connexions_apr09 - local CFA Societies

connexions_apr09 - local CFA Societies

connexions_apr09 - local CFA Societies

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

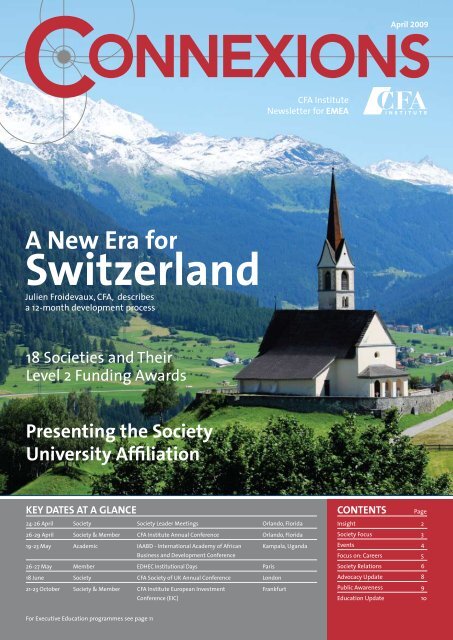

society focusImplementing the <strong>CFA</strong> Institute EMEA Strategy 2012 in Switzerland:The Swiss <strong>CFA</strong> Society Hires an Executive Directorby Julien Froidevaux, <strong>CFA</strong>, Past President of the Swiss <strong>CFA</strong> SocietyIn a move aimed to bolster the values andmission of <strong>CFA</strong> Institute in Switzerland, theSwiss <strong>CFA</strong> Society (S<strong>CFA</strong>S) has decided tohire a dedicated executive director. To drivethe process and develop a five-year businessplan, a project group was formed last yearand more recently, a nominating committeewas established to conduct the search for ahigh-calibre candidate. This has resulted inthe appointment of Anne-Katrin Scherer, <strong>CFA</strong>,as executive director of S<strong>CFA</strong>S.Prior to accepting the appointment withthe society, Anne-Katrin Scherer balancedher role as a full-time mother of youngchildren with dedicated volunteer work for<strong>CFA</strong> Institute at both a <strong>local</strong> and a globallevel. In 2006, Anne-Katrin was presentedwith the <strong>CFA</strong> Institute ‘Special ServiceAward’, in recognition of her involvementand contribution. She has graded <strong>CFA</strong> examsfor nine years and was a member of theDisciplinary Review Committee for six years.Anne-Katrin was part of the task force thatestablished S<strong>CFA</strong>S (formerly known as theSwiss Society of Investment Professionals).As well as being a founding board member,she served as the society’s secretary andmembership chair until 2004. She previouslyworked as an equity analyst at Bank JuliusBaer & Co. andUnion Bank ofSwitzerlandin Zurich.The executivedirector willmanage anddevelop S<strong>CFA</strong>S,support initiativesAnne-Katrin Scherer, <strong>CFA</strong> in the interest ofmembers, andreport on a regular basis to the society’sboard. Anne-Katrin Scherer’s knowledgeof <strong>CFA</strong> Institute will be of paramountimportance in implementing the ambitiousEMEA Strategy 2012 in Switzerland. A keypart of her role will be to increase activitiesand services and to develop a businessmodel which will lead to the societybecoming fully self-sustaining withinan agreed period of time.The S<strong>CFA</strong>S was established in 1996. It wasthe first <strong>CFA</strong> society created outside NorthAmerica. Over the years, the society hasexperienced rapid growth and has nowreached close to 2,000 members. Severalevents are organized monthly in both Zurichand Geneva, the two principal financialcentres, with eminent speakers from bothSwitzerland and abroad. The society has alsoparticipated in several travelling conferencesand is actively involved in <strong>local</strong> advocacy.Given the voluntary nature of the S<strong>CFA</strong>Sboard and the high frequency of eventsorganized by the society, it was decidedseveral years ago to outsource part of theadministrative function to an externalprovider. The hiring of a dedicated executivedirector comes as a natural stage ofdevelopment for the largest <strong>CFA</strong> Societyin continental Europe.The existing board of the Swiss <strong>CFA</strong> Societywill remain in place; its role will graduallychange from running the society’sactivities on a voluntary basis to providingsupport and strategic guidance to theexecutive director.The Swiss <strong>CFA</strong> Society’s board believes thisappointment marks the beginning of a newera for the society, which will benefit both<strong>CFA</strong> candidates and members. Please joinme in welcoming Anne-Katrin Scherer as ournew executive director!Top Tips: <strong>CFA</strong> Cyprus ‘Mentoring’ ProgramAs a small society of just over 70members, <strong>CFA</strong> Cyprus had the usualproblem of encouraging participationand identifying volunteers fromamongst its membership. However,rather than viewing size as a problem,society leaders have turned it totheir advantage.Operating a ‘mentoring’ program ofsorts, each board member is assigned15 members and has responsibilityfor nurturing them and involvingthem in the society’s activities.They will typically:• Invite them to the eventsorganised by the society• Work with them to raisesponsorship• Assign volunteer tasksThis approach helps both to engagemembers and to enable societyleaders to get to know potentialvolunteers.“Each board member’s allocation of members and candidates is based on their personal andbusiness contacts and relationships and is reviewed annually. This method of communication is ofparticular importance and effectiveness for societies located within small financial communities”Constantinos Papanastasiou, <strong>CFA</strong>, President of <strong>CFA</strong> Cyprus3

focus on:careers<strong>CFA</strong> UK Launches Careers Guide 2009News FlashGlobal InvestmentResearch ChallengeIn December 2008, <strong>CFA</strong> UK (co-sponsoredwith <strong>CFA</strong> Institute) launched the “CareersGuide 2009: The Definitive Guide to aCareer in the Investment Profession.” Thisguide has the potential to be shared oradapted by other societies. It includes:n Insights into business functions andemployer types across the professionn 63 profiles of investment professionalsn 54 interviews with industry expertsn 46 recruitment agenciesn 14 business areas coveredn 18 job functions assessedn Recruitment round table: where arethere still job opportunities?n How to put together your CV: whatevery candidate should known Top 10 tips on successful interviews,including the mistakes to avoidn How headhunters workServing Our Members inDifficult TimesIn addition to the “Careers Guide 2009,”<strong>CFA</strong> UK is also providing the followingcareers services:n Careers events:• Sector specific (e.g.,“DistressedDebt,” “Prime Brokerage”)• Broad (e.g., “Working in theMiddle East”)• Soft skills (e.g., “DistinguishingYourself”)• Annual “Working in the InvestmentProfession” eventn Recruiter details onlinen Careers support materials online(e.g., interview tips)n Jobsite (4,000 – 5,000 unique userseach month; income generating)Joe Biernat, <strong>CFA</strong>, chairman of <strong>CFA</strong> UK, said:“The last year has been a difficult one forour profession. Careers support serviceshave always been a priority for membersbut are now more important than ever.During the last year, the society’s careersservices have been extended. The onlinecareers service is now being consistentlysupplemented with careers events and isbeing supported by the publication (onlineand offline) of this extensive careers guide.The guide is designed to help youngermembers and those in the <strong>CFA</strong> Programidentify suitable career paths in theinvestment profession.”You can download the guide from <strong>CFA</strong> UKat http://publishing.yudu.com/Ax8w0/Careers08/, or contact Will Goodhart,CEO, <strong>CFA</strong> UK (wgoodhart@cfauk.org) forfurther information.Finalists in the Turkish IRC 2009London recently played host to thefinale of the Global InvestmentResearch Challenge (GIRC), welcomingteams from Europe, Asia Pacific, andthe Americas. We are very gratefulto Thomson Reuters, global sponsorsof the GIRC, for their tremendoussupport for both the regional andglobal events.We would like to thank the societiesthat took part, particularly thosebased in EMEA, and to congratulateall the teams on making this year’sevents such a success.The winners were from thefollowing universities:Global Finale:Nanyang Technological University,SingaporeRegional Final:University College Cork, IrelandLocal Finals:France:Université de Lille IIIreland:University College CorkItaly:Bocconi UniversityNetherlands:University of AmsterdamSpain:Instituto de Empresa Business SchoolTurkey:Koç UniversityUK:Warwick Business SchoolNext year we hope to havemany more societies from EMEAcompeting in the GIRC.For further information contactyour SRR or Rhonda Reid(rhonda.reid@cfainstitute.org).5

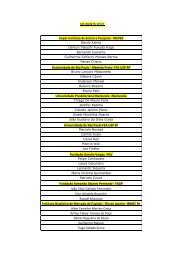

society relationsLevel 2 Funding Report:EMEA Society ProjectsResults from the first applicationround for the new <strong>CFA</strong> Institute Level2 funding were announced in February2009. There was a strong showing fromthe EMEA region: all 18 societies thatsubmitted proposals by the deadlinewere awarded all or part of the fundsthey requested.Here is a summary of the projects thesesocieties will be developing over thecoming months. We hope this will helpsocieties develop proposals for 2010.The Level 2 funding process will beexamined over the coming monthswith the intention of improving theprogramme. Details are expected to beavailable in June or July 2009 and willbe posted online at the Society LeaderResource Centre.Society Project Objective(s)BahrainBermudaParticipation in a Career Fairconducted by the University ofBahrainSociety’s 20th Anniversary Project(reception and investor educationadvertising insert in Bermudadaily newspaper)To target students of the Banking and Financegraduation course to pursue the <strong>CFA</strong> Program.To provide impetus to raise public awareness andeducate investors.Bulgaria Career Development Event To create further awareness and influence amongstemployers in the <strong>local</strong> financial industry.CzechRepublicEgyptFinlandGermanyItalyForecast DinnerSeminars with prominentinvestment professionals fromthe <strong>local</strong> investment communitySpeaker event (three foreignspeakers) focussing on a timelytopic and targeting members,students, universities andmembers of the <strong>local</strong> investmentprofessionSpeaker and networking eventsin multiple financial centresPrize for the best post-graduatedissertationTo generate significant brand awareness of the<strong>CFA</strong> Program and the <strong>CFA</strong> designation in the CzechRepublic.To build awareness of the importance to theinvestment community of having a <strong>local</strong>, professionalsociety.To build awareness of <strong>CFA</strong> Institute and the <strong>CFA</strong>designation and to launch employer outreach efforts.To build on progress in becoming a countrywidesociety.To gain visibility with universities, graduates andpotential <strong>CFA</strong> candidates, media and members. Toprovide an opportunity for professors to engage withthe society as part of the judging panel.Kuwait Society launch event To introduce <strong>CFA</strong> Institute and its mission to thepublic in Kuwait, and to promote the <strong>CFA</strong> Programand charter.Mauritius Awareness and Governance Event To re-establish the value of the <strong>CFA</strong> charter asone of the most visible standards in the investingprofession.NetherlandsRomaniaA high-profile event featuringprominent Dutch speakers andhigh-level representatives fromthe top credit houses“Investments Day” as part of theFIAR (international insurance /reinsurance forum)To increase <strong>CFA</strong> Institute brand awareness and putthe society on the map as a provider of high-quality,relevant events.To give the society maximum exposure to theinsurance, reinsurance and private pensionsindustries.6South Africa “JobForum” To provide a sophisticated electronic platformfor members of the <strong>local</strong> society to connect withemployers.SpainEmployment and ProfessionalDevelopment Outreach EventTo raise awareness with employers, candidates,universities and other investment professionals. Toprovide an opportunity for networking and mediaexposure.Sweden Ethics Seminar To build awareness of the <strong>CFA</strong> charter, including theCode of Ethics and the Standards of ProfessionalConduct, with key audiences (e.g., universities,employers, and potential members).Switzerland Financial Innovation Prize To foster relationships between practitioners andacademics and increase overall awareness of therole of the society in encouraging the highest levelof knowledge, professionalism, and integrity in theinvestment business.United ArabEmiratesUnitedKingdomCorporate Governance Award forListed Companies (in partnershipwith Hawkamah)Live webcasting of the society’sContinuing Education andCareers programmingTo demonstrate the importance of corporategovernance and to encourage its implementation inthe UAE.To fulfil our mission to provide continuing educationand career support to our members.

<strong>CFA</strong> FinlandFrom Plan to ExecutionFrom left to right: Timo Löyttyniemi, Managing Director, The State Pension Fund of Finland,Billyana Ize-Okhae, <strong>CFA</strong>, Vice-President, <strong>CFA</strong> Finland, Knut N. Kjaer, ex-CEO, Norges BankInvestment Management (Norwegian Oil Fund), Rich Herman, Managing Director, GlobalHead of Institutional Sales, Deutsche Bank, Dr. Juha Tarkka, Adviser to the Board, Bank ofFinland. Dennis McLeavey, <strong>CFA</strong>, Head of Education, EMEA, <strong>CFA</strong> Institute and Mikko Niskanen,<strong>CFA</strong>, President, <strong>CFA</strong> Finland.“The society's sense ofpurpose is more clearlydefined as a resultof both the planningsession and thecurrent crisisMikko Niskanen, <strong>CFA</strong>,President of <strong>CFA</strong> Finland”Last year board members of <strong>CFA</strong> Finlanddecided that they needed to revitalisethe society and raise awareness of the<strong>CFA</strong> designation amongst employers,universities, students, and otherinvestment professionals in Finland.Candidate growth was stagnant, andas a small society of only 60 members,the board needed to think about howto encourage more people to embarkon the <strong>CFA</strong> Program.Mikko Niskanen, <strong>CFA</strong>, president of <strong>CFA</strong>Finland, asked for help from <strong>CFA</strong> Instituteto first survey the membership andthen put together a strategic planningsession for the society’s board. The surveyconfirmed that the membership regardedpromotion of the <strong>CFA</strong> designation as themost important function of the society atthis stage in its development. Since theJune 2008 session, facilitated by EmilyDunbar, the board has focused on refiningand executing its plan to raise awarenessand increase society membership.With this in mind, the society successfullyapplied for Level 2 funding to support anumber of activities around its annualforecast dinner, which targeted all of itskey constituencies. It arranged for threeprominent speakers to take part in aseminar prior to the forecast dinner onthe topic of “Investment Managementin the Aftermath of the FinancialCrisis.” The event achieved its aim toattract participation from beyond themembership and generated interest inthe society from amongst <strong>local</strong> regulators,who realised that the society – withits global connections and affiliationwith <strong>CFA</strong> Institute – has a role to play indiscussions around ethics and regulation.The society also invited Dennis McLeavey,<strong>CFA</strong>, to be one of the speakers at theevent and capitalised on his presencein the region by arranging meetingswith both the <strong>local</strong> business school and<strong>local</strong> employers. There are currently noprep courses in Helsinki; if the universitydevelops a programme, it will act asan incentive for employers to put theirstaff through the <strong>CFA</strong> Program, thusincreasing the level of candidates inFinland. Discussions along these lineswith both the university and employerswere extremely positive. The society wasable to reinforce both the value of the <strong>CFA</strong>charter and the message that companiescannot be complacent and should besupporting staff in upgrading their skills– a message that was well received andbroadly accepted.It will be some time before the societyboard can assess the extent to whichtheir plans have been successful. However,in just a few months, they have madesignificant progress without greatlyincreasing the burden on volunteers.“The society’s sense of purpose is moreclearly defined as a result of both theplanning session and the current crisis,”says Mikko Niskanen. “Everything weare doing now is linked to our goals,and we are beginning to get across themessage that <strong>CFA</strong> Finland has somethingvaluable to contribute to the <strong>local</strong>investment profession.”News FlashMember Offer<strong>CFA</strong> Institute is proud to support EDHECInstitutional Days 2009 – five majorinvestment events that will allowprofessionals to review major industrychallenges, explore state-of-the-artinvestment techniques, and benchmarkpractices to research advances. The eventswill be held May 26 – 27 in Paris. <strong>CFA</strong>Institute will be hosting an exhibitionbooth at the event, and we are pleasedto offer our members a 40 percentregistration fee discount.Please visit www.edhec-risk.com/events/edhec_conferences/EID_2009/ for moreinformation. To take advantage of the 40percent discount, please register atwww.edhec-risk.com/<strong>CFA</strong>discountEIDWe encourage you to share this offer withyour members, and we hope to see youin Paris!7

advocacy updateby Charles Cronin, <strong>CFA</strong>The rate of regulatory inquiry into thefinancial crisis continues at an unrelentingpace. Since we last penned our copy to‘Connexions,’ the only good news is thatthe world’s major stock indices havenot fallen much further. However, theeconomic news continues to get worse,questioning whether this condition issustainable.The Centre’s impact on the regulatoryprocess continues to grow from strengthto strength. We have taken part in twopublic hearings that neatly bracket ouractivity over the last few months.Fair ValueOn Armistice Day, we achieved anotherfirst by giving evidence and answeringquestions before the UK’s TreasurySelect Committee investigation intothe financial crisis. The Treasury SelectCommittee, chaired by the Rt. Hon. JohnMcFall MP, scrutinises the activity of thegovernment’s Treasury department andrelated bodies. Our participation was inconnection with the role of fair-valueaccounting in the crisis. Our view is thatfair-value accounting cannot be blamedfor the crisis and that confidence willnot return to the financial sector untilinvestors have renewed confidence in thefinancial statements of the financial sector.The Audit IndustryIn early February, we were invited to aroundtable on the audit industry hosted atthe European Parliament. We spoke withothers about the European Commission’sproposals to allow non-auditors to investin audit partnerships. In attendancewere Eddy Wymeersch, the chairman ofCESR, and Pierre Delsaux, the director ofCompany Law and Corporate Governanceof DG Market.The Commission and other bodies, such asthe Financial Reporting Council, are veryconcerned that there are effectively onlyfour auditors serving the requirements oflarge issuers around the world. Should oneof the big four rapidly exit the market, asArthur Andersen did on the back of theEnron Corporation scandal, it would bevery difficult for issuers linked with thatauditor to find a replacement at shortnotice. Beyond the immediate problem toissuers, the failure of one of the big fourcould create a crisis of investor confidencein financial statements that would havedire consequences for the cost of publiccapital. The Commission is exploringideas to foster consolidation of the highlyfragmented European small auditormarket and encourage new capital into theaudit business by removing restrictions onthe sources of its capital. It is hoped thatthrough access to other sources of capital,new entrants will emerge to compete withthe business of the big four. We agree withthis idea and go further to propose thatthe EU harmonize auditor obligations andduties as well as enforcement of thoseobligations and duties as a necessaryrequirement to enable consolidation.Further ConsultationsIn-between these two events, we haveresponded to consultations concerningMiFiD, MAD, hedge funds, and hedge fundsof funds as well as to rights issues fromCESR, the European Commission, IOSCO,and the FSA. All our comment letters canbe found on the Centre’s website atwww.cfainstitute.org/centre/topics/comment/index.html.IPACFinally, the <strong>CFA</strong> Society of the UK– the most active in advocacy in theEMEA region – has recently appointedpast chairman Colin McLean, FSIP,founder and managing director ofSVM Asset Management, as chairmanof its Investment Profession AdvocacyCommittee (IPAC). IPAC’s terms ofreference are similar to the CapitalMarkets Directorate at the Centre. Overthe last 12 months, we have steppedup our joint work with the UK Societyand look forward to working with Colin.“I am delighted totake on the roleof chairman ofthe InvestmentProfession AdvocacyCommittee (IPAC)for <strong>CFA</strong> UK, and with thesupport that Charles and hiscolleagues are providing.Our advocacy will be linkedclosely to members’ views,and I look forward to workingwith Charles”Colin McLean, FSIP8Martin Sjöberg JoinsCentre Team in BrusselsMartin Sjöberg has joined the <strong>CFA</strong>Institute Centre for Financial MarketIntegrity as manager, European Affairs,at the newly opened Brussels office.Reporting to Charles Cronin, <strong>CFA</strong>, he willbe responsible for monitoring legislativeand regulatory developments in theEuropean Union and identifying publicpolicies and related developments inthe capital market arena that affect theinterests of <strong>CFA</strong> Institute.Most recently, Martin held the position ofhead of office for the Swedish ChristianDemocrats in the European Parliamentin Brussels, where he was an advisor to amember of the European parliament anda former governor of the Swedish CentralBank. Previously, he served as the headof economic analysis in the public affairsdepartment at the Stockholm Chamber ofCommerce.Martin holds a bachelor’s degree inEuropean studies from Skövde Universityand a master’s degree in economics fromStockholm University. Additionally, Martinis currently pursuing his charter. He isfluent in English, French, and Swedish.

public awarenessDeveloping Society Media Relationsin Four Simple StepsCase Study:<strong>CFA</strong> SpainMedia relations can play a vital role inraising awareness of societies and theirwork. Here are four steps to help increaseyour knowledge and understanding ofthe media:Step 1Getting started / fine tuning yourexisting approachn Assign a person to be the main mediacontact responsible for implementingmedia relations.n Arrange media training if necessary.n Identify society members who cancomment on their areas of expertise.n Have a few written key facts andmessages to share about the societyand its goals.Step 2Know your median Identify key investment newspapersand magazines.n Understand the audience and thinkabout what will be of interest to them.n Build a database of key journalists,including e-mail addresses and phonenumbers.Step 3Build relationsn Meet and greet: introduce yourselfand build personal relations (e.g., getin touch to explain who you are, whatyou do, and how you can help; perhapsarrange a coffee or lunch).n Keep journalists informed (e.g., addthem to member communications,such as newsletters).n Provide editors with somethinguseful: the media are often keen tobe educators and thus are willing toaccept informative and/or educationalarticles that will be of interest to theirreaders. Write an article on a timelytopic and seek its publication viathe editor.n Invite contacts to your events:journalists need information andcontacts to do their job; invitations toeducational or social events can buildrelations.Step 4Help journalists do their jobn Set up a media resource or “presscentre” on your website. Includebasic content information about yoursociety, key members, plus your pressreleases (including <strong>CFA</strong> Institute pressreleases, if you wish).n Earn respect as a commentator: sendletters to the editor commenting onkey issues in the news.n Have a society calendar of news andissue press releases.n Organize an education event just forjournalists, such as a short seminaron how aspects of the market work(e.g., “What Are Derivatives?”).Borja Durán, <strong>CFA</strong>Borja Durán, <strong>CFA</strong>, president of <strong>CFA</strong>Spain, organised several mediainterviews for <strong>CFA</strong> Institute DeputyCEO Bob Johnson, <strong>CFA</strong>, during hisrecent visit to the country. Borjaexplains how he arranged theinterviews and achieved his goals:“We prepared Bob's visit to Madridthree months ahead of his actualarrival in order to develop acomprehensive media campaign andto organise meetings. We wanted toget the most out of his visit, so ourfocus for each media meeting wasdecided according to the journalist’sspecialist subject. This meant thatwe used different angles to pitchthe meetings to each publication sowe could increase the breadth anddepth of the message: Bob’s visit toSpain and the virtues of <strong>CFA</strong> Instituteand the <strong>CFA</strong> Program.Through this targeted approach,we achieved meetings with fivepublications, including Spain’sleading daily financial newspaper,a television channel, and anotherleading daily financial newspaper.The media campaign was a greatsuccess. We managed to get <strong>CFA</strong>Institute and <strong>CFA</strong> Spain featured in awide variety of publications throughdifferent approaches. Without adoubt, the number of contactswe have made has led to a majorbreakthrough for the disseminationof the <strong>CFA</strong> Institute message in our<strong>local</strong> financial community. Throughthis campaign, we have reachedregulators, employers, students,professionals, and headhunters.”9

<strong>CFA</strong> Institute Executive Education Calendar<strong>CFA</strong> Institute Executive Educationprogrammes provide an exclusiveopportunity to learn from top thoughtleaders in an intimate academicenvironment. We have open enrolmentprogrammes with London Business School,Oxford, EDHEC, AIF, SFI, and INSEAD.Two new programmes have been addedsince 1 January 2009: Bocconi andReading ICMA.With an emphasis on active learning,these programmes provide insight intothe latest innovations and best practicesin investment management. You can finddetails of the programmes being held inthe EMEA region (listed below) at(www.cfainstitute.org/memresources/conferences/executive_ed.html).International Fixed Incomeand Derivatives (IFID) Program26 April-2 May 2009Sitges, BarcelonaIn partnership with ICMAQuantitative Equity PortfolioManagement InternationalProgram5-8 May 2009MilanIn partnership withSDA Bocconi Schoolof ManagementInternational Wealth & TaxPlanning Seminar11-15 May 2009LucerneIn partnership withSwiss Finance InstituteAdvanced Corporate Valuation10-12 June 2009London& 17-19 August 2009JohannesburgBoth in partnership withAmsterdam Institute of FinanceGlobal Investors Workshop15-19 June 2009FontainbleauIn partnership with INSEADOxford Private Equity Program29 June-2 July 2009OxfordIn partnership withSaïd Business SchoolcontactEMEA Society Programme Chairsn Austrian Bahrainn Belgiumn Bermudan Bulgarian Cyprusn CzechRepublicn Denmarkn Egyptn EmiratesCn Finlandn Francen GermanyAndreas Schuster, <strong>CFA</strong>andreas.schuster@hypocapital.atHamad M.A. Hasanhamadmah@yahoo.comXavier Verdeyen, <strong>CFA</strong>xave21@hotmail.comNathan Kowalski, <strong>CFA</strong>nkowalski@anchor.bmVeneta Ilieva, <strong>CFA</strong>vpilieva@bacb.bgKate Yiannoura, <strong>CFA</strong>kyiannoura@nbg.com.cyPetra Roberts, <strong>CFA</strong>petra.roberts@krpartners.czMarietta Bonnetddf@finansanalytiker.dkHesham Amer, <strong>CFA</strong>h.amer@hotmail.comKhayyam Ahmed Khatlany,cFAkhayyam.ahmed.khatlany@citi.comBillyana KunchevaIze-Okhae, <strong>CFA</strong>billyana.ize-okhae@aktia.fiPhilippe Douillet, <strong>CFA</strong>cabinet.douillet1@wanadoo.frCarsten Mumm, <strong>CFA</strong>c.mumm@donner.den Greece Yiannis Ritsios, <strong>CFA</strong>yiannis@ritsios.grn Hungary Laszlo Banyarbanyar.laszlo@rfh-rt.hun Ireland Ronan McCabe, <strong>CFA</strong>ronan.mccabe@icm.ien ItalyBarbara Valbuzzi, <strong>CFA</strong>barbara.valbuzzi@icfas.itn Jordan Wissam Fares Otaky, <strong>CFA</strong>wissamotaky@gmail.comn Kuwait Fares Hammarmi, <strong>CFA</strong>fareshammarmi@hotmail.comn Lebanon Ioussef Hassan Nizam,C cFAIoussef.nizam@asib.comn Luxembourg Arndt Nicolaus, <strong>CFA</strong>arndt@nicolaus.asn Mauritius Imrith Ramtohul, <strong>CFA</strong>iramtohul@mauritiusunion.comn Netherlands Sjoerd Lontsjoerd.lont@gmail.comn Poland Raimondo Eggink, <strong>CFA</strong>eggink@wp.pln Romania Cristian Dragos, <strong>CFA</strong>cdragos42@yahoo.comn Russia Vladimir A. TutkevichVTutkevich@ifc.orgn Saudi Arabia Zaheeruddin Khalid, <strong>CFA</strong>zukhalid@gmail.comn South African Spainn Swedenn Switzerlandn Turkeyn UKElbie Louw, <strong>CFA</strong>Elbie.Louw@up.ac.zaJuan Tenorio, <strong>CFA</strong>juan-jose.tenorio@caixacatgestio.esMarcus Widmarkmarcus.widmark@cfasweden.seFrançois Aubertfea@yourprivatebanker.chErman Kalkandelenekalkan@templeton.comMark Tapley, <strong>CFA</strong>, FSIPmarktapley@btinternet.comThe EMEA Programming Calendar is updated on a monthly basis and can be viewed at https://www.cfainstitute.org/slrc/private/regions/emea/pdf/speakers.pdf. It includes details of both confirmed and planned events at all EMEA societies. It is compiled usinginformation from <strong>CFA</strong> Institute sources and society websites.11

21–23 October 2009Messe FrankfurtFrankfurt, Germanywww.cfainstitute.org/conferencescontactEMEA OfficeNitin MehtaManaging Director+44 207 531 0753nitin.mehta@cfainstitute.orgCharles Cronin, <strong>CFA</strong>Head of Advocacy+ 44 207 531 0762charles.cronin@cfainstitute.orgDennis McLeavey, <strong>CFA</strong>Head of Education+44 207 531 0756dennis.mcleavey@cfainstitute.orgEmily DunbarDirector, Society Relations+44 207 531 0761emily.dunbar@cfainstitute.orgMartin SjöbergManager, European Affairs+32 2 401 6828martin.sjoberg@cfainstitute.orgVincent Papa, <strong>CFA</strong>Senior Policy Analyst+ 44 207 531 0763vincent.papa@cfainstitute.orgRhodri Preece, <strong>CFA</strong>Policy Analyst+44 207 531 0764rhodri.preece@cfainstitute.orgAndrea GrifoniPolicy Analyst+44 207 531 0754andrea.grifoni@cfainstitute.orgKatalin SzpisjakSociety RelationsRepresentative (East)+44 207 531 9191katalin.szpisjak@cfainstitute.orgSarah-Jane PurvisPR Specialist+44 207 531 0766sarahjane.purvis@cfainstitute.orgAgnieszka KuzmickaEvent Co-ordinator+44 207 531 0760agnieszka.kuzmicka@cfainstitute.orgKate FisherAdministration Assistant+44 207 531 0754kate.fisher@cfainstitute.orgSteve WellardDirector, Marketing& Communications+ 44 207 531 0755steve.wellard@cfainstitute.org<strong>CFA</strong> Institute EMEA Office, London+ 44 207 531 0750 Lon1@cfainstitute.orgNatanya van der LingenSociety RelationsRepresentative (West)+44 207 531 0752natanya.vanderlingen@cfainstitute.org