SUMMARY REPORT - TRUST BOARD MEETING (PART 1):

SUMMARY REPORT - TRUST BOARD MEETING (PART 1):

SUMMARY REPORT - TRUST BOARD MEETING (PART 1):

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

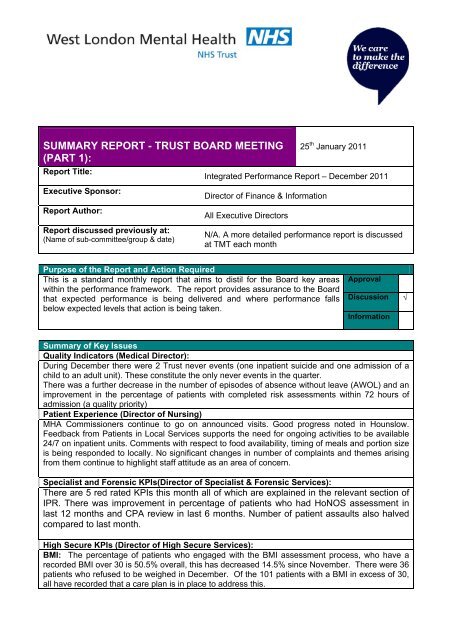

<strong>SUMMARY</strong> <strong>REPORT</strong> - <strong>TRUST</strong> <strong>BOARD</strong> <strong>MEETING</strong>(<strong>PART</strong> 1):Report Title:Executive Sponsor:Report Author:Report discussed previously at:(Name of sub-committee/group & date)25 th January 2011Integrated Performance Report – December 2011Director of Finance & InformationAll Executive DirectorsN/A. A more detailed performance report is discussedat TMT each monthPurpose of the Report and Action RequiredThis is a standard monthly report that aims to distil for the Board key areaswithin the performance framework. The report provides assurance to the Boardthat expected performance is being delivered and where performance fallsbelow expected levels that action is being taken.ApprovalDiscussionInformation√Summary of Key IssuesQuality Indicators (Medical Director):During December there were 2 Trust never events (one inpatient suicide and one admission of achild to an adult unit). These constitute the only never events in the quarter.There was a further decrease in the number of episodes of absence without leave (AWOL) and animprovement in the percentage of patients with completed risk assessments within 72 hours ofadmission (a quality priority)Patient Experience (Director of Nursing)MHA Commissioners continue to go on announced visits. Good progress noted in Hounslow.Feedback from Patients in Local Services supports the need for ongoing activities to be available24/7 on inpatient units. Comments with respect to food availability, timing of meals and portion sizeis being responded to locally. No significant changes in number of complaints and themes arisingfrom them continue to highlight staff attitude as an area of concern.Specialist and Forensic KPIs(Director of Specialist & Forensic Services):There are 5 red rated KPIs this month all of which are explained in the relevant section ofIPR. There was improvement in percentage of patients who had HoNOS assessment inlast 12 months and CPA review in last 6 months. Number of patient assaults also halvedcompared to last month.High Secure KPIs (Director of High Secure Services):BMI: The percentage of patients who engaged with the BMI assessment process, who have arecorded BMI over 30 is 50.5% overall, this has decreased 14.5% since November. There were 36patients who refused to be weighed in December. Of the 101 patients with a BMI in excess of 30,all have recorded that a care plan is in place to address this.

Assaults: The data reported is for physical assaults, rather than verbal assaults and does notinclude any reports awaiting countersigning for the period. Of the assaults all were from HDU /ICU / MDU / Admission wards. The number of patient to patient assaults dropped significantly (by60%) in the month. Physical assaults are generally subject to an investigation; either a LocalTeam Review or a Grade 1 review, and learning shared with clinical teams hospital wide.Programmed Activity: The data for December shows that 85% of patients were offered more than25 hours of programmed activity. There were 29 patients who were offered less than 25 hours, ofwhich 89% were either Admissions / ICU / HDU / MDU patients. The slight decrease from 90% to85% of patients being offered more than 25 hours of programmed activity could be attributed to therecording of activity being affected by annual leave increasing over the Christmas and New YearPeriod.Workforce (Director of OD & Workforce):External recruitment activity remains is low and considerable effort is being made to facilitateredeployment due decommissioning and service changes.Finance (Director of Finance & Information):The Trust is reporting a £2,181k favourable variance against plan for the first nine months of2011/12. Year-to-date capital under spend of £6.8m reflects delays in projects commencing. Fullyear capital spend for 11/12 was reprofiled in December by the Director of Estates and is nowforecast to be £1.5m under spent.DH Performance Targets:There is no red rated performance target this month. Delayed transfers of care have improved(8.7% compared with 10.8% last month) against a revised target of 7.5% for OPS and Adult AcuteServices.Performance against 7-day follow-up target has improved this month.HoNOS assessment 12-month has dropped slightly and % of Adults in employment has remainedunchanged from last month. These two KPIs are currently amber rated.Performance against all other targets remains stable.Relationship to Trust Corporate ObjectivesC01: To provide a safe and effective service. √C02: To provide excellent personalised care, treatment and support. √C03: To become a provider of choice. √C04: To continuously improve the quality and productivity of our services. √C05: To build an engaged workforce which is focussed on recovery and the needs of serviceusers and carers.√[Please only leave the tick (√ ) next to the relevant corporate objective]Relationship to the Board Assurance FrameworkRisk reference:Are any existing risks in the Board The IPR is derived from the Trust wide balance scorecard.Assurance Framework affected? This is segmented by CSU and there are protocols todetermine when red rated items should be added to therisk registerCorporate Impact Assessment OR Board Statements: Assurance(s) against:Performance ManagementThis report provides overall assurance that the Trust Boardreceives information on key areas of performanceCommunicationKey points are summarised in the monthly Team brief.External bodies such as CQC will take note of this report2

Acronyms / Terms used in the reportThe final page of IPR has anexplanation of acronyms andspecialist terms usedAttachmentsIPR report attachedIPR December 2011(Final Version)3