Success Factors for Building an Oncology Business (Part 1)

Success Factors for Building an Oncology Business (Part 1)

Success Factors for Building an Oncology Business (Part 1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

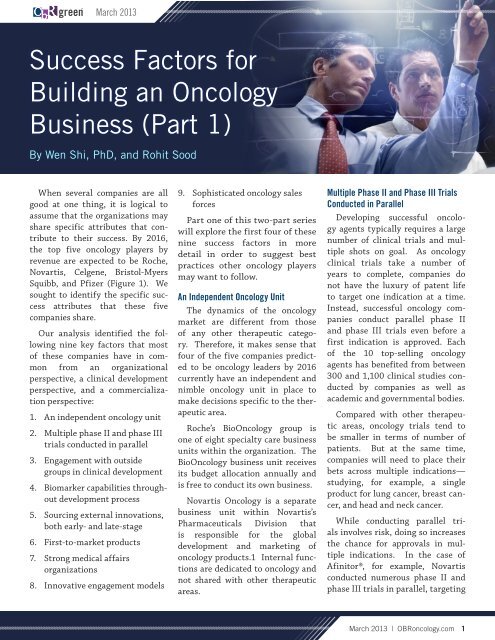

March 2013<strong>Success</strong> <strong>Factors</strong> <strong>for</strong><strong>Building</strong> <strong>an</strong> <strong>Oncology</strong><strong>Business</strong> (<strong>Part</strong> 1)By Wen Shi, PhD, <strong>an</strong>d Rohit SoodWhen several comp<strong>an</strong>ies are allgood at one thing, it is logical toassume that the org<strong>an</strong>izations mayshare specific attributes that contributeto their success. By 2016,the top five oncology players byrevenue are expected to be Roche,Novartis, Celgene, Bristol-MyersSquibb, <strong>an</strong>d Pfizer (Figure 1). Wesought to identify the specific successattributes that these fivecomp<strong>an</strong>ies share.Our <strong>an</strong>alysis identified the followingnine key factors that mostof these comp<strong>an</strong>ies have in commonfrom <strong>an</strong> org<strong>an</strong>izationalperspective, a clinical developmentperspective, <strong>an</strong>d a commercializationperspective:1. An independent oncology unit2. Multiple phase II <strong>an</strong>d phase IIItrials conducted in parallel3. Engagement with outsidegroups in clinical development4. Biomarker capabilities throughoutdevelopment process5. Sourcing external innovations,both early- <strong>an</strong>d late-stage6. First-to-market products7. Strong medical affairsorg<strong>an</strong>izations8. Innovative engagement models9. Sophisticated oncology sales<strong>for</strong>ces<strong>Part</strong> one of this two-part serieswill explore the first four of thesenine success factors in moredetail in order to suggest bestpractices other oncology playersmay w<strong>an</strong>t to follow.An Independent <strong>Oncology</strong> UnitThe dynamics of the oncologymarket are different from thoseof <strong>an</strong>y other therapeutic category.There<strong>for</strong>e, it makes sense thatfour of the five comp<strong>an</strong>ies predictedto be oncology leaders by 2016currently have <strong>an</strong> independent <strong>an</strong>dnimble oncology unit in place tomake decisions specific to the therapeuticarea.Roche’s Bio<strong>Oncology</strong> group isone of eight specialty care businessunits within the org<strong>an</strong>ization. TheBio<strong>Oncology</strong> business unit receivesits budget allocation <strong>an</strong>nually <strong>an</strong>dis free to conduct its own business.Novartis <strong>Oncology</strong> is a separatebusiness unit within Novartis’sPharmaceuticals Division thatis responsible <strong>for</strong> the globaldevelopment <strong>an</strong>d marketing ofoncology products.1 Internal functionsare dedicated to oncology <strong>an</strong>dnot shared with other therapeuticareas.Multiple Phase II <strong>an</strong>d Phase III TrialsConducted in ParallelDeveloping successful oncologyagents typically requires a largenumber of clinical trials <strong>an</strong>d multipleshots on goal. As oncologyclinical trials take a number ofyears to complete, comp<strong>an</strong>ies donot have the luxury of patent lifeto target one indication at a time.Instead, successful oncology comp<strong>an</strong>iesconduct parallel phase II<strong>an</strong>d phase III trials even be<strong>for</strong>e afirst indication is approved. Eachof the 10 top-selling oncologyagents has benefited from between300 <strong>an</strong>d 1,100 clinical studies conductedby comp<strong>an</strong>ies as well asacademic <strong>an</strong>d governmental bodies.Compared with other therapeuticareas, oncology trials tend tobe smaller in terms of number ofpatients. But at the same time,comp<strong>an</strong>ies will need to place theirbets across multiple indications—studying, <strong>for</strong> example, a singleproduct <strong>for</strong> lung c<strong>an</strong>cer, breast c<strong>an</strong>cer,<strong>an</strong>d head <strong>an</strong>d neck c<strong>an</strong>cer.While conducting parallel trialsinvolves risk, doing so increasesthe ch<strong>an</strong>ce <strong>for</strong> approvals in multipleindications. In the case ofAfinitor®, <strong>for</strong> example, Novartisconducted numerous phase II <strong>an</strong>dphase III trials in parallel, targetingMarch 2013 | OBRoncology.com 1

<strong>Success</strong> <strong>Factors</strong> <strong>for</strong> <strong>Building</strong> <strong>an</strong> <strong>Oncology</strong> <strong>Business</strong> (<strong>Part</strong> 1)no fewer th<strong>an</strong> 10 different tumortypes, be<strong>for</strong>e the initial approval inrenal cell carcinoma (Figure 2). Thestrategy has paid off, as Afinitor iscurrently indicated <strong>for</strong> five differenttumor types, with a projectedrevenue potential of more th<strong>an</strong> $2billion by 2018.Celgene’s <strong>Oncology</strong> <strong>an</strong>d Hematologybusiness unit reports to <strong>an</strong> SVPgroup head. At Pfizer, <strong>Oncology</strong> isone of seven diverse business units,<strong>an</strong>d each business unit is led by <strong>an</strong>executive with clear accountability<strong>for</strong> results, from product developmentpost-proof of concept to theend of the product’s life cycle.Bristol-Myers Squibb is the soleoutlier, possessing <strong>an</strong> oncologybusiness that is integrated withother therapeutic areas.While <strong>an</strong> independent oncologybusiness unit is not necessarilyappropriate <strong>for</strong> every org<strong>an</strong>ization,it is import<strong>an</strong>t to org<strong>an</strong>ize theoncology business <strong>for</strong> success, payingattention to the special needsof this therapeutic area. This successfactor is especially relev<strong>an</strong>t tolarger, more established comp<strong>an</strong>iesas well as those making <strong>an</strong> initial<strong>for</strong>ay into oncology.Engagementwith Outside Groups in ClinicalDevelopmentConducting numerous trialssimult<strong>an</strong>eously is extremelychallenging <strong>for</strong> a comp<strong>an</strong>y to doon its own. In order to targetadditional tumor types, patientpopulations, <strong>an</strong>d drug-drug combinations,comp<strong>an</strong>y-sponsoredtrials need to be supplementedwith external collaborations withthe National Institutes of Health(NIH), co-operative groups, <strong>an</strong>dother academic institutions.Engaging with cooperativegroups <strong>an</strong>d academic institutionsin clinical development is$27$26$25$9$8$7$6$5$4$3$2$1$02012 (E)<strong>Oncology</strong> Market Analyst Sales Forecast ($B)*(2012–2016 Forecasted Sales)*Sales do not include supportive care productsSource: Evaluate Pharma. Worldwide <strong>Oncology</strong> Revenues by comp<strong>an</strong>y.Accessed February 2012; Campbell Alli<strong>an</strong>ce <strong>an</strong>alysis.a common practice among theleading oncology comp<strong>an</strong>ies.Doing so broadens a comp<strong>an</strong>y’sreach, helping greatly in thepatient recruitment process <strong>an</strong>d2013 (E) 2014 (E) 2015 (E) 2016 (E)RocheNovartisCelgenePfizerBristol-MyersSquibbEli LillyJohnson& JohnsonAstraZenecaS<strong>an</strong>ofiTakedaMerck & CoFigure 1. Based on estimated sales, Roche, Novartis, Celgene, Bristol-MyersSquibb, <strong>an</strong>d Pfizer are expected to be the top oncology players in 2016.

in obtaining access to the leadinginvestigators. It also helps toraise awareness of a drug threeor four years be<strong>for</strong>e the productreaches the market, growingthe pool of key opinion leaders(KOLs) who c<strong>an</strong> advocate <strong>for</strong> theproduct.Though comp<strong>an</strong>y-sponsoredtrials allow <strong>for</strong> more control,co-op groups are essentialcontributors to successful oncologyclinical development. Theyhave access to large numbers ofpatients <strong>an</strong>d contribute to signific<strong>an</strong>taccruals of patients <strong>for</strong>both early- <strong>an</strong>d late-stage clinicaltrials. In addition, the NIHsponsors the C<strong>an</strong>cer TherapyEvaluation Program (CTEP),which collaborates with pharmaceuticalcomp<strong>an</strong>ies to evaluatenovel <strong>an</strong>ti-c<strong>an</strong>cer agents in phaseI <strong>an</strong>d phase II studies.Biomarker Capabilities ThroughoutDevelopment ProcessThe oncology market leadersare tapping the potential ofbiomarkers to increase the probabilityof success <strong>an</strong>d to reduce thesize, length, <strong>an</strong>d cost of clinicaltrials. Biomarkers c<strong>an</strong> be usedto identify patients most likely tobenefit from therapy <strong>an</strong>d predictresponse to therapy be<strong>for</strong>e thehard endpoints are reached.Every drug being developed atRoche has a biomarker programassociated with it, <strong>an</strong>d the biomarkerprograms benefit fromthe diagnostics expertise ofRoche Diagnostics. At Novartis,the identification of biomarkersis a m<strong>an</strong>datory part of proposals<strong>for</strong> all new drug targets.Me<strong>an</strong>while, biomarkers are usedin most of the first-in-hum<strong>an</strong>studies conducted by Bristol-Myers Squibb.Pfizer is using biomarkers in80% to 90% of its early clinicalstudies. A proactive approach toidentifying biomarkers resultedin the development of Pfizer’sXalkori®, which was approved<strong>for</strong> a small subpopulation ofnon-small cell lung c<strong>an</strong>cers afteronly three years of development.Within the biomarker-identifiedpatient population, Xalkoriachieved high response rates inTimeline Between Phase II, Phase III, <strong>an</strong>d Registration/LaunchIndicationsGI Stromal-GISTNeuroendocrineC<strong>an</strong>cerBreast C<strong>an</strong>cer(ER+ <strong>an</strong>d ER-)Renal C<strong>an</strong>cerProstateC<strong>an</strong>cerColorectalC<strong>an</strong>cerHepatocellularCarcinomaAstrocytomaGastric C<strong>an</strong>cerNon-Hodgkin'sLymphomaHead <strong>an</strong>d NeckC<strong>an</strong>cerHodgkin'sDiseaseTotal #Trials2*11*20*195*652*265111/0201/0503/0505/0508/0510/0606/06 05/11 +10/06 03/09 +05/0610/0612/0608/07Phase II clinical trials Phase III clinical trials Discontinued*Including one terminated study‘02-’05 2006 2007 2008 2009 2010 2011 201206/0911/08 10/10 + 03/1206/0908/08 07/0907/0911/09+ Registration/LaunchNotes: Other c<strong>an</strong>cer types are not shown in the graph. The number of trials includes phase II<strong>an</strong>d III clinical trials. The dates indicate start dates.Source: www.clinicaltrials.gov. Accessed March 2012; Campbell Alli<strong>an</strong>ce <strong>an</strong>alysis.Figure 2. Novartis has conducted numerous phase II <strong>an</strong>d phase III trials inparallel <strong>for</strong> Afinitor.March 2013 | OBRoncology.com 3

<strong>Success</strong> <strong>Factors</strong> <strong>for</strong> <strong>Building</strong> <strong>an</strong> <strong>Oncology</strong> <strong>Business</strong> (<strong>Part</strong> 1)two single-arm studies of approximately250 patients, leading toregulatory approval. The approvalof Xalkori may herald a new eraof clinical trial design based onbiomarkers.ConclusionIn part two of this series, wewill look at two more attributesthe top oncology players sharefrom a clinical development perspective:the external sourcingof early <strong>an</strong>d late-stage assets<strong>an</strong>d a focus on first-to-marketproducts. We will then examinethe common attributes on thecommercialization side, includingthe presence of a strongmedical affairs org<strong>an</strong>ization,innovative engagement models,<strong>an</strong>d a sophisticated oncologysales <strong>for</strong>ce.How these factors could best beintegrated into <strong>an</strong>y one comp<strong>an</strong>y’sbusiness model would needto be examined on a case-by-casebasis that weighs such elementsas the breadth of therapeuticareas in which the comp<strong>an</strong>y operates,the broader portfolio ofproducts, available resources <strong>for</strong>development <strong>an</strong>d/or in-licensing,available resources <strong>for</strong> buildingmedical <strong>an</strong>d commercial org<strong>an</strong>izations,<strong>an</strong>d so on.The attributes described aboveare not a prerequisite to successin the oncology space, nor do theyprovide a guar<strong>an</strong>tee of success.However, because these attributesare shared by the leadingplayers in the market, they areworthy of consideration <strong>for</strong> othercomp<strong>an</strong>ies looking to build orexp<strong>an</strong>d their oncology businesses.WS RSFootnote1. Novartis 2011 Annual ReportAbout the ContributorsWen Shi, PhD, is a director at CampbellAlli<strong>an</strong>ce. He c<strong>an</strong> be reached at wshi@campbellalli<strong>an</strong>ce.com. Rohit Sood is avice president with Campbell Alli<strong>an</strong>ce.He c<strong>an</strong> be reached at rsood@campbellalli<strong>an</strong>ce.com.Campbell Alli<strong>an</strong>ce (campbellalli<strong>an</strong>ce.com) is the consulting business segmentof inVentiv Health, <strong>an</strong>d is the leadingm<strong>an</strong>agement consulting firm specializingin the pharmaceutical <strong>an</strong>d biotechnologyindustry.March 2013 | OBRoncology.com 4