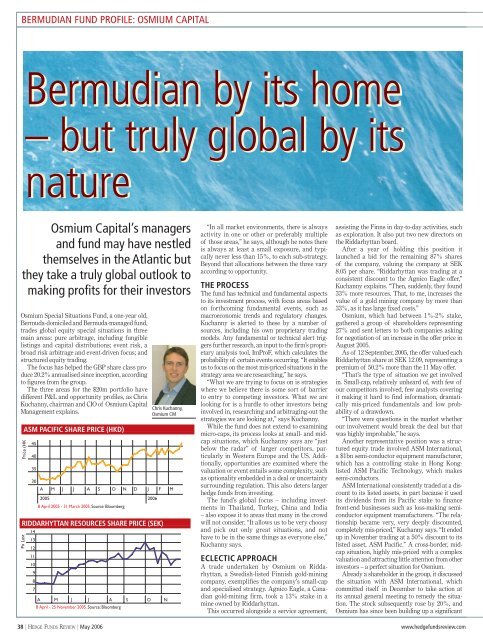

BERMUDIAN FUND PROFILE: OSMIUM CAPITALBermudian by its home– but truly global by itsnatureOsmium Capital’s managersand fund may have nestledthemselves in the Atlantic butthey take a truly global outlook tomaking profits for their investorsOsmium Special Situations Fund, a one-year old,Bermuda-domiciled and Bermuda-managed fund,trades global equity special situations in threemain areas: pure arbitrage, including fungiblelistings and capital distributions; event risk, abroad risk arbitrage and event-driven focus; andstructured equity trading.The focus has helped the GBP share class produce20.2% annualised since inception, accordingto figures from the group.The three areas for the $20m portfolio havedifferent P&L and opportunity profiles, as ChrisKuchanny, chairman and CIO of Osmium CapitalManagement explains.Price (HKD)5045403530AMJJ20058 April 2005 - 31 March 2005. Source: BloombergASONDJChris Kuchanny,Osmium CM2006RIDDARHYTTAN RESOURCES SHARE PRICE (SEK)Px LastASM PACIFIC SHARE PRICE (HKD)1413121110987A M J J A8 April - 25 November 2005. Source: BloombergSOFNM“In all market environments, there is alwaysactivity in one or other or preferably multipleof those areas,” he says, although he notes thereis always at least a small exposure, and typicallynever less than 15%, to each sub-strategy.Beyond that allocations between the three varyaccording to opportunity.THE PROCESSThe fund has technical and fundamental aspectsto its investment process, with focus areas basedon forthcoming fundamental events, such asmacroeconomic trends and regulatory changes.Kuchanny is alerted to these by a number ofsources, including his own proprietary tradingmodels. Any fundamental or technical alert triggersfurther research, an input to the firm’s proprietaryanalysis tool, ImProF, which calculates theprobability of certain events occurring. “It enablesus to focus on the most mis-priced situations in thestrategy area we are researching,” he says.“What we are trying to focus on is strategieswhere we believe there is some sort of barrierto entry to competing investors. What we arelooking for is a hurdle to other investors beinginvolved in, researching and arbitraging-out thestrategies we are looking at,” says Kuchanny.While the fund does not extend to examiningmicro-caps, its process looks at small- and midcapsituations, which Kuchanny says are “justbelow the radar” of larger competitors, particularlyin Western Europe and the US. Additionally,opportunities are examined where thevaluation or event entails some complexity, suchas optionality embedded in a deal or uncertaintysurrounding regulation. This also deters largerhedge funds from investing.The fund’s global focus – including investmentsin Thailand, Turkey, China and India– also expose it to areas that many in the crowdwill not consider. “It allows us to be very choosyand pick out only great situations, and nothave to be in the same things as everyone else,”Kuchanny says.ECLECTIC APPROACHA trade undertaken by Osmium on Riddarhyttan,a Swedish-listed Finnish gold-miningcompany, exemplifies the company’s small-capand specialised strategy. Agnico Eagle, a Canadiangold-mining firm, took a 13% stake in amine owned by Riddarhyttan.This occurred alongside a service agreement,assisting the Finns in day-to-day activities, suchas exploration. It also put two new directors onthe Riddarhyttan board.After a year of holding this position itlaunched a bid for the remaining 87% sharesof the company, valuing the company at SEK8.05 per share. “Riddarhyttan was trading at aconsistent discount to the Agnico Eagle offer,”Kuchanny explains. “Then, suddenly, they found33% more resources. That, to me, increases thevalue of a gold mining company by more than33%, as it has large fixed costs.”Osmium, which had between 1%-2% stake,gathered a group of shareholders representing27% and sent letters to both companies askingfor negotiation of an increase in the offer price inAugust 2005.As of 12 September, 2005, the offer valued eachRiddarhyttan share at SEK 12.09, representing apremium of 50.2% more than the 11 May offer.“That’s the type of situation we get involvedin. Small-cap, relatively unheard of, with few ofour competitors involved, few analysts coveringit making it hard to find information, dramaticallymis-priced fundamentals and low probabilityof a drawdown.“There were questions in the market whetherour involvement would break the deal but thatwas highly improbable,” he says.Another representative position was a structuredequity trade involved ASM International,a $1bn semi-conductor equipment manufacturer,which has a controlling stake in Hong KonglistedASM Pacific Technology, which makessemi-conductors.ASM International consistently traded at a discountto its listed assets, in part because it usedits dividends from its Pacific stake to financefront-end businesses such as loss-making semiconductorequipment manufacturers. “The relationshipbecame very, very deeply discounted,completely mis-priced,” Kuchanny says. “It endedup in November trading at a 50% discount to itslisted asset, ASM Pacific.” A cross-border, midcapsituation, highly mis-priced with a complexvaluation and attracting little attention from otherinvestors – a perfect situation for Osmium.Already a shareholder in the group, it discussedthe situation with ASM International, whichcommitted itself in December to take action atits annual general meeting to remedy the situation.The stock subsequently rose by 20%, andOsmium has since been building up a significant38 | HEDGE FUNDS REVIEW | May 2006 www.hedgefundsreview.com

BERMUDIAN FUND PROFILE: OSMIUM CAPITALposition in the company, which it holds today.Although the position initially moved against thefund by about 25%, it did not suffer a loss in thisperiod due to an active trading policy. Kuchannysaid the downside was less than 10% with anupside in excess of 100%, and that ASM Internationalis still deeply discounted.DIARY OF A FUND GETTING STARTEDOsmium has up to 49 positions at any onetime, diversified across global markets and sectors.The fund’s holdingperiods range from intraday,especially in the arbitragestrategy, through tolonger than a year in thestructured equity trades.“For a longer-term trade,I will have a portionthat is actively traded,making money out of thevolatility on the spread,”he says.UBS is the primebroker, while administrationis provided byDundee Leeds, the fundhaving recently changedfrom Bank of Bermuda.Its new administratorshares the same building,and while they are notone of the largest providerson the island theyhave reputable clients ontheir books, among themCitadel.Kuchanny stressed it was not dissatisfied withthe service received from the Bank of Bermuda,which he said provides a good service, especiallyfor larger clients. However, he noted “for thesmaller clients it does make sense to go with asmall- or mid-cap administrator to some degree.You are much more likely to get a high level ofservice. They’re a good, safe pair of hands.”It is currently looking to recruit to assist withresearch and investment decisions, with twohirings expected within the coming months. “Inthe past, I was a prop trader, so I have alwaysmanaged this number of strategies, and havemanaged a lot more money, with a portfolio ofover $1bn long and short,” he says. “But thereare so many more great strategies out there thatI haven’t got time to research.” He says it wasimportant to reach the one-year mark. Havingan audited track-record for this period is aninvaluable asset for attracting investors.BARRIERS TO ENTRY“The barriers to entry are enormous, andgrowing. Regulation is increasing. The cost tostart-up is increasing. Investor requirements areincreasing. Considering our returns we shouldbe five times the size we are,” Kuchanny says.“The reason we’re not is because you’ve gotto go jump over so many hurdles before a fundof hedge funds can invest. Many FoHFs havebecome institutions with very large amountsof capital, only able to invest in certain types ofstrategies and in certain ways.”As well as seeing a track record FoHFs wantto know the size of the team, and the numberof assets already managed. “The real thingsare track record and assets under management.It’s a Catch 22. You start with less than $10mbut you need to be $20m-$50m before many“The barriers to entry areenormous and growing.Regulation is increasing. The costto start up is increasing. FoHFshave become institutions withvery large amounts of capitalable to invest only in certain...strategies and in certain ways.The real things are track recordand assets under management.”investors will even look at you. The rule is 10%.”He says many talented managers don’t makeit simply because of this rule, which makesraising the first $20m so difficult.One way he tackled the problem was to startsmall, and avoid making big initial outlays onanything but the necessities. Osmium starteddeliberately small, with a small team to remain asustainable business and contain costs.“The asset jump, when it happens, is large anddramatic. You can go from between $20m-$50mto $100m in months. It’s theway the market works.”He feels Osmium is pastthe hardest hurdle in itsgrowth phase.“Returns are the onlyway to make a hedge fundwork. The guys who startwith big teams, buy offthe-shelfmodels and backofficesystems, and thenstill fail are the ones thatdon’t come out of the boxmaking money,” he says.“Forget everything else.The rest will come if youcan make returns, and ifyour strategy is not capableof surviving in all marketenvironments and youaren’t going to have a greatfirst two years, then justdon’t start.”Osmium has posted positivereturns everymonth since it launched, even Marchand April 2005 when most of itscompetitors were losing. It has alsoappeared in Bloomberg’s top 10 performersamong European managedevent-driven hedge funds four times,coming second in October 2005. Its sterlingshare class has delivered annualised returns of20.2% since inception.Osmium is partly owned by The Genesis Foundation, a charitywhich owns 10% of the management company. “Tithing is anessential part of what we do. The Genesis Foundation additionallybenefits by receiving 0.5% of Osmium’s 2% annual managementfee. The 2% is paid monthly pro rata directly to the managementcompany in the normal way, who then pays 25% of this incomedirectly to the charity. Genesis gives this money to a range ofglobal charities, with 50% going to African charities, includingHIV/Aids and self-sufficiency projects,” Kuchanny explains.Kuchanny’s family are based in Zambia, and he chairs theboard of trustees for a UK-based charity involved in HIV/Aids there.The other 50% is donated to other areas, with investorsencouraged to suggest worthy causes. Suggestions for investmentso far have been limited due to the still-small size of the fund,but as it grows, Kuchanny is optimistic it will prove popular withinvestors. “TCI are the only ones that come to anyone’s mind ashaving a charitable element to their structure.”However, Osmium changed its management fee from 1.5% to2%, with the extra money going directly to Genesis.FUNDAMENTALSName of manager: Chris KuchannyName of fund:Osmium SpecialSituations FundAddress of manager: Penthouse Suite,129 Front St,Hamilton, HM12,BermudaFurther information: +1 441 296 7131Launch date of fund: 15 March 2005Size of portfolio: $20mOpen or closed? OpenTarget annualised return: 20.2% (£), 19.8% ($)Geographic focus: GlobalStrategy:Special sits (equity)Administrator:Dundee LeedsPrime broker:UBSManagement/perf. fee: 2%/20%Domicile/listing: Bermuda/NilShare classes/currencies: GBP, dollarMinimum investment: £500,000/$1mRedemption:MonthlyEnvisioned capacity: $400m (hard close)THE BEAUTY OF BERMUDAKuchanny’s previous life as a proprietary traderwas based in London, where he lived for anumber of years, but he says he was no longertied to the lifestyle there anymore. “I wanted abit more greenery, a more outward-bound-typelifestyle,” he says. “In terms of the way I trade,there is no particular advantage to me being inLondon. I’m not reliant on going and seeing com-GLOBAL GIVINGpanies in person. It’s not that type of strategy.In the rare instance we need to, we can catch aplane,” he adds.Neither does he see this as particular to hisown strategy. “There are relatively few fundsthat really do go and kick the tyres and have tomeet companies face-to-face.“Today, telecommunications are sogood, and so fast, you can have a teleconferencewith someone and lookthem in the eye when you ask thema question,” he says. “The advantagesof face-to-face meetings, withthe speed and quality of telecommunications,are lessening.”Kuchanny had already visited the island, andknew a hedge fund and a hedge fund sales groupbased in Bermuda who were able to recommendit. “Bermuda is great from a number of perspectives.From the lifestyle perspective it is dramaticallybetter. It’s more outward-bound, we havea large garden, which I couldn’t have living inKnightsbridge.”Tax is another factor: “There are big taxadvantages. It’s a great offshore jurisdiction. Ofthe offshore jurisdictions Bermuda is leaguesahead in terms of legal protection. The Court ofAppeal in Bermuda is a UK privy council, so ifyou have a legal issue in Bermuda you are prettymuch under UK law. And the Bermuda MonetaryAuthority (BMA) is a good, well-known regulator,”Kuchanny says.He also finds the time-zone convenient, “withinhitting distance of every time zone,” he says. “Itis very difficult to trade Asia based in London,you’ve got to be up in the middle of the night.”He also notes the island, with its large ex-patriatecommunity, is relatively urban with bars andrestaurants, and schools, making it an obviouschoice for managers with families. The only disadvantageis the distance from his investors, whoso far are predominantly European – thougheven that is not a deal-breaker. “Investors enjoycoming over to Bermuda,” he says.Osmium plans to expand its investor-base inthe US, for which its location will be even less ofan issue.www.hedgefundsreview.com May 2006 | HEDGE FUNDS REVIEW | 39