Hedge Funds Review's - Incisive Media

Hedge Funds Review's - Incisive Media

Hedge Funds Review's - Incisive Media

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

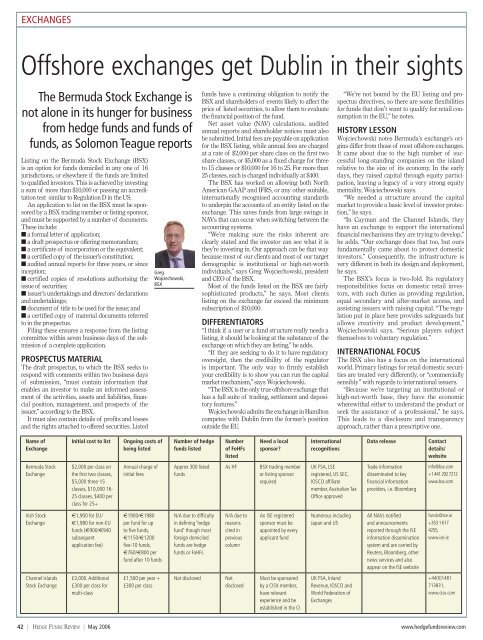

EXCHANGESOffshore exchanges get Dublin in their sightsThe Bermuda Stock Exchange isnot alone in its hunger for businessfrom hedge funds and funds offunds, as Solomon Teague reportsListing on the Bermuda Stock Exchange (BSX)is an option for funds domiciled in any one of 16jurisdictions, or elsewhere if the funds are limitedto qualified investors. This is achieved by investinga sum of more than $10,000 or passing an accreditationtest similar to Regulation D in the US.An application to list on the BSX must be sponsoredby a BSX trading member or listing sponsor,and must be supported by a number of documents.These include:■ a formal letter of application;■ a draft prospectus or offering memorandum;■ a certificate of incorporation or the equivalent;■ a certified copy of the issuer’s constitution;■ audited annual reports for three years, or sinceinception;■ certified copies of resolutions authorising theissue of securities;■ issuer’s undertakings and directors’ declarationsand undertakings;■ document of title to be used for the issue; and■ a certified copy of material documents referredto in the prospectus.Filing these ensures a response from the listingcommittee within seven business days of the submissionof a complete application.PROSPECTUS MATERIALThe draft prospectus, to which the BSX seeks torespond with comments within two business daysof submission, “must contain information thatenables an investor to make an informed assessmentof the activities, assets and liabilities, financialposition, management, and prospects of theissuer,” according to the BSX.It must also contain details of profits and lossesand the rights attached to offered securities. ListedGregWojciechowski,BSXfunds have a continuing obligation to notify theBSX and shareholders of events likely to affect theprice of listed securities, to allow them to evaluatethe financial position of the fund.Net asset value (NAV) calculations, auditedannual reports and shareholder notices must alsobe submitted. Initial fees are payable on applicationfor the BSX listing, while annual fees are chargedat a rate of $2,000 per share class on the first twoshare classes, or $5,000 as a fixed charge for threeto 15 classes or $10,000 for 16 to 25. For more than25 classes, each is charged individually at $400.The BSX has worked on allowing both NorthAmerican GAAP and IFRS, or any other suitable,internationally recognised accounting standardsto underpin the accounts of an entity listed on theexchange. This saves funds from large swings inNAVs that can occur when switching between theaccounting systems.“We’re making sure the risks inherent areclearly stated and the investor can see what it isthey’re investing in. Our approach can be that waybecause most of our clients and most of our targetdemographic is institutional or high-net-worthindividuals,” says Greg Wojciechowski, presidentand CEO of the BSX.Most of the funds listed on the BSX are fairlysophisticated products,” he says. Most clientslisting on the exchange far exceed the minimumsubscription of $10,000.DIFFERENTIATORS“I think if a user or a fund structure really needs alisting, it should be looking at the substance of theexchange on which they are listing,” he adds.“If they are seeking to do it to have regulatoryoversight, then the credibility of the regulatoris important. The only way to firmly establishyour credibility is to show you can run the capitalmarket mechanism,” says Wojciechowski.“The BSX is the only true offshore exchange thathas a full suite of trading, settlement and depositoryfeatures.”Wojciechowski admits the exchange in Hamiltoncompetes with Dublin from the former’s positionoutside the EU.“We’re not bound by the EU listing and prospectusdirectives, so there are some flexibilitiesfor funds that don’t want to qualify for retail consumptionin the EU,” he notes.HISTORY LESSONWojciechowski notes Bermuda’s exchange’s originsdiffer from those of most offshore exchanges.It came about due to the high number of successfullong-standing companies on the islandrelative to the size of its economy. In the earlydays, they raised capital through equity participation,leaving a legacy of a very strong equitymentality, Wojciechowski says.“We needed a structure around the capitalmarket to provide a basic level of investor protection,”he says.“In Cayman and the Channel Islands, theyhave an exchange to support the internationalfinancial mechanisms they are trying to develop,”he adds. “Our exchange does that too, but oursfundamentally came about to protect domesticinvestors.” Consequently, the infrastructure isvery different in both its design and deployment,he says.The BSX’s focus is two-fold. Its regulatoryresponsibilities focus on domestic retail investors,with such duties as providing regulation,equal secondary and after-market access, andassisting issuers with raising capital. “The regulationput in place here provides safeguards butallows creativity and product development,”Wojciechowski says. “Serious players subjectthemselves to voluntary regulation.”INTERNATIONAL FOCUSThe BSX also has a focus on the internationalworld. Primary listings for retail domestic securitiesare treated very differently, or “commerciallysensibly” with regards to international issuers.“Because we’re targeting an institutional orhigh-net-worth base, they have the economicwherewithal either to understand the product orseek the assistance of a professional,” he says.This leads to a disclosure and transparencyapproach, rather than a prescriptive one.Name ofExchangeInitial cost to listOngoing costs ofbeing listedNumber of hedgefunds listedNumberof FoHFslistedNeed a localsponsor?InternationalrecognitionsData releaseContactdetails/websiteBermuda StockExchange$2,000 per class onthe first two classes,$5,000 three-15classes, $10,000 16-25 classes, $400 perclass for 25+Annual charge ofinitial feesApprox 300 listedfundsAs HFBSX trading memberor listing sponsorrequiredUK FSA, LSEregistered, US SEC,IOSCO affiliatemember, Australian TaxOffice approvedTrade informationdisseminated to keyfinancial informationproviders, i.e. Bloomberginfo@bsx.com+1 441 292 7212www.bsx.comIrish StockExchange€1,900 for EU/€1,980 for non-EUfunds (€900/€940subsequentapplication fee)€1900/€1980per fund for upto five funds,€1150/€1200five-10 funds,€760/€800 perfund after 10 fundsN/A due to difficultyin defining ‘hedgefund’ though mostforeign domiciledfunds are hedgefunds or FoHFsN/A due toreasonscited inpreviouscolumnAn ISE registeredsponsor must beappointed by everyapplicant fundNumerous includingJapan and USAll NAVs notifiedand announcementsreported through the ISEinformation disseminationsystem and are carried byReuters, Bloomberg, othernews services and alsoappear on the ISE websitefunds@ise.ie+353 1 6174255,www.ise.ieChannel IslandsStock Exchange£3,000. Additional£300 per class formulti-class£1,500 per year +£300 per classNot disclosedNotdisclosedMust be sponsoredby a CISX member,have relevantexperience and beestablished in the CIUK FSA, InlandRevenue, IOSCO andWorld Federation ofExchanges+44(0)1481713831,www.cisx.com42 | HEDGE FUNDS REVIEW | May 2006 www.hedgefundsreview.com