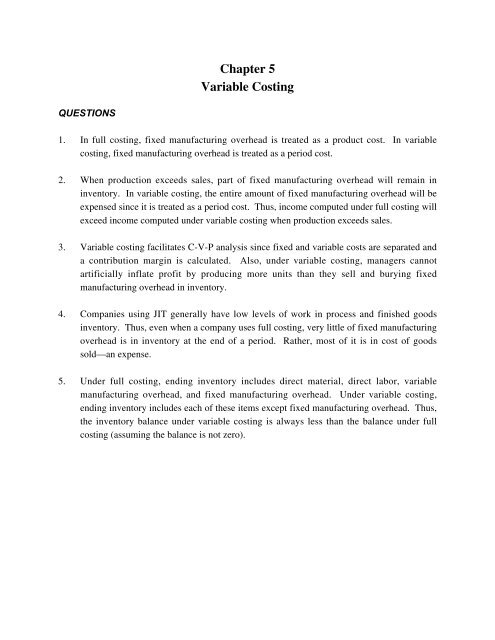

Chapter 5 Variable Costing

Chapter 5 Variable Costing

Chapter 5 Variable Costing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Chapter</strong> 5<strong>Variable</strong> <strong>Costing</strong>QUESTIONS1. In full costing, fixed manufacturing overhead is treated as a product cost. In variablecosting, fixed manufacturing overhead is treated as a period cost.2. When production exceeds sales, part of fixed manufacturing overhead will remain ininventory. In variable costing, the entire amount of fixed manufacturing overhead will beexpensed since it is treated as a period cost. Thus, income computed under full costing willexceed income computed under variable costing when production exceeds sales.3. <strong>Variable</strong> costing facilitates C-V-P analysis since fixed and variable costs are separated anda contribution margin is calculated. Also, under variable costing, managers cannotartificially inflate profit by producing more units than they sell and burying fixedmanufacturing overhead in inventory.4. Companies using JIT generally have low levels of work in process and finished goodsinventory. Thus, even when a company uses full costing, very little of fixed manufacturingoverhead is in inventory at the end of a period. Rather, most of it is in cost of goodssold—an expense.5. Under full costing, ending inventory includes direct material, direct labor, variablemanufacturing overhead, and fixed manufacturing overhead. Under variable costing,ending inventory includes each of these items except fixed manufacturing overhead. Thus,the inventory balance under variable costing is always less than the balance under fullcosting (assuming the balance is not zero).

5-2Jiambalvo Managerial AccountingEXERCISESE1. The income statement produced using variable costing provides a contributionmargin. If we divide this by sales, we have the contribution margin ratio (thecontribution margin per dollar of sales). Once we have this value, we canestimate the incremental effect on profit of an increase in sales.E2. Increasing production will increase profit since more fixed manufacturingoverhead will be buried in ending inventory rather than expensed in cost ofgoods sold. For example, if the company produced and sold 40,000 items, theentire $20,000,000 of fixed manufacturing overhead would be in cost of goodssold. However, if the company produces 50,000 units, the fixedmanufacturing overhead per unit will be $400. Then $16,000,000 will end upin cost of goods sold when the company sells only 40,000 units (i.e., $400 x40,000) and $4,000,000 will be in ending inventory ($400 x 10,000).E3. Most Web sites make the point that variable costing aids planning anddecision making. And, it prevents managers from artificially inflating profitby over-producing.Some Web sites seem to imply that variable costing is simply “wrong”because fixed overhead is a real cost and it is not included in inventory undervariable costing. However, these same Web sites state or imply that variablecosting is more useful for decision making. Frankly, it’s hard to see how themethod can be more useful for decision making and still be “wrong.”E4. <strong>Variable</strong> cost per unit $300Fixed manufacturing overhead per unit($600,000 ÷ 1,000 units) 600Full cost per unit $900Ending inventory under full costing:$900 x 100 units = $90,000

<strong>Chapter</strong> 5 <strong>Variable</strong> <strong>Costing</strong> 5-3E5. Ending inventory under variable costing:$300 x 100 = $30,000E6. Full cost per unit is $900 per exercise 4. Therefore, cost of goods sold underfull costing is $900 x 900 units sold = $81,000.E7. <strong>Variable</strong> cost per unit is $300. Therefore variable cost of goods sold is $300 x900 = $27,000. Under variable costing, the $600,000 of fixed manufacturingoverhead is treated as a period expense.E8. Sales ($1,500 x 900 pairs) $1,350,000Less cost of goods sold ($900 x 900 pairs) 810,000Gross margin 540,000Less selling expense 200,000Less administrative expense 100,000Net income $ 240,000E9. Sales ($1,500 x 900 pairs) $1,350,000Less variable cost of goods sold ($300 x 900 pairs) 270,000Contribution margin 1,080,000Less fixed manufacturing overhead 600,000Less selling expense 200,000Less administrative expense 100,000Net income $ 180,000E10.The difference in net income between full and variable costing is $240,000 -$180,000 = $60,000. This is equal to the amount of fixed manufacturingoverhead in ending inventory under full costing ($600 x 100 pairs = $60,000).

5-4Jiambalvo Managerial AccountingPROBLEMSP1. a.2006 2007 2008Fixed manufacturing overhead $ 600,000 $ 600,000 $ 600,000Divided by units produced 10,000 12,000 8,000Fixed manufacturing overhead per unit 60 50 75<strong>Variable</strong> manufacturing costs 100 100 100Full cost per unit $ 160 $ 150 $ 175Sales ($200 x 10,000 units) $2,000,000 $2,000,000 $2,000,000Less cost of goods sold:($160 x 10,000) 1,600,000($150 x 10,000) 1,500,000($150 x 2,000 + $175 x $8,000) 1,700,000Gross margin 400,000 500,000 300,000Less selling and administrative expense 200,000 200,000 200,000Net income $ 200,000 $ 300,000 $ 100,000 $ 600,000Ending inventory-0-($150 x 2,000) $ 300,000-0-b. Even though sales is the same in each period, profit fluctuates. That resultsbecause different quantities are produced each period which affects thefixed manufacturing overhead in cost of goods sold versus endinginventory.

<strong>Chapter</strong> 5 <strong>Variable</strong> <strong>Costing</strong> 5-5c.2006 2007 2008Fixed manufacturing overhead $ 600,000 $ 600,000 $ 600,000<strong>Variable</strong> manufacturing costs per unit 100 100 100Sales ($200 x 10,000 units) $2,000,000 $2,000,000 $2,000,000Less variable cost of goods sold:($100 x 10,000) 1,000,000 1,000,000 1,000,000Contribution margin 1,000,000 1,000,000 1,000,000Less fixed costs:Manufacturing 600,000 600,000 600,000Selling and administrative 200,000 200,000 200,000Net income $ 200,000 $ 200,000 $ 200,000 $ 600,000Ending inventory-0-($100 x 2,000) $ 200,000-0-d. Profit does not fluctuate each period because fixed manufacturing overheadis treated as a period cost and expensed each year even if more units areproduced than sold.Note that income is the same under variable and full costing in 2006 sincethe quantity produced is equal to the quantity sold. Income under fullcosting is higher than variable costing income in 2007 since the quantityproduced is greater than the quantity sold. Income under full costing is lessthan income under variable costing in 2008 since the quantity produced isless than the quantity sold.

5-6Jiambalvo Managerial AccountingP2. a.2006 2007 2008Fixed manufacturing overhead $ 20,000,000.00 $ 20,000,000.00 $ 20,000,000.00Divided by units produced 20,000.00 20,000.00 14,000.00Fixed manufacturing overhead per unit 1,000.00 1,000.00 1,428.57<strong>Variable</strong> manufacturing costs per unit 800.00 800.00 800.00Full cost per unit $ 1,800.00 $ 1,800.00 $ 2,228.57Sales($2,000 x 20,000 units) $ 40,000,000.00($2,000 x 18,000) $ 36,000,000.00($2,000 x 16,000) $ 32,000,000.00Less cost of goods sold:($1,800.00 x 20,000) 36,000,000.00($1,800.00 x 18,000) 32,400,000.00($1,800.00 x 2,000 + 2,228.57 x 14,000) 34,799,980.00Gross margin 4,000,000.00 3,600,000.00 (2,799,980.00)Less selling and administrative expense 300,000.00 300,000.00 300,000.00Net income $ 3,700,000.00 $ 3,300,000.00 $ (3,099,980.00) $ 3,900,020.00Ending inventory-0-($1,800 x 2,000) $ 3,600,000.00b.2006 2007 2008Fixed manufacturing overhead $ 20,000,000.00 $ 20,000,000.00 $ 20,000,000.00<strong>Variable</strong> manufacturing costs per unit $ 800.00 $ 800.00 $ 800.00Sales($2,000 x 20,000 units) $ 40,000,000.00($2,000 x 18,000) $ 36,000,000.00($2,000 x 16,000) $ 32,000,000.00Less variable cost of goods sold:($800 x 20,000 units) 16,000,000.00($800 x 18,000) 14,400,000.00($800 x 16,000) 12,800,000.00Contribution margin 24,000,000.00 21,600,000.00 19,200,000.00Less fixed costs:Manufacturing 20,000,000.00 20,000,000.00 20,000,000.00Selling and administrative 300,000.00 300,000.00 300,000.00Net income $ 3,700,000.00 $ 1,300,000.00 $ (1,100,000.00) $ 3,900,000.00-0-Ending inventory-0-($800 x 2,000) $ 1,600,000.00-0-

<strong>Chapter</strong> 5 <strong>Variable</strong> <strong>Costing</strong> 5-7Note that the $20 difference in net income for the three years between full andvariable costing is due to rounding.c. Under full costing, management could manipulate profit in 2007 byoverproducing (producing more units than really needed in 2007). Thisresults in fixed manufacturing overhead being buried in ending inventory.Note that the difference in profit in 2007 between full and variable costingis equal to the difference in ending inventory under full and variablecosting.This approach to manipulating earnings could not be repeated year afteryear—eventually the inventory build-up would be quite obvious.P3. a.2006 2007Fixed manufacturing overhead $ 2,000,000.00 $ 2,000,000.00Divided by units produced 10,000.00 6,000.00Fixed manufacturing overhead per unit 200.00 333.33<strong>Variable</strong> manufacturing costs per unit 2,200.00 2,200.00Full cost per unit $ 2,400.00 $ 2,533.33Sales ($3,000 x 8,000 units) $ 24,000,000.00 $ 24,000,000.00Less cost of goods sold:($2,400 x 8,000) 19,200,000.00($2,400 x 2,000 + $2,533.33 x 6,000) 19,999,980.00Gross margin 4,800,000.00 4,000,020.00Less selling and administrative expense 1,000,000.00 1,000,000.00Net income $ 3,800,000.00 $ 3,000,020.00 $ 6,800,020.00Ending inventory($2,400 x 2,000) $ 4,800,000.00-0-b. Company performance is really not worse in 2007—note that the companyhad the same cost structure and the same level of sales. The difference isdue to greater production in 2006 which lowered unit cost and buried fixedmanufacturing overhead in inventory.

5-8Jiambalvo Managerial Accountingc.2006 2007Fixed manufacturing overhead $ 2,000,000.00 $ 2,000,000.00<strong>Variable</strong> manufacturing costs per unit $ 2,200.00 $ 2,200.00Sales ($3,000 x 8,000 units) $ 24,000,000.00 $ 24,000,000.00Less cost of goods sold:($2,200 x 8,000 units) 17,600,000.00 17,600,000.00Contribution margin 6,400,000.00 6,400,000.00Less fixed costs:Manufacturing 2,000,000.00 2,000,000.00Selling and administrative 1,000,000.00 1,000,000.00Net income $ 3,400,000.00 $ 3,400,000.00 $ 6,800,000.00Ending inventory($2,200 x 2,000) $ 4,400,000.00-0-Note that the difference in income between full and variable costing overthe two years is due to rounding.d. <strong>Variable</strong> costing presents a more realistic view of firm performance in thatincome is the same in both years which is consistent with the firm havingthe same cost structure and level of sales in both years.P4. Income computed under full costing is $4,000 higher than income computedunder variable costing. Under variable costing, the entire amount of fixedmanufacturing overhead ($24,000) was treated as a period cost. Under fullcosting, $4,000 remains in ending inventory.Fixed manufacturing overhead $24,000Divided by units produced 1,200Fixed manufacturing overhead per unit $ 20Amount of fixed manufacturing overhead in ending inventory:$20 x 200 units = $4,000

<strong>Chapter</strong> 5 <strong>Variable</strong> <strong>Costing</strong> 5-9P5. a. Contribution margin ÷ sales = contribution margin ratio$8,100,000 ÷ $18,000,000 = .45.(Incremental sales x contribution margin ratio) – incremental salaries =incremental profit($1,600,000 x .45) - $120,000 = $600,000.b. The chief accountant is treating income per dollar of sales as thecontribution margin ratio. Income only varies in proportion to sales if allcosts are variable which is clearly not the case for Wilner Glass Company.P6. a.<strong>Variable</strong> <strong>Costing</strong> 2004 2005 2006Sales $ 10,000,000 $ 12,500,000 $ 15,000,000Less variable cost of goods sold 4,000,000 5,000,000 6,000,000Contribution margin 6,000,000 7,500,000 9,000,000Less:Fixed production costs 6,000,000 6,000,000 6,000,000Fixed selling and administrative costs 2,000,000 2,000,000 2,000,000Net income $ (2,000,000) $ (500,000) $ 1,000,000b. Under full costing, it appears that Ed did a good job since the company hitthe break-even point in its first year and then earned a profit of $500,000 inits second year. However, variable costing provides a better picture of thefirms profitability under Ed’s guidance. Note that under variable costing,the company had a $500,000 loss in its second year. Ed was able to showa profit under full costing by producing more than needed for currentperiod sales and burying a substantial amount of fixed manufacturing costin ending inventory. That’s why Zac could not show a profit under fullcosting in 2004. He had to cut production in 2004 to avoid building upexcess inventory. This increased per unit cost. Income statementsprepared under variable costing indicate that Zac’s performance was quitegood. Sales have increased and so has profit.

5-10Jiambalvo Managerial Accountingc. The company should not get out of the tractor business. As indicated inthe variable costing income statement, the company is generating asubstantial profit. If the company can continue performing at this level, itwill be quite successful.P7. a. Fixed manufacturing overhead ÷ Units produced = fixed overhead per unit$500,000 ÷ 100,000 = $5$5 x 80,000 units sold = $400,000.b. With variable costing, the entire amount of fixed manufacturing overhead($500,000) will be expensed.c. The amount of fixed manufacturing overhead in ending inventory underfull costing is $100,000:$5 x 20,000 units = $100,000.This accounts for the difference between income under full versus variablecosting.

5-12Jiambalvo Managerial Accountingb.2006Sales ($120 x 170,000 units) $ 20,400,000.00Less variable cost of goods sold:($85.00 x 170,000) 14,450,000.00Less variable selling expense($.10 x $20,400,000) 2,040,000.00Contribution margin 3,910,000.00Less fixed costs:Manufacturing 2,000,000.00Selling expense 1,000,000.00Administrative expense 800,000.00Net income $ 110,000.00Ending inventory($85 x 30,000) $ 2,550,000.00c. The amount of fixed manufacturing inventory that is included in endinginventory under full costing is $300,000 ($10 x 30,000 units). Thisaccounts for the difference in income under full versus variable costing.