Student Handbook - Lee University

Student Handbook - Lee University

Student Handbook - Lee University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

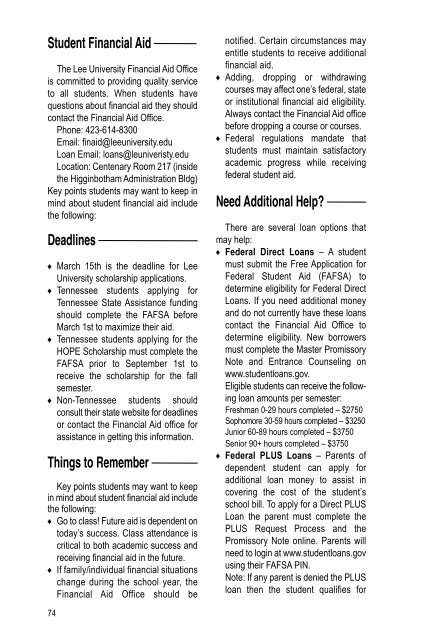

student financial aidThe <strong>Lee</strong> <strong>University</strong> Financial Aid Officeis committed to providing quality serviceto all students. When students havequestions about financial aid they shouldcontact the Financial Aid Office.Phone: 423-614-8300Email: finaid@leeuniversity.eduLoan Email: loans@leuniveristy.eduLocation: Centenary Room 217 (insidethe Higginbotham Administration Bldg)Key points students may want to keep inmind about student financial aid includethe following:deadlines8 March 15th is the deadline for <strong>Lee</strong><strong>University</strong> scholarship applications.8 Tennessee students applying forTennessee State Assistance fundingshould complete the FAFSA beforeMarch 1st to maximize their aid.8 Tennessee students applying for theHOPE Scholarship must complete theFAFSA prior to September 1st toreceive the scholarship for the fallsemester.8 Non-Tennessee students shouldconsult their state website for deadlinesor contact the Financial Aid office forassistance in getting this information.Things to rememberKey points students may want to keepin mind about student financial aid includethe following:8 Go to class! Future aid is dependent ontoday’s success. Class attendance iscritical to both academic success andreceiving financial aid in the future.8 If family/individual financial situationschange during the school year, theFinancial Aid Office should benotified. Certain circumstances mayentitle students to receive additionalfinancial aid.8 Adding, dropping or withdrawingcourses may affect one’s federal, stateor institutional financial aid eligibility.Always contact the Financial Aid officebefore dropping a course or courses.8 Federal regulations mandate thatstudents must maintain satisfactoryacademic progress while receivingfederal student aid.need additional Help?There are several loan options thatmay help:8 Federal Direct Loans – A studentmust submit the Free Application forFederal <strong>Student</strong> Aid (FAFSA) todetermine eligibility for Federal DirectLoans. If you need additional moneyand do not currently have these loanscontact the Financial Aid Office todetermine eligibility. New borrowersmust complete the Master PromissoryNote and Entrance Counseling onwww.studentloans.gov.Eligible students can receive the followingloan amounts per semester:Freshman 0-29 hours completed – $2750Sophomore 30-59 hours completed – $3250Junior 60-89 hours completed – $3750Senior 90+ hours completed – $37508 Fe deral PLUS Loans – Parents ofdependent student can apply foradditional loan money to assist incovering the cost of the student’sschool bill. To apply for a Direct PLUSLoan the parent must complete thePLUS Request Process and thePromissory Note online. Parents willneed to login at www.studentloans.govusing their FAFSA PIN.Note: If any parent is denied the PLUSloan then the student qualifies for74