Europe's Approach to Islamic Banking: A Way Forward - Wbiaus.org

Europe's Approach to Islamic Banking: A Way Forward - Wbiaus.org

Europe's Approach to Islamic Banking: A Way Forward - Wbiaus.org

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

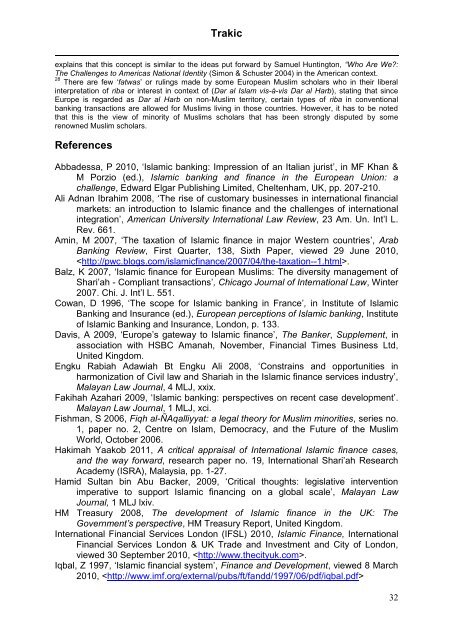

Trakicexplains that this concept is similar <strong>to</strong> the ideas put forward by Samuel Hunting<strong>to</strong>n, “Who Are We?:The Challenges <strong>to</strong> Americas National Identity (Simon & Schuster 2004) in the American context.28 There are few ‘fatwas’ or rulings made by some European Muslim scholars who in their liberalinterpretation of riba or interest in context of (Dar al Islam vis-à-vis Dar al Harb), stating that sinceEurope is regarded as Dar al Harb on non-Muslim terri<strong>to</strong>ry, certain types of riba in conventionalbanking transactions are allowed for Muslims living in those countries. However, it has <strong>to</strong> be notedthat this is the view of minority of Muslims scholars that has been strongly disputed by somerenowned Muslim scholars.ReferencesAbbadessa, P 2010, ‘<strong>Islamic</strong> banking: Impression of an Italian jurist’, in MF Khan &M Porzio (ed.), <strong>Islamic</strong> banking and finance in the European Union: achallenge, Edward Elgar Publishing Limited, Cheltenham, UK, pp. 207-210.Ali Adnan Ibrahim 2008, ‘The rise of cus<strong>to</strong>mary businesses in international financialmarkets: an introduction <strong>to</strong> <strong>Islamic</strong> finance and the challenges of internationalintegration’, American University International Law Review, 23 Am. Un. Int’l L.Rev. 661.Amin, M 2007, ‘The taxation of <strong>Islamic</strong> finance in major Western countries’, Arab<strong>Banking</strong> Review, First Quarter, 138, Sixth Paper, viewed 29 June 2010,.Balz, K 2007, ‘<strong>Islamic</strong> finance for European Muslims: The diversity management ofShari’ah - Compliant transactions’, Chicago Journal of International Law, Winter2007. Chi. J. Int’l L. 551.Cowan, D 1996, ‘The scope for <strong>Islamic</strong> banking in France’, in Institute of <strong>Islamic</strong><strong>Banking</strong> and Insurance (ed.), European perceptions of <strong>Islamic</strong> banking, Instituteof <strong>Islamic</strong> <strong>Banking</strong> and Insurance, London, p. 133.Davis, A 2009, ‘Europe’s gateway <strong>to</strong> <strong>Islamic</strong> finance’, The Banker, Supplement, inassociation with HSBC Amanah, November, Financial Times Business Ltd,United Kingdom.Engku Rabiah Adawiah Bt Engku Ali 2008, ‘Constrains and opportunities inharmonization of Civil law and Shariah in the <strong>Islamic</strong> finance services industry’,Malayan Law Journal, 4 MLJ, xxix.Fakihah Azahari 2009, ‘<strong>Islamic</strong> banking: perspectives on recent case development’.Malayan Law Journal, 1 MLJ, xci.Fishman, S 2006, Fiqh al-ÑAqalliyyat: a legal theory for Muslim minorities, series no.1, paper no. 2, Centre on Islam, Democracy, and the Future of the MuslimWorld, Oc<strong>to</strong>ber 2006.Hakimah Yaakob 2011, A critical appraisal of International <strong>Islamic</strong> finance cases,and the way forward, research paper no. 19, International Shari’ah ResearchAcademy (ISRA), Malaysia, pp. 1-27.Hamid Sultan bin Abu Backer, 2009, ‘Critical thoughts: legislative interventionimperative <strong>to</strong> support <strong>Islamic</strong> financing on a global scale’, Malayan LawJournal, 1 MLJ lxiv.HM Treasury 2008, The development of <strong>Islamic</strong> finance in the UK: TheGovernment’s perspective, HM Treasury Report, United Kingdom.International Financial Services London (IFSL) 2010, <strong>Islamic</strong> Finance, InternationalFinancial Services London & UK Trade and Investment and City of London,viewed 30 September 2010, .Iqbal, Z 1997, ‘<strong>Islamic</strong> financial system’, Finance and Development, viewed 8 March2010, 32