FAFSA 10-11 (en) Form 2009-12-28.indd

FAFSA 10-11 (en) Form 2009-12-28.indd

FAFSA 10-11 (en) Form 2009-12-28.indd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

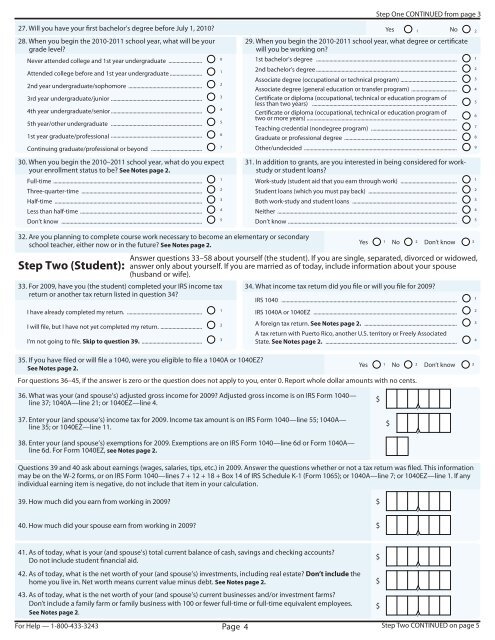

Step One CONTINUED from page 327. Will you have your first bachelor’s degree before July 1, 20<strong>10</strong>?28. Wh<strong>en</strong> you begin the 20<strong>10</strong>-20<strong>11</strong> school year, what will be yourgrade level?Never att<strong>en</strong>ded college and 1st year undergraduate .........................Att<strong>en</strong>ded college before and 1st year undergraduate ........................2nd year undergraduate/sophomore .......................................................3rd year undergraduate/junior ....................................................................4th year undergraduate/s<strong>en</strong>ior ....................................................................5th year/other undergraduate ....................................................................1st year graduate/professional ....................................................................Continuing graduate/professional or beyond ......................................30. Wh<strong>en</strong> you begin the 20<strong>10</strong>–20<strong>11</strong> school year, what do you expectyour <strong>en</strong>rollm<strong>en</strong>t status to be? See Notes page 2.Full-time ...............................................................................................................Three-quarter-time ..........................................................................................Half-time ..............................................................................................................Less than half-time ...........................................................................................Don’t know .........................................................................................................0<strong>12</strong>34567<strong>12</strong>345Yes 1No 229. Wh<strong>en</strong> you begin the 20<strong>10</strong>-20<strong>11</strong> school year, what degree or certificatewill you be working on?1st bachelor’s degree .........................................................................................................2nd bachelor’s degree ......................................................................................................... 2Associate degree (occupational or technical program) ..........................................Associate degree (g<strong>en</strong>eral education or transfer program) ..................................Certificate or diploma (occupational, technical or education program ofless than two years) ............................................................................................................Certificate or diploma (occupational, technical or education program oftwo or more years) ................................................................................................................Teaching cred<strong>en</strong>tial (nondegree program) ................................................................Graduate or professional degree ....................................................................................Other/undecided ..................................................................................................................31. In addition to grants, are you interested in being considered for workstudyor stud<strong>en</strong>t loans?Work-study (stud<strong>en</strong>t aid that you earn through work) ..........................................Stud<strong>en</strong>t loans (which you must pay back) ..................................................................Both work-study and stud<strong>en</strong>t loans ..............................................................................Neither ......................................................................................................................................Don’t know ..............................................................................................................................13456789<strong>12</strong>34532. Are you planning to complete course work necessary to become an elem<strong>en</strong>tary or secondaryschool teacher, either now or in the future? See Notes page 2.Yes1No2 Don’t know 3Step Two (Stud<strong>en</strong>t):Answer questions 33–58 about yourself (the stud<strong>en</strong>t). If you are single, separated, divorced or widowed,answer only about yourself. If you are married as of today, include information about your spouse(husband or wife).33. For <strong>2009</strong>, have you (the stud<strong>en</strong>t) completed your IRS income taxreturn or another tax return listed in question 34?34. What income tax return did you file or will you file for <strong>2009</strong>?IRS <strong>10</strong>40 ...................................................................................................................................1I have already completed my return. ........................................................1IRS <strong>10</strong>40A or <strong>10</strong>40EZ ...........................................................................................................2I will file, but I have not yet completed my return. ...............................2A foreign tax return. See Notes page 2. .....................................................................3A tax return with Puerto Rico, another U.S. territory or Freely AssociatedI’m not going to file. Skip to question 39. .............................................3State. See Notes page 2. ..................................................................................................435. If you have filed or will file a <strong>10</strong>40, were you eligible to file a <strong>10</strong>40A or <strong>10</strong>40EZ?See Notes page 2.For questions 36–45, if the answer is zero or the question does not apply to you, <strong>en</strong>ter 0. Report whole dollar amounts with no c<strong>en</strong>ts.Yes1NoDon’t know2 336. What was your (and spouse’s) adjusted gross income for <strong>2009</strong>? Adjusted gross income is on IRS <strong>Form</strong> <strong>10</strong>40—line 37; <strong>10</strong>40A—line 21; or <strong>10</strong>40EZ—line 4.37. Enter your (and spouse’s) income tax for <strong>2009</strong>. Income tax amount is on IRS <strong>Form</strong> <strong>10</strong>40—line 55; <strong>10</strong>40A—line 35; or <strong>10</strong>40EZ—line <strong>11</strong>.38. Enter your (and spouse’s) exemptions for <strong>2009</strong>. Exemptions are on IRS <strong>Form</strong> <strong>10</strong>40—line 6d or <strong>Form</strong> <strong>10</strong>40A—line 6d. For <strong>Form</strong> <strong>10</strong>40EZ, see Notes page 2.$$,,Questions 39 and 40 ask about earnings (wages, salaries, tips, etc.) in <strong>2009</strong>. Answer the questions whether or not a tax return was filed. This informationmay be on the W-2 forms, or on IRS <strong>Form</strong> <strong>10</strong>40—lines 7 + <strong>12</strong> + 18 + Box 14 of IRS Schedule K-1 (<strong>Form</strong> <strong>10</strong>65); or <strong>10</strong>40A—line 7; or <strong>10</strong>40EZ—line 1. If anyindividual earning item is negative, do not include that item in your calculation.39. How much did you earn from working in <strong>2009</strong>?40. How much did your spouse earn from working in <strong>2009</strong>?$$,,41. As of today, what is your (and spouse’s) total curr<strong>en</strong>t balance of cash, savings and checking accounts?Do not include stud<strong>en</strong>t financial aid.42. As of today, what is the net worth of your (and spouse’s) investm<strong>en</strong>ts, including real estate? Don’t include thehome you live in. Net worth means curr<strong>en</strong>t value minus debt. See Notes page 2.43. As of today, what is the net worth of your (and spouse’s) curr<strong>en</strong>t businesses and/or investm<strong>en</strong>t farms?Don’t include a family farm or family business with <strong>10</strong>0 or fewer full-time or full-time equival<strong>en</strong>t employees.See Notes page 2.For Help — 1-800-433-3243Page 4$$$,,,Step Two CONTINUED on page 5