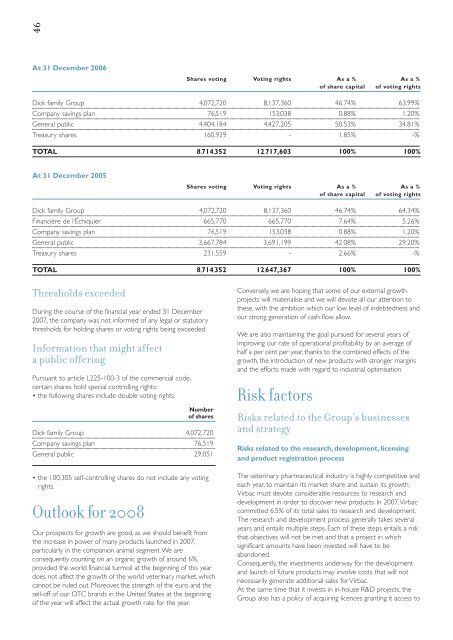

46At 31 December 2006Shares voting Voting rights As a % As a %of share capital of voting rightsDick family Group 4,072,720 8,137,360 46.74% 63.99%Company savings plan 76,519 153,038 0.88% 1.20%General public 4,404,184 4,427,205 50.53% 34.81%Treasury shares 160,929 - 1.85% -%TOTAL 8,714,352 12,717,603 100% 100%At 31 December 2005Shares voting Voting rights As a % As a %of share capital of voting rightsDick family Group 4,072,720 8,137,360 46.74% 64.34%Financière de l’Échiquier 665,770 665,770 7.64% 5.26%Company savings plan 76,519 153,038 0.88% 1.20%General public 3,667,784 3,691,199 42.08% 29.20%Treasury shares 231,559 - 2.66% -%TOTAL 8,714,352 12,647,367 100% 100%Thresholds exceededDuring the course of the <strong>financial</strong> year ended 31 December<strong>2007</strong>, the company was not informed of any legal or statutorythresholds for holding shares or voting rights being exceeded.Information that might affecta public offeringPursuant to article L225-100-3 of the commercial code,certain shares hold special controlling rights:• the following shares include double voting rights:Numberof sharesDick family Group 4,072,720Company savings plan 76,519General public 29,051• the 100,305 self-controlling shares do not include any votingrights.Outlook for 2008Our prospects for growth are good, as we should benefit fromthe increase in power of many products launched in <strong>2007</strong>,particularly in the companion animal segment.We areconsequently counting on an organic growth of around 6%,provided the world <strong>financial</strong> turmoil at the beginning of this yeardoes not affect the growth of the world veterinary market, whichcannot be ruled out. Moreover, the strength of the euro and thesell-off of our OTC brands in the United States at the beginningof the year will affect the actual growth rate for the year.Conversely, we are hoping that some of our external growthprojects will materialise and we will devote all our attention tothese, with the ambition which our low level of indebtedness andour strong generation of cash flow allow.We are also maintaining the goal pursued for several years ofimproving our rate of operational profitability by an average ofhalf a per cent per year, thanks to the combined effects of thegrowth, the introduction of new products with stronger marginsand the efforts made with regard to industrial optimisation.Risk factorsRisks related to the Group’s businessesand strategyRisks related to the research, development, licensingand product registration processThe veterinary pharmaceutical industry is highly competitive andeach year, to maintain its market share and sustain its growth,<strong>Virbac</strong> must devote considerable resources to research anddevelopment in order to discover new products. In <strong>2007</strong>,<strong>Virbac</strong>committed 6.5% of its total sales to research and development.The research and development process generally takes severalyears and entails multiple steps. Each of these steps entails a riskthat objectives will not be met and that a project in whichsignificant amounts have been invested will have to beabandoned.Consequently, the investments underway for the developmentand launch of future products may involve costs that will notnecessarily generate additional sales for <strong>Virbac</strong>.At the same time that it invests in in-house R&D projects, theGroup also has a policy of acquiring licences granting it access to

47either new products ready to be marketed, or to projects underdevelopment that it will itself pursue up through their successfulconclusion. As is true of in-house R&D projects, there is always arisk that these projects will not be finished, or that thecommercial prospects will turn out to be less attractive thanexpected, which may lead to the recognition of a provision forimpairment of these assets.Once the research and development phase is finished,<strong>Virbac</strong>, inits capacity as a veterinary pharmaceutical laboratory, mustobtain any administrative authorisations necessary to market itsproducts.This step is often long and complicated, and theGroup’s chances of success are not guaranteed. In fact, the filingof a registration dossier with the appropriate authority providesno automatic guarantee that the authorisation to market theproduct will be obtained, or such authorization may be onlypartial, i.e. limited to certain countries or to certain applications.Once marketing authorisation has been obtained, products aresubjected to continuous controls and their marketing may stillbe restricted, or they may be withdrawn from the market.<strong>Virbac</strong> seeks to limit these risks by employing a stringentselection process for the research and development projects inwhich it invests (whose probabilities of success, as measured bya combination of technical, regulatory and marketing factors, areover 50%) and through the expertise of its Department ofRegulatory Affairs, which is responsible for the filing, monitoringand renewal of marketing authorisations.Risks related to the Group’s distribution<strong>Virbac</strong> is present in many countries, either through itssubsidiaries or through distributors in those countries in whichthe Group has no subsidiary.Although there are many types of distribution networks, andeach depends on the country in which the products are beingsold, the Group’s products are virtually always distributed toveterinarians through wholesalers and central purchasing groups.Throughout the world, these relationships are defined bycontracts that are reviewed regularly; nevertheless, this kind ofdistribution method can occasionally create a certaindependency for <strong>Virbac</strong>, or provide it with an insufficient degreeof control over its presence and future growth.<strong>Virbac</strong> seeks to reduce this risk by studying opportunities tocreate a distribution subsidiary each time its sales attain asufficient level in any given market.<strong>Virbac</strong> then proceeds withthe most appropriate solution, either acquiring its distributor orcreating a new company.Reputational risksProduct liability is a risk inherent to <strong>Virbac</strong>’s type of business(pharmaceutical products).In order to keep these risks low,<strong>Virbac</strong> has established drugmonitoring procedures and stringent quality controls for all ofthe products the Group markets, in addition to taking outappropriate insurance.It is nevertheless possible for <strong>Virbac</strong> to be involved in productliability suits, which could affect its reputation as well as its sales,operating profit or <strong>financial</strong> position.Risk of dependency on third parties for the supplyor manufacturing of certain productsAll of the raw materials and active ingredients that make up theproducts <strong>Virbac</strong> produces are supplied by third parties.In certain cases, the Group also uses manufacturers or industrialpartners with expertise in or control over special technologies.<strong>Virbac</strong> diversifies its sources of supplies to the greatest extentpossible by establishing relationships with several suppliers, whileensuring that all of these different sources present adequateprofiles in terms of quality and reliability.<strong>Virbac</strong> is exposed tosome risk of supply shortages or price pressure, however, oncertain supplies or technologies for which diversification isdifficult or impossible.To limit these risks, the Group strives to identify as many diversesuppliers as possible, and in certain cases acts to secure itssupply chain by acquiring the technologies and expertise it ismissing and that create too much of a dependency. An exampleof this was the acquisition of the patent rights and the industrialplant for the production of the protein used to make the maincat vaccine, Leucogen ® .Risk related to the Group’s external growth policyEver since it was founded,<strong>Virbac</strong> has pursued an activeacquisition policy. As a result, the Group now has operations inmany countries and a broad range of products.In <strong>2007</strong>, the Group continued its geographic expansion bymaking an acquisition in Thailand in the aquaculture sector and iscontemplating continuing this policy in the future to reinforceboth its geographic positioning and its product offer.This growth through acquisitions entails both <strong>financial</strong> andoperational risks.<strong>Virbac</strong>’s previous acquisitions, both older and more recent,demonstrate the company’s ability to manage the acquisitionprocess and all associated challenges effectively. It accomplishesthis notably by using competent, multidisciplinary teams in all itsacquisition projects; if needed, these teams may be backed up byindependent advisors.Industrial and environmental risksRisks related to the use of dangerous materialsAs part of its business manufacturing veterinary medicine,<strong>Virbac</strong>uses substances that present health, fire and/or explosion, airpollution and water pollution risks at the various phases of theproduction process (manufacturing, storage and transport).To minimise these risks, the Group complies with the safetymeasures prescribed by all prevailing laws and regulations,establishes best manufacturing and laboratory practices, andensures that all its employees have been trained appropriately.Its manufacturing sites and research and development facilitiesare also inspected regularly by regulatory authorities.