COMMON APPLICATION FORM LIQUID, DYNAMIC BOND.pdf

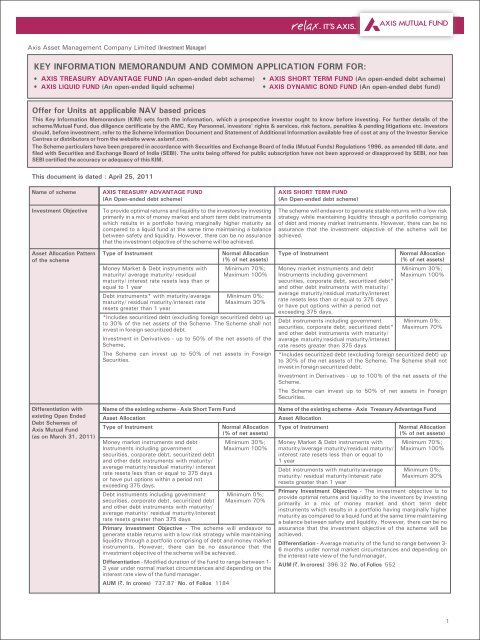

COMMON APPLICATION FORM LIQUID, DYNAMIC BOND.pdf

COMMON APPLICATION FORM LIQUID, DYNAMIC BOND.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Differentiation withexisting Open EndedDebt Schemes ofAxis Mutual Fund(as on March 31, 2011)(Contd...)Name of the existing scheme - Axis Income SaverAsset AllocationType of InstrumentNormal Allocation (% of net assets)Debt and money market instruments Minimum 65%; Maximum 99%Equity and Equity related instruments Minimum 1%; Maximum 35%Primary Investment Objective -The Scheme seeks to generate regular income through investments in debt & money marketinstruments, along with capital appreciation through limited exposure to equity and equity related instruments. It also aims to managerisk through active asset allocation.Differentiation - Investment in Equity and Equity related instruments up to 35% of the net assets of the scheme.AUM (`. In crores) 439.38 No. of Folios 25480Name of the existing scheme - Axis Dynamic Bond FundAsset AllocationType of InstrumentDebt instruments including GSecs and corporate debt 0% - 100%Money market instruments 0% - 100%includes securitized debt up to 30% of the net assets of the Scheme.Normal Allocation (% of net assets)Primary Investment Objective - The scheme will endeavor to generate optimal returns while maintaining liquidity through activemanagement of a portfolio of debt and money market instruments.Differentiation - Active duration management.Investment StrategyThe risk-return profile of this fund positions it in between a liquidfund and short duration income fund. The portfolio strategy seeksto increase yield by having a marginally higher maturity andmoderately higher credit risk as compared to a liquid fund; whilstmaintaining balance between safety and liquidity.The Fund Manager will try to allocate the assets of the scheme in adiversified portfolio of various high quality Fixed Income Securitiesto achieve stable returns while having a low risk strategy.The fund manager will seek to look for investment opportunitieswith the same class of fixed income securities (e.g. governmentsecurities) having different maturities (e.g. government securitieshaving a residual maturity of 1 year and 2.5 years) or differentclasses of Fixed Income Securities with the same maturityprofile/residual maturity. (e.g. a government security, an NBFCand a manufacturing corporate security having a residual maturityof 2 years).Risk Profile of theSchemeMutual Fund Units involve investment risks including the possible loss of principal. Please read the SID carefully for details on riskfactors before investment.Scheme specific Risk Factors are summarized below:The scheme carries risks associated with investing in debt and money market securities, derivatives, Foreign Securities, securitizeddebt, short selling and securities lending.Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk.Trading volume may restrict liquidity. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio.Also, the value of the Scheme investments may be affected by currency exchange rates, changes in law/policies of the government,taxation laws and political, economic or other developments.Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spreadrisk, prepayment risk, etc. Please refer to the SID for further details.Risk ManagementStrategiesInterest rate risk is managed by meticulous determination ofaverage maturity (which is the expression for change in portfoliovalue for a basis point change in interest rate) of the portfolio.Extensive analysis of macro economic conditions is done to form aview on future interest rates and to position the portfolioaccordingly. Credit risk is managed by in-depth analysis of issuer(financial/operating performance) with the help of internal andexternal research. Liquidity risk is addressed by maintainingexposure to cash/cash equivalents and highly liquid instruments.Risk Management is an integral part of the investment process andadequate safeguards for controlling risks would be incorporatedby the Asset Management Company (AMC) in the portfolioconstruction process. The following are the key risks associatedwith investments in fixed income securities and the manner theAMC would endeavor to address themRisk InvolvedInterest Rate Risk: Risk that a rise in interest rates will cause priceof bonds to fall. In general, there is an inverse relationshipbetween interest rates and bond prices so that when interest ratesrise, bond price fall and vice versa.Risk Mitigant: The average modified duration of a portfolio is oneof the means of measuring the interest rate risk of the portfolio.Higher is the modified duration, the fund stands exposed to ahigher degree of interest rate risk. The Investment ReviewCommittee (IRC) of the Asset Management Company woulddecide on the modified duration to be maintained for the portfolioat a particular point of time after taking into account the currentscenario and the investment objective of the scheme. Theportfolio duration will be decided after doing a thorough researchon the general macroeconomic condition, political environment,systemic liquidity, inflationary expectations, corporateperformance and other economic considerations.Credit Risk: Risk of default on payments by the issuer of a securityRisk Mitigant: The credit analyst will make a detailed study of eachof the issuers whose security will be bought by the fund. Hisanalysis will include a study of the operating environment, pasttrack record and short term/long term financial health of theissuer. The credit analyst will also take the help of data fromexternal credit rating agencies like ICRA, CRISIL and Fitch duringhis analysis. The Credit Analyst will recommend the name of theissuers to the IRC who will be the final approving authority forincluding any issuer in the “target universe of issuers”.Liquidity RiskRisk Mitigant: The Mutual Fund will maintain adequate cash/cashequivalent securities to manage the day to day redemptions of the2

Risk ManagementStrategies(Contd...)Plans and OptionPlans: Retail & Institutional (Both plans will have a common portfolio)Options: Growth & DividendDividend Frequency: Daily Dividend (Only Reinvestment facility);Weekly Dividend (Payout & Reinvestment); Monthly Dividend(Payout & Reinvestment)Default Plan (Fresh Purchase): If investment amount is > = ` 1crore: Institutional; If investment amount is < ` 1 crore: Retail;Default Plan (Additional Purchase): If investment amount is > =` 1 lac: Institutional; If investment amount is < ` 1 lac: RetailDefault option: GrowthDefault between payout & Reinvestment option : Reinvestmentfund. Attention would be given to the historic redemption trendswhile deciding on the cash equivalent component of the portfolio.Further, the scheme would also make investments only in highquality debt and money market instruments to mitigate the risk ofilliquidity of the portfolio.The AMC would endeavor to identify & measure risks throughvarious risk measurement tools like various risk ratios and analyzethe same to be able to act in a preventive manner.Plans: Retail & Institutional (Both plans will have a common portfolio)Options: Growth & Dividend (Payout & Reinvestment);Dividend Frequency: Regular Dividend; Monthly DividendDefault Plan (Fresh Purchase): If investment amount is > =` 1 crore: Institutional; If investment amount is < ` 1 crore: RetailDefault Plan (Additional Purchase): If investment amount is > =` 1 lac: Institutional; If investment amount is < ` 1 lac: RetailDefault option: GrowthDefault between payout & Reinvestment option : ReinvestmentDefault Dividend Frequency: MonthlyApplicable NAVSubscriptions/Purchases including Switch - ins:The following cut-off timings shall be observed by the Mutual Fund in respect of purchase of units of the Scheme, and the following NAVsshall be applied for such purchase:1. where the application is received upto 3.00 pm with a local cheque or demand draft payable at par at the place where it is received -closing NAV of the day of receipt of application;2. where the application is received after 3.00 pm with a local cheque or demand draft payable at par at the place where it is received -closing NAV of the next Business Day ; and3. where the application is received with an outstation cheque or demand draft which is not payable on par at the place where it isreceived - closing NAV of day on which the cheque or demand draft is credited.4. In respect of purchase of units with amount equal to or more than ` 1 crore, irrespective of the time of receipt of application, the closingNAV of the day on which the funds are available for utilization shall be applicable provided that:(a) For allotment of units in respect of purchase in the scheme under pt (4) above, it shall be ensured that:i. Application is received before the applicable cut-off timeii.Funds for the entire amount of subscription/purchase as per the application are credited to the bank account of the schemebefore the cutoff time.iii. The funds are available for utilization before the cut-off time without availing any credit facility whether intra-day or otherwise,by the scheme.(b) For allotment of units in respect of switch-in to the scheme under Pt (4) above from other schemes, it shall be ensured that:i. Application for switch-in is received before the applicable cut-off time.ii.Funds for the entire amount of subscription/purchase as per the switch-in request are credited to the bank account of thescheme before the cut-off time.iii. The funds are available for utilization before the cut-off time without availing any credit facility whether intra-day or otherwise,by the scheme.Redemptions including Switch - outs:The following cut-off timings shall be observed by the Mutual Fund in respect of Repurchase of units:1. Where the application received upto 3.00 pm - closing NAV of the day of receipt of application; and2. An application received after 3.00 pm - closing NAV of the next Business Day.Minimum Applicationand RedemptionAmount/Number of UnitsPurchase Additional Purchase RepurchaseRetail Plan` 5,000 and in multiplesof ` 1 thereafterRetail Plan` 1,000 and in multiplesof ` 1 thereafterInstitutional Plan Institutional Plan` 1 crore and in multiples ` 1 lac and in multiplesof ` 1 thereafter of ` 1 thereafterMinimumRedemption` 1,000 or1 Unit inrespect ofeach OptionPurchase Additional Purchase RepurchaseRetail Plan` 5,000 and in multiplesof ` 1 thereafterRetail Plan` 100 and in multiplesof ` 1 thereafterInstitutional Plan Institutional Plan` 1 crore and in multiples ` 1 lac and in multiplesof ` 1 thereafter of ` 1 thereafterMinimumRedemption` 1,000 or1 Unit inrespect ofeach OptionFor details of investment through Systematic Investment Purchase (SIP) and Systematic Transfer Plan (STP) please refer to the relevantScheme Information Document.Despatch of Repurchase(Redemption) RequestBenchmark IndexDividend PolicyWithin 10 working days from the receipt of the redemption request at the Authorized Centre of Axis Mutual Fund.CRISIL Liquid Fund IndexCRISIL Short Term Bond Fund IndexThe Trustee will endeavour to declare the Dividend as per the specified frequencies, subject to availability of distributable surpluscalculated in accordance with the Regulations. The actual declaration of Dividend and frequency will inter-alia, depend on availability ofdistributable surplus calculated in accordance with SEBI (MF) Regulations and the decisions of the Trustee shall be final in this regards.There is no assurance or guarantee to the Unit holders as to the rate of Dividend nor that will the Dividend be paid regularly.Name of Fund ManagerName of the TrusteeCompanyMr Ninad Deshpande & Mr R. SivakumarAxis Mutual Fund Trustee LimitedMr R. Sivakumar & Mr Ninad Deshpande3

Performance of thescheme(as on March 31, 2011)Axis Treasury Advantage Fund - Institutional PlanPeriod Scheme Returns Benchmark Returns1 year 6.61% 6.21%Since Inception 5.94% 5.25%Axis Treasury Advantage Fund - Retail PlanPeriod Scheme Returns Benchmark Returns1 year 6.35% 6.21%Since Inception 6.20% 6.08%Absolute returns for the past 2 financial yearsAxis Short Term Fund - Institutional PlanPeriod Scheme Returns Benchmark Returns1 year 5.48% 5.12%Since Inception 5.34% 5.02%Axis Short Term Fund - Retail PlanPeriod Scheme Returns Benchmark Returns1 year 5.17% 5.12%Since Inception 5.41% 5.33%Absolute returns for the past 2 financial years6.61%6.21%6.35% 6.21%5.48% 5.12% 5.17% 5.12%2009-2010*2010-20112.12%1.54% *Inception to0.84%0.32% 0.82% *Inception to 0.65% 0.61%March 31, 2010 0.34% March 31, 20102009-2010* 2010-2011 2009-2010* 2010-20112009-2010*2010-2011Axis Treasury Advantage Fund -Institutional Plan - GrowthCrisil Liquid Fund Index(Benchmark)Axis Treasury Advantage Fund -Retail Plan - GrowthCrisil Liquid Fund Index(Benchmark)Axis Short Term Fund -Institutional Plan - GrowthCrisil Short Term Bond FundIndex (Benchmark)Axis Short Term Fund -Retail Plan - GrowthCrisil Short Term BondFund Index (Benchmark)thDate of Allotment - 9 October, 2009Past performance may or may not be sustained in future. Returnsare compounded annualized for period more than or equal to1 year. Since inception returns are calculated on ` 1,000 investedat inception. Calculations are based on Growth Option NAVs.Since inception returns for Institutional Plan - Growth Option &Retail Plan - Growth Option are calculated from 9th October 2009& 3rd March 2010 respectively. Retail Plan introduced on 2ndMarch 2010.ndDate of Allotment - 22 January, 2010Past performance may or may not be sustained in future. Returnsare compounded annualized for period more than or equal to1 year. Since inception returns are calculated on ` 10 invested atinception. Calculations are based on Growth Option NAVs. Sinceinception returns for Institutional Plan - Growth Option & RetailPlan - Growth Option are calculated from 22nd January 2010 &2nd March 2010 respectively. Retail Plan introduced on 2ndMarch 2010.Expenses of the Scheme(i) Load Structure(also applicable toSIP/STP and Switches)(ii) Recurring ExpensesWaiver of Load forDirect ApplicationsTax Treatment forInvestors UnitholdersDaily Net Asset Value(NAV) PublicationFor Investor Grievancesplease contactUnitholder’sInformationEntry load : NA; Exit load : NilEntry load : NA; Exit load : 0.25% if units are redeemed/switchedout within 30 days from the date of allotment.No Load will be charged on the Units allotted on reinvestment of Dividends.The above mentioned load structure shall be equally applicable to the special products such as SIP/STP, switches, etc. offered under theScheme. SEBI vide its circular no. SEBI/IMD/CIR No. 4/ 168230/09 dated June 30, 2009 has decided that there shall be no entry Loadfor all Mutual Fund Schemes. The upfront commission on investment made by the investor, if any, shall be paid to the ARN Holder (AMFIregistered Distributor) directly by the investor, based on the investor's assessment of various factors including service rendered by theARN Holder.The Trustee / AMC reserve the right to change / modify the Load structure from a prospective date.The recurring expenses of the Scheme (including the Investment Management and Advisory Fees) shall be as per the limits prescribedunder the SEBI (MF) Regulations. These are as follows: On the first ` 100 crores of the average weekly net assets - 2.25%; On the next `300 crores of the average weekly net assets - 2.00%; On the next ` 300 crores of the average weekly net assets - 1.75%; On the balanceof the assets - 1.50%Actual expenses for the financial year ended March 31, 2011 -0.48% (unaudited)Not applicableActual expenses for the financial year ended March 31, 2011 -0.59% (unaudited)Investors are advised to refer to the paragraph on Taxation in the “Statement of Additional Information” and to consult their own taxadvisors with respect to the specific amount of tax and other implications arising out of their participation in the scheme.The NAV will be declared on all business days and will be published in 2 newspapers. NAV can also be viewed on www.axismf.com andwww.amfiindia.com [You can also telephone us at 1800 3000 3300.]Registrar - Karvy Computershare Private Limited, Unit - Axis Mutual Fund, Karvy Plaza, H No 8-2-596, Street 1, Banjara Hills,Hyderabad 34. Tel 040 2331 2454 Fax 040 2331 1968Mutual Fund - Mr Milind Vengurlekar, Axis House, 1st Floor, Bombay Dyeing Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai- 400025, India. Tel 022 4325 4138/ 4123 E-mail customerservice@axismf.com Fax 022 4325 5199 Toll Free 1800 3000 3300Web www.axismf.comAccount Statements An account statement reflecting the number of Units allotted shall be dispatched to the Unit Holder by ordinarypost / courier/ electronic mail within the following periods:(I) Within 30 days from the date of closure of NFO/acceptance of valid application; (ii)In case of SIP/STP - within 10 working days fromthe end of quarter (March, June, September and December). However, the first account statement under SIP/STP/Switch shall beissued within 10 working days of the initial investment and in case of specific request, the account statement shall be despatchedwithin 5 working days from the receipt of such request without any charges.Annual Account Statement: The Mutual Fund shall provide the Account Statement to the Unit holders who have not transacted duringthe last six months prior to the date of generation of account statements. The account statements in such cases may be generated andissued along with the Portfolio Statement or Annual Report of the Scheme. Annual Report: Scheme-wise Annual Report or an abridgedsummary thereof shall be mailed to all Unit Holders within four months from the date of closure of the relevant accounting year i.e. 31stMarch each year. Half yearly disclosures: The Mutual Fund shall publish a complete statement of the Scheme portfolio and theunaudited financial results, within one month from the close of each half year (i.e. 31st March and 30th September), by way of anadvertisement at least, in one National English daily and one regional newspaper in the language of the region where the head office ofthe Mutual Fund is located. The Mutual Fund may opt to send the portfolio to all Unit holders in lieu of the advertisement. The AnnualReport, portfolio statement and the un audited financial results will also be displayed on the website of the Mutual Fund4

Name of schemeInvestment ObjectiveAsset Allocation Patternof the schemeDifferentiation withexisting Open EndedDebt Schemes ofAxis Mutual Fund(as on March 31, 2011)AXIS <strong>LIQUID</strong> FUND(An open-ended liquid scheme)To provide a high level of liquidity with reasonable returnscommensurating with low risk through a portfolio of moneymarket and debt securities. However, there can be no assurancethat the investment objective of the scheme will be achieved.Type of InstrumentNormal Allocation(% of net assets)Money market instruments (including cash, Minimum 50%;repo,CPs, CDs, Treasury Bills and Maximum 100%Government securities) with maturity /residual maturity up to 91 daysDebt instruments (including floating rate Minimum 0%;debt instruments and securitized debt)* Maximum 50%with maturity/residual maturity / weightedaverage maturity up to 91 days*securitized debt cumulative allocation not to exceed 30% of the netassets of the Scheme (excluding foreign securitized debt).Investment in Derivatives - up to 50% of the net assets of theScheme.The Scheme can invest up to 50% of net assets in Foreign Securities.Pursuant to SEBI circular No. SEBI/IMD/CIR No. 13/150975/09 datedJanuary 19, 2009, the Scheme shall make investment in / purchasedebt and money market securities with maturity of up to 91 daysonly.Explanation:a. In case of securities where the principal is to be repaid in a singlepayout, the maturity of the securities shall mean residual maturity.In case the principal is to be repaid in more than one payout thenthe maturity of the securities shall be calculated on the basis ofweighted average maturity of the security.b. In case of securities with put and call options (daily or otherwise)the residual maturity of the securities shall not be greater than 91days.c. In case the maturity of the security falls on a Non Business Day,then settlement of securities will take place on the next BusinessDay.Not ApplicableAXIS <strong>DYNAMIC</strong> <strong>BOND</strong> FUND(An open-ended debt fund)The scheme will endeavor to generate optimal returns whilemaintaining liquidity through active management of a portfolio ofdebt and money market instruments.Type of InstrumentNormal Allocation(% of net assets)Debt instruments* including GSecs and 0% - 100%corporate debtMoney market instruments 0% - 100%*includes securitized debt up to 30% of the net assets of theScheme.Investments in derivatives shall be up to 75% of the net assets ofthe scheme.The Scheme can invest up to 50% of net assets in ForeignSecurities.The cumulative gross exposure through debt and derivativepositions shall not exceed 100% of the net assets of the scheme.Cash or cash equivalents with residual maturity of less than 91days shall be treated as not creating any exposure.'Axis Dynamic Bond Fund, an open ended debt scheme is a newscheme offered by Axis Mutual Fund and is not a minormodification of any other existing scheme/product of Axis MutualFundName of the existing scheme - Axis Income SaverAsset AllocationType of InstrumentNormal Allocation(% of net assets)Debt and money market instruments Minimum 65%;Maximum 99%Equity and Equity related instruments Minimum 1%;Maximum 35%Primary Investment Objective -The Scheme seeks to generateregular income through investments in debt & money marketinstruments, along with capital appreciation through limitedexposure to equity and equity related instruments. It also aims tomanage risk through active asset allocation.Differentiation - Investment in Equity and Equity relatedinstruments up to 35% of the net assets of the scheme.AUM (`. In crores) 439.38 No. of Folios 25480Name of the existing scheme - Axis Short Term FundAsset AllocationType of InstrumentNormal Allocation(% of net assets)Money market instruments and debt Minimum 30%;Instruments including government Maximum 100%securities, corporate debt, securitized debtand other debt instruments with maturity/average maturity/residual maturity/ interestrate resets less than or equal to 375 daysor have put options within a period notexceeding 375 days.Debt instruments including government Minimum 0%;securities, corporate debt, securitized debt Maximum 70%and other debt instruments with maturity/average maturity/ residual maturity/interestrate resets greater than 375 daysPrimary Investment Objective - The scheme will endeavor togenerate stable returns with a low risk strategy while maintainingliquidity through a portfolio comprising of debt and money marketinstruments. However, there can be no assurance that theinvestment objective of the scheme will be achieved.Differentiation - Modified duration of the fund to range between 1-3 year under normal market circumstances and depending on theinterest rate view of the fund manager.AUM (`. In crores) 737.87 No. of Folios 11845

Differentiation withexisting Open EndedDebt Schemes ofAxis Mutual Fund(as on March 31, 2011)(Contd...)Investment StrategyRisk Profile of theSchemeUnder normal circumstances, the fund shall seek to generatereasonable returns commensurate with low risk by positioning itselfat the lowest level of the risk-return matrix.The Scheme will invest predominantly in money market securitieswith some tactical allocation towards other debt securities toenhance returns from the portfolio.Name of the existing scheme - Axis Treasury Advantage FundAsset AllocationType of InstrumentNormal Allocation(% of net assets)Money Market & Debt instruments with Minimum 70%;maturity/average maturity/residual maturity/ Maximum 100%interest rate resets less than or equal to1 yearDebt instruments with maturity/average Minimum 0%;maturity/ residual maturity/interest rate Maximum 30%resets greater than 1 yearPrimary Investment Objective - The investment objective is toprovide optimal returns and liquidity to the investors by investingprimarily in a mix of money market and short term debtinstruments which results in a portfolio having marginally highermaturity as compared to a liquid fund at the same time maintaininga balance between safety and liquidity. However, there can be noassurance that the investment objective of the scheme will beachieved.Differentiation - Average maturity of the fund to range between 3-6 months under normal market circumstances and depending onthe interest rate view of the fund manager.AUM (`. In crores) 396.32 No. of Folios 552The investment objective of this scheme is to maximize returns tothe investor through an active management of the portfolio, byelongating the duration of the portfolio in a falling interest ratescenario and reducing the duration at a time when interest rates aremoving up.With the discretion to take aggressive interest rate/duration riskcalls, this could mean investing the entire net assets in long datedGovernment securities and debt instruments (carrying relativelyhigher interest rate risk/duration risk), or on defensiveconsiderations, entirely in money market instruments. Accordingly,the interest rate risk/duration risk of the scheme may changesubstantially depending upon the Fund’s call.Mutual Fund Units involve investment risks including the possible loss of principal. Please read the SID carefully for details on riskfactors before investment. Scheme specific Risk Factors are summarized below:The scheme carries risks associated with investing in debt and money market securities, derivatives, Foreign Securities, securitizeddebt, short selling and securities lending.Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk.Trading volume may restrict liquidity. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio.Also, the value of the Scheme investments may be affected by currency exchange rates, changes in law/policies of the government,taxation laws and political, economic or other developments.Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spreadrisk, prepayment risk, etc. Please refer to the SID for further details.Risk ManagementStrategiesPlans and OptionInterest rate risk is managed by meticulous determination ofaverage maturity (which is the expression for change in portfoliovalue for a basis point change in interest rate) of the portfolio.Extensive analysis of macro economic conditions is done to form aview on future interest rates and to position the portfolioaccordingly. Credit risk is managed by in-depth analysis of issuer(financial/operating performance) with the help of internal andexternal research. Liquidity risk is addressed by maintainingexposure to cash/cash equivalents and highly liquid instruments.Plans: Retail & Institutional (Both plans will have a commonportfolio)Options: Growth & DividendDividend Frequency: Daily Dividend (Only Reinvestment facility);Weekly Dividend (Payout & Reinvestment); Monthly Dividend(Payout & Reinvestment)Default Plan (Fresh Purchase): If investment amount is > =` 1 crore: Institutional; If investment amount is < ` 1 crore:RetailDefault Plan (Additional Purchase): If investment amount is > =` 1 lac: Institutional; If investment amount is < ` 1 lac: RetailDefault option: GrowthDefault between payout & Reinvestment option : ReinvestmentDefault Dividend Frequency: DailyInterest rate risk is managed by a meticulous determination of themodified duration of the portfolio. Extensive analysis of macroeconomic conditions is done to form a view on future interestrates and to position the portfolio accordingly. Credit risk ismanaged by in-depth analysis of issuer (financial/operatingperformance) with the help of internal and external research.Liquidity risk is addressed by maintaining exposure to cash/cashequivalents and highly liquid instruments.Plans: NilOptions: The Scheme would offer Growth and Dividend Option.Sub Options: The Dividend Option would provide the following suboptions:Quarterly (Payout and Reinvestment); Half Yearly (Payout andreinvestment)If Dividend payable under Dividend Payout option is equal to or lessthan ` 500/- then the Dividend would be compulsorily reinvested inthe option of the Scheme.6

Applicable NAVi) Subscriptions/Purchases including Switch - ins:i. where the application is received upto 2.00 p.m. on a day andfunds are available for utilization before the cut-off time withoutavailing any credit facility, whether, intra-day or otherwise - theclosing NAV of the day immediately preceding the day ofreceipt of application;ii.where the application is received after 2.00 p.m. on a day andfunds are available for utilization on the same day withoutavailing any credit facility, whether, intra-day or otherwise - theclosing NAV of the day immediately preceding the nextbusiness day ; andiii. irrespective of the time of receipt of application, where thefunds are not available for utilization before the cut-off timewithout availing any credit facility, whether, intra-day orotherwise - the closing NAV of the day immediately precedingthe day on which the funds are available for utilization.For allotment of units in respect of purchase in to the scheme, itshall be ensured that:i. Application is received before the applicable cut-off time.ii.Funds for the entire amount of subscription/purchase as per theapplication are credited to the bank account of the schemebefore the cut-off time.iii. The funds are available for utilization before the cut-off timewithout availing any credit facility whether intra-day orotherwise, by the scheme.For allotment of units in respect of switch-in to the scheme fromother schemes, it shall be ensured that:i. Application for switch-in is received before the applicable cutofftime.ii.Funds for the entire amount of subscription/purchase as per theswitch-in request are credited to the bank account of thescheme before the cut-off time.iii. The funds are available for utilization before the cut-off timewithout availing any credit facility whether intra-day orotherwise, by the respective switch-in schemes.Redemptions including Switch - outs:a. In respect of valid applications received upto 3.00 p.m. - theclosing NAV of the day immediately preceding the nextBusiness Day ; andb. In respect of valid applications received after 3.00 p.m. by theMutual Fund, the closing NAV of the next Business Day shall beapplicable.Subscriptions/Purchases including Switch - ins:The following cut-off timings shall be observed by the Mutual Fundin respect of purchase of units of the Scheme, and the followingNAVs shall be applied for such purchase:1. where the application is received upto 3.00 pm with a localcheque or demand draft payable at par at the place where it isreceived - closing NAV of the day of receipt of application;2. where the application is received after 3.00 pm with a localcheque or demand draft payable at par at the place where it isreceived - closing NAV of the next Business Day ; and3. where the application is received with an outstation cheque ordemand draft which is not payable on par at the place where itis received - closing NAV of day on which the cheque ordemand draft is credited.4. In respect of purchase of units with amount equal to or morethan ` 1 crore, irrespective of the time of receipt of application,the closing NAV of the day on which the funds are available forutilization shall be applicable provided that:(a) For allotment of units in respect of purchase in the schemeunder pt (4) above, it shall be ensured that:i. Application is received before the applicable cut-offtimeii. Funds for the entire amount of subscription/purchase asper the application are credited to the bank account ofthe scheme before the cutoff time.iii. The funds are available for utilization before the cut-offtime without availing any credit facility whether intradayor otherwise, by the scheme.(b) For allotment of units in respect of switch-in to the schemeunder Pt (4) above from other schemes, it shall be ensuredthat:i. Application for switch-in is received before theapplicable cut-off time.ii. Funds for the entire amount of subscription/purchase asper the switch-in request are credited to the bankaccount of the scheme before the cut-off time.iii. The funds are available for utilization before the cut-offtime without availing any credit facility whether intradayor otherwise, by the scheme.Redemptions including Switch - outs:The following cut-off timings shall be observed by the Mutual Fundin respect of Repurchase of units:1. where the application received upto 3.00 pm - closing NAV ofthe day of receipt of application; and2. an application received after 3.00 pm - closing NAV of the nextBusiness Day.Minimum Applicationand RedemptionAmount/Number of UnitsPurchase Additional Purchase RepurchaseRetail Plan` 5,000 and in multiplesof ` 1 thereafterRetail Plan` 1,000 and in multiplesof ` 1 thereafterInstitutional Plan Institutional Plan` 1 crore and in multiples ` 1 lac and in multiplesof ` 1 thereafter of ` 1 thereafterMinimumRedemption` 1,000 or1 Unit inrespect ofeach OptionFor details of transfer/investment through Systematic TransferPlan (STP) facility please refer to the relevant SID.Fresh Purchase` 5,000 and in multiples of ` 1 thereafterAdditional Purchase` 100 and in multiples of ` 1 thereafterRepurchase` 1,000 or 100 Units or account balance whichever is lowerFor details on investments through Sleep in Peace (SIP) andSystematic Transfer Plan (STP) facilities, please refer to the SID.Despatch of Repurchase(Redemption) RequestWithin 10 working days from the receipt of the redemption request at the Authorized Centre of Axis Mutual Fund.Benchmark IndexCRISIL Liquid Fund IndexCRISIL Composite Bond Fund indexDividend PolicyThe Trustee will endeavour to declare the Dividend as per the specified frequencies, subject to availability of distributable surpluscalculated in accordance with the Regulations. The actual declaration of Dividend and frequency will inter-alia, depend on availability ofdistributable surplus calculated in accordance with SEBI (MF) Regulations and the decisions of the Trustee shall be final in this regard.There is no assurance or guarantee to the Unit holders as to the rate of Dividend nor that the Dividend will be paid regularly.Name of Fund ManagerName of the TrusteeCompanyMr Ninad Deshpande & Mr R SivakumarAxis Mutual Fund Trustee LimitedMr R Sivakumar & Mr Ninad Deshpande7

Performance of thescheme(as on March 31, 2011)Axis Liquid Fund - Institutional PlanPeriod Scheme Returns Benchmark Returns1 year 6.60% 6.21%Since Inception 5.80% 5.25%Axis Liquid Fund - Retail PlanPeriod Scheme Returns Benchmark Returns1 year 6.40% 6.21%Since Inception 6.23% 6.11%Absolute returns for the past 2 financial yearsThis is a new scheme and does not have any performance trackrecord.6.60%6.21%6.40% 6.21%1.94% 1.54% *Inception to0.34%March 31, 2010 0.40%2009-2010* 2010-20112009-2010*Axis Liquid Fund -Institutional Plan - GrowthCrisil Liquid Fund Index(Benchmark)Axis Liquid Fund -Retail Plan - GrowthCrisil Liquid Fund Index(Benchmark)2010-2011thDate of Allotment - 9 October, 2009Past performance may or may not be sustained in future. Returnsare compounded annualized for period more than or equal to 1 year.Since inception returns are calculated on ` 1000 invested atinception. Calculations are based on Growth Option NAVs. Sinceinception returns for Institutional Plan - Growth Option & Retail Plan- Growth Option are calculated from 9thOctober 2009 & 1st March2010 respectively. Retail Plan introduced on 2nd March 2010.Expenses of the Scheme(i) Load Structure(also applicable to SIP/STP and Switches)(ii) Recurring ExpensesWaiver of Load forDirect ApplicationsTax Treatment forInvestors (Unitholders)Daily Net Asset Value(NAV) PublicationFor Investor Grievancesplease contactUnitholder’sInformationEntry load : NA; Exit load : NilNo Load (if any) will be charged on the Units allotted on reinvestment of Dividends.The above mentioned load structure shall be equally applicable to the special products such as STP, switches, etc. offered under theScheme.SEBI vide its circular no. SEBI/IMD/CIR No. 4/ 168230/09 dated June 30, 2009 has decided that there shall be no entry Load for allMutual Fund Schemes. The upfront commission on investment made by the investor, if any, shall be paid to the ARN Holder (AMFIregistered Distributor) directly by the investor, based on the investor's assessment of various factors including service rendered by theARN Holder.The Trustee/AMC reserve the right to change / modify the Load structure from a prospective date.The recurring expenses of the Scheme (including the Investment Management and Advisory Fees) shall be as per the limits prescribedunder the SEBI (MF) Regulations. These are as follows:On the first ` 100 crores of the average weekly net assets - 2.25%; On the next ` 300 crores of the average weekly net assets - 2.00%;On the next ` 300 crores of the average weekly net assets - 1.75% On the balance of the assets - 1.50%;Actual expenses for the previous financial year ended March 31,2011 - 0.35% (unaudited)Not applicableInvestors are advised to refer to the paragraph on Taxation in the “Statement of Additional Information” and to consult their own taxadvisors with respect to the specific amount of tax and other implications arising out of their participation in the scheme.The NAV will be declared for all calendar days and will be publishedin 2 newspapers. NAV can also be viewed on www.axismf.comand www.amfiindia.com [You can also telephone us at 1800 30003300.]Entry load : NA; Exit load : 0.5% if redeemed/switched out within6 months from the date of allotment.The NAV will be declared on all business days and will be publishedin 2 newspapers. NAV can also be viewed on www.axismf.comand www.amfiindia.comRegistrar - Karvy Computershare Private Limited, Unit - Axis Mutual Fund, Karvy Plaza, H No 8-2-596, Street 1, Banjara Hills,Hyderabad 34. Tel 040 2331 2454 Fax 040 2331 1968Mutual Fund - Mr Milind Vengurlekar, Axis House, 1st Floor, Bombay Dyeing Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai- 400025, India. Tel 022 4325 4138/ 4123 E-mail customerservice@axismf.com Fax 022 4325 5199 Toll Free 1800 3000 3300Web www.axismf.comAccount Statements: An account statement reflecting the numberof Units allotted shall be dispatched to the Unit Holder by ordinarypost / courier/ electronic mail within the following periods:(i) Within 30 days from the date of closure of NFO / acceptance ofvalid application. (ii) In case of STP - within 10 working days fromthe end of quarter (March, June, September and December).However, the first account statement under STP shall be issuedwithin 10 working days of the initial investment and in case ofspecific request, the account statement shall be despatched within5 working days from the receipt of such request without anycharges.NAAccount Statements: An account statement reflecting the numberof Units allotted shall be dispatched to the Unit Holder by ordinarypost / courier/ electronic mail within the following periods:(i) Within 30 days from the date of acceptance of valid application.(ii) Within 5 business days of closure of NFO - in case of applicationduring NFO. (iii) In case of SIP/STP - within 10 working days from theend of quarter (March, June, September and December). However,the first account statement under SIP/STP shall be issued within 10working days of the initial investment and in case of specific request,the account statement shall be despatched within 5 working daysfrom the receipt of such request (without any charges).Annual Account Statement - The Mutual Fund shall provide the Account Statement to the Unit holders who have not transacted duringthe last six months prior to the date of generation of account statements. The account statements in such cases may be generated andissued along with the Portfolio Statement or Annual Report of the Scheme.Annual Report - Scheme-wise Annual Report or an abridged summary thereof shall be mailed to all Unit Holders within four months fromthe date of closure of the relevant accounting year i.e. 31st March each year.Half yearly disclosures - The Mutual Fund shall publish a complete statement of the Scheme portfolio and the unaudited financial results,within one month from the close of each half year (i.e. 31st March and 30th September), by way of an advertisement at least, in oneNational English daily and one regional newspaper in the language of the region where the head office of the Mutual Fund is located.The Mutual Fund may opt to send the portfolio to all Unit holders in lieu of the advertisement.The Annual Report, portfolio statement and the un audited financial results will also be displayed on the website of the Mutual Fund(www.axismf.com) and Association of Mutual Funds in India (www.amfiindia.com).8

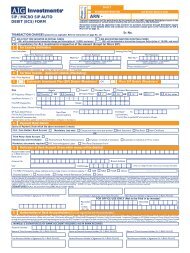

INSTRUCTIONS FOR COMPLETING THE <strong>APPLICATION</strong> <strong>FORM</strong>Please read the SID carefully before signing the application form and tendering payment.1. GENERAL INSTRUCTIONS1. The Application Form should be completed in ENGLISH and in BLOCK LETTERS only.2. All cheque, demand draft, pay orders should be crossed “Account Payee only” and made favouring “scheme nameA/c First investor name” or “Scheme name A/c Permanent Account no”.3. The default option shall be as specified in SID/KIM of respective schemes.4. For any correction / changes (if any) made on the application form, applicants are requested to authenticate thesame by canceling, entering the correct details and counter-signing the corrections by sole / all applicants.5. Application forms along with Cheques/ DDs/ Debit Mandates can be submitted to ISC’s/ OPA of KarvyComputershare and offices of Axis AMC as listed in form.6. Investors must write the Application Form number / Folio number on the reverse of the cheques/ draft accompanyingthe Application Form, if applicable.7. Investors are requested to check the contents of the account statement and any discrepancy has to be reported tothe AMC / Registrar within 7 calendar days on the receipt of the statement, else the particulars would be presumed tobe correct.8. Any application may be accepted or rejected at the sole and absolute discretion of the AMC / Trustee, withoutassigning any reason whatsoever.9. Incomplete forms are liable to be rejected.10. Please note that a non-transferable account statement will be issued for each investment.11. Units allotted are subject to realisation of cheques.12. All Unitholders who have invested/ may invest through channel distributors and intend to make their futureinvestments through the Direct route, are advised to complete the procedural formalities prescribed by AMC fromtime to time.13. Please note that there would be a cooling period of not more than 10 days in case the investor changes the bankmandate for validation and verification of bank accounts.2. DECLARATION AND SIGNATURES1. The signature can be in English or in any Indian language.2. Thumb impressions must be attested by a Magistrate / Notary Public under his / her official seal.3. In case of HUF, the Karta wiII sign on behalf of the HUF.4. Applications by minors should be signed by their guardian.5. For Corporates, Signature of Authorised Signatory from Authorised Signatory List (ASL) is required.3. PAYMENTS1. At present direct debit facility through debit mandate is available with Axis Bank.2. The AMC intends using electronic payment services (like NEFT, RTGS, ECS (Credits) and such like) to the extentpossible for dividend / redemption proceeds towards ensuring faster realization of proceeds for the investor. Tofacilitate verification of your bank account details for the purpose, please furnish the following details in the form:(a) Clearing Circle (City Name) in which your Bank branch participates.(b) MICR Code of your bank / branch (9 digit number appearing next to the cheque number on the cheque leaf)(c) IFSC Code of your bank / branch (11 character alphanumeric code, imprinted on your cheque leaf). If your cheque leafdoes not carry this, please check for the same with your local Bank branch.In case the Unit holders require these to be sent by cheque/ draft using postal/ courier service, the unit holders shallprovide appropriate instructions for the same t o the AMC/ Registrar.3. You are also requested to enclose a cancelled cheque leaf (or copy thereof) in case your investment instrument is notfrom the same bank account as mentioned in the bank mandate details in the application form.4. The AMC has put in place sufficient checks and balances but will not be liable for any wrong credits on account ofwrong information presented by the investor himself.5. The Fund may from time to time commence / discontinue Direct Credit arrangements with various banks for directcredit of redemptions / dividends. Investors would not have to submit a separate consent letter to avail of this service.The AMC would commence this operation based on the bank mandate details forwarded by the Investor.6. Any communication / despatch of redemption / dividend proceeds, account statements etc. to the unit holders wouldbe made by the Registrar / AMC in such a manner as they may consider appropriate in line with reasonable standardsof servicing.4. BANK DETAILSInvestors are requested to mention the bank account details, since the same is mandatory as per the directives issued bySEBI. Applications without this information will be deemed to be incomplete and are liable for rejection. The Mutual Fundreserves the right to hold redemption proceeds in case the requisite details are not submitted.a) Investor having multiple accountsThe Mutual Fund has also provided a facility to the investors to register multiple bank accounts. By registeringmultiple bank accounts, the investors can use any of the registered bank accounts to receive redemption / dividendproceeds. These account details will be used by the AMC / Mutual Fund / R&TA for verification of instrument used forsubscription to ensure that third party payments are not used for mutual fund subscription, except where permittedabove. Investors are requested to avail the facility of registering multiple bank accounts by filling in the ApplicationForm for Registration of Multiple Bank Accounts available at our ISCs / OPAs or on our website www.axismf.com.Investment bank cheque submitted along with subscription should be same as the beneficiary investor, or should beas per bank mandate details provided in the Multiple Bank Accounts Registration form (except for Minor less than`.50,000/- investments and Corporate/Non individuals).For Demand draft submitted by investor, would be allowed only with the required documents such as certificateissued by banker stating that Demand draft has been issued by debiting the investor bank account along withinvestor name and PAN. In case a pre-funded instrument issued by the Bank against Cash shall not be accepted forinvestments of `.50,000/- or more. This also should be accompanied by a certificate from the banker giving name,address and PAN of the person who has requested for the demand draft.• In case of RTGS/NEFT/NECS payment submitted by investor, it would be allowed only with the required documentssuch as certificate issued by banker stating the RTGS/NEFT/NECS is issued by debiting the investor bank account andwith investor name and PAN.• In case the payment submitted by the investor is from a bank other than the bank account mentioned on the'Multiple Bank Account Registration Form' the following documents needs to be provided any one of 'the paymentcheque to have the pre printed name of the holder/s, Bank statement, Pass book or Bank certificate' or elseapplication is liable for rejection.b) Restriction on Acceptance of Third Party Payments for Subscription of Unitsa) When payment is made through instruments issued from an account other than that of the beneficiary investor,the same is referred to as Third-Party payment. In case of payments from a joint bank account, the first holder ofthe mutual fund folio has to be one of the joint holders of the bank account from which payment is made.b) The Asset management Company shall not accept subscriptions with Third-Party payments except in thefollowing exceptional situations:1. Payment by Parents/Grand-Parents/related persons on behalf of a minor in consideration of natural love andaffection or as gift for a value not exceeding `.50,000/- (each regular purchase or per SIP installment)2. Payment by Employer on behalf of employee under Systematic Investment Plans through Payroll deductions.3. Custodian on behalf of an FII or a client.5. Documents to be obtained for exceptional cases:Investors submitting their applications through the above mentioned 'exceptional cases' are required to comply with thefollowing, without which applications for subscriptions for units will be rejected / not processed / refunded.(A) Mandatory KYC for all investors (guardian in case of minor) and the person making the payment i.e. third party. Inorder for an application to be considered as valid, investors and the person making the payment should attach theirvalid KYC Acknowledgement Letter to the application form.(B) Submission of a separate, complete and valid 'Third Party Payment Declaration Form' from the investors (guardian incase of minor) and the person making the payment i.e. third party. The said Declaration Form shall, inter-alia, containthe details of the bank account from which the payment is made and the relationship with the investor(s). Pleasecontact the nearest OPA/ISC of Axis Mutual Fund or visit our website www.axismf.com for the said Declaration Form.6. PAN AND KYC DETAILSPlease furnish PAN & KYC details for each applicant/unit holder, including for Guardian and / or Power of Attorney (POA)holders as explained in the paragraphs below.A) PANAs per SEBI Circular No. MRD/DoP/Cir- 05/2007 dated April 27, 2007, it is now mandatory that Permanent AccountINSTRUCTIONS FOR COMPLETING THE NOMINATION SECTION1. Nomination is mandatory for all the folios/accounts, where the mode of holding is single or the folio/account is opened byindividual without any joint holding. New subscriptions received from individuals without nomination will be rejected.2. The nomination can be made only by individuals holding units on their own behalf singly or jointly. Non-Individuals includingSociety, Trust, Body Corporate, Partnership Firm, Karta of Hindu Undivided Family, holder of Power of Attorney cannotnominate. If the units are held jointly, all joint holders will sign the nomination form.3. Nomination will not be allowed for the folios/accounts opened by minors4. A minor can be nominated and in that event, the name and address of the guardian of the minor nominee shall be provided bythe Unitholder. If no guardian is provided, nomination of minor will be invalid. The guardian should be a person other than theUnitholder. Nomination can also be in favour of the Central Govt, State Govt, local authority, any person designated by virtueof his office or a religious charitable trust.5. The Nominee shall not be a trust other than a religious or charitable trust, society, body corporate, partnership firm, Karta ofHindu Undivided Family or a Power of Attorney holder. A non-resident Indian can be a Nominee subject to the exchangecontrols in force, from time to time.6. Nomination in respect of the units stands rescinded upon the transfer of units.7. The nomination facility extended under the Scheme is subject to existing laws. The AMC shall, subject to production of suchevidence which in their opinion is sufficient, proceed to effect the payment / transfer to the Nominee(s). Transfer of Units /payment to the nominee(s) of the sums shall discharge the Mutual Fund / AMC of all liability towards the estate of thedeceased Unit holder and his / her / their successors / legal heirs.8. The cancellation of nomination can be made only by those individuals who hold units on their own behalf singly or jointly andwho made the original nomination. (Please note that if one of the joint holder dies other surviving holder cannot cancel.)Number (PAN) issued by the IT Department would be the sole identification number for all participants transacting in thesecurities market, irrespective of the amount of transaction. Please note that furnishing of PAN with an attested copy of yourPAN Card for each applicant / unit holder is mandatory for all investments. In the absence of this, your application will berejected. The attestation of the PAN card may be done by a Notary Public or a Gazetted Officer or a Manager of a Bank or afinancial advisor under it's / his seal and should carry the name and designation of the person attesting it.PAN will not be required incase of SIP where aggregate of installments in a financial year i e April to March does not exceed `50,000. This exemption will be applicable only to investments by individuals,Non Resident Indian (NRI), minors, joint holders and sole proprietary firms (but not including Persons of Indian Origin (PIO),Hindu Undivided Family (HUF) and other categories). PAN requirement is also exempt for investors residing in the state ofSikkim, Central Government, State Government, and the officials appointed by the courts e.g. Official liquidator, Courtreceiver etc. (under the category of Government) subject to AMC confirming the above mentioned status. However, thiswould be subject to submission of necessary documents required by the AMC from time to time.Any one of the following PHOTO IDENTIFICATION documents can be submitted along with Micro SIP applications as proof ofidentification in lieu of PAN.• Voter Identity Card • Driving License • Government/ Defense identification card • Passport • Photo Ration Card• Photo Debit Card (Credit card not included because it may not be backed up by a bank account) • Employee ID cards issuedby companies registered with Registrar of Companies • Photo Identification issued by Bank Managers of ScheduledCommercial Banks / Gazetted Officer / Elected Representatives to the Legislative Assembly / Parliament • ID card issued toemployees of Scheduled Commercial / State / District Co-operative Banks • Senior Citizen / Freedom Fighter ID card issued byGovernment • Cards issued by Universities/ deemed Universities or institutes under statutes like ICAI, ICWA, ICSI •Permanent Retirement Account No (PRAN) card isssued to New Pension System (NPS) subscribers by CRA (NSDL) • Any otherphoto ID card issued by Central Government/ State Governments/ Municipal authorities/ Government organizations likeESIC/ EPFOB) KYC COMPLIANCE WITH ANTI MONEY LAUNDERING (AML) REGULATIONSWith reference to the circular 35/MEM-COR/54/10-11 dated 16th August 2010 from AMFI effective 1st January 2011. AMFICommittee on KYC based on the discussion with SEBI recommended that the current threshold limit of `.50,000 to bereduced to Nil for Individual Investors.• KYC is compulsory for all Individual, Non-individual, NRI and Channel distributor investors.*• Investors covered under this clause are - Individual retail, Corporate, Partnership Firms, Trusts, HUF, NRIs including PIOsand all individual and non individual investors of channel distributors.• Individuals shall be required to be KYC compliant for any amount of investment.Please note that it is mandatory for each applicant /unit holder to be KYC-compliant. Please enclose a copy of the KYCacknowledgement letter issued by CDSL ventures ltd with your application for investment.• Guardians to minor applicants need to be KYC compliant.• POA holders need to be KYC compliant irrespective of the amount of investment.In case you are not yet KYC-compliant, please approach a Point of service (POS) of CDSL ventures Limited obtain KYCcompliance and submit a copy of your KYC acknowledgment letter to us.* For any investment amount.7. MINORAs per the recommendations made by NISM , AMFI had circulated guidelines dated 09th February 2011 on account ofMINOR ,which will be effective from 1st April, 2011 :1. The minor shall be the first and the sole holder in an account.2. No Joint holders are allowed. In case investor provides joint holder/s details in the application, those details will not becaptured.3. Guardian in the account / folio on behalf of the minor should be either a natural guardian (i.e. father or mother) or acourt appointed legal guardian.4. Guardian should mention the relationship with minor and date of birth of the Minor on the application form.5. A document evidencing the relationship and Date of Birth of the Minor should be submitted by the Guardian alongwith application for the first time during the opening of account/Folio..Guardian can submit any of the following listed documents :a. Birth certificate of the minor orb. School leaving certificate / mark sheet of Higher Secondary Board of respective states, ICSE, CBSE etc. orc. Passport of the minor ord. Any other suitable proof evidencing the relationship.8. <strong>APPLICATION</strong>S UNDER POWER OF ATTORNEYAn applicant wanting to transact through a power of attorney must lodge the photocopy of the Power of Attorney (PoA)attested by a Notary Public or the original PoA (which will be returned after verification) within 30 days of submitting theApplication Form / Transaction Slip at a Designated ISC’s / Official Point of acceptance or along with the application in case ofapplication submitted duly signed by POA holder. Applications are liable to be rejected if the power of attorney is notsubmitted within the aforesaid period.9. ELECTRONIC SERVICES FACILITYThe AMC intends to provide Electronic Transaction Facility including through its website and over phone.For more details, Terms & Conditions and for availability of Online Transaction refer AMC websitewww.axismf.com and for EasyCall facility please contact the nearest AMC or Registrar.10. SIP1. Unit Holder can enroll for the SIP by submitting duly completed SIP Application Form and one time debit mandate formfor electronic debits. Alternatively unit holder can enroll for the SIP using EasyCall facility subject to services offered byAMC from time to time. The first investment shall be through cheque only.2. An Investor shall have the option of choosing any date of the month as his SIP date except dates 29th, 30th, 31st. Theminimum amount per SIP installment shall be as specified in SID / KIM. The minimum number of installments under theSIP is 36. If the SIP period is not specified by the unit holder then the SIP enrolment will be deemed to be for perpetuityand processed accordingly.3. All SIP cheques / payment instructions will be of the same amount and same date (excluding first cheque).4. There will be a gap of 30 days between first SIP Installment and the second installment in case SIP started duringongoing offer.5. If the Fund fails to get the proceeds from three Installments out of a continuous series of Installments submitted at thetime of initiating a SIP (Subject to a minimum under SIP i.e. 36 months), the SIP is deemed as discontinued.6. Investors can discontinue the SIP facility at any time by sending a written request to any of the Official Point(s) ofAcceptance. Notice of such discontinuance should be received at least 30 days prior to the due date of the next debit.7. In case of “At Par” cheques, investors need to mentioned the MICR number of his actual bank branch.8. Axis Mutual Fund reserves the right to reject any application without assigning any reason thereof.9. Investor will not hold Axis Mutual Fund, its registrars and other service providers responsible if the transaction isdelayed or not effected or the investor bank account is debited in advance or after the specific SIP date due to variousclearing cycles for ECS.10. Axis Mutual Fund, its registrars and other service providers shall not be responsible and liable for anydamages/compensation for any loss, damage etc. incurred by the investor. The investor assumes the entire risk of usingthis facility and takes full responsibility.11. You can download the SIP application form and the SIP debit mandate form from our website www.axismf.com orcontact any of the AMC offices11. NRIs, FIIsa) Repatriation Basis• NRIs : Payment may be made either by inward remittance through normal banking channels or out of funds held ina Non-Resident (External) Rupee Account (NRE) / Foreign Currency (Non-Resident) Account (FCNR). In case Indianrupee drafts are purchased abroad or from Foreign Currency Accounts or Non-resident Rupee Accounts anaccount debit certificate from the Bank issuing the draft confirming the debit will need to be enclosed.• FIIs shall pay their subscription either by inward remittance through normal banking channels or out of funds heldin Foreign Currency Account or Non-Resident Rupee Account maintained by the FII with a designated branch of anauthorised dealer.b) Non-repatriation BasisIn the case of NRIs, payment may be made either by inward remittance through normal banking channels or out offunds held in a NRE / FCNR / Non-Resident Ordinary Rupee Account (NRO). In case Indian rupee drafts are purchasedabroad or from Foreign Currency Accounts or Non-resident Rupee Accounts an account debit certificate from the Bankissuing the draft confirming the debit will need to be enclosed.9. On cancellation of the nomination, the nomination shall stand rescinded and the Asset Management Company shall not beunder any obligation to transfer the units in favour of the Nominee.10. Nomination shall be registered only if the form is filled in completely.11. Nomination will be updated at folio/account level and not at scheme level.12. Nomination can be made for maximum of 3 nominees. In case of multiple nominees, the percentage of allocation / share infavour of each of the nominees should be indicated against their name and such allocation / share should be in wholenumbers without any decimals making a total of 100 percent. In the event of Unit holders not indicating the percentage ofallocation / share for each of the nominees, the Mutual Fund / the AMC, by invoking default option shall settle the claimequally amongst all the nominees.13. The investor(s) by signing this nomination form is / are deemed to have read and understood the provisions of Regulation 29A of SEBI (Mutual Funds) Regulations, 1996, read with SEBI circular dated Feb. 16, 2004 and / or any amendments theretoor any rules / regulations framed in pursuance thereof governing the nomination facility and agree/s to be bound by thesame.14. In case of fresh nominee registrations, existing nominee details will be over written across the schemes under the folio andthis is effective 01st April 2011.15 In case investor do not wish to nominate for specific folio / account, he should fill the specific field by writing “Nominationnot required” and sign on the application form.For multiple nomination form please contact the nearest AMC office or Registrar. The form can be obtained from the websitewww.axismf.com

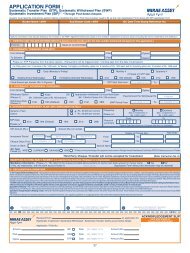

<strong>COMMON</strong> <strong>APPLICATION</strong> <strong>FORM</strong>Form 1Date D D M M Y YApplication No. IDistributor Code / ARN No. Sub-distributor Code / ARN No. / Sol ID Serial Number, Date and Time StampARN-1912Upfront commission shall be paid directly by the investor to the AMFI registered distributor based on the investors’ assessment of various factors including the service rendered by the distributor.1 EXISTING FOLIO NUMBERExisting Investors - Please fill in Sections 1, 9, 10,11 and 13 only2 UNIT HOLDER IN<strong>FORM</strong>ATIONDate of Birth D D M M Y Y Age (No. of years) Y YName of the First Applicant / Corporate InvestorMr/ Ms/ M/s/ Dr/ MinorRelationshipDocument EnclosedPAN (mandatory) Enclosed - PAN Proof KYC Letter (mandatory ,for any investment amount) Refer instruction no. 6 A, B & 7Name of the Second ApplicantMr/ Ms/ M/s/ DrPAN (mandatory) Enclosed - PAN Proof KYC Letter (mandatory ,for any investment amount) Refer instruction no. 6 A & BName of the Third ApplicantMr/ Ms/ M/s/ DrPAN (mandatory) Enclosed - PAN Proof KYC Letter (mandatory ,for any investment amount) Refer instruction no. 6 A & BName of the Guardian (in case of a minor)Mr/ Ms/ M/s/ DrRelationshipDocument EnclosedPAN (mandatory) Enclosed - PAN Proof KYC Letter (mandatory ,for any investment amount) Refer instruction no. 6 A, B & 7Name of the Power of Attorney HolderMr/ Ms/ M/sPAN (mandatory) Enclosed - PAN Proof KYC Letter (mandatory ,for any investment amount) Refer instruction no. 6 A & BName of the Third Party (When payment is made through instruments issued from an account other than that of the beneficiary investor)Mr/ Ms/ M/sPAN (mandatory) PAN Proof KYC Letter (mandatory ,for any investment amount) Refer instruction no. 6 A & BEnclosed -RelationDeclaration Form (Mandatory)3456ASTATUS OF FIRST APPLICANT Resident Individual Bank HUF Proprietor Minor Society FIIPartnership Firm NRI PIO Trust Company Other (specify)MODE OF OPERATION Single Joint Anyone or Survivor (Default option is Joint)OCCUPATION (of First/ Sole Applicant) Service Housewife Defence Professional Retired Business Agriculture Other (specify)CONTACT DETAILS - FIRST APPLICANT/ GUARDIAN/ CORPORATE (PO Box address is not sufficient. Mobile number and email id is mandatory to avail of online facility.)Contact Person (In case of Non Individual Investor)AddressState Pincode Landline No.Mobile (Holder 1)* Email (Holder 1)*Mobile (Holder 2)* Email (Holder 2)*Mobile (Holder 3)* Email (Holder 3)**Mandatory to transact using online transaction mode on our website www.axismf.com6B OVERSEAS ADDRESS (Mandatory in case of NRIs/ FIIs) (PO Box address is not sufficient. Investors residing overseas & with PO Box address must provide their Indian address)AddressCity State PincodeMobileLandline No.EmailCity10AAXIS MUTUAL FUND - DEBIT MANDATE (For Axis Bank account holders only)TO BE DETACHED BY THE REGISTRAR (KARVY COMPUTERSHARE PVT LTD) AND PRESENTED TO AXIS BANK CMS BRANCHDate D D M M Y YApplication No. ITo CMS DEPARTMENT - Axis Bank *I/ Weauthorise you to debit my/ our account no.Name of the account holder(s)*To be processed in CMS software under client code “AXISMF”to pay for thepurchase of Axis Treasury Advantage Fund / Axis Short Term Fund / Axis Liquid Fund / Axis Dynamic Bond Fund (Strike off those not applicable)Please debit an amount of ` (in figures) ` (in words)AXIS MUTUAL FUND - ACKNOWLEDGMENT SLIP (To be filled in by the investor)Received from Mr/ Ms/ M/s/ Dran application for purchase of units inAxis Treasury Advantage FundAxis Short Term FundAxis Liquid FundPlan Option Dividend Frequencyfor ` (in figures) on Date D D M M Y Y vide Instrument no.Axis Dynamic Bond FundApplication No. ISignature of Account Holder(s) as per bank records /Authorised Signatory(ies)Stamp & Signature

Form 17 CONTACT & ADDRESS OF POWER OF ATTORNEY HOLDER (PO Box address is not sufficient)AddressCity State PincodeMobileLandline No.Email8 MODE OF CORRESPONDENCE (Where the investor has provided his e-mail id, the AMC shall send all communication to the investor via e-mail. Investors who wish to receivecorrespondence through physical mode instead of e-mail are requested to ). Email communication will help save paper & the planet.I / We wish to receive all communication through physical mode in lieu of email.9 BANK ACCOUNT DETAILS OF FIRST / SOLE APPLICANT (Refer “Bank Details” under Instructions. Please enclose a copy of a cancelled cheque) For Multiple Bank AccountsRegistration form available at www.axismf.com.Name of BankBranchCity State Account No.Account Holder NameAccount Type Current Savings NRO NRE FCNR Others(specify)MICR code*IFSC code**Document attached (Any one) Cancelled Cheque with name pre-printed Bank statement Pass book Bank CertificateNote: In case bank details are not provided in “Multiple Bank Account Registration Form’’ as default bank the above section 9 bank details shall be treated as default bank.*Mandatory for dividend payout via ECS (The 9 digit code appears on your cheque next to the cheque number) **Mandatory for credit via RTGS/ NEFT (11 digit code also found on your cheque leaf.)10 PAYMENT OPTIONS (Please either Cheque / DD payment or RTGS/ NEFT)Cheque / DD RTGS NEFT Debit Mandate (For Axis Bank A/c holders only. Also fill section 10A)Cheque / DD UTR (for RTGS / NEFT) No.Drawn on BankBranch NameBranchCity State Account No.Account Type Current Savings NRO NRE FCNR Others (specify)Cheque Issuer NameIn case cheque is issued by person other than the investorTotal amount ` (In figures) inclusive of DD charges if any` (In words) inclusive of DD charges if anyDD Charges ` (In figures) if any11 INVESTMENT DETAILSAxis Treasury Advantage Fund Axis Short Term FundPlan Institutional Option Growth Dividend Re-investment#RetailDividend Payout#Not available for Daily Dividend Frequency12 NOMINATION DETAILSI / Wedo herebynominate the under mentioned person to receive the units to my / our credit in this foliono. in the event of my / our death. I / We also understand that all payments andsettlements made to such Nominee, and signature of the Nominee acknowledgmentreceipt thereof shall be a valid discharge by the AMC / Mutual Fund / Trustee.Nominee's NameRelationshipAddress13 DECLARATION AND SIGNATURESIn case Nominee is a MinorName of GuardianAddress of GuardianDate of BirthHaving read and understood the content of the SID / SAI of the scheme, I / we hereby apply for units of the scheme. I have read andunderstood the terms, conditions, rules and regulations governing the scheme. I / We hereby declare that the amount invested in thescheme is through legitimate source only and does not involve designed for the purpose of the contravention of any Act, Rules,Regulations, Notifications or Directives of the provisions of the Income Tax Act, Anti Money Laundering Laws, Anti Corruption Lawsor any other applicable laws enacted by the Government of India from time to time. I / We have understood the details of theScheme & I / we have not received nor have been induced by any rebate or gifts, directly or indirectly in making this investment. I /We confirm that the funds invested in the Scheme, legally belongs to me / us. In event “Know Your Customer” process is notcompleted by me / us to the satisfaction of the Mutual Fund, (I / we hereby authorize the Mutual Fund, to redeem the funds investedin the Scheme, in favour of the applicant, at the applicable NAV prevailing on the date of such redemption and undertake such otheraction with such funds that may be required by the law.) The ARN holder has disclosed to me/ us all the commissions (in the form oftrail commission or any other mode), payable to him for the different competing Schemes of various Mutual Funds from amongstwhich the Scheme is being recommended to me / us. For NRIs only - I / We confirm that I am/ we are Non Residents of Indiannationality / origin and that I / We have remitted funds from abroad through approved banking channels or from funds in my/ ourNon Resident External / Non Resident Ordinary / FCNR account. I / We confirm that details provided by me / us are true and correct.CHECKLIST Documents as listed below are to be submitted along with the Application Form (as applicable to your specific case)D D M M Y Y Y YCheque/DD DateFirst / Sole Applicant / GuardianThird ApplicantSignature of GuardianD D M M Y YAxis Liquid Fund Axis Dynamic Bond FundDividend FrequencyDaily Weekly Monthly (Applicable for Axis Treasury Advantage Fund & Axis Liquid Fund)Regular Monthly (Applicable for Axis Short Term Fund)Quarterly Half Yearly (Applicable only for Axis Dynamic Bond Fund)In case of more than one nominee, kindly submit multiple nomination (maximum 3 nominees)forms. Extra nomination forms can be obtained from the nearest ISC or Registrar or from theAMC website.Second ApplicantPower of Attorney HolderDocument submitted. Sr Documents Individuals Companies Trusts Societies Partnership FIIs NRIs InvestmentsKindly () No Firms through POA1 Resolution / Authorisation to invest 2 List of Authorised Signatories with Specimen Signature(s) 3 Memorandum & Articles of Association 4 Trust Deed 5 Bye-Laws 6 Partnership Deed 7 Notarised Power of Attorney 8 Account Debit Certificate in case payment is made by DD fromNRE / FCNR A/c where applicable9 PAN Proof (not required for existing investors) 10 KYC acknowledgment letter (required if not already submitted)# 11 Copy of cancelled cheque All documents in 1 to 6 above should be originals or true copies certified by the Director / Trustee / Company Secretary / Authorised Signatory / Notary Public / Partner as applicable. Originals will be handed over after verification.For list of official point of acceptance please visit www.axismf.comAxis Asset Management Company LimitedInvestment Manager to Axis Mutual FundAxis House, First Floor, Bombay Dyeing Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai - 400 025, India.Tel 91 22 4325 5100 Fax 91 22 4325 5199 / 2425 5199 Toll Free 1800 3000 3300 Email customerservice@axismf.com www.axismf.com

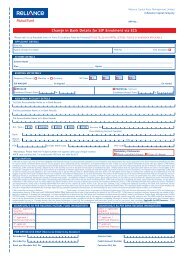

<strong>APPLICATION</strong> <strong>FORM</strong> FORDate D D M M Y YApplication No.IForm 2Distributor Code / ARN No. Sub-distributor Code / ARN No. / Sol ID Serial Number, Date and Time StampARN-1912Upfront commission shall be paid directly by the investor to the AMFI registered distributor based on the investors’ assessment of various factors including the service rendered by the distributor.SIP Registration by New Investor SIP Registration by Existing Investor Micro SIP Registration by New Investor Micro SIP Registration by Existing Investor1 EXISTING FOLIO NUMBERExisting Investors - Please fill in Sections 1, 9, 10,11 and 13 only2*Micro SIP - PAN is not mandatory in case of Micro SIP. Please refer to the Terms and Conditions overleaf.Date of Birth D D M M Y Y Type of supporting document Identification number details3 STATUS OF FIRST APPLICANT4MODE OF OPERATION Single Joint Anyone or Survivor (Default option is Joint)Mobile (Holder 3) Email (Holder 3)6B OVERSEAS ADDRESS (Mandatory in case of NRIs/ FIIs) (PO Box address is not sufficient. Investors residing overseas & with PO Box address must provide their Indian address)AddressCity State PincodeMobileEmail7Resident Individual Bank HUF Proprietor Guardian Society FII Partnership FirmNRI PIO Trust Company Minor Other (specify)5 OCCUPATION (of First/ Sole Applicant)Service Housewife Defence Professional Retired Business Agriculture Other (specify)6A CONTACT DETAILS - FIRST APPLICANT/ GUARDIAN/ CORPORATE (PO Box address is not sufficient. Mobile number and email id is mandatory to avail of online facility.)Contact Person (In case of Non Individual Investor)AddressState Pincode Landline No.Mobile (Holder 1) Email (Holder 1)Mobile (Holder 2) Email (Holder 2)AddressLandline No.CONTACT & ADDRESS OF POWER OF ATTORNEY HOLDER (PO Box address is not sufficient)City State PincodeMobileEmailUNIT HOLDER IN<strong>FORM</strong>ATIONName of the First Applicant / Corporate InvestorMr/ Ms/ M/s/ Dr/ MinorRelationshipDocument EnclosedPAN (mandatory)* Enclosed- PAN Proof KYC Letter**(mandatory, for any investment amount) Refer instruction no. 6 A, B & 7Name of the Second ApplicantMr/ Ms/ M/s/ DrPAN (mandatory)* Enclosed- PAN Proof KYC Letter**(mandatory, for any investment amount) Refer instruction no. 6 A & BName of the Third ApplicantMr/ Ms/ M/s/ DrPAN (mandatory)* Enclosed- PAN Proof KYC Letter**(mandatory, for any investment amount) Refer instruction no. 6 A & BName of the Guardian (in case of a minor)Mr/ Ms/ M/s/ DrRelationshipDocument EnclosedPAN (mandatory)* Enclosed- PAN Proof KYC Letter**(mandatory, for any investment amount) Refer instruction no. 6 A, B & 7Name of the Power of Attorney HolderMr/ Ms/ M/sPAN (mandatory)* Enclosed- PAN Proof KYC Letter**(mandatory, for any investment amount) Refer instruction no. 6 A & BName of the Third Party (When payment is made through instruments issued from an account other than that of the beneficiary investor)Mr/ Ms/ M/sPAN (mandatory) PAN Proof KYC Letter (mandatory, for any investment amount) Refer instruction no. 6 A & BEnclosed -RelationDeclaration Form (Mandatory)Landline No.AXIS MUTUAL FUND - ACKNOWLEDGMENT SLIP (To be filled in by the investor)Received from Mr/ Ms/ M/s/ Dran application for purchase of units in Axis Treasury Advantage Fund Axis Short Term FundPlan Option Dividend Frequencyfor ` (in figures) on Date D D M M Y Y vide Instrument no.Date of Birth D D M M Y Y Age (No. of years) Y YCityApplication No. IAxis Dynamic Bond FundStamp & Signature