Property Fund - New Ireland Assurance

Property Fund - New Ireland Assurance

Property Fund - New Ireland Assurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

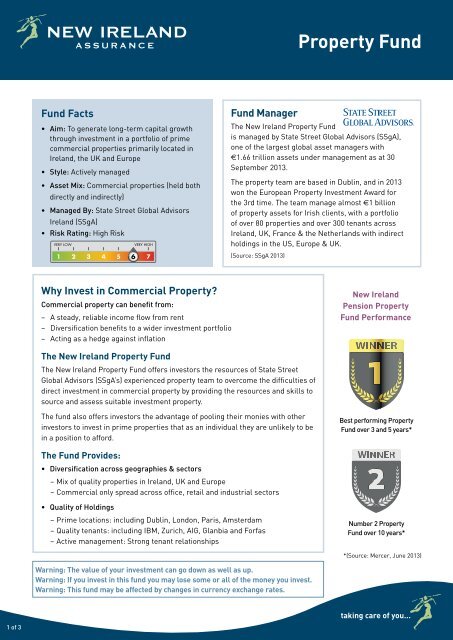

<strong>Property</strong> <strong>Fund</strong>The <strong>Property</strong> Portfolio• Direct exposure to high quality commercial properties primarily in <strong>Ireland</strong>, UK and mainland Europe• Prime locations include:– <strong>Ireland</strong>: Dublin City Centre including St Stephens Green– UK: London City, Liverpool and Manchester– Europe: Amsterdam and ParisThe fund may also invest in indirect property assets, such as property holding companies and Real Estate Investment Trusts(REITs).REITs are investment vehicles that are listed on stock markets and are traded similar to company shares. REITs can bebought or sold very quickly (unlike buying or selling an individual property), allowing the fund manager to act very quicklywhen taking a view on the property market.A Snapshot of Direct Properties Currently Held Within The <strong>Fund</strong>:France<strong>Ireland</strong>NetherlandsUnited KingdomMixedUseOfficesRetail andOfficesMixedUse(as at July 2013) Source: SSgAImportant informationInvestors should be aware of the special characteristics of a property fund:• The company reserves the right to delay encashment or a switch out of the fund in the event of outflows from the fund• If the company has to sell properties to meet significant cash outflows, unit prices may be marked down to reflect thecosts of disposalWarning: The value of your investment may go down as well as up.Warning: This fund may be affected by changes in currency exchange rates.Warning: Past performance is not a reliable guide to future performance.Warning: If you invest in this fund you may lose some or all of the money you invest.2 of 3

<strong>Property</strong> <strong>Fund</strong>TWO COLOUR WHITE PROCESS VERSION VERSIONMinimum Recommended Investment PeriodC100 M24 Y0 K64C24 M0 Y46 K10Investing should always be considered over the medium to long-term (typically, 5-7 years or more) so as to give theLithographic Printunderlying assets time to grow in value. However, even long-term investing involves risk as values will fluctuateover time.VERY LOWVERY HIGH1 2 3 4 5 7Risk Rating – High Risk6<strong>New</strong> <strong>Ireland</strong> has rated the <strong>Property</strong> <strong>Fund</strong> a high risk investment fund. High risk funds have the followingcharacteristics - the potential return from high risk investments is much higher than deposits or inflation. Thefocus is on maximising the potential return to investors, rather than minimising risks. Some high risk funds mayconsist almost entirely of one asset class or be concentrated in one geographic region or sector. Investors’ capitalis not secure and may fluctuate significantly. Investors may get back substantially less than they originally invested.Product AvailabilityThe <strong>Property</strong> <strong>Fund</strong> is available to investors through the following <strong>New</strong> <strong>Ireland</strong> products:• Smart <strong>Fund</strong>s• FutureSave• Personal Retirement Plan• Executive Retirement Plan• Trustee Investment Plan• Group Pensions• Approved Retirement <strong>Fund</strong> (ARF• Approved Minimum Retirement <strong>Fund</strong> (AMRF)• Personal Retirement Bond• AVCsChargesNormal product charges and allocation rates for these products apply.MTalk to your Financial Broker or Advisor1890 405 905 †fundcentre.newireland.ieWarning: The value of your investment can go down as well as up.Warning: If you invest in this fund you may lose some or all of the money you invest.Warning: This fund may be affected by changes in currency exchange rates.†To improve our service to you, calls may be recorded.Terms and conditions apply. Where relevant life assurance tax applies. A Government levy (currently 1% of the premium) is payable on all premiums paid toa life assurance policy.While great care has been taken in its preparation, this document is of a general nature and should not be relied on in relation to specific issues withouttaking appropriate financial, insurance, investment or other professional advice. The content of this document is for information purposes only and doesnot constitute an offer or recommendation to buy or sell any investment or to subscribe to any investment management or advisory service. In the event ofany changes in taxation or legislation, <strong>New</strong> <strong>Ireland</strong> may amend the terms and conditions of the relevant contract to take account of any such changes. Thedetails shown above relating to this <strong>Fund</strong> and its composition are as at the date of this document unless otherwise stated and may change over time. If thereis any conflict between this document and the Policy Conditions, the Policy Conditions will apply.State Street Global Advisors <strong>Ireland</strong> Limited is regulated by the Central Bank of <strong>Ireland</strong>. Incorporated and registered in <strong>Ireland</strong> at Two Park Place, Upper Hatch Street, Dublin 2.Registered number 145221. Member of the Irish Association of Investment Managers.<strong>New</strong> <strong>Ireland</strong> <strong>Assurance</strong> Company plc is regulated by the Central Bank of <strong>Ireland</strong>. A member of Bank of <strong>Ireland</strong> Group.3 of 3January 2014301055 V7.01.14