FAFSA 10-11 (en) Form 2009-12-28.indd

FAFSA 10-11 (en) Form 2009-12-28.indd

FAFSA 10-11 (en) Form 2009-12-28.indd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

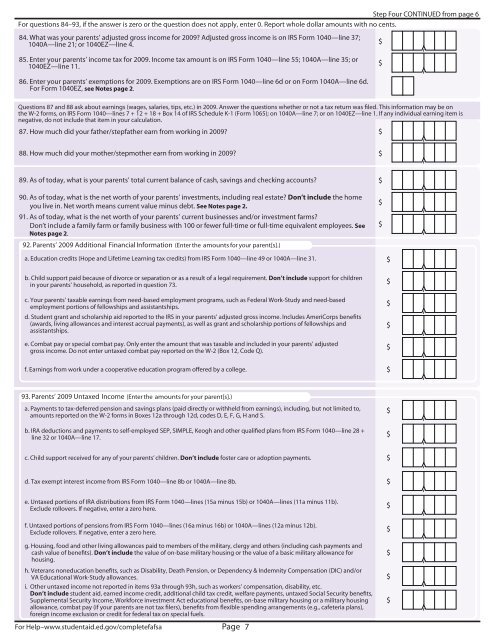

Step Four CONTINUED from page 6For questions 84–93, if the answer is zero or the question does not apply, <strong>en</strong>ter 0. Report whole dollar amounts with no c<strong>en</strong>ts.84. What was your par<strong>en</strong>ts’ adjusted gross income for <strong>2009</strong>? Adjusted gross income is on IRS <strong>Form</strong> <strong>10</strong>40—line 37;<strong>10</strong>40A—line 21; or <strong>10</strong>40EZ—line 4.85. Enter your par<strong>en</strong>ts’ income tax for <strong>2009</strong>. Income tax amount is on IRS <strong>Form</strong> <strong>10</strong>40—line 55; <strong>10</strong>40A—line 35; or<strong>10</strong>40EZ—line <strong>11</strong>.86. Enter your par<strong>en</strong>ts’ exemptions for <strong>2009</strong>. Exemptions are on IRS <strong>Form</strong> <strong>10</strong>40—line 6d or on <strong>Form</strong> <strong>10</strong>40A—line 6d.For <strong>Form</strong> <strong>10</strong>40EZ, see Notes page 2.$$,,Questions 87 and 88 ask about earnings (wages, salaries, tips, etc.) in <strong>2009</strong>. Answer the questions whether or not a tax return was filed. This information may be onthe W-2 forms, on IRS <strong>Form</strong> <strong>10</strong>40—lines 7 + <strong>12</strong> + 18 + Box 14 of IRS Schedule K-1 (<strong>Form</strong> <strong>10</strong>65); on <strong>10</strong>40A—line 7; or on <strong>10</strong>40EZ—line 1. If any individual earning item isnegative, do not include that item in your calculation.87. How much did your father/stepfather earn from working in <strong>2009</strong>?88. How much did your mother/stepmother earn from working in <strong>2009</strong>?89. As of today, what is your par<strong>en</strong>ts’ total curr<strong>en</strong>t balance of cash, savings and checking accounts?90. As of today, what is the net worth of your par<strong>en</strong>ts’ investm<strong>en</strong>ts, including real estate? Don’t include the homeyou live in. Net worth means curr<strong>en</strong>t value minus debt. See Notes page 2.91. As of today, what is the net worth of your par<strong>en</strong>ts’ curr<strong>en</strong>t businesses and/or investm<strong>en</strong>t farms?Don’t include a family farm or family business with <strong>10</strong>0 or fewer full-time or full-time equival<strong>en</strong>t employees. SeeNotes page 2.92. Par<strong>en</strong>ts’ <strong>2009</strong> Additional Financial Information (Enter the amounts for your par<strong>en</strong>t[s].)$$$$$,,,,,a. Education credits (Hope and Lifetime Learning tax credits) from IRS <strong>Form</strong> <strong>10</strong>40—line 49 or <strong>10</strong>40A—line 31.b. Child support paid because of divorce or separation or as a result of a legal requirem<strong>en</strong>t. Don’t include support for childr<strong>en</strong>in your par<strong>en</strong>ts’ household, as reported in question 73.c. Your par<strong>en</strong>ts’ taxable earnings from need-based employm<strong>en</strong>t programs, such as Federal Work-Study and need-basedemploym<strong>en</strong>t portions of fellowships and assistantships.d. Stud<strong>en</strong>t grant and scholarship aid reported to the IRS in your par<strong>en</strong>ts’ adjusted gross income. Includes AmeriCorps b<strong>en</strong>efits(awards, living allowances and interest accrual paym<strong>en</strong>ts), as well as grant and scholarship portions of fellowships andassistantships.e. Combat pay or special combat pay. Only <strong>en</strong>ter the amount that was taxable and included in your par<strong>en</strong>ts’ adjustedgross income. Do not <strong>en</strong>ter untaxed combat pay reported on the W-2 (Box <strong>12</strong>, Code Q).$$$$$,,,,,f. Earnings from work under a cooperative education program offered by a college. $,93. Par<strong>en</strong>ts’ <strong>2009</strong> Untaxed Income (Enter the amounts for your par<strong>en</strong>t[s].)a. Paym<strong>en</strong>ts to tax-deferred p<strong>en</strong>sion and savings plans (paid directly or withheld from earnings), including, but not limited to,amounts reported on the W-2 forms in Boxes <strong>12</strong>a through <strong>12</strong>d, codes D, E, F, G, H and S.b. IRA deductions and paym<strong>en</strong>ts to self-employed SEP, SIMPLE, Keogh and other qualified plans from IRS <strong>Form</strong> <strong>10</strong>40—line 28 +line 32 or <strong>10</strong>40A—line 17.c. Child support received for any of your par<strong>en</strong>ts’ childr<strong>en</strong>. Don’t include foster care or adoption paym<strong>en</strong>ts.d. Tax exempt interest income from IRS <strong>Form</strong> <strong>10</strong>40—line 8b or <strong>10</strong>40A—line 8b.e. Untaxed portions of IRA distributions from IRS <strong>Form</strong> <strong>10</strong>40—lines (15a minus 15b) or <strong>10</strong>40A—lines (<strong>11</strong>a minus <strong>11</strong>b).Exclude rollovers. If negative, <strong>en</strong>ter a zero here.f. Untaxed portions of p<strong>en</strong>sions from IRS <strong>Form</strong> <strong>10</strong>40—lines (16a minus 16b) or <strong>10</strong>40A—lines (<strong>12</strong>a minus <strong>12</strong>b).Exclude rollovers. If negative, <strong>en</strong>ter a zero here.g. Housing, food and other living allowances paid to members of the military, clergy and others (including cash paym<strong>en</strong>ts andcash value of b<strong>en</strong>efits). Don’t include the value of on-base military housing or the value of a basic military allowance forhousing.h. Veterans noneducation b<strong>en</strong>efits, such as Disability, Death P<strong>en</strong>sion, or Dep<strong>en</strong>d<strong>en</strong>cy & Indemnity Comp<strong>en</strong>sation (DIC) and/orVA Educational Work-Study allowances.i. Other untaxed income not reported in items 93a through 93h, such as workers’ comp<strong>en</strong>sation, disability, etc.Don’t include stud<strong>en</strong>t aid, earned income credit, additional child tax credit, welfare paym<strong>en</strong>ts, untaxed Social Security b<strong>en</strong>efits,Supplem<strong>en</strong>tal Security Income, Workforce investm<strong>en</strong>t Act educational b<strong>en</strong>efits, on-base military housing or a military housingallowance, combat pay (if your par<strong>en</strong>ts are not tax filers), b<strong>en</strong>efits from flexible sp<strong>en</strong>ding arrangem<strong>en</strong>ts (e.g., cafeteria plans),foreign income exclusion or credit for federal tax on special fuels.For Help–www.stud<strong>en</strong>taid.ed.gov/completefafsa Page 7$$$$$$$$$,,,,,,,,,