Annual Report 1011 - The Stena Metall Group

Annual Report 1011 - The Stena Metall Group

Annual Report 1011 - The Stena Metall Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

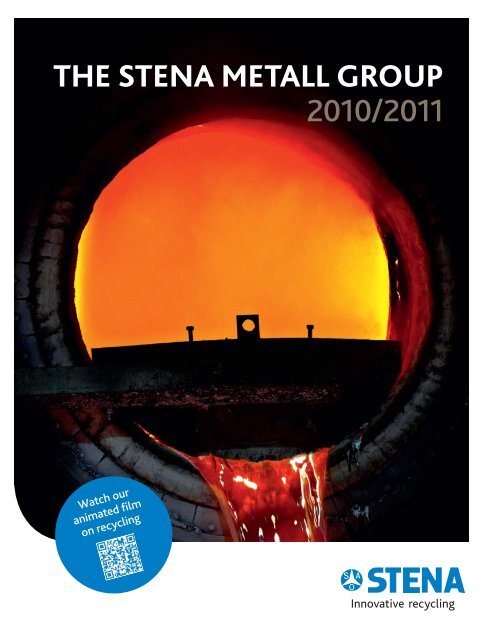

THE STENA METALL GROUP2010/2011Watch ouranimated filmon recycling

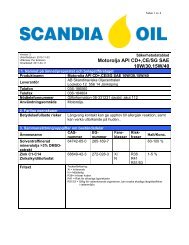

You can alsowatch ouranimated filmon recyclingat www.stenametall.se/en/recyclingfilmCONTENTSHighlights of 2010/2011inside flapWe are the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> 1Chief Executive Officer’s comment 2Market and prices 4Our operations 6BUSINESS AREASRecycling 12Trading & Sales 16Electronics Recycling 18Aluminium 20Steel 22Oil 24Economics & Finance 26<strong>The</strong> <strong>Stena</strong> Sphere 28FINANCIAL REVIEWDirectors’ report 32<strong>Group</strong>Income statement 35Statement of changes in equity 35Balance sheet 36Statement of cash flows 38Accounting and valuation principles 39Notes to the financial statements 42Parent CompanyIncome statement 53Statement of changes in equity 53Balance sheet 54Statement of cash flows 56Notes to the financial statements 57Holdings 60Proposed distribution of earnings 62Auditors’ report 63Board of Directors 64Addresses 64COVER:One of <strong>Stena</strong> Aluminium’s smelting furnacesin Älmhult, with a capacity of 30 tons.

OPERATING OVERVIEWRECYCLING<strong>The</strong> <strong>Group</strong> provides recycling services in fivegeographical markets under the <strong>Stena</strong> Recyclingname. Waste from throughout society is processedat one of around 200 facilities.www.stenarecycling.comTRADING & SALES<strong>The</strong> companies <strong>Stena</strong> Metal Internationaland <strong>Stena</strong> Metal Inc. trade in scrap, pig iron,hot briquetted iron and finished steel products.<strong>Stena</strong> Metal Inc. has operations in the U.S.,Brazil, Thailand and China.www.stenametalinternational.comwww.stenametall.comHighlights of 2010/2011Record profits for <strong>Stena</strong> Aluminium and<strong>Stena</strong> Recycling in Norway and Poland.<strong>The</strong> acquisition of an Italian electronicsrecycler makes us a market leader in Italy.<strong>Stena</strong> Solutions, a total waste managementconcept, was introduced to customers inSweden and is scheduled for launch in all ofthe <strong>Group</strong>’s recycling markets.A dedicated safety program with the vision of“Making <strong>Stena</strong> accident free” continued withsuccess in most areas.A new recycling branch concept was openedoutside Stockholm and achieved great success.An extensive trainee program was launchedto guarantee future access to competentemployees.ELECTRONICS RECYCLING<strong>The</strong> collection, processing and recycling of electricaland electronic waste is handled by the WEEE businessarea at 28 facilities in ten countries.www.stenatechnoworld.comALUMINIUM<strong>Stena</strong> Aluminium produces customized aluminiumalloys from recycled raw material in solid and liquidform for foundries and the steel industry.www.stenaaluminium.comSTEEL<strong>Stena</strong> Stål, with facilities in Sweden and Norway,offers a wide range of steel products as well assteel pretreatment and flame cutting/machiningof heavy plate.www.stenastal.comOIL<strong>The</strong> largest Nordic supplier of bunker oil, <strong>Stena</strong> Oilhas operations in the Nordic region and outsideWest Africa. <strong>Stena</strong> Oil also trades oil internationally.www.stenaoil.comFINANCE<strong>The</strong> Finance business area handles financial activitiesand serves as the <strong>Group</strong>’s internal bank.www.stenametall.comFive-year summarySEK million 2010/2011 2009/2010 2008/2009 2007/2008 2006/2007Visit our websites to find news, innovative solutionsand detailed information on our products and services.You’ll also find contact information for our local offices.Net sales 28,977 23,160 20,465 31,781 25,404EBITDA 1,337 1,247 358 1,648 1,465Operating income 722 603 –338 948 894Shareholders’ equity 4,407 4,115 3,716 4,202 3,859Equity/assets ratio, % 33.0 38.0 32.5 28.0 28.5Average numberof employees 3,486 3,184 3,453 3,638 3,409

WE ARE THE STENA METALL GROUP<strong>The</strong> <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> benefits customers and createsnew resources by recycling society’s wastes. Our recyclingoffering consists of products and services for every typeof business. In addition, we process and trade steel andaluminium and trade oil and metals in the internationalmarket. <strong>The</strong> <strong>Group</strong> also includes finance operations.We have a strong culture based on decentralized businessacumen with the goal of generating value for our customers,ourselves and society as a whole. Our vision is to set anexample and be the most innovative company in all ourbusinesses.We are part of the <strong>Stena</strong> Sphere, which consists of thethree parent companies <strong>Stena</strong> AB (publ), <strong>Stena</strong> Sessan ABand <strong>Stena</strong> <strong>Metall</strong> AB.<strong>The</strong> photo was taken at <strong>Stena</strong> Recycling’sfacility in Malmö. Leyla Agalar, assistantproduction manager in the hazardous wastedepartment. Marek Lewandowski, ferrousand non-ferrous metals department.1

CHIEF EXECUTIVEOFFICER’S COMMENTSeeAnders Janssoncomment onthe past year*2010/2011 brought with it an increase in both sales volumes and market shares. This was despitetight competition and widespread economic uncertainty. <strong>The</strong> <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s profit wasSEK 525 million before tax, an increase of 16 percent compared with the previous year.<strong>The</strong> conditions faced by our businesses fluctuatedin 2010/2011. Fall 2010 started out on a positivenote, but was followed by a harsh winter thatimpacted most of our businesses. Conditionsbrightened in the spring, with improvementsacross the board. Our hopes were dashed,however, when uncertainty increased in thefinancial market. This would come to definethe latter part of our financial year.Our philosophy of delegated business acumenwith independent, service-oriented branches inmore than 250 locations close to our customersserves as the key to the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’sdevelopment. It has been impressive to see theenergy and commitment of our employees inthe last year. We continue to invest in our businessesand in the development of our employees.Because of this, I feel confident in our ability toproduce economic benefits for our customersand ourselves even in tough times.Business developmentIn our recycling operations, we have seen goodvolume growth and stronger market shares.Our offering has been expanded to include newproducts and services. Today we provide bothindustry-specific and customized solutions forevery sector of society under the name <strong>Stena</strong>Solutions.In Sweden, an expanded offering, combinedwith an increased focus on efficiencies, has contributedto our continued positive development.Focused business acumen and customizedwaste management solutions produced significantgains in the Polish recycling operationsduring the year. We now have a solid foundationfor continued growth.Our Norwegian recycling business had its bestyear ever. At the start of the current financialyear we acquired Norsk <strong>Metall</strong>retur, Norway'sleading recycler of ferrous and non-ferrousmetals, to complement our current operationsand give us an exciting base for further growthin the Norwegian market.Our Danish recycling operations continue todevelop well and gain market share. As part ofthe effort to strengthen our positions in theDanish recycling market and complement ourproduction structure, we acquired a shreddingfacility in Grenå, on Jylland, early in the currentfinancial year.Our electronics recycling operations, WEEE,had a tough year in the face of stiff competition,fluctuating volumes and price volatility in manymarkets. In spite of this, we improved our positionsin a number of areas and are especiallypleased with developments in the Nordic regionand Italy.<strong>Stena</strong> Stål has performed well and improvedits profitability in a changeable market in recentyears. We have expanded our range of productsand services, including through the acquisitionof AHAB Steel, which operates in the coil metalsegment.By utilizing strong business acumen, <strong>Stena</strong>Aluminium improved its earnings and thequality of its offering. Close cooperations withcustomers, where <strong>Stena</strong> Aluminium analyzestheir technical support and training needs, werea continued success.In an extremely volatile and uncertain financialmarket, <strong>Stena</strong> <strong>Metall</strong> Finans generated anacceptable result given the circumstances. At thesame time we were able to utilize our knowledgeof the Nordic bond market to secure additionalfunding and extend the maturity profile of theloan portfolio.<strong>Stena</strong> Oil continued to report good volumesand strengthened its market shares, especiallyin its new market outside West Africa.<strong>Stena</strong> Metal Inc. generally had a good yearand reported a satisfactory profit. It also beganto broaden its offering to include new products.Innovation leads to profitabilityOur position is that we are never better thanwhat people think of us. Three words – simplicity,reliability and development – sum up the aim ofour work at every level. Working with <strong>Stena</strong>should be easy for customers. <strong>The</strong>y shouldexpect quick decisions and results.We also want to communicate to customersthat our long experience and wide range ofexpertise make us a safe choice and a supplierthat keeps its promises. Our employees areencouraged to think along new lines and be2* You can also watch the film at www.stenametall.se/en/executivesummary

Staffan Persson, president of <strong>Stena</strong> Aluminium, in conversation with CEOAnders Jansson at the warehouse for aluminium ingots in Älmhult. <strong>Stena</strong>Aluminium had a successful financial year 2010/2011, when it improvedboth its earnings and customer offering. In addition, it was grantedapproval to raise production from 50,000 to 90,000 tons a year.innovative, regardless of their position. This ishow we believe solutions are created, preferablyin cooperation with the customer.<strong>The</strong>se core values are reflected in our localbusiness acumen and generate profitable business.During the financial year there were manygratifying examples of how our innovativecapabilities led to profitable new businessesthat also benefited customers. By carefullyanalyzing their needs, we can offer the servicethey need and do it profitably.In Västberga, outside Stockholm, we launcheda unique concept for a recycling branch designedspecifically for building contractors, where theycan quickly and easily dispose of their material,with the help of new technical solutions. More ofthese branches are already in the works.Our detailed knowledge of various types ofwaste is often a competitive advantage. In Denmark,for example, our chemists strongly contributedto several new projects during the year.Being close to customers is critical to <strong>Stena</strong>Stål and often leads to projects beyond theordinary. Reliable deliveries were decisive whenone of its customers needed help with an orderfor 150 tons of specially designed, ready-toassemblebeams for overhead cranes.!SAFETYContinuous focus on safetyWe have a vision of “Making <strong>Stena</strong> accident free”and an ambitious goal to greatly reduce thenumber of accidents within the <strong>Group</strong>. Duringthe financial year we further accelerated ourefforts to implement new tools and policies inorder to create safer workplaces. In manylocations we see clear signs of improvement,although this is a long-term project and muchremains to be done.Solid foundation for further growthAt the time of writing the world is strugglingto overcome widespread economic pessimism.However, thanks to the combination of stronglong-term owners, decentralized business acumenand a stable financial platform, the <strong>Group</strong> is wellprepared for the possibility of a tougher future.In 2008 a major safety program waslaunched by the <strong>Group</strong> with the vision of“Making <strong>Stena</strong> accident free.” <strong>The</strong> goal isto reduce the number of accidents by 80percent by 2012.Per-Olof Winnansson is the <strong>Group</strong>'ssafety coordinator.“In many areas we have come quite farand can already see improvements,” hesaid. “<strong>The</strong> financial year 2010/2011 sawa 33 percent reduction in accidents comparedwith the previous year. But thisisn’t a project that simply ends. It requireslong-term thinking and patience. We haveto bear down if things go poorly in a certainmonth and not get too carried away aftera short period of improvements.“Long-term success will be achievedwhen we manage to keep managers andemployees focused on the issue. All accidentscan be avoided, and it is the actionsof the individual employee that we haveto try to influence.”Anders Jansson, Göteborg, October 20113

MARKET AND PRICES<strong>The</strong> prices of the majority of the <strong>Group</strong>’s most important raw materials rose at the beginning of the financial year.This changed during the spring and early summer, when prices fell substantially. One reason was the increasing globaluncertainty. Major economies saw an improvement after the financial crisis in 2008, but were now showing signs ofweakness. Other reasons included the growing concerns about sovereign debt and budget deficits in many countries aswell as the increasing risks associated with the banking system’s financing. <strong>The</strong>re is tremendous uncertainty aboutgrowth prospects in the years ahead and at the start of the financial year 2011/2012.NON-FERROUS METALSSTEELMetal prices on the London Metal Exchange (LME)were volatile during the last financial year, but as awhole settled at historically high levels. Copper reachedan all-time high in February at over US$10,000 per ton.Despite growing financial concerns, prices on the LMEwere approximately 15 percent higher (in USD) at theend of the financial year than at the beginning, with theexceptions of nickel and zinc, which fell to the levelswhere they began.Metals on the LME and other raw materials areattracting great interest from financial players, andvolatility naturally follows from financial turbulence.Unrest in Northern Africa and the Middle East, thetsunami in Japan and the current euro zone crisis haveall had an impact.Strong growth in China and other emerging countriesis creating huge demand for metals, however, andprices and demand have both stayed at high levels. Forexample, China’s share of global copper consumptionhas risen from 22 to 38 percent between 2006 and2010. <strong>The</strong> corresponding figure for aluminium is from25 to 42 percent and for nickel from 20 to 40 percent.During the year LME non-ferrous inventories increasedwith the exception of nickel. Aluminium inventoriesremain very high (over 4.5 million tons), but areowned mainly by banks and financial players, whichare more concerned about global growth than the balancebetween supply and demand.Scrap: <strong>The</strong> market for non-ferrous scrap was stableduring the financial year, with continued demand fromChina, India, South Korea and other emerging markets.Demand in Europe was also relatively high. Demandfor aluminium scrap was stable, while the record-highcopper prices produced a large supply of copper scrapin Europe, at times leading to weaker demand. NorthernEurope’s strong industrial sector has been a stablesales channel at the same time export volumes to Asiaremained strong. <strong>The</strong> turbulence following the Westerndebt crisis has not yet had a significant impact ondemand, though obviously there are concerns goingforward.Nickel (USD/ton), LME50,00040,00030,00020,00010,000008/09 09/10 10/11Prices fell steadily from fall 2010 until the end of theyear and at the start of 2011 were about 10 percentbelow September’s prices.In January prices began to rise, which was earlierthan expected given normal seasonal patterns. <strong>The</strong>reasons were pent-up demand to fill unusually lowinventories and a larger degree of speculation whenprices were thought to have hit bottom. During thefirst quarter many steel mills were quickly booked upand prices rose. Long scrap-based products were firstin the cycle, but flat ore-based steel followed slightlylater.By the middle of the second quarter long productsretreated and in the third quarter the same was felt byflat products. At the end of the financial year pricelevels were back where they started the year.Steel mills are under pressure from high raw materialcosts and face poor profitability with low margins.<strong>The</strong>re were signs during the summer that capacity wasbeing cut in Europe when a number of blast furnaceswere removed from production.Copper (USD/ton), LME10,0008,0006,0004,0002,000008/09 09/10 10/11Aluminium (USD/ton), LME4,0003,0002,0001,000008/09 09/10 10/11Commercial steel (SEK/ton), import prices10,0008,0006,0004,0002,000008/09 09/10 10/114

RECOVERED PAPERFrom a historically high level at the start of the financialyear, prices continued to rise for the most importantrecovered paper grades, reaching record levelsduring the spring. Strong demand eventually led toconsistent price levels across markets and customers,with everyone facing the same conditions.<strong>The</strong> first signs that the paper market, and recoveredpaper, were beginning to weaken came in the summer.Machinery was periodically shut down due to slackeningdemand. At the end of the financial year priceswere still very high, however, and by spreading outsales an inventory build-up was averted.All indications are that prices will continue to fall,although the importance of recovered paper as a rawOIL<strong>The</strong> price of crude oil (Nymex) rose during the yearfrom USD 72 to USD 89 per barrel. Prices were essentiallyhigher for most of the year, but with a significantdownward correction at the end of the financial year.Among the key factors pushing prices higher wasthe decision by the International Energy Agency (IEA)in fall 2010 to adjust its demand forecast higher.Demand rose substantially, especially in China butalso in other countries such as Russia and Brazil. <strong>The</strong>North African revolutions that began in Tunisia andeventually reached Libya led to lower supply and apolitical risk that sent oil prices climbing higher. <strong>The</strong>fact that the production lost in Libya represented onlyabout 1.5 percent of global production shows how thinthe margins in the oil market are.FERROUS SCRAPIt was an eventful year in the ferrous scrap market.<strong>The</strong> world’s largest single scrap market, Turkey, wasaffected by the turbulence in North Africa and theMiddle East. Scrap trading in general was impacted bythe nuclear disaster following Japan's huge earthquake.It was feared that Japanese scrap had been contaminatedby radiation and trading was temporarilystopped. In late 2010/11 prices fluctuated greatlywhen the harsh winter first led to scrap shortages andhigher prices, then to a surplus and rapid price declinewhen the snow melted.During the first eight months of the year Europewas the train and Germany its locomotive. <strong>The</strong>German industrial expansion slowed slightly duringthe latter part of the financial year, however, resultingin a slight surplus of raw material. This could lead tocontinued price pressure in Europe.<strong>The</strong> Asian market remains healthy after a relativelystable year. Iron ore has noted slight adjustments. Onthe other hand, last year’s flooding in Australia led tohigh coke prices for blast furnace operators.Corrugated board (EUR/ton), export price20015010050008/09 09/10 10/11material for the world’s emerging countries willprobably mean only a modest decline.Oil (USD/barrel), Nymex13011090705030During spring and summer 2011 weak macroeconomicdata from the U.S. and an increased focuson the Western debt crisis adversely affected oilprices. Nonetheless, oil finished the financial yearup about 24 percent.Ferrous scrap (USD/ton), fob Rotterdam800600400200008/09 09/10 10/1108/09 09/10 10/11<strong>The</strong> U.S. steel industry’s utilization rate was around75 percent with stable pricing throughout the year.Domestic demand for steel products remained underpressure, but because of the relatively high productionin the U.S. and Europe scrap prices were historicallyhigh.PIG IRON<strong>The</strong> price of pig iron rose during the first half of thefinancial year, but then began to level off. <strong>The</strong> pricerise was driven by strong demand from steel mills,especially for flat products, in part due to generaloptimism about the economy. Toward the end ofthe financial year prices began to fall due to growingworries about the economic outlook in Europe andthe U.S. This was partly offset by continued demandfrom emerging countries.Pig iron (USD/ton), cfr New Orleans1,000750500250008/09 09/10 10/11FREIGHTFreight prices were lower than the previous year.Rates hit their low point in February 2011, dropping toessentially the same level as during the financial crisisin late 2008. Daily rates have continued to fluctuatefrom a historically low level. In general, it appears thatprices will remain under pressure due to the largenumber of new construction programs that are addingtonnage to an already sated market.Freight Baltic Dry Index8,0006,0004,0002,000008/09 09/10 10/11All graphs on this page refer to price trends for the periodSeptember 1, 2008 through September 26, 2011. All indicatemonthly figures.Sources: Reuters, MBR and <strong>Stena</strong> <strong>Metall</strong>5

OUR OPERATIONSA BUSINESS THAT WORKSFOR EVERYONEAs far back as 1939 our founder, Sten A Olsson, saw an opportunity in recycling. Since then our <strong>Group</strong> has grown organicallyand through acquisitions and today has operations in around 250 locations in 14 countries. <strong>The</strong> recycling businessis our largest, but we are also a trading company with operations that vary in specialty and approach.One thing all our businesses have in common is that they develop in pace with the changes in the society around us.To us, the concept of sustainable business means benefiting customers as well as the environment, while also improvingprofitability and safety. Truly benefiting society helps us all.Recycling and processingOUR RECYCLING BUSINESSSooner or later most things end up as scrap andare thrown out. Regardless of whether wastearises from consumption or production, we arethere to take care of the raw materials. We don’tconsider waste a problem. On the contrary, it is avital resource at a time when we have to conserveraw materials, energy, clean air and clean water.We collect waste from every sector of societyand, in our efforts to properly manage the rawmaterials, try to recycle as much as possible andavoid adding to landfills.6THE WORLDIN WHICH WE OPERATEFor <strong>Stena</strong>’s business to succeed, the environment inwhich we operate also has to be healthy. Customers,local communities and our employees addvitally important value to our business, and withoutthem we are nothing. That’s why we care aboutthem. <strong>The</strong> same applies to the environment aroundus and nature’s finite resources: We cannot affordto work in a way that does not protect these assets.Our goal is to be profitable while benefiting ourstakeholders and the world in which we operate.TURBINE BLADESAND CAMPERSBECOME CEMENTTogether with a German partner, we have developed apatented solution in Denmark to recycle 100 percent ofold wind turbine blades, recreational vehicles and plasticpleasure boats. After the energy has been recovered from50 percent of the turbine blades, what’s left is an ash thathas traditionally posed a challenge, ending up either inlandfills or being incinerated, both of which are costlyand problematic. With our new method, the ash isnow used to produce cement, since its chemicalcomposition is nearly identical tonew cement.You can watch our animated short on recycling atwww.stenametall.se/en/recyclingfilm

STENA FACILITIES<strong>The</strong> waste we collect is recycled at one of around 220facilities. End-of-life products or production waste fromindustry are divided into scrap, paper, plastics, hazardouswaste, electronics and other production waste.We sort and shred the waste into clean raw materialusing innovative, environmentally safe methods. Usuallywe will recover the energy from any waste that cannotbe recycled.INNOVATIVE SOLUTIONSIn parallel with our research, innovative work is conductedat all our facilities. Since our customers face a constantlychanging reality, we have to work closely with themto develop the recycling solutions of tomorrow, largeand small.Systematic innovation is being done within the <strong>Group</strong>,giving us access to new ideas from which we can choosethose with the greatest potential and spread them toour markets and customers.RESEARCH ANDDEVELOPMENTOur constant challenge is to stay a step ahead anddevelop innovative, profitable recycling solutionsas new products and composites reach the market.Today’s research is focused on recycling more ofthe products we consume. Demand for materialis growing around the world, increasing the incentiveto extract more from low-value material.<strong>Stena</strong>’s own recycling research fills a vacuum.We collaborate with universities and organizationsaround the world and sponsor a professorship inrecycling at Chalmers University of Technologyin Göteborg. Our researchers are working continuouslyon a number of projects in areas thatcurrently lack commercially and environmentallysustainable solutions.CAR PARTSREPLACE COALWe have been working for some time to find a solutionfor the small parts left over after cars are dismantled at ourshredding facilities. <strong>The</strong> combination of leather, rubber, textilesand plastics previously couldn’t be recycled and ended up inlandfills. In recent years some parts have been burned as fuel, butthanks to <strong>Stena</strong>’s research, the waste can now be separated so thatplastics and metals are extracted and recycled. Moreover, the fuelfractions are clean enough to replace fossil fuels. This fuel hasbeen used lately by the cement industry instead of coal withgood results. <strong>The</strong> solution has several positive side effects.For one thing, it reduces the need for fossil fuels. Secondly,we are able to recycle material and recover energythat had previously gone to landfill.7

STENA SOLUTIONSOur total waste management solution, <strong>Stena</strong> Solutions, makes wastemanagement easier and more economical for customers. We offercustomized recycling for essentially every sector and industry insociety, ranging from retailers and manufacturers to hair salons.During the financial year 2010/2011 we began introducing <strong>Stena</strong>Solutions in our recycling markets with good results. <strong>The</strong> offeringis divided into five different stages, beginning with waste audits andresource optimization, continuing with training and waste management,and concluding with reporting and monitoring.5. <strong>Report</strong>ing andmonitoring1. Customized total wastemanagement solution2. Resource optimization4. Waste management3. Training andinformationServices are a large and important part of <strong>Stena</strong> Solutions, where we utilize our expertise to help customersdevise the most effective, environmentally safe and profitable recycling solution for their particular waste.Customers and employeesCUSTOMER’S REALITYIt’s when collaborating with customers thatour capabilities are put to the test. Our goal isto offer solutions that increase the value of theirbusinesses. As a customer, they should feel thatwe can find the right level for their particularoperations, regardless of whether they are a majormanufacturer or run a machine shop on the corner.Today we have around 220 recycling facilitiesthroughout Europe. Our familiarity with localconditions, combined with specialized expertisein various types of waste, is the key to finding themost profitable sales channel for each customer’swaste volumes.CABLES ARERETURNED TOCIRCULATIONCable recycling is constantly improving. Recycling cables hasalways been a challenge, since they consist of several differentplastics and metals all wrapped together. For several years <strong>Stena</strong>has recycled them at dedicated cable granulation plants, wherepatented technology is used to better separate the plasticsfrom each other and recycle the material. During the year weachieved a breakthrough when we managed to separateplastics so well that they have exactly the same propertiesas the original plastic raw material. This meansthat cable manufacturers can receive the rawmaterial back from their waste and useit directly in production.8

3,700EMPLOYEES<strong>The</strong> 3,700 employees who work in the <strong>Stena</strong> EMPLOYEES*<strong>Metall</strong> <strong>Group</strong> together are helping to promotea more economical and sustainable society. Ourdecentralized organization offers individuals agreat deal of personal responsibility and is basedon commitment and a passion for the work. Weare geographically diverse, but have a strong setof common values. With three words, Simplicity,Reliability and Development, we have summedup how we want to be seen by everyone whoworks with us. In 2011 we have launched an internaltraining program, <strong>Stena</strong> Story, which will help tomaintain and build support for our strong culturein new markets. We also launched an extensivetrainee program where 27 applicants wereaccepted from our various business areas. Nearlyhalf of them are women.DECENTRALIZEDBUSINESS ACUMENEverything we do in our business reflects a commitmentto decentralized business acumen. Wewant to be our customers’ first choice and webelieve that decisions should be made as closeto them as possible. <strong>The</strong> organization is built onresponsibility and decisiveness, and our employeesmeet their customers’ needs and expectationswith personal commitment and a focus onachieving the goals at hand.SAFETYFor <strong>Stena</strong>, safety equals quality, and our vision isto create a group without a single accident. A safeworkplace makes work enjoyable and gives ouremployees and subcontractors a sense of security.We also know that safety is good for business andtherefore is a critical element in decentralizedbusiness acumen. Our customers also benefit,since a high level of safety means higher productivityand quality.We take a proactive approach to eliminatingand managing risks. All of the <strong>Group</strong>’s employeeshave received training and been made aware oftheir personal responsibility in helping us to reachour common goal: Making <strong>Stena</strong> accident free.CONTINUOUSIMPROVEMENTSTo drive our business forward, we have a <strong>Group</strong>wideperformance management tool we callContinuous Improvements. Each year hundredsof projects are started and completed within the<strong>Group</strong>. Thanks to systematic improvements, we areable to prioritize, measure and follow up all projects,at the same time the tool gives our employeesthe opportunity to be inspired by others’ success.* Refers to number of employees. <strong>The</strong>re was an average of 3,486 employees.9

Production, trading and salesALUMINIUM PRODUCTION<strong>The</strong> <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> includes the production of recycled aluminium. <strong>Stena</strong>Aluminium is the Nordic region’s leading supplier of aluminium to foundriesand the steel industry. Among other things, it is the only company in the regionto offer liquid aluminium. Our mission is to help customers to be successful.In recent years we have focused strongly on offering training and technical supportwith very positive results. By producing aluminium from recycled raw material,we reduce energy consumption by 95 percent compared with manufacturingfrom bauxite.STEEL SALES<strong>Stena</strong> Steel is Sweden’s third-largest full-serviceprovider of steel products, with the goal of stayingclose to customers geographically and inour relationships. We are seeing an increase inrequests from customers for preprocessed andprefabricated material which they can usedirectly in their production. Our machinery andoffering are constantly being expanded, and wehave the right expertise and experience to helpcustomers make the right choice.BUNKER DELIVERIES<strong>Stena</strong> Oil has been bunkering ships in Scandinavianwaters for over 30 years. Since 2010 we also operateoutside the coast of West Africa with four ships.Our concept is based on customer satisfaction,safety, flexibility and performance, which hasproduced many satisfied customers over the years.10

RAW MATERIAL FOR NEW PRODUCTSThanks to our innovative capabilities and curiosity, we have detailed knowledge of how rawmaterials are extracted, processed, used and eventually recycled for reuse in new productsin society.After we have processed the material we collect at our recycling facilities, we sell it as rawmaterial to end-customers around the world, including steel mills, foundries, paper mills,plastics manufacturers and other producers. We provide customers around the world withlarge quantities of processed raw material of consistently high quality which meets specificcustomer specifications. By using recycled materials, we conserve virgin raw materials fromforests, mines and oil reserves.That’s how popular new products are manufactured from society’s wastes, which becomea resource and an opportunity, over and over again.65%REDUCTION IN CO 2EMISSIONSLOGISTICSLarge quantities of waste are transported every day to recycling facilitiesor ports for export. <strong>The</strong> environmental benefits of recycling are considerableeven though it is a transport-intensive industry. For several years we have beentransporting waste by rail using <strong>Stena</strong>’s own scrap trains. We also collect scrapby train from some of our customers. In the last three years using trains insteadof trucks has reduced CO 2emissions by 65 percent!We work continuously to reduce the load on our roads, including throughhigher environmental requirements and modern technology.11

Baled cardboard en route from a <strong>Stena</strong> facility to a paper mill.Together we convert a material that many consider a wasteproduct to an important and valuable industrial raw material.Today recovered paper serves as the raw material for morethan half of the paper products manufactured in the world.Our recovered paper business consists of two parts. One isto create as much value as possible for the customer and ourselvesthrough efficiencies, know-how and the best possiblesales channels. <strong>The</strong> other is the collection services we offer.Nearly all paper products can be manufactured withrecovered paper as a raw material, although packaging board,newsprint and soft paper are especially well suited.12

RECYCLINGSTENA RECYCLING OFFERSBREADTH AND DEPTH<strong>The</strong> environmentalsavings from our recycling areenough to powerall the televisionsin Europefor three months*<strong>Stena</strong> Recycling handles all types of waste for all types of businesses andindustries. With over 200 facilities in five countries, <strong>Stena</strong> Recycling offersits customers a dynamic partner active in every part of the recycling chain.<strong>Stena</strong> Recycling’s customers can be found inamong others, which has given us knowledgemanufacturing, engineering, municipal services,that we can spread to our markets.offices, restaurants, auto scrap yards, small andmedium-sized workshops and printing plants.Safety generated new businessIn short, practically every sector and industryToday we handle every type of material (ferrousin society. We have a complete offering – <strong>Stena</strong>and non-ferrous metals, plastics, paper, hazard-Solutions – with customized waste managementous waste and other waste) in all our recyclingsolutions, where we handle the entire chainmarkets: Sweden, Denmark, Poland, Finlandfrom collections to practical recycling. Withand Norway. (<strong>Stena</strong> also offers electronicsall our products and services under the samerecycling; see page 18.) We have been recyclingumbrella, specifically designed for varioussociety’s wastes for more than 70 years, andindustries, it is easy for the customer to feelcomfortable and find the right solution justfor them.our experience and breadth have provided uswith expertise in every type of waste. In Denmark,for example, our skilled chemists wereiSTENA RECYCLING<strong>Stena</strong> Solutions in every marketIn 2010/2011 we began introducing <strong>Stena</strong>Solutions in all five of our recycling marketswith good results. We already knew that manycustomers want a single partner for all theirrecycling needs. Someone who takes care of alltheir wastes safely for people and the environment.<strong>The</strong>y also want that little somethingextra, like a solution specially tailored to theircritical in helping us to sign several new contractsduring the year. Continuous training forour employees means we can offer customersrecycling solutions that produce the bestreturns and, for the environment, the biggestbenefits.In December 2010 the Finnish mining companyPyhäsalmi Mine Oy signed an agreementwith <strong>Stena</strong> Recycling Oy in Finland for a totalwaste management solution encompassing<strong>Stena</strong> Recycling has recycling operations inSweden, Poland, Denmark, Norway andFinland, with a network of around 200facilities. Through innovative, cost- effectivesolutions, we recycle and process waste fromthroughout society with our total wastemanagement solution, <strong>Stena</strong> Solutions. <strong>The</strong>offering includes related services such asinternal logistics, training, statistical dataand safety advice.Business Area Manager Anders Janssonspecific requirements. That's what they getfrom <strong>Stena</strong> Recycling.over 30 fractions. Together with the customer,<strong>Stena</strong> has managed to raise the recycling rateAssistant Business Area ManagerLorentz RondahlA frequent request from our largest customersis for insourcing, which we see as proof thatthey consider <strong>Stena</strong> a reliable partner and partof their operations. In Sweden we have workedthis way for several years with Volvo and ABB,thanks to dedicated efforts. One of the keys tothese successful results was the specializedrecycling training Pyhäsalmi’s employees wereoffered as part of <strong>Stena</strong>’s solution. <strong>The</strong> twocompanies also had a similar approach to safetyPresidentsSweden Leif GustafssonPoland Fredrik ValentinDenmark Lars PetersenNorway Fredrik Eide AassFinland Risto Airas* <strong>The</strong> example is based on the CO 2emissions that recycling helps to avoid. Recycling by the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>eliminated 9.8 million tons of CO 2emissions in 2010/2011. This corresponds to the environmental impact all730 million Europeans would have by watching television three hours a day for three months.13

RECYCLINGand shared the same goals and vision. This was acontributing factor in the decision to hire <strong>Stena</strong>.As a hazardous waste recycler, <strong>Stena</strong> hasalways focused considerable energy on safety,and we offer a number of courses on how tomanage hazardous waste in the safest way possible.In recent years the <strong>Group</strong>’s internal safetywork has also been intensified through an overarchingprogram and frequent follow-ups. <strong>The</strong>semeasures pave the way for even higher qualityservices, and it is gratifying that our customersappreciate the efforts.A year with several acquisitions<strong>The</strong> financial year 2010/2011 concluded withunrest in the global market, but as a whole waspositive for our recycling operations, with agood flow of incoming volumes and many newcollaborations. In Denmark, we acquired a plantfor other waste, and in Sweden we opened atotally new type of facility close to centralStockholm. <strong>The</strong> concept, which <strong>Stena</strong> is alone! MAKING STENAACCIDENT FREEMaking <strong>Stena</strong> accident free is our visionin order to create safer workplaces. Toachieve it, we abide by a number of principles,the first three of which are:1. All accidents and occupational injuriescan be prevented.2. All accidents and incidents must bereported and followed up so that theydo not happen again.3. As a <strong>Stena</strong> employee or subcontractor,I always set a good example.During the financial year 2010/2011 allemployees received safety training, sincewe know that nearly all accidents can betraced to the human factor. Anotherimportant tool are safety walks, wheremanagement and employees on the floorgo through the facilities in detail to quicklyspot any risks. Thousands of safety walkswere conducted during the year as part ofthis long-term effort.in offering, is similar to a drive-through restaurant,but here the customers can quickly andeasily drop off scrap metal and have theirmoney deposited directly into their accountafter the scrap is weighed and inspected. <strong>The</strong>main target group is building contractors, andthe drop-off facility has become such a successthat others are already in the works. In Sweden,our offering was further expanded through theacquisition of Kretsloppsparken in Kristianstad.Its broad-based operations include recyclingsolutions for businesses, but it also serves as arecycling center for Kristianstad municipality.At the beginning of the financial year <strong>Stena</strong>Recycling AS of Norway had three branches.When 2011/2012 began the number was 16. Inspring 2011 it acquired the recycling companyAanerød AS close to the Swedish border, andon September 1, 2011 the number of employeesincreased by 130 through the acquisition of Norsk<strong>Metall</strong>retur, a company with twelve branchesalong the Norwegian coast.International recycling<strong>The</strong> recycling market is constantly changing.For <strong>Stena</strong>, this has meant collaborating moreacross borders. This is partly because globalcustomers want us to follow them internationally,but also so that we and our customers canbenefit from economies of scale from havingbranches in more than 200 locations. Certainlyit is a question of knowledge transfers, but it isalso about jointly packaging the <strong>Stena</strong> Solutionsconcept. On September 1, 2011 the recyclingcompanies in Denmark were merged to form<strong>Stena</strong> Recycling A/S. As a result, we have aunified brand and customers need only onepartner in all five markets. <strong>The</strong> cross-bordercollaboration also lets us utilize expertise fromneighboring countries. This was the case with aNorwegian kitchen cabinet maker, which sendsthe paint waste from its plant to Göteborgfor recycling. <strong>The</strong>se international recyclings olutions make us extremely competitive.Core business generates benefitsOur core business generates enormous environmentalbenefits, although that doesn’t stop usfrom working in many areas to further reduceour environmental impact. Recycling is a transport-intensiveindustry and we continuously tryto improve our logistics solutions to avoid emissionsand cut costs. Developments in this areaare happening rapidly, thanks in large part tomodern technology.Offering our customers sensible recyclingsolutions and compensating them for materialthat can then be returned to circulation is thebest environmental benefit we can think of. Ata time when most companies are trying toreduce their environmental impact, it is gratifyingto be able to provide a puzzle piece asimportant as recycling. One of our most popularservices is our customer portal, where customerscan access data on their recycled wastefor reporting and communication purposes.<strong>The</strong> Norwegian chemical company CytecNorway KS explained that it had worked forseveral years to reduce its waste volumes andmanaged to cut them by no less than 50 percent.But after switching to <strong>Stena</strong>, it was able tofurther reduce its wastes – at a lower cost!It is also gratifying that a number of companies,including Husqvarna, are now taking a stepfurther and seeking <strong>Stena</strong>’s knowledge andexperience when they design their products.A team of experts from <strong>Stena</strong> showed Husqvarnathe obstacles and opportunities associated withdismantling and shredding its products in orderto help it design with recycling in mind.14

!FOCUS ON INNOVATIONS<strong>The</strong> Finnish company Hartwall, one ofthe largest beverage makers in the Nordicregion, is constantly focused on innovationand quality improvements, especiallyfrom an environmental standpoint.<strong>The</strong> company, which is owned byHeineken, produces beverages for brandssuch as Lapin Kulta and Foster’s as well asan array of nonalcoholic alternatives.Since 2011 <strong>Stena</strong> Recycling has servedas its partner responsible for wastemanagement at a state-of-the-artfacility in Lahti.Hartwall’s rigorous environmentalsafety requirements are reflected in thegoals it sets for suppliers. <strong>Stena</strong>’s rolewas to raise the already high recyclingrates for Hartwall’s waste products,a major challenge it met in partnershipwith the customer and which resulted inspecially designed instructions, machineryand receptacles. <strong>The</strong> recycling rate is nowover 90 percent.Fractions from Hartwall include PETbottles and other plastics, glass, paper,wood, metals, hazardous waste and afraction limited to breweries: organicmalt dust.One of Hartwall’s waste objectives isto convert all byproducts containingsugar or ethanol into energy in the formof bioethanol. With the help of <strong>Stena</strong>’sequipment, liquid is separated from cansand bottles and converted into energybefore leaving the brewery.15

TRADING & SALESRecycled materials and scrap are becoming an increasingly importantglobal resource. <strong>The</strong> <strong>Group</strong> has two companies that sell them: <strong>Stena</strong> MetalInternational AB, which sells the <strong>Group</strong>’s processed scrap to end-customers,and <strong>Stena</strong> Metal Inc., which trades scrap, pig iron and raw materials on theinternational market.16Ulf Håkansson, plant manager at the steel mill Höganäs Sweden AB, discussing the quality of thinplate with Stefan Roos, Non-Ferrous Product Manager, Sweden at <strong>Stena</strong> Metal International AB.<strong>The</strong> scrap at the Halmstad mill comes largely from the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s home markets and isprocessed into iron powder for use in car parts, among other things. Quality assurance is rigorousand the cooperation between <strong>Stena</strong> and Höganäs dates back more than 30 years.

LOCAL COLLECTIONS AND GLOBAL SALES<strong>Stena</strong> Metal International AB is the sales companyresponsible for the ferrous and non-ferrousscrap collected by the <strong>Group</strong>. <strong>The</strong> company wasformed at the end of 2009, and customersquickly noticed that we lived up to our promiseto be a reliable partner capable of selling tosteel and metal mills around the world. <strong>Stena</strong>Metal International AB coordinates shipmentsof material from our home markets, so that wecan reach customers we couldn't sell to before.Thanks to relatively low costs for containerfreight, we have a market essentially spanningthe world. <strong>The</strong> domestic markets in our recyclingcountries – Sweden, Poland, Finland, Denmarkand Norway – are important. Other key salesmarkets for ferrous and non-ferrous scrapinclude Germany, Turkey, Spain, India, Chinaand the U.S.Focus on relationshipsTo further support the important Chinese market,we opened a representative office during thefinancial year 2010/2011 in Hong Kong, wherewe can serve existing customers and establishnew contacts.During the year we also established a separatesales support department at our head office inGöteborg to free up time for our sales representativesto devote to their most important task– meeting customers.Getting to know customers is essential tocreating the long-term relationships we want.We are good at satisfying each customer's specificneeds, and our aim is that as a customer of<strong>Stena</strong> Metal International AB you will receivethe grade of scrap that works optimally for yourspecific manufacturing process.iSTENA METALINTERNATIONAL AB<strong>Stena</strong> Metal International AB is the <strong>Group</strong>’ssales company for the ferrous, non-ferrousand stainless scrap volumes collected in<strong>Stena</strong> Recycling’s markets. Its main office islocated in Göteborg with a representativeoffice in Hong Kong. Customers include steeland metal mills around the world.President Thomas AnderssonRELIABLE PARTNER<strong>Stena</strong> Metal Inc.’s strong long-term relationshipswith customers have proven critical to itsexactly when they want it, at a competitiveprice. For the producer, it guarantees they caniSTENA METAL INC.success, especially in recent years. With over 30years of experience, it is a seasoned risk assessorand can maximize the market for its customers.From its headquarters in Stamford, Connect-sell their inventory and get paid quickly.<strong>The</strong> financial year 2010/2011 ended with adownbeat market, but as a whole was a goodyear. While demand from certain markets isweak, others have slowly increased to levels not<strong>Stena</strong> Metal Inc. trades internationallyin scrap, pig iron, hot briquetted iron(HBI) and finished steel products. It doesbusiness with producers and end-usersin every part of the world and has officesin the U.S., Brazil, Thailand and China.icut, in the U.S., <strong>Stena</strong> Metal Inc. helps rawmaterial producers and customers around theseen since before the global recession in 2008.In addition, we have broadened our productPresident Flemming Jensenworld find each other. For the end-customer, itrange with new ferrous products.guarantees they will receive the right material17

ELECTRONICS RECYCLINGON THE CUTTING EDGE IN WEEEAs Europe’s leading electronics recycler, we continue to develop unique customersolutions. We also continue to make progress in our new market, Italy.At the end of the financial year <strong>Stena</strong> was collectingelectronic scrap in 18 European countriesand had its own plants in ten of them.<strong>Stena</strong> collects, processes and recycles electronicscrap from households, companies andproducers. All operations are governed by theWEEE directive, which gives manufacturers andimporters re-sponsibility for recycling their productsproperly.Recycling electronic scrap is a relatively newindustry, but it is the fastest growing type ofwaste in the EU. As we consume more andproduct lifecycles become shorter, more trashends up in landfills. Each year Europeans throwiWEEEWASTE OF ELECTRICAL ANDELECTRONIC EQUIPMENT<strong>Stena</strong> is Europe’s leading electronics recycler,with 28 facilities in ten countries: Sweden,Norway, Denmark, Poland, Finland, Germany,Austria, Italy, Romania and the CzechRepublic. We also collect material fromanother eight countries.<strong>Stena</strong> collects, processes and recyclesWEEE from households, businesses andmanufacturers. We also develop and sell anumber of products from recycled material.Business Area Manager Phär Oscárout over nine million tons of used televisions,computers, refrigerators, etc. Official figuresshow that only 33 percent of the end-of-lifeelectronics is collected, which means that ahuge amount of untapped resources is available.<strong>The</strong> relative maturity of the various countriesdiffers significantly, however. From 17 kg ofelectronic scrap collected annually per personin Sweden and Norway to only around 2.5 kg inPoland, for example.Market leader in Italy<strong>Stena</strong> continued to grow in Italy in 2010/2011,both organically and through acquisitions. Afteronly three years, <strong>Stena</strong> is the market leader,with five plants from Milan in the west to Venicein the east and Verona at the center.We have signed extended contracts with allof the country’s collective recycling schemes,which represent the largest volumes.<strong>The</strong> European WEEE market is constantlychanging. We are seeing it consolidate andmargins shrink. At this point electronics recyclingmainly involves finding new ways to handlelarge volumes efficiently and safely for the environmentin accordance with current EU legislation.In recent years <strong>Stena</strong> has passed severalmilestones in electronics recycling. We haveunique solutions to recycle CRT televisions, LCDflat screens and computer monitors. <strong>The</strong> sameapplies to a technology that makes it possibleto separate brominated from non-brominatedplastics in computer scrap.Our innovations also make it possible tomeet future EU requirements, which benefitscustomers in all our markets.<strong>Stena</strong> manufactures a growing number ofcustomized products from recycled material.One example is a blasting abrasive manufacturedfrom old picture tubes.Reliable processes<strong>The</strong> goal of our continuous development workis to make it profitable for ourselves and ourcustomers to recycle. Our solutions also meanthat more material can be returned to circulation.Our 28 facilities around Europe receive electronicscrap to separate and process into rawmaterial that is so clean it can be used directlyin the manufacture of new products.During the year we significantly raised productivityat many of our facilities. This wasdone partly through major strides and extensivechanges as well as by continuously finetuningour processes to make them even moreefficient.But our processes not only have to be efficientbut safe for employees and the environment.We increased our market shares during thefinancial year through both new customers andcontract extensions. In Sweden, we extendedour agreement with Elkretsen, the businesssector’s electronic waste collector, making usSweden’s leading electronics recycler, withslightly over one third of the country’s volumesfrom both households and businesses.18

Dismantler Serhat Mehmedikoglu works at <strong>Stena</strong>Technoworld GmbH in Stockerau, Austria. <strong>The</strong> plant,which has been in operation since February 2011,specializes in recycling televisions, computer monitorsand small domestic appliances (SDA).19

Here finished aluminium alloy is poured from afurnace heated to a temperature between 750and 850 degrees. Now it is ready for delivery tothe customer in liquid form or cast as ingots.20

ALUMINIUMIN PARTNERSHIPWITH CUSTOMERSToday we produce50,000 tons of aluminiuma year, equivalent to3.5 billionsoda cans<strong>Stena</strong> Aluminium’s mission is to help its customers become successful. In recentyears it has therefore focused strongly on offering training and technical supportwith very good results. At the end of the financial year the company was grantedenvironmental approval to expand production, which will provide additionalresources to meet future customer needs.<strong>The</strong> smelting plant in Älmhult produces recycledaluminium for foundries and steel mills. <strong>The</strong>aluminium is shipped in ingots, drops and liquidform. Liquid aluminium provides major economicand environmental benefits for the customerand is something <strong>Stena</strong> Aluminium alone offersin the Nordic market.Aluminium is a material steadily growing inpopularity and demand. Its properties make itwell suited for use in components for the autoindustry, for example, where there are manyend-customers.<strong>Stena</strong> Aluminium’s production is based onrecycled aluminium, which eliminates around450,000 tons of CO 2emissions each year comparedwith aluminium produced from bauxite.Our operations benefit the environment onseveral levels. In part because we use recycledaluminium, but also thanks to the methods weuse in production and the investments wemake in the environment.Expanded offering<strong>Stena</strong> Aluminium’s mission is to help its customersbe successful, which it does by creatinglong-term relationships based on flexibility, theright quality, reliable deliveries and easy accessto products and technical support. During thefinancial year our focus on technical supportand training continued to produce positiveresults. We started a competence project withthe help of an EU grant, where we workedintensely to raise competence levels togetherwith five customers.During the financial year large parts of themarket recovered, especially in the auto andtelecom industries. Customer requirements interms of specific alloys and properties areincreasing, creating growing demand for ourmetallurgy and processing services. During theyear we opened a new laboratory to betterhelp customers optimize properties and quality.This is an important and growing part ofour offering, where we are more of a partnerthan a supplier. We have improved our positionsand see that customers appreciate it.Focus on safety<strong>Stena</strong> Aluminium is working extensively toimprove safety. All employees receive continuoustraining and we are working deliberately toimprove transparency and structures, followingup at all levels. As a result, we set a new recordwith 391 consecutive days without an accidentrequiring sick leave.An eventful financial year ended with theCounty Administrative Board and the EnvironmentalCourt giving the go-ahead to increaseproduction from 50,000 tons today to 90,000tons. This is the result of a multi-year effortand means that we can continue to followour customers as they grow in pace with themarket’s recovery. As part of our own growthefforts, we are investing in a new flue gasde sulfurizati facility, thanks to which our environmentalimpact will be lower at 90,000 tonsthan it is today.iSTENAALUMINIUM AB<strong>Stena</strong> Aluminium is the Nordic region’sleading supplier of aluminium to foundriesand the steel industry. It also offers technicalsupport and training as well as metallurgyservices. <strong>The</strong> large part of thecompany’s operations is in Älmhult,Sweden, with a small office in Kolding,Denmark.President Staffan Persson21

STEELMORE PRODUCTS AND FASTERCUSTOMER DELIVERIESIt was a good year for <strong>Stena</strong> Stål, when global steel consumption rose. In addition,AHAB Steel was acquired, expanding <strong>Stena</strong> Stål into a new product segment andbroadening its customer offering.<strong>Stena</strong> Steel has been Sweden's third largestTo further develop the business, we expandedsteel supplier for many years. Our main offeringto a totally new segment during the financialis in long products and heavy gauge plate,year 2010/2011 through the acquisition ofwhere we have a significant part of the SwedishAHAB Steel, which has since been renamedmarket and are seeing very good growth. Being<strong>Stena</strong> Stål Storfors AB.quick and staying as close to customers as pos-<strong>The</strong> coil metal segment accounts for moresible have always been the keys for <strong>Stena</strong> Stål.than half of the Swedish steel market. AlthoughWe currently have 21 locations in Sweden andwe previously were able to supply thin sheet toNorway. <strong>The</strong> basic idea is to be on site locally,our customers, the acquisition offers manyclose to customers, and be familiar with geo-important advantages. One is that <strong>Stena</strong> Stålgraphical conditions. <strong>The</strong> level of service wecan now grind and cut sheet from rolls usingoffer should be so high that customers can havein-house resources.their material delivered from our smaller localWith the production units in Storfors, we canwarehouses on short notice.supply even more products to our customers,In addition, we are continuously expandingwhile delivering them faster than before.and improving our distribution system to raisethe level of service and deliver material reliablyIncreased digital presenceto customers.During the financial year we devoted great effortCustomization is increasingClose proximity is important to truly understandto making our facilities even safer, including byappointing a safety coordinator.We have also invested heavily to improve ouriSTENA STÅL ABa customer’s business and suggest improvements.We see a very positive, growing trend with suchcollaborations, where the aim is to choose theright steel, the right production method andthe right logistics solution.Another thing that has grown in popularity isthat customers increasingly want material thatis already preprocessed and prefabricated. <strong>The</strong>ywant to avoid having to spend time modifyingdigital presence. <strong>Stena</strong> Steel’s website can nowbe read in three languages: Swedish, Norwegianand English. In addition, we have developed ourown smartphone app.Market upswingIn terms of volume, 2010/2011 was a good yearfor <strong>Stena</strong> Stål, when we saw global steel consumptionrise. Demand has been high, which<strong>Stena</strong> Stål is a nationwide Swedish steelsupplier with a wide range of products thatincludes beams, reinforcing bars, tubes,plate, merchant bars, stainless, tool steel,alloyed structural steel, forgings and castings.It is the leader in flame cutting andCNC processing of heavy plate, while alsogrinding and cutting thin plate and sheetsfrom rolls. <strong>Stena</strong> Stål has warehouses, productionand sales in 21 locations in Swedenas well as in Moss, Norway.the material in their own facilities. With themachinery we have, we can do most of the workhas driven up raw material prices.President Jan-Erik Dahlinfor them and deliver the material to their exactspecifications.22

AHAB Steel in Storfors was acquired during thefinancial year. With its production units, <strong>Stena</strong> Stålhas broadened its offering in the coil metal segment.<strong>The</strong> photo shows 15-ton rolls being custom-cut.End-customers are mainly active in laser cutting,punching, pressing and rolling.23

OILGROWING BUSINESSIN WEST AFRICA90%of all goods have been shippedby boat at some point*Since its launch in January 2010, <strong>Stena</strong> Oil’s West African venture has performedstrongly and allowed us to offer our services to shipping companies that navigatethe region. We have grown from two vessels to four, and our African business areanow accounts for a significant share of revenue.<strong>The</strong> decision to launch a bunkering businessoutside the coast of West Africa was made at atime when the market was in decline. Whilemany other companies were having problems inthe wake of the financial crisis, <strong>Stena</strong> Oil,thanks to long-term owners, was able to investand prepare for an eventual rebound. Duringthe financial year 2010/2011 the fleet wasexpanded from two vessels to four. We can nowdeliver oil to customers along large parts of thestretch from Abidjan south to Angola.<strong>The</strong> customer base, which consists of internationalshipping companies with operations inEurope and West Africa, has grown steadilysince the start.iSTENA OIL AB<strong>Stena</strong> Oil is Scandinavia’s leading supplierof bunker oil, providing full-service solutionsfor ships operating in the Skagerak,Kattegatt and North Sea region. Since2010 we bunker ships outside the coast ofWest Africa as well. <strong>The</strong> company alsotrades internationally in bunker oil.President Jonas PerssonIn August 2011 an agreement was signedwith a customer from an industry that is new tous – the oil rig market. We will now be regularlydelivering oil to a rig with three supply boats.Interest in oil drilling outside the coast of WestAfrica is growing, and it will be a learning periodfor us during which we can make importantcontacts for the future.Quality is keyBehind the successful venture in West Africalies a proven business concept. For over thirtyyears <strong>Stena</strong> Oil has supplied bunker oil to shipsin the Kattegatt, Skagerak and the North Seaarea. <strong>The</strong> focus since the start has been oncustomer satisfaction, safety, flexibility andperformance. In recent years we have takenadditional steps and prioritized environmentaland safety work through the Green Bunkeringprogram.With our collective experience, we were ableto launch the venture in West Africa, where weknew that there was plenty of room forimprovement in terms of service and quality,since we ourselves had purchased oil there formany years. One example is wait times, whichwere often far too long.In hindsight, <strong>Stena</strong> Oil’s venture has beenhighly successful. <strong>The</strong> goal is to continue toexpand in the area.Exclusive agreement with depotIn our home market, Scandinavia, we saw a positivetrend during the financial year. Volumesgrew steadily and margins rebounded. Duringthe spring we signed an exclusive agreement tomanage the oil depot in the port of Göteborg asof October 2011. <strong>The</strong> depot is central to ouroffering and is one of our most important competitiveadvantages. It is where we have ourown warehouse and where we load all our shipsbefore they are sent out on assignment. Beingable to manage the depot ourselves allows usto improve efficiencies on several levels bymaking them an integral part of our operations.Oil prices are critical<strong>Stena</strong> Oil also offers its customers in Nordicwaters a very popular full-service marine solutionwhere it removes flush water and sludgeafter bunkering. This hazardous waste is thendelivered to <strong>Stena</strong> Recycling’s facilities, where itis cleaned and processed into an alternative fuelfor the cement industry – a solution that benefitseveryone involved, and certainly the environment.In addition to bunkering ships, <strong>Stena</strong> Oiltrades bunker oil in the international market.Oil prices and regulations on sulfur contentsaffect both businesses. This means that wehave to always stay a step ahead and find solutionsto meet changing conditions.24* Our punctual deliveries of high-quality marine fuels are critical to efficiently shipping goods on time andaround the world.

Martin Guldhed is responsible for commercial operationsat <strong>Stena</strong> Oil. All of the company's business is handledfrom the office in Göteborg. Customer relationships arecritical, and <strong>Stena</strong> Oil is open 24 hours a day, seven daysa week, year-round.25

ECONOMICS & FINANCENEW CFO SEES STRENGTHIN BUSINESS ACUMENOn September 1 John Lindqvist stepped down as CFO of the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>,but still retains his position as Deputy CEO. <strong>The</strong> new CFO is Jonas Höglund.After 32 years as the <strong>Group</strong>'s CFO, what haveyou learned that you would like to pass on toJonas?JL: Our business is built on local business acumen,and as CFO you have to be closely involved inhelping our branches make decisions andunderstand the reality they face. During myyears we have seen fantastic growth, goingfrom seven locations to 250, but we are still aflat organization. This is one of the reasons forour success in the past, and it will be in thefuture as well.What is your impression of the <strong>Group</strong> from afinancial perspective?JH: <strong>The</strong> company has a solid financial foundationwith long-term owners at its core and has beendistinguished for years by a high growth rateand stable profit level, with the exception of thelatest financial crisis. You quickly realize that thecornerstones are business acumen and a stronglocal presence and how important it is to safeguardthat culture. For me it is a question ofassimilating the culture and helping the companyto continue to develop in this direction.How do you describe the <strong>Group</strong>’s financingsituation during the last financial year?JL: In 2010/2011 we issued three bond loans:two in Sweden and one in Norway. This givesus greater financial security by reducing ourdependence on bank financing. <strong>The</strong> issues alsoplace increased demands on information.What are your comments on the <strong>Group</strong>’srevenue and continued focus on costs?JL: Our revenue is greatly dependent on metalprices, so it is not something we use as a me -asuring stick. We always focus on profit, andto achieve our goals the priority will continueto be reducing costs within the <strong>Group</strong>.JH: Tremendous work has been done, but it isa job that never ends. As always in a growingorganization, it is a challenge to compensatefor the increased costs that come with rapidexpansion, which we do partly by improvingproductivity. I feel confident in saying that<strong>Stena</strong> <strong>Metall</strong> has a good business model thatwill continue to generate positive results.John Lindqvist, Deputy CEO, and Jonas Höglund, CFO.26

iAB STENA METALL FINANS<strong>Stena</strong> <strong>Metall</strong> Finans handles financial activitiesand internal banking within the <strong>Group</strong>.THE GROUP’S INTERNAL BANK<strong>Stena</strong> <strong>Metall</strong> Finans serves as the <strong>Group</strong>’sinternal bank. Its areas of responsibilityinclude:• Active participation in analysis, qualityassurance of guidance documents andfinancing of investment activities.• Maintain routines for cash management,capital procurement and account structures,and actively work to reduce the <strong>Group</strong>’stied-up working capital.• Contribute to the <strong>Group</strong>’s short- and longtermearnings by efficiently managing andtrading liquid assets.• Monitor financial markets.• Weigh risk levels in the <strong>Group</strong>’s customercredits and manage the credit portfolio.• Ensure the <strong>Group</strong>’s access to long-termfinancing.EXCHANGE RATE EFFECTSON CONSOLIDATED INCOME<strong>The</strong> best possible balance is always soughtbetween assets and liabilities and betweenrevenue and expenses in foreign currency.It is important that the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>finances its operations in the right currency.Other projected flows are continuouslyhedged using forward exchange contracts.Faster information flows and expandingtrade across national and currency bordershave led to more transparent scrap prices.<strong>The</strong> <strong>Group</strong>’s earnings were previouslyaffected more by the exchange ratebetween USD and SEK than they are today.When the dollar fluctuates against thekrona, Swedish purchasing prices areadjusted much faster than before.LIQUIDITY AND FINANCING<strong>The</strong> <strong>Group</strong>’s external financing is securedthrough capital markets and the bankingsystem. Previous bilateral financing hasbeen replaced by syndicated credit agreementswith longer expirations. <strong>The</strong> syndicateincludes six major Nordic banks withoperations in the countries where the <strong>Stena</strong><strong>Metall</strong> <strong>Group</strong> is established and has a needfor banking services. For financing purposes,the basic rule is that no assets belonging tothe <strong>Group</strong>’s core businesses may be used ascollateral.Agreements have been reached with ourbanks on certain covenants and periodicinformation updates as a condition forfinancing.ENVIRONMENTAL INSURANCEAs in previous years, the <strong>Group</strong> has allocatedthe necessary provisions for environmentalinsurance to cover future remediation costsfor contaminated soil.Exchange rates*131197508/09 09/10 10/11Morgan Stanley World Index, USD*1,4001,2001,000800600Stockholm Stock Exchange’sOMXS30 Index*1,4001,2001,00080008/09 09/10 10/11EUR/SEKUSD/SEK60008/09 09/10 10/11VIX, Volatility Index*Maturing bond loans (SEK million)1,50070501,200309001008/09 09/10 10/1160030002011 20121 year20132 years20143 years20154 years20165 years20176 years* All graphs on this page refer to prices during theperiod September 1, 2008 through September26, 2011. All graphs refer to monthly figures.Sources: Reuters, MBR and <strong>Stena</strong> <strong>Metall</strong>27

THE STENA SPHEREBUSINESS AREA *STENA ABSTENA SESSAN ABSTENA METALL ABFERRY LINESSales SEK 9,092 millionProfit SEK –380 million<strong>Stena</strong> LineSHIPPINGSales SEK 3,220 millionProfit SEK –305 million<strong>Stena</strong> Bulk<strong>Stena</strong> RoRo<strong>Stena</strong> TeknikNorthern MarineManagementConcordia Maritime (52%)RoPaxvesselsOFFSHORE DRILLINGSales SEK 7,777 millionProfit SEK 1,233 million<strong>Stena</strong> DrillingShuttle tankersShuttle tankersREAL ESTATESales SEK 2,380 millionProfit SEK 1,422 million<strong>Stena</strong> Fastigheter<strong>Stena</strong> RealtyADACTUMSales SEK 4,630 millionProfit SEK 232 million<strong>Stena</strong> AdactumFINANCE/OTHERSales SEK 7 millionProfit SEK 687 million<strong>Stena</strong> Finans MEDA (22%)Beijer Electronics (30%)<strong>Stena</strong> <strong>Metall</strong> FinansRECYCLING, ENVIRONMENTALSERVICES AND TRADINGSales SEK 28,977 millionProfit SEK 525 million<strong>Stena</strong> <strong>Metall</strong><strong>The</strong> <strong>Stena</strong> Sphere is comprised of three parentcompanies wholly owned by the Sten A. Olssonfamily – <strong>Stena</strong> AB (publ), <strong>Stena</strong> Sessan AB and <strong>Stena</strong><strong>Metall</strong> AB – in addition to their wholly or partlyowned subsidiaries.<strong>The</strong> partly owned company Concordia Maritime AB(publ), which is listed on NASDAQ OMX Stockholm,is 52 percent owned by <strong>Stena</strong> Sessan AB.Total sales for the <strong>Stena</strong> Sphere amounted toSEK 53,637 million*.28Number of employees in <strong>Stena</strong> Sphere20,00015,00010,0005,00002007 2008 2009 2010 2011Net sales (SEK M)*30,00022,50015,0007,5000<strong>Stena</strong>AB<strong>Stena</strong><strong>Metall</strong>AB<strong>Stena</strong> ConcordiaSessan MaritimeAB AB*<strong>Stena</strong> <strong>Metall</strong>’s figures cover the period September 1,2010 – August 31, 2011. For other companies, theperiod is January 1, 2010 – December 31, 2010.

Peter Birgersson works as a machinist and Anna Friborg as asales representative at <strong>Stena</strong> Recycling’s branch in Skövde.29

FINANCIAL REVIEWDirectors’ report 32<strong>Group</strong>Income statement 35Shareholders’ equity 35Balance sheet 36Statement of cash flows 38Accounting andvaluation principles 39Notes to thefinancial statements 42Parent CompanyIncome statement 53Shareholders’ equity 53Balance sheet 54Statement of cash flows 56Notes to thefinancial statements 57Shares and participationsin <strong>Group</strong> companies 60Proposed distributionof earnings 62Auditors’ report 63Board of Directors 64Addresses 6431