspects to monitor whenanalyz<strong>in</strong>g <strong>the</strong> possible paths that <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> may pursue (<strong>and</strong> <strong>the</strong>ir impact on<strong>the</strong> <strong>in</strong>ternational system) <strong>in</strong>clude <strong>the</strong> follow<strong>in</strong>g elements. First, it is essential to watchwhat approach <strong>the</strong>se countries adopt regard<strong>in</strong>g <strong>the</strong>ir exchange rate policy,particularly <strong>in</strong> light <strong>of</strong> <strong>the</strong> susta<strong>in</strong>ed appreciation pressure (from <strong>the</strong> market <strong>and</strong><strong>the</strong> <strong>in</strong>ternational political environment). While significant appreciation may beresisted <strong>in</strong> <strong>the</strong> short run by fur<strong>the</strong>r reserve accumulation, this is <strong>in</strong>creas<strong>in</strong>gly costly<strong>and</strong> may compromise o<strong>the</strong>r policy objectives. Second, a sharp correction <strong>in</strong> <strong>the</strong> USdollar vis-à-vis o<strong>the</strong>r major currencies may act as an external trigger for a switch togreater exchange rate flexibility <strong>in</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong>, as <strong>the</strong> renm<strong>in</strong>bi <strong>and</strong> <strong>the</strong> rupeewould become (more) undervalued relative to those major, relevant currencies.Indeed, concerns about such a correction may also prompt <strong>the</strong>se countries to alter <strong>the</strong>currency composition <strong>of</strong> reserves, affect<strong>in</strong>g <strong>in</strong>terest rates <strong>and</strong> possibly exchange rates(at least <strong>in</strong> <strong>the</strong> short run). A third key component to monitor is how fast <strong>the</strong>secountries substitute reserve hold<strong>in</strong>gs for o<strong>the</strong>r assets abroad. To <strong>the</strong> extent that <strong>the</strong><strong>in</strong>ternational environment keeps be<strong>in</strong>g favorable, it is likely that some <strong>of</strong> <strong>the</strong>proposals to shift away from traditional reserve hold<strong>in</strong>gs start to materialize. Fourth,a fully-fledged liberalization <strong>of</strong> capital controls rema<strong>in</strong>s unlikely <strong>in</strong> <strong>the</strong> short tomedium term, <strong>in</strong> view <strong>of</strong> <strong>the</strong> outst<strong>and</strong><strong>in</strong>g weaknesses <strong>in</strong> cop<strong>in</strong>g with unrestricteddebt flows. However, it is likely that <strong>the</strong>se countries will cont<strong>in</strong>ue to liberalize <strong>the</strong>irf<strong>in</strong>ancial sectors, with implications for <strong>the</strong> composition <strong>of</strong> <strong>the</strong>ir <strong>in</strong>ternational balancesheets <strong>and</strong> net foreign asset positions. <strong>The</strong> exact form <strong>of</strong> this liberalization process,its tim<strong>in</strong>g, <strong>and</strong> its pace are still to be determ<strong>in</strong>ed <strong>and</strong> will rema<strong>in</strong> a subject <strong>of</strong>attention. For all <strong>the</strong>se reasons, we anticipate that <strong>the</strong> <strong>in</strong>ternational f<strong>in</strong>ancial<strong>in</strong>tegration <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> is set to undergo significant reshap<strong>in</strong>g <strong>in</strong> <strong>the</strong> yearsto come.Acknowledgement This paper draws on <strong>the</strong> longer study conta<strong>in</strong>ed <strong>in</strong> Lane <strong>and</strong> Schmukler (2007). Wethank many colleagues at <strong>the</strong> IMF <strong>and</strong> <strong>the</strong> World Bank for <strong>in</strong>teract<strong>in</strong>g with us at <strong>the</strong> <strong>in</strong>itial stages <strong>of</strong> thisproject. For useful comments, we are grateful especially to Bob McCauley <strong>and</strong> Alan W<strong>in</strong>ters, <strong>and</strong> also toRichard Cooper, Subir Gokarn, Yasheng Huang, Phil Keefer, Aart Kraay, Louis Kuijs, Jong-Wha Lee,Simon Long, Guonan Ma, <strong>and</strong> T.N. Sr<strong>in</strong>ivasan. We also are grateful to participants at presentations held at<strong>the</strong> World Bank <strong>Ch<strong>in</strong>a</strong> Office (Beij<strong>in</strong>g), <strong>the</strong> World Bank headquarters (Wash<strong>in</strong>gton, DC), <strong>the</strong> conference“<strong>Ch<strong>in</strong>a</strong> <strong>and</strong> Emerg<strong>in</strong>g Asia: Reorganiz<strong>in</strong>g <strong>the</strong> <strong>Global</strong> Economy” (Seoul), <strong>the</strong> <strong>India</strong>n Council for Researchon International Economic Relations—World Bank conference “Increased Integration <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong><strong>in</strong> <strong>the</strong> <strong>Global</strong> F<strong>in</strong>ancial System” (Delhi), <strong>the</strong> Center for Pacific Bas<strong>in</strong> Studies’ 2006 Pacific Bas<strong>in</strong>conference (Federal Reserve Bank <strong>of</strong> San Francisco), <strong>the</strong> National University <strong>of</strong> S<strong>in</strong>gapore SCAPE-IPS-World Bank workshop (S<strong>in</strong>gapore), <strong>and</strong> <strong>the</strong> 2006 IMF–World Bank Annual Meet<strong>in</strong>gs (S<strong>in</strong>gapore) for veryhelpful feedback. Jose Azar, Agust<strong>in</strong> Benetrix, Francisco Ceballos, Vahagn Galstyan, Niall McInerney,<strong>and</strong> Maral Shamloo provided excellent research assistance at different stages <strong>of</strong> <strong>the</strong> project. We thank <strong>the</strong>S<strong>in</strong>gapore Institute <strong>of</strong> Policy Studies, IIIS, <strong>the</strong> World Bank Irish Trust Fund, <strong>and</strong> <strong>the</strong> World Bank ResearchDepartment, East Asia Region, <strong>and</strong> South Asia Region for f<strong>in</strong>ancial support. <strong>The</strong> views expressed <strong>in</strong> thispaper are entirely those <strong>of</strong> <strong>the</strong> authors <strong>and</strong> do not necessarily represent <strong>the</strong> op<strong>in</strong>ions <strong>of</strong> <strong>the</strong> World Bank.

<strong>The</strong> evolv<strong>in</strong>g role <strong>of</strong> <strong>Ch<strong>in</strong>a</strong> <strong>and</strong> <strong>India</strong> <strong>in</strong> <strong>the</strong> global f<strong>in</strong>ancial systemAppendixTable 3 Brief chronology <strong>of</strong> <strong>Ch<strong>in</strong>a</strong>’s f<strong>in</strong>ancial liberalization s<strong>in</strong>ce 1990DateDetails1990 Shanghai Securities Exchange was <strong>of</strong>ficially recognizedApril 1990 An amendment to <strong>the</strong> law on Ch<strong>in</strong>ese foreign equity jo<strong>in</strong>t ventures, stipulat<strong>in</strong>g that <strong>the</strong>State would not nationalize jo<strong>in</strong>t ventures, simplify<strong>in</strong>g <strong>the</strong> approval procedures fornew foreign <strong>in</strong>vestment enterprises, <strong>and</strong> extend<strong>in</strong>g <strong>the</strong> management rights <strong>of</strong>foreigners was passedMay 1990 Shanghai was opened to FDI, with tax <strong>in</strong>centives similar to special economic zones.<strong>The</strong> State Council issued regulations for <strong>the</strong> sale <strong>and</strong> transfer <strong>of</strong> l<strong>and</strong> use rights <strong>in</strong>cities <strong>and</strong> towns to encourage foreign <strong>in</strong>vestors to plan long-term <strong>in</strong>vestment.Shenzhen Stock Exchange was <strong>of</strong>ficially recognized1991 Shenzhen Stock Exchange was <strong>of</strong>ficially recognizedApril 1991 <strong>The</strong> tax <strong>of</strong> 10% on distributed pr<strong>of</strong>its remitted abroad by foreign <strong>in</strong>vestors <strong>in</strong> foreignfunded enterprises was elim<strong>in</strong>ated, unify<strong>in</strong>g <strong>the</strong> tax rates on Ch<strong>in</strong>ese foreign jo<strong>in</strong>tventures <strong>and</strong> entirely foreign enterprises. Also, more tax benefits were given topriority <strong>in</strong>dustrial sectors1992 <strong>The</strong> B-share market was launchedMarch 1992 Foreign <strong>in</strong>vestment was fur<strong>the</strong>r liberalized, with <strong>the</strong> open<strong>in</strong>g <strong>of</strong> a large number <strong>of</strong> <strong>in</strong>l<strong>and</strong><strong>and</strong> border areasJuly 1993 Q<strong>in</strong>gdao Beer was <strong>the</strong> first Ch<strong>in</strong>ese firm to list <strong>in</strong> <strong>the</strong> Hong Kong Stock Exchange1997 F<strong>in</strong>ancial <strong>in</strong>stitutions were allowed to issue bonds <strong>in</strong> <strong>in</strong>ternational markets with SAFEapprovalFebruary 1999 A private Ch<strong>in</strong>ese firm was listed abroad for <strong>the</strong> first timeFebruary 2001 Domestic <strong>in</strong>vestors were allowed to purchase B shares with exist<strong>in</strong>g foreign currencydepositsJune 2001 Domestic <strong>in</strong>vestors were allowed to purchase B shares with new foreign currencydepositsSeptember 2001 Restrictions were liberalized on purchases <strong>of</strong> foreign exchange for advance repayments<strong>of</strong> loans <strong>and</strong> debtsApril 2002 A new four-tier classification was <strong>in</strong>troduced, def<strong>in</strong><strong>in</strong>g sectors <strong>in</strong> which foreign<strong>in</strong>vestment is encouraged, permitted, restricted, or banned. As a result, sectors thatwere previously closed to foreign <strong>in</strong>vestment were openedDecember 2002 Qualified foreign <strong>in</strong>stitutional <strong>in</strong>vestors were allowed to purchase A shares, subject torestrictionsJanuary 2003 Permission from <strong>the</strong> SAFE was no longer required for domestic residents to borrowforeign exchange from domestic Ch<strong>in</strong>ese f<strong>in</strong>ancial <strong>in</strong>stitutionsNovember 2003 In some prov<strong>in</strong>ces <strong>and</strong> regions, <strong>the</strong> limit on outward direct <strong>in</strong>vestment was raised to $3million, from $1 million2004 Insurance companies were allowed to use <strong>the</strong>ir own foreign exchange to <strong>in</strong>vest <strong>in</strong><strong>in</strong>ternational capital marketsJanuary 2004 <strong>The</strong> asset requirements for Hong Kong (<strong>Ch<strong>in</strong>a</strong>) banks to open branches <strong>in</strong> ma<strong>in</strong>l<strong>and</strong><strong>Ch<strong>in</strong>a</strong> were lowered to $6 billion, from $20 billion. O<strong>the</strong>r restrictions on Hong Kongbanks were eased tooJune 2004 Domestic foreign-funded banks were not permitted to convert debt contracted abroad<strong>in</strong>to RMB, <strong>and</strong> were not allowed to purchase foreign exchange for servic<strong>in</strong>g suchdebts. Capital remitted through FDI could only be converted to RMB upon pro<strong>of</strong> <strong>of</strong>domestic paymentDecember 2004 Foreign heirs were allowed to take <strong>in</strong>heritance out <strong>of</strong> <strong>the</strong> ma<strong>in</strong>l<strong>and</strong>. Emigrants wereallowed to take legally obta<strong>in</strong>ed personal assets with <strong>the</strong>m2005 A foreign company was listed <strong>in</strong> <strong>the</strong> Shanghai Stock Exchange for <strong>the</strong> first time.February 2005 Domestic residents were allowed to set up companies abroad to facilitate round-tripp<strong>in</strong>g<strong>in</strong>vestment or overseas f<strong>in</strong>anc<strong>in</strong>g (issu<strong>in</strong>g bonds <strong>and</strong> stocks).This made it easier for private firms to access <strong>in</strong>ternational capital markets <strong>and</strong> for