Rollover Application - Korn/Ferry International

Rollover Application - Korn/Ferry International

Rollover Application - Korn/Ferry International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

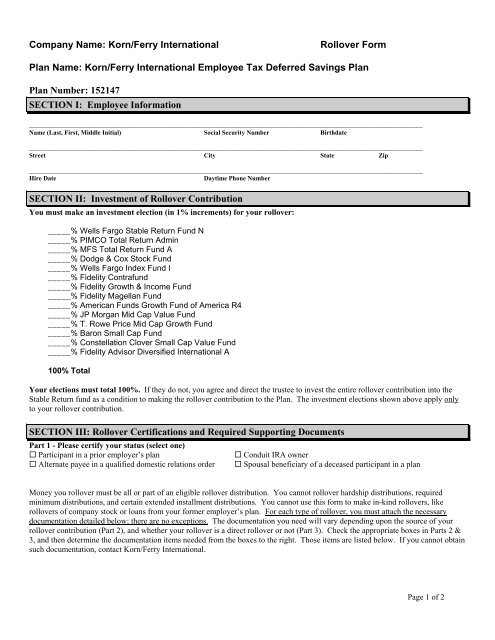

Company Name: <strong>Korn</strong>/<strong>Ferry</strong> <strong>International</strong><strong>Rollover</strong> FormPlan Name: <strong>Korn</strong>/<strong>Ferry</strong> <strong>International</strong> Employee Tax Deferred Savings PlanPlan Number: 152147SECTION I: Employee Information_________________________________________________________________________________________________________________________Name (Last, First, Middle Initial) Social Security Number Birthdate_________________________________________________________________________________________________________________________Street City State Zip_________________________________________________________________________________________________________________________Hire DateDaytime Phone NumberSECTION II: Investment of <strong>Rollover</strong> ContributionYou must make an investment election (in 1% increments) for your rollover:_____% Wells Fargo Stable Return Fund N_____% PIMCO Total Return Admin_____% MFS Total Return Fund A_____% Dodge & Cox Stock Fund_____% Wells Fargo Index Fund I_____% Fidelity Contrafund_____% Fidelity Growth & Income Fund_____% Fidelity Magellan Fund_____% American Funds Growth Fund of America R4_____% JP Morgan Mid Cap Value Fund_____% T. Rowe Price Mid Cap Growth Fund_____% Baron Small Cap Fund_____% Constellation Clover Small Cap Value Fund_____% Fidelity Advisor Diversified <strong>International</strong> A100% TotalYour elections must total 100%. If they do not, you agree and direct the trustee to invest the entire rollover contribution into theStable Return fund as a condition to making the rollover contribution to the Plan. The investment elections shown above apply onlyto your rollover contribution.SECTION III: <strong>Rollover</strong> Certifications and Required Supporting DocumentsPart 1 - Please certify your status (select one) Participant in a prior employer’s plan Alternate payee in a qualified domestic relations order Conduit IRA owner Spousal beneficiary of a deceased participant in a planMoney you rollover must be all or part of an eligible rollover distribution. You cannot rollover hardship distributions, requiredminimum distributions, and certain extended installment distributions. You cannot use this form to make in-kind rollovers, likerollovers of company stock or loans from your former employer’s plan. For each type of rollover, you must attach the necessarydocumentation detailed below; there are no exceptions. The documentation you need will vary depending upon the source of yourrollover contribution (Part 2), and whether your rollover is a direct rollover or not (Part 3). Check the appropriate boxes in Parts 2 &3, and then determine the documentation items needed from the boxes to the right. Those items are listed below. If you cannot obtainsuch documentation, contact <strong>Korn</strong>/<strong>Ferry</strong> <strong>International</strong>.Page 1 of 2

Part 2 - Indicate the source of your rollover (select one) Qualified retirement plan 403(b) plan 457 governmental plan Conduit IRA (Traditional IRAs consisting solely ofamounts from a qualified retirement plan)Part 3 - Type of rollover (select one) Direct rollover (check is made out to the Plan or itstrustee for your benefit), but no after-tax contributions Other rollover (check is made out to you)Documents required (see list below)ABCA, DDocuments required (see list below)EFA. A letter from the prior plan administrator stating the distributing plan has an IRS determination letter (or a copy of thedetermination letter itself); or a letter from the prior plan administrator attesting to that plan's qualified status.B. A copy of your most recent statement from your 403(b) plan provider.C. A copy of your most recent statement from your 457(b) governmental plan provider.D. A copy of your most recent IRA statement. The date on the check from your IRA must be within 60 days of your rollovercontribution. Additionally, by signing this form, you certify under penalties of perjury that your contribution from the originalplan to the IRA was made within 60 days of its distribution, you have contributed no other amounts to the IRA, and you aremaking this rollover contribution within 60 days of the distribution from your IRA.E. No additional documents needed.F. A copy of the distribution statement that accompanied your check showing the date, tax withholding, and amount of thedistribution. By signing this form you certify under penalties of perjury that your distribution is not one of a series of periodicpayments, that the entire amount of the rollover contribution would be includible in gross income if not rolled over, and that youdid not receive the distribution more than 60 days before this attempted rollover.SECTION IV: InstructionsThe following information may assist you in filling out the distribution form you will receive from your former employer:Name of Plan:<strong>Korn</strong>/<strong>Ferry</strong> <strong>International</strong> Employee Tax Deferred Savings PlanPlan ID#: 152147Name of Trustee: Wells Fargo Bank, N.A.Have rollover check made payable to Wells Fargo Bank, N.A. as Trustee for the <strong>Korn</strong>/<strong>Ferry</strong> <strong>International</strong> 401(k) Plan, FBO“Participant Name” and mailed to your home address. Mail the check, this completed form (no personal check will be accepted), andthe supporting documentation described in section III above to:Wells Fargo Retirement Plan ServicesAttn: Client Services, <strong>Korn</strong>/<strong>Ferry</strong> <strong>International</strong>MAC N9113-0302700 Snelling Ave. N., Suite 300Roseville, MN 55113Your rollover will be delayed and/or returned to you if any of the requested information is incomplete! It is your responsibility tomake sure the funds and supporting documentation are sent to the above address with this form!SECTION V: SignatureSign and date this form.I certify that the requirements stated above have been fulfilled and the information provided is true and correct to the best of myknowledge. I understand that decisions regarding rollovers have important tax consequences and I have been advised to seek theguidance of a tax professional with regard to this decision. I choose to make this rollover contribution to the plan in the amountshown on the rollover check. I assume full and sole responsibility for the consequences of this decision.____________________________________________________Employee Signature____________________________________DatePage 2 of 2