CODE 0143

CODE 0143

CODE 0143

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

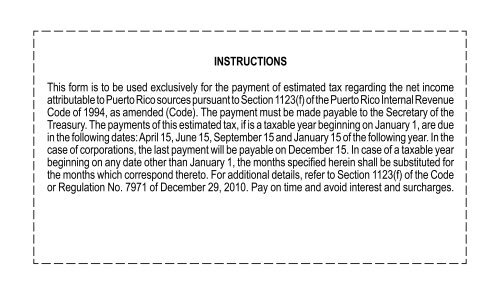

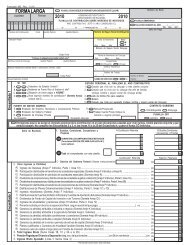

INSTRUCTIONSThis form is to be used exclusively for the payment of estimated tax regarding the net incomeattributable to Puerto Rico sources pursuant to Section 1123(f) of the Puerto Rico Internal RevenueCode of 1994, as amended (Code). The payment must be made payable to the Secretary of theTreasury. The payments of this estimated tax, if is a taxable year beginning on January 1, are duein the following dates: April 15, June 15, September 15 and January 15 of the following year. In thecase of corporations, the last payment will be payable on December 15. In case of a taxable yearbeginning on any date other than January 1, the months specified herein shall be substituted forthe months which correspond thereto. For additional details, refer to Section 1123(f) of the Codeor Regulation No. 7971 of December 29, 2010. Pay on time and avoid interest and surcharges.