20. STATEMENTS OF CHANGES IN FINANCIAL POSITIONSource of funds <strong>2004</strong> 2003Funds obtained from operations 295,238 222,300Capital subsidies – 148Increase in long-term debt 3,424 62,493Disposal of tangible fixed assets 6,532 4,686Disposal of long-term investments 2,662 –Repayment or transfer to short term oflong-term investments 1,021 455Increase in provisions for contingencies and expenses – 2,869Decrease in working capital 2,619 –311,496 292,951Application of funds <strong>2004</strong> 2003Fixed asset additions: 65,365 141,192Intangible assets 29,056 58,386Tangible fixed assets 29,291 36,221Long-term investments 7,018 46,585Acquisition of treasury stock – 7,257Dividends 179,294 81,018Repayment or transfer to short term of long-term debt 66,837 6,306Increase in working capital – 57,178311,496 292,951Variation in working capital <strong>2004</strong> 2003Increase Decrease Increase DecreaseInventories – 12,634 6,676 –Deudores 56,972 – 35,208 –Accounts payable – 54,794 18,434 –Short-term investments 17,281 – 5,369 –Cash – 8,307 – 6,222Accrual accounts – 1,137 – 2,28774,253 76,872 65,687 8,509Variation in working capital 2,619 – – 57,17876,872 76,872 65,687 65,687The reconciliation of the income per books for the year to the funds obtained from operations shown in the foregoing statements of changesin financial position is as follows:<strong>2004</strong> 2003Income for the year after taxes 196,628 149,826Depreciation and amortization expense 50,932 45,260Period provision to reversion reserve 944 890Deferred charges (94) (376)Provisions for contingencies and expenses 41,194 (7,083)Variation in investment valuation allowances 6,348 34,953Losses on fixed asset disposals (308) (760)Capital subsidies transferred to income for the year (406) (410)Funds obtained from operations 295,238 222,300246

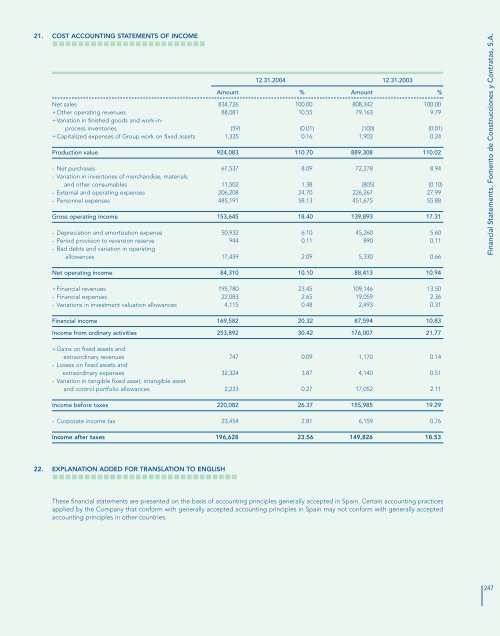

21. COST ACCOUNTING STATEMENTS OF INCOME12.31.<strong>2004</strong> 12.31.2003Amount % Amount %Net sales 834,726 100.00 808,342 100.00+Other operating revenues 88,081 10.55 79,163 9.79+Variation in finished goods and work-inprocessinventories (59) (0.01) (100) (0.01)+Capitalized expenses of Group work on fixed assets 1,335 0.16 1,903 0.24Production value 924,083 110.70 889,308 110.02- Net purchases 67,537 8.09 72,278 8.94-Variation in inventories of merchandise, materialsand other consumables 11,502 1.38 (805) (0.10)- External and operating expenses 206,208 24.70 226,267 27.99- Personnel expenses 485,191 58.13 451,675 55.88Gross operating income 153,645 18.40 139,893 17.31- Depreciation and amortization expense 50,932 6.10 45,260 5.60- Period provision to reversion reserve 944 0.11 890 0.11- Bad debts and variation in operatingallowances 17,459 2.09 5,330 0.66Financial Statements. Fomento de Construcciones y Contratas, S.A.Net operating income 84,310 10.10 88,413 10.94+Financial revenues 195,780 23.45 109,146 13.50- Financial expenses 22,083 2.65 19,059 2.36-Variations in investment valuation allowances 4,115 0.48 2,493 0.31Financial income 169,582 20.32 87,594 10.83Income from ordinary activities 253,892 30.42 176,007 21.77+Gains on fixed assets andextraordinary revenues 747 0.09 1,170 0.14- Losses on fixed assets andextraordinary expenses 32,324 3.87 4,140 0.51-Variation in tangible fixed asset, intangible assetand control portfolio allowances 2,233 0.27 17,052 2.11Income before taxes 220,082 26.37 155,985 19.29- Corporate income tax 23,454 2.81 6,159 0.76Income after taxes 196,628 23.56 149,826 18.5322. EXPLANATION ADDED FOR TRANSLATION TO ENGLISHThese financial statements are presented on the basis of accounting principles generally accepted in Spain. Certain accounting practicesapplied by the Company that conform with generally accepted accounting principles in Spain may not conform with generally acceptedaccounting principles in other countries.247

- Page 1 and 2:

AnnualReportThe FCC Group • Areas

- Page 3 and 4:

Letter fromthe Chairman

- Page 5 and 6:

Dear shareholders,Letter fromthe Ma

- Page 8 and 9:

Governing BodiesGoverning BodiesBoa

- Page 10:

StrategyStrategygrowingFounded in 1

- Page 13 and 14:

The FCC Group in FiguresTurnoverMil

- Page 15 and 16:

Evolution of stock pricesFomento de

- Page 17 and 18:

Brief history of financial figuresA

- Page 20:

The FCC Group’sareas of activitie

- Page 23 and 24:

City sanitationStreet cleaning serv

- Page 25 and 26:

Madrid. Cleaning of the Juan Carlos

- Page 27 and 28:

The reduced size vehicle, which is1

- Page 29 and 30:

Water managementDrinking water and

- Page 31 and 32:

Industrial wasteIndustrial waste tr

- Page 33 and 34:

VersiaFCC Versia, S.A. operates in

- Page 35 and 36:

Urban furniture and advertisingTurn

- Page 37 and 38:

Conservation and systemsTurnover51

- Page 39 and 40:

Technical vehicle inspectionTurnove

- Page 42 and 43:

ConstructionAnalysis of the sectorI

- Page 44 and 45:

FCC’s activityAll of the construc

- Page 46 and 47:

The second system was used to push

- Page 48 and 49:

Viaduct over the Escudo River.Cant

- Page 50 and 51:

Maritime worksThe most noteworthy c

- Page 52 and 53:

Railroad infrastructuresThe activit

- Page 54 and 55:

Urban developmentThe most noteworth

- Page 56 and 57:

Non-residentialThis section include

- Page 58 and 59:

ConstructionCommunity of MadridSpor

- Page 60 and 61:

ElectricityEspecialidades Eléctric

- Page 62 and 63:

Infrastructure conservationThe FCC

- Page 64 and 65:

Hydraulic works•Improvement of th

- Page 66 and 67:

Pipelines and gas pipelinesAuxiliar

- Page 68 and 69:

Infrastructure awardsThe FCC group

- Page 70:

kilometres long. Since going into s

- Page 73 and 74:

Cementos Portland Valderrivas, S.A.

- Page 76 and 77:

Real estateAnalysis of the sectorTh

- Page 78 and 79:

RealiaFCC’s activityRealia Busine

- Page 80:

Torre PicassoSince its inauguration

- Page 83 and 84:

Vehicle sales and technical assista

- Page 85 and 86:

Environmental managementServicesThe

- Page 87 and 88:

This company keeps managementprogra

- Page 89 and 90:

ConstructionEnvironmental managemen

- Page 91 and 92:

Generation of Noise and VibrationEf

- Page 93 and 94:

Sustainability as a pathIn 1997 FCC

- Page 95 and 96:

PersonnelAs of 31 st December of la

- Page 97 and 98:

Social and cultural activitiesThe F

- Page 99 and 100:

Fomento de Construcciones y Contrat

- Page 101 and 102:

A.3.Complete the following table on

- Page 103 and 104:

- EK will be entitled to appoint th

- Page 105 and 106:

A.9.Describe the conditions and the

- Page 107 and 108:

B.1.3.Complete the following tables

- Page 109 and 110:

Name of Director Name of Company or

- Page 111 and 112:

Number of beneficiaries 9Board of D

- Page 113 and 114:

Article 18. Term of Office“1.The

- Page 115 and 116:

B.1.25. Explain any mechanisms esta

- Page 117 and 118:

B.1.29. Indicate whether the audito

- Page 119 and 120:

Appointments and Retributions Commi

- Page 121 and 122:

The members of the Appointments and

- Page 123 and 124:

- Evaluating the reports on propose

- Page 125 and 126:

Unless otherwise stipulated in the

- Page 127 and 128:

The interests held by the members o

- Page 129 and 130:

D. RISK CONTROL SYSTEMSD.1.General

- Page 131 and 132:

3. Management of organisational ris

- Page 133 and 134:

E. GENERAL MEETINGE.1.List the quor

- Page 135 and 136:

E.5.State whether the Chairman of t

- Page 137 and 138:

As a consequence of the Directors a

- Page 139 and 140:

F. LEVEL OF COMPLIANCE WITH CORPORA

- Page 141 and 142:

8. Control Committees.RECOMMENDATIO

- Page 143 and 144:

3. If such a request for informatio

- Page 145 and 146:

18. Communications with shareholder

- Page 147 and 148:

Financial StatementsManagement repo

- Page 149 and 150:

Financial Statements,Management rep

- Page 151 and 152:

CONSOLIDATED BALANCE SHEETFomento d

- Page 153 and 154:

CONSOLIDATED STATEMENT OF INCOMEFom

- Page 155 and 156:

ContentsFomento de Construcciones y

- Page 157 and 158:

c) Changes in the consolidated Grou

- Page 159 and 160:

The interest capitalized as describ

- Page 161 and 162:

t) Environmental informationThe FCC

- Page 163 and 164:

Los movimientos de las diversas par

- Page 165 and 166:

With respect to the “Change in Co

- Page 167 and 168:

13. TRADE RECEIVABLE FOR SALES AND

- Page 169 and 170:

d) Treasury stockAs of December 31,

- Page 171 and 172:

The balance as of December 31, 2004

- Page 173 and 174:

Adjusted consolidated income per bo

- Page 175 and 176:

The detail of the backlog for const

- Page 177 and 178:

24. FEES PAID TO AUDITORSThe 2004 f

- Page 179 and 180:

27. CONSOLIDATED COST ACCOUNTING ST

- Page 181 and 182:

Company Net book values % Nominal p

- Page 183 and 184:

Company Net book values % Nominal p

- Page 185 and 186:

Company Net book values % Nominal p

- Page 187 and 188: Company Net book values % Nominal p

- Page 189 and 190: Company Net book values % Nominal p

- Page 191 and 192: EXHIBIT II.MULTIGROUP COMPANIESComp

- Page 193 and 194: Company Net book values % Nominal p

- Page 195 and 196: Company Net book values % Nominal p

- Page 197 and 198: Company Net book values % Nominal p

- Page 199 and 200: Company Net book values % Nominal p

- Page 201 and 202: Company Net book values % Nominal p

- Page 203 and 204: EXHIBIT IV.CHANGES IN THE CONSOLIDA

- Page 205 and 206: ManagementreportConsolidatedGroup

- Page 207 and 208: 2.1. Net salesIn 2004 the FCC Group

- Page 209 and 210: 2.9. Funds ObtainedIn 2004 the fund

- Page 211 and 212: 3.2. Services3.2.1. Earnings2004 20

- Page 213 and 214: 3.4. Cementos Portland Valderrivas3

- Page 215 and 216: OUTLOOK FOR 2005Below we set forth

- Page 217 and 218: Auditor’s report. Consolidated Gr

- Page 219 and 220: FinancialStatementsFomento deConstr

- Page 221 and 222: as of december 31, 2004In thousands

- Page 223 and 224: as of december 31, 2004In thousands

- Page 225 and 226: 1. COMPANY’S BUSINESS ACTIVITIEST

- Page 227 and 228: e) InventoriesInventories are value

- Page 229 and 230: 6. TANGIBLE FIXED ASSETSThe detail

- Page 231 and 232: The variations in 2004 were as foll

- Page 233 and 234: The legal reserve can be used to in

- Page 235 and 236: II.Short-termTax receivables:Prepai

- Page 237: 18. FEES PAID TO AUDITORSThe “Out

- Page 241 and 242: Company Book Value % Dividends Capi

- Page 243 and 244: Company % Ownership Company % Owner

- Page 245 and 246: EXHIBIT IV. "REPORT OF THE BOARD OF

- Page 247 and 248: COMPANY PERFORMANCE IN 2004The Comp

- Page 249 and 250: At 2004 year-end, the construction

- Page 251 and 252: Auditor’s report. Fomento de Cons

- Page 253 and 254: Water ManagementManaging DirectorDe

- Page 255 and 256: Domestic ConstructionZone IAndaluc

- Page 257 and 258: Administration and FinanceDirector