2010 Annual report - Nedbank Group Limited

2010 Annual report - Nedbank Group Limited

2010 Annual report - Nedbank Group Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

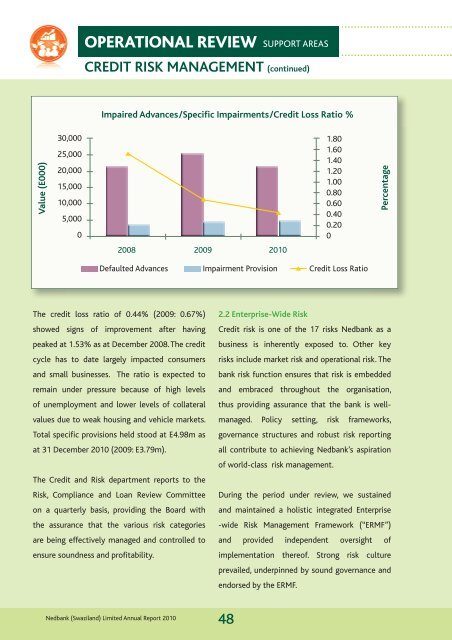

OPERATIONAL REVIEWCREDIT RISK MANAGEMENTSUPPORT AREAS(continued)Impaired Advances/Specific Impairments/Credit Loss Ratio %Value (E000)30,00025,00020,00015,00010,0005,00001.801.601.401.201.000.800.600.400.200Percentage2008 2009 <strong>2010</strong>Defaulted Advances Impairment Provision Credit Loss RatioThe credit loss ratio of 0.44% (2009: 0.67%)showed signs of improvement after havingpeaked at 1.53% as at December 2008. The creditcycle has to date largely impacted consumersand small businesses. The ratio is expected toremain under pressure because of high levelsof unemployment and lower levels of collateralvalues due to weak housing and vehicle markets.Total specific provisions held stood at E4.98m asat 31 December <strong>2010</strong> (2009: E3.79m).The Credit and Risk department <strong>report</strong>s to theRisk, Compliance and Loan Review Committeeon a quarterly basis, providing the Board withthe assurance that the various risk categoriesare being effectively managed and controlled toensure soundness and profitability.2.2 Enterprise-Wide RiskCredit risk is one of the 17 risks <strong>Nedbank</strong> as abusiness is inherently exposed to. Other keyrisks include market risk and operational risk. Thebank risk function ensures that risk is embeddedand embraced throughout the organisation,thus providing assurance that the bank is wellmanaged.Policy setting, risk frameworks,governance structures and robust risk <strong>report</strong>ingall contribute to achieving <strong>Nedbank</strong>’s aspirationof world-class risk management.During the period under review, we sustainedand maintained a holistic integrated Enterprise-wide Risk Management Framework (“ERMF”)and provided independent oversight ofimplementation thereof. Strong risk cultureprevailed, underpinned by sound governance andendorsed by the ERMF.<strong>Nedbank</strong> (Swaziland) <strong>Limited</strong> <strong>Annual</strong> Report <strong>2010</strong>48