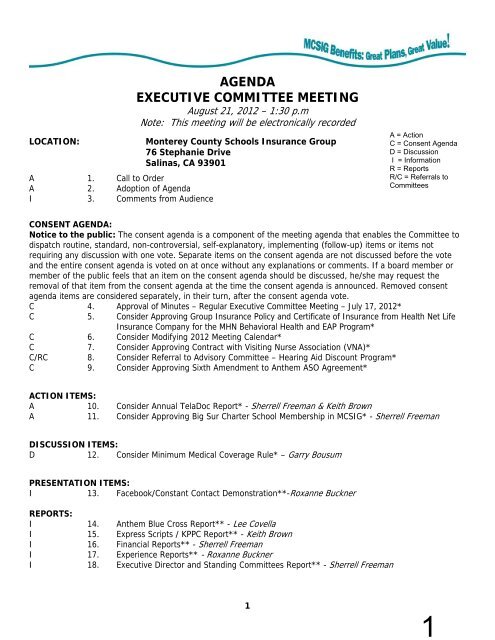

AGENDA EXECUTIVE COMMITTEE MEETING - Mcsig.com

AGENDA EXECUTIVE COMMITTEE MEETING - Mcsig.com

AGENDA EXECUTIVE COMMITTEE MEETING - Mcsig.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

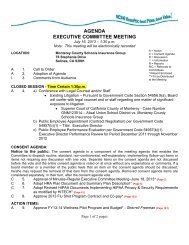

CONSENT CALENDAR3

5Executive Committee MinutesJuly 17, 2012Page 2 of 4DRAFTADOPTION OF <strong>AGENDA</strong>Ms. Freeman pulled item #4 from the agenda. Following a motion byMs. Sanchez, seconded by Mr. Keller, the adoption of the July 19,2012 agenda was approved unanimously.COMMENTS FROM AUDIENCENo <strong>com</strong>ments givenCONSENT CALENDAR: Notice to the Public: The consent agenda is a <strong>com</strong>ponent of the meetingagenda that enables the Committee to dispatch routine, standard, non-controversial, self-explanatory,implementing (follow-up) items or items not requiring any discussion with one vote. Separate items onthe consent agenda are not discussed before the vote and the entire consent agenda is voted on at oncewithout any explanations or <strong>com</strong>ments. If a board member or member of the public feels that an itemon the consent agenda should be discussed, he/she may request the removal of that item from theconsent agenda at the time the consent agenda is announced. Removed consent agenda items areconsidered separately, in their turn, after the consent agenda vote.• Approval Of Minutes–Regular Executive Committee Meeting, 6/19/12• Consider Re-appropriation of FY11-12 Flu Shot Program Funds toHealthy Lifestyle Solutions• Consider Modifying 2012 Meeting Calendar• Consider Renewal of Financial Audit ContractMr. Price moved to approve the above listed Consent Calendar items.Ms. Sanchez seconded the motion, which passed unanimously.CONSIDER RECOMMENDED MODIFICATIONS TO THE EVIDENCE OF COVERAGEDOCUMENTS FOR 2013Ms. Freeman summarized the July 17, 2012 Executive Director’s reportstating that she created a table with current Evidence of Coverage(EOC) documents and the proposed language as a result of Anthem’srevisions to their fully-insured policies to <strong>com</strong>ply with changes inapplicable Federal or State regulations. Each year, staff reviewsthe list to determine if any of the Anthem changes would beappropriate for MCSIG. Ms. Freeman stated that the table outlinesthe language changes that staff is re<strong>com</strong>mending for the MCSIG selffundedPPO and EPO EOC documents, and she reported on each item.Ms. Dodd moved approval of the changes/additions/deletions aspresented and re<strong>com</strong>mended same to the Full Board to be effective1/1/13. The motion was seconded by Ms. Sanchez. The motion passedunanimously.

6Executive Committee MinutesJuly 17, 2012Page 3 of 4CONSIDER APPROVING FIRST YEAR OF THREE-YEAR PILOT WELLNESS PROGRAMAUGMENTATIONMs. Freeman summarized the July 17, 2012 Executive Director’s Reportstating that at their 2012 workshop, the Executive Committeeconcluded that MCSIG should focus on developing long-term medicalclaim cost containment strategies as next steps toward stabilizingmedical claim costs. The Committee explored the concept of a threeyearpilot program designed to capitalize on a positive wellnessprogram Return on Investment (ROI).Ms. Freeman reported that the first year of the pilot programprimarily focuses on increasing the number of wellness programparticipants through three initiatives: (1) Removing participationcaps currently in place; (2) Expanding the number of individualself-directed activity opportunities; and (3) Funding marketing andoutreach efforts to district executives, school site ambassadors,participants and physicians. She stated that the FY12-13 operatingbudget includes the current level of wellness program resources.Mr. Keller asked about a smoking cessation program and Ms. Freemanreplied that she would have Mr. Hertsch research it and report backat the August Executive Committee meeting.Ms. Perez requested to see an earlier ROI than 3 years. Ms. Freemanreplied that she could provide indicators and a matrix. Ms. Perezalso requested to be kept up-to-date on all of Mr. Hertsch’s pilotprogram travels. Ms. Freeman replied that a log would be kept andprovided. She also noted that the auto allowance would be within theconfines of the pilot program only.Ms. Perez moved approval of the proposed year one of the three-yearpilot program, and it was seconded by Ms. Dodd. Ms. Perez requestedfor a revised FY12-13 budget. Ms. Freeman replied that a revisedbudget would be brought back. The motion passed unanimously.DRAFTCONSIDER AMBULANCE SERVICES BENEFIT FOR THE SELF-FUNDED MEDICALPLANSMs. Freeman summarized the July 17, 2012 Executive Director’s reportstating that the MCSIG self-funded medical plans have always coveredambulance services, and that air ambulance claims are adjudicatedthe same as ground ambulance. Up until January 2012 all of MCSIG’sambulance claims for all self-funded medical plans have been paid at80% of billed charges because Anthem utilized the Ingenix databasefor determining U&C amounts. However, as of September 2011 Anthemdiscontinued utilizing the Ingenix database and began utilizing theFAIR database in October 2011.

7Executive Committee MinutesJuly 17, 2012Page 4 of 4DRAFTAs a result, PPO ambulance claims are now being paid at 60% of U&Cand members are being balance-billed by the ambulance provider forthe unpaid balance. Ms. Freeman presented options for the Committeeto evaluate and make a re<strong>com</strong>mendation to the Full Board. Adiscussion followed.Ms. Dodd moved to approve and re<strong>com</strong>mend to the Full Board option #3with #1 as a back-up option, as presented. Mr. Keller seconded themotion, which passed unanimously.CONSIDER MODIFYING COORDINATION OF BENEFIT RULESMs. Freeman summarized the July 17, 2012 Executive Director’s reportstating that there are typically three methods of calculatingCoordination of Benefits (COB) in the industry; the standard COB,the Maintenance of Benefits (MOB) and the Carve-out. MCSIG utilizesthe standard COB methodology enhanced with claim reserve feature.Staff re<strong>com</strong>mends that the COB language for both PPO and EPO plans bemodified to not allow for coordination of benefits to other PPO-typeplans and to consumer driven high deductible (CDHD) type-plans.Ms. Dodd moved to approve and re<strong>com</strong>mend same to the Full Boardmodifications to the Coordination of Benefits language as describedin the report. Mr. Keller seconded the motion. The motion passedunanimously.COMMENTS FROM EC MEMBERSNo <strong>com</strong>ments given.<strong>AGENDA</strong> ITEMS FOR NEXT <strong>MEETING</strong>No items were given.ADJOURNMENTThere being no further business to discuss, the Vice President askedfor a motion to adjourn. Ms. Dodd moved to adjourn the meeting at3:35 p.m., and Ms. Sanchez seconded the motion, which passedunanimously.

8Report from the Executive Director to the MCSIG Executive Committee at the Meeting ofAugust 21, 2012.SUBJECT: Consider Approving Group Insurance Policy and Certificate of Insurance withHealth Net Life Insurance Company for MHN Behavioral Health Services and EAP ProgramBackground:At their March 2012 meeting, the Full Board approved moving the MCSIG EAP and BehavioralHealth Programs from OptumHealth to MHN (a wholly owned subsidiary of Health Net LifeInsurance Company) effective July 1, 2012 for a period of two years.The first year (July 2012 to June 2013) premium is $23.24 and MHN provided a rate guarantee foryear two of no more than a 12% increase.Discussion:The attached Group Insurance Policy and Certificate of Insurance defines the benefits availableunder the policy and will be posted on the MCSIG website to serve as participants’ evidence ofcoverage.Re<strong>com</strong>mendation:That the Executive Committee approve the Group Insurance Policy and Certificate of Insurance asdescribed in this report and authorize the Executive Director to make monthly premium paymentsas outlined in the policy.1

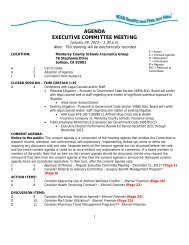

75Report from the Executive Director to the MCSIG Executive Committee at the Meeting ofAugust 21, 2012.Subject: Consider Changes to 2012 Full Board and Executive Committee MeetingCalendar (Attached)BackgroundThe MCSIG Executive Committee and the Full Board adopted their 2012 calendar of meetings attheir regular meetings on November 15, 2011.The Executive Committee approved a change to the September 2012 meeting date at their Julymeeting.DiscussionThe November 2012 Executive Committee and Full Board meeting is currently scheduled forNovember 13. This date falls during the annual International Foundation of Employee BenefitPlans Conference. Four MCSIG board members and two MCSIG staff are currently scheduledto attend this conference.Staff requests the Committee re-schedule the Full Board and Executive Committee meeting ofNovember 13 to November 27, 2012.Re<strong>com</strong>mendationThat the Executive Committee reschedule the November 13, 2012 meeting to November 27,2012.

76UPDATED CALENDAR OF <strong>MEETING</strong>S FOR 2012Adopted 11/15/2011All meetings will be held at the following location (unless otherwise indicated)Monterey County Schools Insurance Group76 Stephanie DriveSalinas, CA 93901REGULARREGULAR<strong>EXECUTIVE</strong> <strong>COMMITTEE</strong>/ <strong>MEETING</strong> <strong>MEETING</strong>FULL BOARD DATES* TIMESExecutive Committee 1/17/2012 noonFull Board Strategic Wkshp 1/17/2012 1:30 p.m.Executive Committee 2/21/2012 1:30 p.m.Executive Committee Wkshp 3/2/12 - 3/3/12 Los LaurelesExecutive Committee 3/20/2012 1:30 p.m.Full Board 3/20/2012 3:00 p.m.Executive Committee 4/17/2012 1:30 p.m.Executive Committee 5/15/2012 1:30 p.m.Full Board 5/15/2012 3:00 p.m.Executive Committee 6/19/2012 1:30 p.m.Full Board 6/19/2012 3:00 p.m.Executive Committee 7/17/2012 1:30 p.m.Executive Committee 8/21/2012 1:30 p.m.Executive Committee 9/25/2012 1:30 p.m.Full Board 9/25/2012 3:00 p.m.Executive Committee 10/16/2012 1:30 p.m.Executive Committee 11/27/2012 1:30 p.m.Full Board 11/27/2012 3:00 p.m.Special Executive Committee 11/13/2012 4:00 p.m.Executive Committee 12/11/2012 1:30 p.m.*Regular dates are scheduled for third Tuesday of each month

77Report from the Executive Director to the MCSIG Executive Committee at the Meeting ofAugust 21, 2012.Subject:Consider Approving Agreement with Visiting Nurse Association (VNA)BackgroundAt their June 2012 meeting, the MCSIG Executive Committee awarded the 2012 flu shot programcontract to Visiting Nurse Association.DiscussionThe attached proposed Agreement reflects the understanding of the parties as respects VNA’sprovision of services in support of MCSIG’s 2012 flu shot program.Re<strong>com</strong>mendationThat the Executive Committee approve the proposed Agreement and authorize the ExecutiveDirector to sign same.

76 Stephanie Dr., Salinas, CA 93901MASTER SERVICES AGREEMENTThis Master Services Agreement (this “Agreement”) is entered into this 24 th day of July, 2012, by andbetween Monterey County Schools Insurance Group (MCSIG), with offices located at 76 Stephanie Drive,Salinas, CA 93901, hereinafter referred to as MCSIG, and Central Coast Visiting Nurse Association, hereinafterreferred to as service provider with offices located at the addresses set forth below.In consideration of the promises set forth herein, and for other good and valuable consideration, the receiptand sufficiency of which are acknowledged by the parties, and intending to be legally bound, MCSIG andservice provider hereby agree to the following terms and conditions of this Agreement and the attached Riders:ARTICLE 1. TERM OF AGREEMENT1.1 Term. This Agreement will be in effect as of the date hereof and will continue indefinitely until terminated.1.2 Termination. Either party may terminate this Agreement at any time, with or without cause, by providing atleast thirty (30) days advance written notice of the termination date to the other party. Either party mayterminate this Agreement immediately in the event of a material breach of this Agreement by the other partyby providing written notice to other party; however, the notice must describe in reasonable detail the natureof the alleged breach and provide for a cure period of at least five (5) days. Any termination will have noeffect upon the rights and obligations resulting from any transactions occurring prior to the effective date ofthe termination.ARTICLE 2. RESPONSIBILITIES OF SERVICE PROVIDER2.1 Services. Upon MCSIG’s request, service provider shall provide immunizations and/or screenings(collectively, “Service(s)”) associated with MCSIG’s 2012 Flu Shot Program to MCSIG’s recipient(s) at thelocation and times specified by MCSIG subject to the availability of vaccine/supplies and/or qualified medicalprofessionals (individually and collectively, “Personnel”).2.2 Personnel. All Personnel provided by service provider shall be employees or contractors of serviceprovider, and not of MCSIG. Personnel will be licensed nurses from the local <strong>com</strong>munity when possible inorder to avoid clinic disruption because of long <strong>com</strong>mute times or traffic congestion.2.3 Health and Safety Guidelines. Service provider will follow applicable guidelines issued by the StateDepartment of Health Services pertaining to Services and disposal of waste. Upon receipt of written request,service provider will forward a copy of its Infection Control Guidelines to MCSIG. Prior to providing Services,service provider shall obtain a physician’s order authorizing the provision of Service, as required underapplicable State laws.2.4 Supplies. Service provider will supply all necessary medical supplies and forms to be used in administeringand/or providing Services to RECIPIENTS.2.5 Insurance. Service provider will maintain, at its sole expense, a valid policy of insurance evidencinggeneral and professional liability coverage of not less than $1,000,000 per occurrence and $2,000,000 in the178

aggregate, covering the negligent acts or omissions of Personnel it provides under this agreement occurringin connection with the provision of services under this Agreement. Service provider will provide a generalcertificate of insurance, naming MCSIG as an additional insured. Service provider further agrees tomaintain any statutorily required worker’s <strong>com</strong>pensation insurance for all of its Personnel providing servicesto MCSIG under this Agreement.2.6 Employment and Taxes. Service provider will follow its standard employment policies and procedures toverify that all Personnel meet applicable licensing requirements. Service provider, or its subcontractor ifapplicable, will maintain direct responsibility as employer for the payment of wages and other <strong>com</strong>pensation,and for any applicable mandatory withholdings and contributions such as federal, state, and local in<strong>com</strong>etaxes, social security taxes, worker's <strong>com</strong>pensation, and unemployment insurance.ARTICLE 3. RESPONSIBILITIES OF MCSIG3.1 Work Environment. MCSIG will provide a workspace for service provider to conduct the CLINIC in ahighly visible setting that will enable service provider to safely provide Services to RECIPIENTS seekingsuch service. MCSIG will provide furniture, to include, but is not limited to, tables and chairs, and allowservice provider Personnel reasonable access to telephones for business use.3.2 Clinic Schedule. MCSIG will provide the service provider with a confirmed flu clinic schedule.ARTICLE 4. MUTUAL RESPONSIBILITIES4.1 Non-discrimination. Neither service provider nor MCSIG will discriminate on the basis of age, race, color,national origin, religion, sex, disability, being a qualified disabled veteran, being a qualified veteran of theVietnam era, or any other category protected by applicable law.ARTICLE 5. COMPENSATION5.1 Billing. Service provider will submit invoices to MCSIG for services rendered (as applicable to anyprovisions set forth in applicable Rider(s) and MCSIG shall pay such invoices when due. Invoices shall besubmitted to the following address:MCSIG76 Stephanie DriveSalinas, CA 93901ATTN: Neil Hertsch5.2 Fees. MCSIG will pay the service provider a fee of $18.50 per flu shot given. Attendance records will bekept in duplicate for verification purposes.5.3 Payment. All amounts to service provider are due and payable within thirty (30) days from date of suchinvoice. MCSIG will send all payments to the following address, unless a different address is set forth in anattached Rider:Central Coast Visiting Nurse Association & Hospice5 Lower Ragsdale Dr.Monterey, CA 93940Payments not received within thirty (30) days from the applicable invoice date will accumulate interest, untilpaid, at the rate of one and one-half percent (1 1/2%) per month on the unpaid balance, equal to an annualpercentage rate of eighteen percent (18%), or the maximum rate permitted by applicable law, whichever is less.279

ARTICLE 6. GENERAL TERMS6.1 Independent Contractors. The parties enter into this Agreement as independent contractors, and nothingcontained in this Agreement will be construed to create a partnership, joint venture, agency, or employmentrelationship between the parties.6.2 Assignment. Neither party may assign this Agreement without the prior written consent of the other party,and such consent will not be unreasonably withheld. No such consent will be required for assignment to anentity owned by or under <strong>com</strong>mon control with assignor, but the assignor shall provide assignee with promptwritten notice of the assignment. In any event, the assigning party will remain fully liable to the other partyunder this Agreement.6.3 Indemnification. The parties agree that each is liable for their own losses, costs, damages or expenses,including attorney’s fees and court costs, arising out of any breaches, misrepresentation, negligent acts,errors or omissions of their own employees in performance of this contract.6.4 Responsibility. Except as provided above, each party hereto shall be responsible at its own expense fordefending itself in any litigation brought against it arising out of any activities engaged in connection with thisAgreement whether or not the other party hereto is also a defendant. Each party agrees to provide to theother party information in its possession which is essential to such party’s defense in such litigation. Thisdoes not apply to any situation where Service Provider and MCSIG are adverse parties in the same lawsuit.In such case the Rules of Evidence and /or Civil Procedure should govern all discovery proceedings.6.5 Notices. Any notice or demand required under this Agreement will be in writing; will be personally servedor sent by certified mail, return receipt requested and postage prepaid, or by a recognized overnight carrierwhich provides proof of receipt; and will be sent to the addresses below. Either party may change theaddress to which notices are sent by sending written notice of such change of address to the other party inthe manner specified herein.Monterey County Schools Insurance Central Coast Visiting NurseGroup (MCSIG)Association76 Stephanie Drive 5 Lower Ragsdale Dr.Salinas, CA 93901 Monterey, CA 93940ATTN: Neil HertschATTN: Andrea Zoodsma6.6 Headings. The headings of the sections and subsections of this Agreement are for reference only and willnot affect in any way the meaning or interpretation of this Agreement.6.7 Entire Contract; Counterparts. This Agreement constitutes the entire contract between MCSIG andservice provider regarding the services to be provided hereunder. Any agreements, promises, negotiations,or representations not expressly set forth in this Agreement are of no force or effect. This Agreement maybe executed in any number of counterparts, each of which will be deemed to be the original, but all of whichshall constitute one and the same document. No amendments to this Agreement will be effective unlessmade in writing and signed by duly authorized representatives of both parties. The parties acknowledgeand agree that the execution and delivery of this Agreement by facsimile transmission shall be valid andbinding.6.8 Availability of Vaccine and/or Supplies. As applicable, the parties agree that service provider's obligationunder this Agreement to provide Services is expressly conditioned upon the availability of vaccine and/orsupplies. Should vaccine and/or supplies be<strong>com</strong>e unavailable, through no fault of service provider, serviceprovider will not be required to provide Services pursuant under this Agreement and shall have no liabilitywhatsoever to MCSIG or any third party as a result of its failure or inability to do so. Should only a limitedsupply of vaccine be<strong>com</strong>e available to service provider, MCSIG will have first priority, not withstanding anyFederal guidelines to the contrary.6.9 Force Majeure. Neither service provider nor MCSIG shall be liable for any failure or inability to performtheir respective obligations under this Agreement for a period of up to forty-five (45) days due to any causebeyond the reasonable control of the non-performing party, including but not limited to acts of God,380

egulations of laws of any government, acts of war or terrorism, acts of civil or military authority, fires, floods,accidents, epidemics, quarantine restrictions, unusually severe weather, explosions, earthquakes, strikes,labor disputes, loss or interruption of electrical power or other public utility, freight embargoes or delays intransportation, or any similar or dissimilar cause beyond its reasonable control. If a party’s non-performanceunder this section extends for forty-five (45) days or longer, the party affected by such non-performancemay terminate this Agreement by providing written notice thereof to the other party.6.10 Compliance with Laws. Service provider agrees that all services provided pursuant to this Agreementshall be performed in <strong>com</strong>pliance with all applicable federal, state, or local rules and regulations, includingthe applicable standards of the Joint Commission on Accreditation of Healthcare Organizations (JCAHO).6.11 Severability. In the event that one or more provision of this Agreement is deemed invalid, unlawful and/orunenforceable, then only that provision will be omitted, and will not affect the validity or enforceability of anyother provision; the remaining provisions will be deemed to continue in full force and effect.6.12 Governing Law, Jurisdiction. This Agreement will be governed by and construed in accordance with thelaws of the State of California, without regard to its principles of conflict of laws. Any dispute or claim fromthis Agreement shall be resolved exclusively in the federal and state courts of the State of California andthe parties hereby irrevocably submit to the personal jurisdiction of said courts and waive all defensesthereto.6.13 Confidentiality. The parties agree to keep the terms and conditions of this Agreement, and anyinformation exchanged or obtained hereunder strictly confidential, and not to disclose such information andmaterials to any third party, except pursuant to a court order or applicable law, rule or regulation, andprovided that the other party has been given prompt written notice of the impending disclosure and hasbeen provided a reasonable opportunity to seek an appropriate protective order.6.14 Limitation of Liability. Neither service provider nor MCSIG will be responsible for special, indirect,incidental, punitive, consequential, or other similar damages, including but not limited to lost profits, that theother party may incur or experience in connection with this agreement or the services provided, howevercaused, even if such party has been advised of the possibility of such damages.6.15 Amendment. No amendment, modification or discharge of this Agreement, and no waiver hereunder, shallbe valid or binding unless set forth in writing and duly executed by the party against whom enforcement of theamendment, modification, discharge or waiver is sought.6.16 Attorneys Fees. In the event either party is required to obtain legal assistance to enforce its rights underthis Agreement, or to collect any monies due, hereunder, the prevailing party shall be entitled to recoverfrom the other party, in addition to all other sums due, reasonable attorney's fees (including a reasonablehourly rate for the time expended by in-house counsel), court costs and expenses, if any, incurredenforcing its rights and/or collecting its monies.ARTICLE 7. CONFIDENTIALITY OF PROTECTED HEALTH INFORMATION7.1 HIPAA Compliance. In instances where one party receives Protected Health Information (“PHI”) inconnection with services provided under this Agreement, the receiving party agrees that it shall:a) <strong>com</strong>ply with the applicable provisions of the Administrative simplification section of the HealthInsurance Portability and Accountability Act of 1996, as codified at 42 U.S.C. § 1320d through d-8and as amended (“HIPAA”), and the requirements of any regulations promulgated there under;b) not use or further disclose any PHI concerning a RECIPIENT, other than as permitted by thisAgreement, the requirements of HIPAA and/or applicable federal regulations. The receiving partyshall implement appropriate safeguards to prevent the use or disclosure of a RECIPIENT’s PHIother than as provided for by this Agreement;481

c) promptly report to the other party any violations, use and/or disclosure of a RECIPIENT’s PHI notprovided for by this Agreement as soon as practicable, upon be<strong>com</strong>ing aware of the improperviolation(s), use and/or disclosure; andd) <strong>com</strong>ply with the privacy, security and electronic transaction requirements defined in the HIPAAregulations.7.2 Breach of Confidentiality. In the event that either party is in material breach of any provision(s) of thisArticle, it shall immediately advise the other party and take <strong>com</strong>mercially reasonable steps to remedy suchbreach, including, but not limited to protecting against the consequences of any disclosure or use of PHI inviolation of this Agreement. Both parties acknowledge that use or disclosure of the PHI, in any mannerinconsistent with this Agreement, may result in irreparable and continuing damage. As applicable by law,legal remedies, such as equitable relief may be necessary to protect against any such breach or threatenedbreach, including, without limitation, injunctive relief.MCSIG and service provider have acknowledged their understanding of and agree to the mutual promiseswritten above by executing this Agreement as of the date first set forth above.Monterey County Schools Insurance Group,(MCSIG) :Central Coast Visiting Nurse Association:SignatureSherrell Freeman, Executive DirectorPrinted Name & TitleSignatureSteven A. Johnson, President/CEOPrinted Name & TitleDateDatenh.FLU.11.MASTERSERVAGREEMT.1582

83Report from the Executive Director to the MCSIG Executive Committee at the Meeting ofAugust 21, 2012.Subject:Consider Referral to Advisory Committee – Hearing Aid Discount ProgramBackgroundFrom time to time, MCSIG receives inquiries regarding hearing aid coverage. In the past, MCSIGhas evaluated and declined to add hearing aid coverage due to cost.DiscussionRecently, Keenan & Associates announced they are offering the EPIC Hearing Program andVision Service Plan (VSP), the <strong>com</strong>pany that administers MCSIG’s vision plan, announced anaffiliation with TruHearing. Each vendor offers insured and discount programs.Re<strong>com</strong>mendationThat the Executive Committee refer these two hearing programs to the Advisory Committee forreview and re<strong>com</strong>mendation.

EPIC Hearing Service PlanSummary of Benefits and Savings■ Hearing Tests■ Hearing Aids■ Hearing Aid Batteries■ Ear Protection■ Swim Plugs■ Musician Ear Plugs■ Hearing Aid cleaning supplies& accessories■ Assistive Listening Devices■ TV Ears (Amplifies &clarifies Television)■ Telephone amplification■ Alerting and signaling devicesCall EPIC to order orfor more information17870 Castleton Street, Suite 308City of Industry, CA 91748Corporate Toll Free 877-606-3742Hearing Plans Toll Free 866-956-5400Fax 626-435-0188hspadmin@epichearing.<strong>com</strong>www.epichearing.<strong>com</strong>EPIC Hearing Service PlanIntroductionHearing isone of thefive naturalsenses thatallow usto enjoylife andthe worldaround us.Music, radio,television,movies,theater – allbe<strong>com</strong>e lessaccessible and enjoyable without thebenefit of hearing. And the loss of soundslike sirens and alarms can actuallyendanger your life.Hearing is a valued life asset that can beprotected, treated and assisted througha program for hearing healthcare. TheEPIC Hearing Service Plan provides easyaccess to hearing health professionals –primarily physicians and audiologists –who can help you achieve your maximumhearing potential throughout your life.Joining the EPIC Hearing Service Plan isfree to you and your family and all treatmentcosts within the Plan, includinghearing aids, have been negotiatedby EPIC to provide you with the bestvalue possible.Why Have aHearing Plan?Hearing problems are fairly <strong>com</strong>mon:10% of the US population has someform of hearing impairment and hearingloss is the #3 chronic health problem inthe country.Hearing loss is usually treatable,primarily through the use of hearingaids. But less than 25% of people whocan benefit are treated, often because ofconcerns about cost, difficulty in findinga knowledgeable hearing health specialist,and confusion about the wide range ofoptions in hearing aid technology (analogor digital? behind-the-ear or <strong>com</strong>pletelyin-the-canal?).With EPIC Hearing Services Plan,the barriers to better hearinghealth are eliminated.■ EPIC identifies and screens qualifiedexperts in hearing evaluation andtreatment – Physicians andAudiologists – in your neighborhood.■ EPIC researches and evaluates allhearing aid technology to assurethe latest as well as the mosteffective options are available.■ EPIC negotiates the best prices forall treatment protocols, includinghearing aids. EPIC prices may be asmuch as 50% below manufacturer’ssuggested retail price and up to35% lower than most discountoffers.■ EPIC coordinates coverage with yourexisting healthcare plans85

86Report from the Executive Director to the MCSIG Executive Committee at the Meeting of August21, 2012.Subject:Consider Approving Amendment #6 to Anthem ASO AgreementBackgroundThe current MCSIG/Anthem ASO Agreement took effect in 2002. Since its adoption, five subsequentamendments have been approved.DiscussionAnthem submitted proposed amendment #6 (attached) to MCSIG for approval in the spring of 2010.Proposed amendment #6 is the most substantial amendment proposed since MCSIG signed the currentASO Agreement in 2002. As a result, it has taken some time for staff and legal review and numerousfollow-up discussions with Anthem.As a result of the review process, some changes were made to the original proposal and the modifiedamendment #6 is now being re<strong>com</strong>mended for approval.Re<strong>com</strong>mendationThat the Executive Committee approve the sixth amendment to the Anthem ASO Agreement andauthorize the Executive Director to sign same.

ADMINISTRATIVE SERVICES AMENDMENT NO. 6TOADMINISTRATIVE SERVICES AGREEMENT 18449.TRI-1 303FORMONTEREY COUNTY SCHOOLS INSURANCE GROUPThat certain Administrative Services Agreement 18449.TRI-1 303 (Agreement) between Anthem BlueCross Life and Health Insurance Company (Anthem Blue Cross Life and Health) and Monterey CountySchools Insurance Group (MCSIG) is hereby amended effective July 1, 2009.This Amendment shall supplement and amend the Agreement between MCSIG and Anthem Blue CrossLife and Health. If there are any inconsistencies between the terms of the Agreement and thisAmendment, the terms of this Amendment shall control.The following definition of PAID CLAIM is added to SECTION II: DEFINITIONS:PAID CLAIM. The amount charged to MCSIG for covered services or services provided during the termof the Agreement. Paid Claims may also include any applicable interest and any surcharges assessed bya state or government agency. In addition, Paid Claims shall be determined as follows:a. Provider and Vendor Claims. Except as otherwise provided in the Agreement, Paid Claims shallmean the amount Anthem Blue Cross Life and Health actually pays the provider or vendor (withoutregard to whether Anthem Blue Cross Life and Health reimburses such provider or vendor on apercentage of charges basis, a fixed payment basis, a global fee basis, or single case rate, or otherreimbursement methodology) or whether such amount is more or less than the provider’s or vendor’sactual Billed Charges for a particular service or supply.b. Performance Payments. If a provider or vendor participates in any Anthem Blue Cross Life andHealth program in which performance incentives, rewards or bonuses (“Performance Payments”) arepaid based on the achievement of certain goals, out<strong>com</strong>es or performance standards adopted byAnthem Blue Cross Life and Health (collectively, “Performance Targets”), Paid Claims shall alsoinclude the amount of such Performance Payments. Such Performance Payments may be chargedto MCSIG on a per claim, lump sum, per Employee, per Beneficiary, or a pro-rata apportionmentbasis. The amount charged to MCSIG may be greater than the amount actually paid to any oneparticular provider or vendor pursuant to the terms of the contract with such provider or vendor.c. Fees Paid to Manage Care or Costs. Paid Claims may also include paid to providers or vendors formanaging the care, or cost of care, for designated Beneficiaries. In addition, Paid Claims may alsoinclude an amount Anthem Blue Cross Life and Health charges to oversee programs and suchprogram charges, if any, shall be provided in Attachment C to the Agreement or Section 8 of thisAmendment.d. Claims Payment Pursuant to any Judgment, Settlement, Legal or Administrative Proceeding. PaidClaims shall include any claim amount paid as the result of a settlement, judgment, or legal,regulatory or administrative proceeding brought against the Plan and/or Anthem Blue Cross Life andHealth, or otherwise agreed to by Anthem Blue Cross Life and Health, with respect to the decisionsmade by Anthem Blue Cross Life and Health and MCSIG regarding the coverage of or amounts paidfor services under the terms of the Plan. Paid Claims also includes any amount paid as a result ofAnthem Blue Cross Life and Health’s billing dispute resolution procedures with a provider or vendor.Any such claims paid pursuant to this provision will count towards any stop loss accumulators undera stop loss agreement with Anthem Blue Cross Life and Health.18449.TRI-1.A6 09/19/20111ASO87CA Local

e. Claims Payment Pursuant to the BlueCard and Other BCBSA Programs. Paid Claims shall includeany amount paid for covered services incurred outside the geographical area that Anthem Blue CrossLife and Health serves and that are processed through the BlueCard Program or for any amountspaid for covered services provided through another BCBSA program (e.g. BCBSA Blue DistinctionCenters for Transplant).The Agreement is expanded to include the following in SECTION III: RESPONSIBILITIES OF ANTHEMBLUE CROSS LIFE AND HEALTH:MCSIG delegates to Anthem Blue Cross Life and Health fiduciary authority to determine claims forbenefits under the Plan as well as the authority to determine appeals of any adverse benefitdeterminations under the Plan. Anthem Blue Cross Life and Health shall administer <strong>com</strong>plaints andappeals according to Anthem Blue Cross Life and Health’s <strong>com</strong>plaint and appeals policy, unlessotherwise provided in the benefit booklet. In carrying out this authority, Anthem Blue Cross Life andHealth is delegated full discretion to determine eligibility for benefits under the Plan and to interpretthe terms of the Plan. Anthem Blue Cross Life and Health shall be deemed to have properlyexercised such authority unless a Beneficiary proves that Anthem Blue Cross Life and Health hasabused its discretion or that its decision is arbitrary and capricious. Anthem Blue Cross Life andHealth is a fiduciary of the Plan only to the extent necessary to perform its obligations and duties asexpressed in the Agreement and only to the extent that its performance of such actions constitutesfiduciary action. Anthem Blue Cross Life and Health shall not act as the administrator of the Plan norshall it have any fiduciary responsibility in connection with any other element of the administration ofthe Plan.Subsection 4.3. Tape Administration in SECTION IV: RESPONSIBILITIES OF MCSIG is deleted andreplaced by the following:MCSIG shall furnish to Anthem Blue Cross Life and Health initial eligibility information regardingBeneficiaries. MCSIG is responsible for determining eligibility of individuals and advising AnthemBlue Cross Life and Health in a timely manner, through a method agreed upon by the Parties, as towhich employees, dependents, and other individuals are to be enrolled Beneficiaries. Anthem BlueCross Life and Health reserves the right, in its sole discretion, to limit the effective date of retroactiveenrollment to a date not earlier than 60 days prior to the date notice is received. Such retroactiveenrollments shall be subject to Anthem Blue Cross Life and Health’s receipt of the applicable ServiceFees. The MCSIG shall keep such records and furnish to Anthem Blue Cross Life and Health suchnotification and other information as may be required by Anthem Blue Cross Life and Health for thepurpose of enrolling Beneficiaries, processing terminations, effecting COBRA coverage elections,effecting changes in single or family coverage status, effecting changes due to a Beneficiarybe<strong>com</strong>ing eligible or ineligible for Medicare, effecting changes due to a leave of absence, or for anyother purpose reasonably related to the administration of eligibility under Agreement. MCSIGacknowledges that prompt and <strong>com</strong>plete furnishing of the required eligibility information is essential tothe timely, accurate, and efficient processing of claims.MCSIG shall notify Anthem Blue Cross Life and Health monthly of the Beneficiaries, dependents, orother individuals that will be or have be<strong>com</strong>e ineligible for benefits under the Plan. Upon receipt ofsuch notice, Anthem Blue Cross Life and Health shall terminate coverage effective as of the datespecified in the benefit booklet. MCSIG shall give Anthem Blue Cross Life and Health advancenotice, if possible, of any Beneficiary’s expected termination and/or retirement. Anthem Blue CrossLife and Health reserves the right, in its sole discretion, to limit retroactive terminations to a maximumof three months prior to the date notice is received. Anthem Blue Cross Life and Health shall creditService Fees for each retroactive deletion up to a maximum of three months.SECTION V: RELATIONSHIP OF THE PARTIES is expanded to include the following:5.5 Anthem Blue Cross Life and Health may pay Performance Payments to providers or vendors asdescribed in the definition of Paid Claim in this Amendment. Anthem Blue Cross Life andHealth may perform a periodic settlement or reconciliation based on the provider’s or vendor’sperformance and experience against established Performance Targets that would: (1) requirethe provider or vendor to repay a portion of a Performance Payment previously paid by AnthemBlue Cross Life and Health; or (2) require Anthem Blue Cross Life and Health to make18449.TRI-1.A6 09/19/20112ASO88CA Local

additional payments. MCSIG acknowledges and agrees that it has no responsibility foradditional payments to providers or vendors nor any right in any discounts or excess moneyrefunded or paid to Anthem Blue Cross Life and Health from providers or vendors pursuant tosuch settlement/reconciliation arrangements, and neither it nor the Plan has any legal right orbeneficial interest in such sums retained by Anthem Blue Cross Life and Health. Similarly, ifproviders or vendors do not achieve established Performance Targets, Anthem Blue Cross Lifeand Health is not obligated to refund any amounts previously charged MCSIG. In turn, if underany such settlement/reconciliation Anthem Blue Cross Life and Health is required to payproviders or vendors excess <strong>com</strong>pensation for Beneficiary management performance, risksharingrewards, or other performance incentives, it shall not seek payment from MCSIG or thePlan, and neither MCSIG nor the Plan shall have any liability in connection with such amounts.Such providers or vendors may include Anthem Blue Cross Life and Health affiliates. Incalculating any Beneficiary co-insurance amounts in accordance with the benefit booklet,Anthem Blue Cross Life and Health does not take into account these settlement/reconciliationarrangements.5.6 The Parties acknowledge that Anthem Blue Cross Life and Health, in making decisionsregarding the scope of coverage of services under the benefit booklet, is not engaged in thepractice of medicine. Providers are not restricted in exercising their independent medicaljudgment by contract or otherwise and do not act on behalf of, or as agents for, Anthem BlueCross Life and Health or the Plan.Subsection 8.4. BlueCard Program in SECTION VIII: COMPENSATION is deleted and replaced by thefollowing:BlueCard ProgramLike all Blue Cross and Blue Shield Licensees, Anthem Blue Cross Life and Health InsuranceCompany (“Anthem Blue Cross Life and Health”) participates in a program called “BlueCard”.Whenever Beneficiaries access health care services outside the geographic area Anthem Blue CrossLife and Health serves, the claim for those services may be processed through BlueCard andpresented to Anthem Blue Cross Life and Health for payment in conformity with network access rulesof the BlueCard Policies then in effect (“Policies”). Under BlueCard, when beneficiaries receivecovered health care services within the geographic area served by an on-site Blue Cross and/or BlueShield Licensee (“Host Blue”), Anthem Blue Cross Life and Health will remain responsible to MCSIGfor fulfilling its contract obligations. However, the Host Blue will only be responsible, in accordancewith applicable BlueCard Policies, if any, for providing such services as contracting with itsparticipating providers and handling all interactions with its participating providers.Liability Calculation Method Per ClaimThe financial terms of BlueCard are described in the benefit booklet that is incorporated by referenceinto Anthem Blue Cross Life and Health’s contract with MCSIG. However, the calculation of MCSIG’sliability on claims for covered health care services incurred outside the geographic area Anthem BlueCross Life and Health serves and processed through BlueCard will be based on the negotiated priceAnthem Blue Cross Life and Health pays the Host Blue. The methods employed by a Host Blue todetermine a negotiated price will vary among Host Blues based on the terms of each Host Blue’sprovider contracts.The amount paid by the employee and MCSIG is a final price and will not be affected by BlueCard’spractice of prospective adjustment. In addition, the use of a liability calculation method of EstimatedPrice or Average Price (see benefit booklet) may result in some portion of the amount paid by MCSIGbeing held in a variance account by the Host Blue, pending settlement with its participating providers.Because all amounts paid are final, the funds held in a variance account, if any, do not belong toMCSIG and are eventually exhausted by provider settlements and through prospective adjustment tothe negotiated prices.Return of OverpaymentsUnder BlueCard, recoveries from a Host Blue or from participating providers of a Host Blue can arisein several ways, including, but not limited to, anti-fraud and abuse audits, provider/hospital audits,credit balance audits, utilization review refunds and unsolicited refunds. In some cases, the Host18449.TRI-1.A6 09/19/20113ASO89CA Local

Blue will engage third parties to assist in discovery or collection of recovery amounts. The fees ofsuch a third party are netted against the recovery. Recovery amounts, net of fees, if any, will beapplied in accordance with applicable BlueCard Policies, which generally require correction on aclaim-by-claim or prospective basis.BlueCard Fees and CompensationThe following Service Fees associated with participation in BlueCard and determined in accordancewith the applicable rules of the Blue Cross Blue Shield Association will be charged back to MCSIG:A. Access Fees. Access Fees are a percentage of the savings generated by the discountsbetween the Host Blue and the provider. Some Blue Cross Blue Shield Plans charge 7.16% ofthe savings generated by their provider discounts, up to a maximum of $2,000 per claim, as anetwork access fee. Contractholders with 1,000 up to and including 9,999 enrolled PPOemployees are charged Reduced Access Fees of 3.98% of savings as a network access fee upto a maximum of $2,000 per claim. Contractholders with 10,000 and over enrolled PPOemployees are charged Reduced Access Fees of 3.70% of savings as a network access fee upto a maximum of $2,000 per claim. Contractholders that fall below 10,000, but not below 1,000,enrolled PPO employees will be reverted back to the reduced fees of 3.98% of savings as anetwork access fee up to a maximum of $2,000 per claim. Contractholders that fall below 1,000enrolled PPO employees will be reverted back to the standard charge of 7.16% of savings aslisted above If there are no savings from these discounts, there will be no Access Fee charged.Other Blue Cross Blue Shield Plans have Consortium or Custom BlueCard Fee arrangements ona Per Contract Per Month (PCPM) or per claim basis. Access Fees are waived for plans withConsortium or Custom BlueCard Fee arrangements.A list of Blue Cross Blue Shield Plans which agree to charge Reduced Access Fees or haveConsortium or Custom BlueCard Fee arrangements is available upon request.B. Administrative Fees. Administrative Fees are service charges for each claim payment. SomeBlue Cross Blue Shield Plans charge fees of $11.00 for each institutional claim and $5.00 foreach professional claim paid under BlueCard. Contractholders with 1,000 and over enrolled PPOemployees are charged Reduced Administrative Fees of $9.75 per institutional and $4.00 perprofessional claim paid under BlueCard. Contractholders that fall below 1,000 enrolled PPOemployees will be reverted back to the Standard fees of $11.00 and $5.00 listed above.Other Blue Cross Blue Shield Plans have Consortium or Custom BlueCard Fee arrangements ona Per Contract Per Month (PCPM) or per claim basis. Administrative Fees are waived for planswith Consortium or Custom BlueCard Fee arrangements.A list of Blue Cross Blue Shield Plans which agree to charge Reduced Administrative Fees orhave Consortium or Custom BlueCard Fee arrangements is available upon request.C. Transaction Fees. There are Transaction Fees of $.05 per transaction with usually two to fourtransactions per claim on all fee arrangements.D. Central Finance Agency Fee (CFA). There is a CFA fee of $.20 per claim on all feearrangements.E. Electronic Claims Routing Process (ECRP). There is an ECRP charge of $1.00 per claim forall non-participating provider claims and all Medicare supplemental claims. Transaction Fees of$.05 per transaction and CFA Fees of $.05 per claim apply.These fees are subject to change in accordance with the applicable rules of the Blue Cross BlueShield Association and will be charged to MCSIG.Paragraph C of 10.5. Post-Termination Provisions in SECTION X: TERM OF THE AGREEMENT isdeleted and replaced by the following:Claims Runout Services shall be provided for the period of time provided in the Agreement, ifapplicable (the “Claims Runout Period”). During the Claims Runout Period, the terms of theAgreement shall continue to apply. Anthem Blue Cross Life and Health shall have no obligation toprocess or pay any claims or forward claims to MCSIG beyond the Claims Runout Period. Anyamounts recovered beyond the Claims Runout Period shall be retained by Anthem Blue Cross Life18449.TRI-1.A6 09/19/20114ASO90CA Local

and Health as reasonable <strong>com</strong>pensation for services under the Agreement. Anthem Blue Cross Lifeand Health shall, however, return any recoveries for which Anthem Blue Cross Life and Health hadreceived monies, but had not processed the recovery prior to the end of the Claims Runout Period.In addition, MCSIG shall have no obligation to reimburse Anthem Blue Cross Life and Health for anyamounts paid by Anthem Blue Cross Life and Health due to adjustments to claims after the end of theClaims Runout Period.The following is added to SECTION XIII: RECORDS:Anthem Blue Cross Life and Health and Anthem Blue Cross Life and Health affiliates shall have theright to use or disclose claims data collected in the performance of services under the Agreement orany other agreement between the Parties, so long as: (i) the data is de-identified in a mannerconsistent with the requirements of HIPAA; or (ii) the data is used or disclosed for research, healthoversight activities, or other purposes permitted by law; or (iii) a Beneficiary has consented to therelease of his or her individually identifiable data. The data used or disclosed shall be used for avariety of lawful purposes including, but not limited to, research, monitoring, and benchmarking ofindustry and health care trends. Anthem Blue Cross Life and Health may receive remuneration forthe data only if permitted by HIPAA.Subsection 14.2. Assignment of Rights in SECTION XIV: ASSIGNMENT is deleted and replaced by thefollowing:Unless it has first obtained the written consent of an officer of the other Party, neither Party mayassign the Agreement to any other person. Notwithstanding the foregoing, Anthem Blue Cross Lifeand Health may, with advance written notice to MCSIG, assign or otherwise transfer its rights andobligations hereunder, in whole or in part, to: (i) any affiliate of Anthem Blue Cross Life and Health;or (ii) any entity surviving a transaction involving the merger, acquisition, consolidation, orreorganization of Anthem Blue Cross Life and Health, or in which all or substantially all of AnthemBlue Cross Life and Health’s assets are sold. Additionally, MCSIG may, with advance written noticeto Anthem Blue Cross Life and Health, assign, delegate, or otherwise transfer its rights andobligations hereunder, in whole, to (i) any affiliate of MCSIG; or (ii) any entity surviving a transactioninvolving the merger, acquisition, consolidation or reorganization of MCSIG, or in which all orsubstantially all of MCSIG’s assets are sold, provided that such affiliate or other assignee presents, inAnthem Blue Cross Life and Health’s opinion, an equivalent or better financial status and credit risk.Either Party is required to provide advance written notice under this provision only to the extentpermissible under applicable law and the reasonable terms of the agreement(s) governing suchmerger, acquisition, consolidation, reorganization, or asset sale. If advance written notice is notallowed, notice shall be provided as soon as practicable. Upon receipt of notice of an assignment ofthe Agreement, the other Party may terminate the Agreement by providing the assigning Party with30 days advance written notice of termination. Any assignee of rights or benefits under theAgreement shall be subject to all of the terms and provisions of the Agreement. Either Party maysubcontract any of its duties under the Agreement without the prior written consent of other Party;however, the Party subcontracting the services shall remain responsible for fulfilling its obligationsunder the Agreement. Notwithstanding the foregoing, Anthem Blue Cross Life and Health will striveto provide MCSIG with advance notice of any significant changes in subcontracting arrangementswhere there is significant direct interaction between the Beneficiary and the subcontractor providingthe service, such as customer service.Recovery of Overpayments and Recovery of Liens, designated as D and E, respectively, under ITEMI: CLAIMS ADMINISTRATION in ATTACHMENT A – LIST OF PROVIDED SERVICES, are deleted intheir entirety and replaced by the following:a. MCSIG grants to Anthem Blue Cross Life and Health the right, but not the obligation, to pursuerecoveries related to Paid Claims processed under the Agreement, including during any ClaimsRunout Period. Anthem Blue Cross Life and Health shall exercise discretion to determine whichrecoveries it will pursue and, in no event will Anthem Blue Cross Life and Health pursue a recovery ifthe cost of the collection is likely to exceed the recovery amount or if the recovery is prohibited by lawor an agreement with a provider or vendor. Anthem Blue Cross Life and Health will not be liable forany amounts it does not successfully recover. If Anthem Blue Cross Life and Health determines that18449.TRI-1.A6 09/19/20115ASO91CA Local

there is a potential recovery opportunity, MCSIG grants Anthem Blue Cross Life and Health theauthority and discretion to do the following: (i) determine and take steps reasonably necessary andcost-effective to effect recovery; (ii) select and retain outside counsel or other vendors as appropriate;(iii) reduce any recovery obtained on behalf of the Plan by its proportionate share of the outsidecounsel fees and costs incurred during litigation or settlement activities to obtain such recovery; and(iv) negotiate and effect any settlement of MCSIG’s and Plan’s rights by, among other things,executing a release waiving MCSIG’s and Plan’s rights to take any action inconsistent with thesettlement.b. During the term of the Agreement and any applicable Claims Runout Period, Anthem Blue Cross Lifeand Health may pursue payments to Beneficiaries by any other person, insurance <strong>com</strong>pany or otherentity on account of any action, claim, request, demand, settlement, judgment, liability or expensethat is related to a claim for covered services (“Subrogation Services”). Anthem Blue Cross Life andHealth may charge MCSIG a fixed percentage fee up to 25% of gross subrogation recovery, or, ifoutside counsel is retained, 15% of net recovery after a deduction for outside counsel fees forSubrogation Services (“Subrogation Fee”). Any subrogation recoveries shall be net of theSubrogation Fee and shall be treated as an adjustment to the claims payment in the billing period inwhich the adjustment occurs as described in these paragraphs a, b, c and d. Subrogation Fees willnot be assessed on subrogation recoveries until they are received by Anthem Blue Cross Life andHealth and credited to MCSIG.c. Notwithstanding any other provision of these paragraphs a, b, c and d, Anthem Blue Cross Life andHealth has responsibility for <strong>com</strong>pliance with provider and vendor contracts, including discount andcontract audits. Anthem Blue Cross Life and Health shall have authority to enter into a settlement or<strong>com</strong>promise regarding enforcement of these contracts, including the right to reduce futurereimbursement to provider or vendor in lieu of a lump sum settlement. If Anthem Blue Cross Life andHealth conducts audits or reviews to enforce provider or vendor contracts or activities, and recoveriesor cost avoidance is a result of such audits, reviews or enforcement activities, then Anthem BlueCross Life and Health shall provide MCSIG a credit, after a reduction of third party vendor fees orcosts, if any. Anthem Blue Cross Life and Health shall credit MCSIG a proportionate share of the netrecovery equal to the ratio of (i) total Beneficiaries’ Paid Claims to such provider or vendor for theaudit period, to (ii) total payments made to such provider or vendor for all of Anthem Blue Cross Lifeand Health’s business during the audit period. Notwithstanding the above, Anthem Blue Cross Lifeand Health shall retain any recoveries made from a provider or vendor resulting from any audits orreviews if the cost to administer the refund is likely to exceed the total recovery from the provider orvendor.d. Anthem Blue Cross Life and Health shall credit MCSIG net recovery amounts after deduction of feesand costs as set forth in these paragraphs a, b, c and d not later than 150 days following the receiptof such recovery amounts. If Anthem Blue Cross Life and Health does not credit MCSIG within 150days of its receipt of recovery amounts, Anthem Blue Cross Life and Health shall pay MCSIG interestcalculated at the Federal Reserve Funds Rate in effect at the time of the payment. Anthem BlueCross Life and Health have contracts with network providers or vendors or there may be judgments,orders, settlements, applicable laws or regulations that limit Anthem Blue Cross Life and Health’sright to make recoveries under certain circumstances. MCSIG agrees that Anthem Blue Cross Lifeand Health shall not be responsible for any such amounts that it is unable to recover from suchproviders or vendors. Notwithstanding the provisions of these paragraphs a, b, c and d, Anthem BlueCross Life and Health may, but is not required to, readjudicate claims or adjust Beneficiaries’ costshare payments related to the recoveries made from a provider or a vendor. In no event, however,will Anthem Blue Cross Life and Health be liable to credit MCSIG for any recovery after thetermination date of the Agreement, including any Claims Runout Period, and MCSIG acknowledgesand agrees that such sums shall be retained by Anthem Blue Cross Life and Health as reasonable<strong>com</strong>pensation for recovery services provided by Anthem Blue Cross Life and Health.Cost Containment Programs, designated as B under ITEM II: COST CONTAINMENT inATTACHMENT A – LIST OF PROVIDED SERVICES, is deleted and replaced by the following:Anthem Blue Cross Life and Health may provide or arrange for the provision of the followingmanaged care services:18449.TRI-1.A6 09/19/20116ASO92CA Local

1. Conduct medical necessity review, utilization review, and a referral process, which may include,but is not limited to: (a) preadmission review to evaluate and determine the medical necessity ofan admission or procedure and the appropriate level of care, and for an inpatient admission, toauthorize an initial length of stay; (b) concurrent review throughout the course of the inpatientadmission for authorization of additional days of care as warranted by the patient’s medicalcondition; (c) retrospective review; and (d) authorizing a referral to a non-network provider.Anthem Blue Cross Life and Health shall have the authority to waive a requirement if, in AnthemBlue Cross Life and Health’s discretion, such exception is in the best interest of the Beneficiary orthe Plan, or is in furtherance of the provision of cost effective services under the Agreement.2. Perform case management to identify short and long term treatment programs in cases of severeor chronic illness or injury. Anthem Blue Cross Life and Health may, but is not required to,customize benefits in limited circumstances by approving otherwise non-covered services if, inthe discretion of Anthem Blue Cross Life and Health, such exception is in the best interest of theBeneficiary and the Plan.3. Anthem Blue Cross Life and Health shall offer programs to help MCSIG effectively manage thecost of care, and MCSIG shall pay fees for the programs selected by MCSIG only if such fees areindicated in Attachment C to the Agreement or Section 8 of this Amendment. MCSIG shall abideby all applicable policies and procedures of the programs selected, which may require MCSIG toprovide requested information prior to Anthem Blue Cross Life and Health initiating the service.The following ITEM VIII: CATASTROPHIC EVENT is added to ATTACHMENT A – LIST OF PROVIDEDSERVICES:If a catastrophic event (whether weather-related, caused by a natural disaster, or caused by war,terrorism, or similar event) occurs that affects Beneficiaries in one or more locations, and suchcatastrophic event prevents or interferes with Anthem Blue Cross Life and Health’s ability to conductits normal business with respect to such Beneficiaries or prevents or interferes with Beneficiaries’ability to access their benefits, Anthem Blue Cross Life and Health shall have the right, without firstseeking consent from MCSIG, to take reasonable and necessary steps to process claims and providemanaged care services in a manner that may be inconsistent with the benefit booklet in order tominimize the effect such catastrophic event has on Beneficiaries. As soon as practicable, AnthemBlue Cross Life and Health shall report its actions to MCSIG. MCSIG shall reimburse Anthem BlueCross Life and Health for amounts paid in good faith under the circumstances and such amountsshall constitute Paid Claims, even if the charges incurred were not for services otherwise coveredunder the benefit booklet.The following is added to ATTACHMENT C – SCHEDULE OF SERVICE FEES:Access Fee for Certain Claims Processed When the Host Blue is an Affiliated Plan. When theHost Blue is a <strong>com</strong>pany that is under <strong>com</strong>mon ownership with Anthem Blue Cross Life and Health (an“Affiliated Host Plan”), the Service Fees include an additional monthly network access fee of $8.50per employee per month for employees residing in the geographic area serviced by the Affiliated HostPlan (the “Service Area”). Such fee shall apply when the arrangement between Anthem Blue CrossLife and Health and the Affiliated Host Plan provides that processing of claims relating to coveredservices received by Beneficiaries in the Affiliated Host Plan’s Service Area occurs on a <strong>com</strong>monsystem. The Affiliated Host Plans that are included in this Access Fee and the methodology forcalculating this Access Fee, including but not limited to, the threshold number of members residing inan Affiliated Host Plan’s Service Area that are required before an Access Fee will be assessed, willbe designated by Anthem Blue Cross Life and Health and may be changed by Anthem Blue CrossLife and Health as additional Affiliated Host Plans share <strong>com</strong>mon systems with Anthem Blue CrossLife and Health.18449.TRI-1.A6 09/19/20117ASO93CA Local

AUTHORIZATIONThe authorized representatives of the parties have signed this Amendment to indicate agreement hereto.FOR ANTHEM BLUE CROSS LIFE AND HEALTHby: _______________________________ by: _______________________________Kathy KieferTitle: Title: SecretaryFOR MCSIGBy:_______________________________Title:_______________________________Date:_______________________________18449.TRI-1.A6 09/19/20118ASO94CA Local

ACTION ITEMS95

Report from the Executive Director to the MCSIG Executive Committee at the Meetingof July 17, 2012.Subject:Consider 2 nd Annual TelaDoc Utilization ReportBackgroundAt their September 2009 meeting, the Full Board voted to add the TelaDoc benefit to theself-funded medical coverage program effective January 1, 2010.The TelaDoc benefit was added as a convenience for our members and as a strategy toreduce inappropriate use of expensive emergency rooms for primary care treatment.TelaDoc estimated that with adoption of the $10 employee co-pay level, MCSIG would reacha break-even point against the program costs at the 5% re-direct level. TelaDoc furtherestimated that in the first year of the program we would achieve a 10% re-direct level, anestimated annual savings of approximately $187,230. These estimates were based onTelaDoc’s experience with similarly sized clients.Member experience with the TelaDoc program has been resoundingly positive.DiscussionIn February 2011, staff presented the Committee with a utilization report for the first twelvemonths of the program. Although we did not achieve a 5% re-direct level in the first twelvemonthsof the program, the Committee, based on a marketing plan, voted to continue theprogram to see if the program ROI improved.The marketing program executed throughout 2011 included the following:• Keenan printed refrigerator magnets containing contact numbers for all of the MCSIGprograms. Those magnets were distributed to the participants.• Second-year marketing efforts included:o Member testimonials and how-to-access articles in the MCSIG newslettero Direct TelaDoc mailings to members (four quarterly postcards over the courseof the second year)o Another MHD contestIn addition, TelaDoc:o Reduced the pepm fee to $1.00 (down from $1.50)o Placed a portion of their pepm fee at risk as part of a re-direct level guaranteein conjunction with a member <strong>com</strong>munication planKeith Brown from Keenan & Associates will present a 2.5 year ROI analysis (attached) attoday’s meeting.Re<strong>com</strong>mendationThat the Committee receive the 2.5 ROI analysis and provide direction to the ExecutiveDirector.196

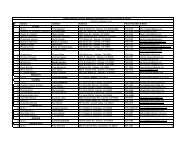

Monterey County Schools Insurance GroupTela-Doc Ideas for Discussion/PEPM vs. Admin. FeeJan 2010 - Dec 2010Primary Dependent Total Primary Dependent Total Primary Dependent TotalDate Members Members Members MHDs MHDs MHDs Consults Consults ConsultsJan-10 5,766 6,331 12,097 69 10 79 5 0 5Feb-10 5,749 6,307 12,056 94 17 111 10 1 11Mar-10 5,740 6,314 12,054 125 28 153 15 6 21Apr-10 5,724 6,290 12,014 138 31 169 9 2 11May-10 5,710 6,312 12,022 145 32 177 11 3 14Jun-10 5,689 6,305 11,994 157 35 192 4 1 5Jul-10 5,542 6,137 11,679 162 39 201 7 2 9Aug-10 5,420 6,018 11,438 164 43 207 11 4 15Sep-10 5,475 6,031 11,506 190 43 233 15 3 18Oct-10 5,481 5,975 11,456 215 52 267 18 5 23Nov-10 5,471 5,818 11,289 239 60 299 17 5 22Dec-10 5,459 5,830 11,289 263 67 330 20 7 27Totals 67,226 73,668 11,289 1,961 457 2,418 142 39 1812010 PEPM $1.50 Option #1 2011 PEPM $1.25 Option #2 2011 PEPM $1.00Annual Fee $100,839 Annual Fee $84,033 Annual Fee $67,226Actual Results vs. Proposed ResultsPCP Visits UC Visits ER Visits Total VisitsTotal Visits 45,708 968 2,459 49,135Cost/Visit $74.90 $68.65 $1,166.09 $129.39Total Costs $3,423,529 $66,453 $2,867,415 $6,357,3985% Redirects 2,285 48 123 2,457 Admin Fee Per RedirectRedirect Savings $171,176 $3,323 $143,371 $317,870 =$102,649 (Estimated Investment / 2,457 (Estimated Redirects)$41.78PCP Visits UC Visits ER Visits Total Visits Savings Per RedirectActual Redirects 86 84 11 181 PCP UC ERCost/Visit $74.90 $68.65 $1,166.09 $129.39 $33.12 $26.87 $1,124.31Actual Savings $6,441 $5,767 $12,827 $25,035Investment - PEPM $100,839Investment - 181 visits x $10 copay $1,810Total Investment $102,649Gain/Loss on Investment ($77,614)R.O.I. -75.61%97

Monterey County Schools Insurance GroupTela-Doc Ideas for Discussion/PEPM vs. Admin. FeeJan 2011 - Dec 2011Primary Dependent Total Primary Dependent Total Primary Dependent TotalDate Members Members Members MHDs MHDs MHDs Consults Consults ConsultsJan-11 5,459 6,195 11,654 309 71 380 13 7 20Feb-11 5,405 6,189 11,594 299 71 370 13 4 17Mar-11 5,401 6,180 11,581 125 28 153 11 4 15Apr-11 5,427 6,300 11,727 138 31 169 17 8 25May-11 5,423 6,396 11,819 145 32 177 20 7 27Jun-11 5,407 6,469 11,876 157 35 192 6 4 10Jul-11 4,730 5,475 10,205 162 39 201 11 4 15Aug-11 4,651 5,450 10,101 164 43 207 12 2 14Sep-11 4,763 5,544 10,307 190 43 233 10 7 17Oct-11 4,740 5,475 10,215 215 52 267 15 5 20Nov-11 4,770 5,522 10,292 239 60 299 21 4 25Dec-11 4,757 5,546 10,303 263 67 330 30 12 42Totals 60,933 70,741 10,303 2,406 572 2,978 179 68 2472011 PEPM $1.00 Option #1 2012 PEPM $1.00 Option #2 2012 PEPM $0.85Annual Fee $60,933 PG Annual Fee $60,933 No PG Annual Fee $51,793Actual Results vs. Proposed ResultsPCP Visits UC Visits ER Visits Total VisitsTotal Visits 40,453 998 2,528 43,979Cost/Visit $79.69 $74.80 $964.43 $130.44Total Costs $3,223,700 $74,650 $2,438,079 $5,736,4295% Redirects 2,023 50 126 2,199 Admin Fee Per RedirectRedirect Savings $161,185 $3,733 $121,904 $286,821 =$63,403 Estimated Investment / 2,199 (Estimated Redirects)$28.83PCP Visits (1) UC Visits ER Visits Total Visits (2) Savings Per RedirectActual Redirects 97 106 19 222 PCP UC ERCost/Visit $79.69 $74.80 $964.43 $153.08 $50.86 $45.97 $935.60Actual Savings $7,730 $7,929 $18,324 $33,983Investment - PEPM $60,933Investment - 247 consults x $10 copay $2,470Total Investment $63,403Gain/Loss on Investment ($29,420)R.O.I. -46.40%(1)(2)PCP Visits include Specialists Visits.25 did not require any treatment.98

Monterey County Schools Insurance GroupTela-Doc Ideas for Discussion/PEPM vs. Admin. FeeJan 12 - Jun 12RedirectsPrimary Dependent Total Primary Dependent Total Primary Dependent Total NoDate Members Members Members MHDs MHDs MHDs Consults Consults Consults PCP UC ER Treatment TotalJan-12 4,724 5,578 10,302 363 116 479 31 5 36 15 16 2 3 36Nov-12 4,716 5,557 10,273 381 126 507 19 7 26 12 12 1 1 26Mar-12 4,716 5,565 10,281 401 131 532 27 8 35 8 22 0 5 35Apr-12 4,702 5,559 10,261 409 137 546 20 7 27 9 16 0 2 27May-12 4,699 5,585 10,284 417 141 558 10 7 17 10 6 0 1 17Jun-12 4,691 5,656 10,347 425 144 569 21 6 27 8 12 1 6 27Jul-12Aug-12Sep-12Oct-12Nov-12Dec-12Totals 28,248 33,500 61,748 2,396 795 3,191 128 40 168 62 84 4 18 1682012 PEPM $1.00 Option #1 2012 PEPM $1.00 Option #2 2012 PEPM $0.85Annual Fee $28,248 PG Annual Fee $28,248 No PG Annual Fee $24,011Actual Results vs. Proposed ResultsPCP Visits UC Visits ER Visits Total VisitsTotal Visits 19,518 620 1,121 21,259Cost/Visit $79.32 $72.83 $966.60 $125.92Total Costs $1,548,168 $45,155 $1,083,559 $2,676,8815% Redirects 976 31 56 1,063 Admin Fee Per RedirectRedirect Savings $77,408 $2,258 $54,178 $133,844 =$29,928 Estimated Investment / 1,063 (Estimated Redirects)$28.15PCP Visits (1) UC Visits ER Visits Total Visits (2) Savings Per RedirectActual Redirects 62 84 4 150 PCP UC ERCost/Visit $79.32 $72.83 $966.60 $99.35 $51.17 $44.68 $938.45Actual Savings $4,918 $6,118 $3,866 $14,902Investment - PEPM $28,248Investment - 168 consults x $10 copay $1,680Total Investment $29,928Gain/Loss on Investment ($15,026)R.O.I. -50.21%(1)(2)PCP Visits include Specialists Visits.18 did not require any treatment.99

100Report from the Executive Director to the MCSIG Executive Committee at the Meeting ofAugust 21, 2012.Subject:Consider Approving Big Sur Charter School Membership in MCSIGBackgroundThe Big Sur Charter School is currently a member of MCSIG through the Big Sur Unified SchoolDistrict (formerly Pacific Unified School District).DiscussionMCSIG was recently contacted by staff from Big Sur Charter and provided documents evidencingthat Big Sur Charter School had been granted independent charter status by their authorizingagent, Big Sur Unified School District. Big Sur Charter School seeks to remain a member ofMCSIG as a stand-alone charter school.Three other independent charter schools currently belong to MCSIG: Learning For Life Charter,Bay View Academy Charter and Monterey Bay Charter.Staff conferred with general legal counsel and was advised to utilize our standard process forbringing new members into MCSIG.Toward that end, staff requested the Big Sur Charter Board adopt a resolution approving the 2012revised JPA Agreement and approve and sign attached Participation Agreement for presentationto the MCSIG Board for approval. A signed copy will be made available at today’s meeting.Re<strong>com</strong>mendationThat the Executive Committee approve the Big Sur Charter School as an independent memberof MCSIG re<strong>com</strong>mend same to the Full Board.

PARTICIPATION AGREEMENT BETWEEN THEMONTEREY COUNTY SCHOOLS INSURANCE GROUPAND BIG SUR CHARTER SCHOOLWHEREAS, the Monterey County Schools Insurance Group (MCSIG) is a joint powersauthority properly constituted under the laws of the State of California which administers a selfinsuredhealth and welfare program;WHEREAS, MCSIG offers health insurance and related coverage to public schooldistricts in Monterey and adjacent counties;WHEREAS, Big Sur Charter School currently participates in MCSIG as member of theBig Sur Unified School District; andWHEREAS, Big Sur Charter School recently became an independent California charterschool properly constituted under the laws of the State of California; andWHEREAS, Big Sur Charter School wishes to participate in MCSIG as a separate districtmember, effective July 1, 2012;NOW, THEREFORE, the parties to this Agreement do hereby agree as follows:1. Big Sur Charter School agrees to be subject to MCSIG’s JPA Agreement and Bylaws, including asthose documents may from time to time be amended.2. Big Sur Charter School understands and agrees to the provisions in MCSIG bylaws requiring aninitial membership <strong>com</strong>mitment of three years and Big Sur Charter School further understands andagrees that any withdrawal must <strong>com</strong>ply with the relevant provisions of the MCSIG bylaws,including but not limited to the bylaws’ notice provisions, and/or any relevant policies pertaining towithdrawal as may be adopted or revised by the Board.3. Big Sur Charter School agrees to make, as of July 1, 2012, monthly per-participant contributions toMCSIG in accord with MCSIG procedures and in the aggregate per-participant amounts set forth onattachment A to this Agreement, including as these amounts may from time to time be increased ormodified by the Board.4. Active employees and retirees may participate in MCSIG’s dental or vision plans at the samerates assessed for other groups participating in MCSIG. MCSIG’s orthodontia benefit is notavailable on an individual basis; the benefit must be selected by an entire bargaining unit ordistrict. The entire unit or district, including individuals retired from that group or district, mustparticipate in, and pay the rate for, the orthodontia benefit.5. Retirees who are eligible for Medicare are restricted to selecting MCSIG’s MedicarePage 1 of 2 pages101

Supplemental plan or Medical Plan PPO Option I (with Medicare).6. Retirees may not expand upon the MCSIG coverage and dependent elections made by theretiree at the time of initial enrollment as a retiree. For example, if a retiree does not choosedental coverage at the time of initial enrollment, the retiree cannot thereafter add that coverage.If a retiree does not enroll a spouse at the time of initial enrollment, that spouse cannotthereafter be added. A retiree; however, is permitted at any time to delete coverages ordependents.7. Big Sur Charter School agrees to be subject to MCSIG’s policies and procedures, includingMCSIG’s minimum medical coverage policy (attachment B) to this Agreement, including asthese policies and procedures may from time to time be amended, altered, rescinded, ormodified.8. For purposes of this agreement only, the term participant shall refer to an eligible employee oran eligible retiree but not to a dependent of either.9. This Agreement may only be amended in writing.10. This Agreement reflects the final agreement of the parties, and any prior agreements orunderstandings not contained in this Agreement are null and void.11. This Agreement is effective July 1, 2012.The undersigned parties by their signing agree to the terms of this Agreement,MONTEREY COUNTY SCHOOLSINSURANCE GROUPBIG SUR CHARTER SCHOOLBy: _____________________________ By: _____________________________GARRY BOUSUM, President, PresidentDated:_____________________________Dated:___________________________Date of Ratification by JPA Board:____________________________________Page 2 of 2 pages102

103CodeACTIVE EmployeesMEDICAL, DENTAL & VISION2012/2013Monthly Premium RatesPreferred Provider Options (PPO)Option IOption IIIEmployee Employee + One Employee + Family CodeEmployee Employee + One Employee + Family41 $863.30 $1,723.36 $2,239.40 42 $573.67 $1,144.11 $1,486.36Code48Code43Exclusive Provider Option (EPO)Employee Employee + One Employee + Family$509.37 $1,015.48 $1,319.14Health Maintenance Organization (HMO)Anthem Premiere 10Employee Employee + One Employee + Family$921.99 $1,384.79 $1,914.82Dental(no orthodontia)Dental PremiumDelta Dental Plan of Ca.Dental(with orthodontia)OPTIONEmployee Employee + One Employee + Family Employee Employee + One Employee + FamilyLOW $46.94 $86.65 $138.97 $47.96 $90.02 $154.76MEDIUM $50.53 $93.84 $151.59 $51.58 $97.21 $167.42HIGH $55.94 $102.85 $167.86 $56.98 $106.23 $183.66OPTIONABCVision PremiumVision Service Plan (VSP)Employee Employee + 1 Employee + Family$11.19 $16.16 $28.99$12.22 $17.33 $30.92$12.33 $20.62 $36.992012/2013 Premium Rates Adopted: May 15, 2012Rate sheet reflects premium rates for all actives - includes life insurance

104CodeEARLY Retirees *MEDICAL, DENTAL & VISION2012/2013Monthly Premium RatesPreferred Provider Options (PPO)Option IOption IIIEmployee Employee + One Employee + Family CodeEmployee Employee + One Employee + Family41 $860.05 $1,720.11 $2,236.15 42 $570.42 $1,140.86 $1,483.11Code48Employee$506.12Exclusive Provider Option (EPO)Employee + One$1,012.23Employee + Family$1,315.89Code43Employee$918.74Health Maintenance Organization (HMO)Employee + One$1,381.54Employee + Family$1,911.57Dental(no orthodontia)Dental PremiumDelta Dental Plan of Ca.Dental(with orthodontia)OPTIONEmployee Employee + One Employee + Family Employee Employee + One Employee + FamilyLOW $46.94 $86.65 $138.97 $47.96 $90.02 $154.76MEDIUM $50.53 $93.84 $151.59 $51.58 $97.21 $167.42HIGH $55.94 $102.85 $167.86 $56.98 $106.23 $183.66OPTIONABCVision PremiumVision Service Plan (VSP)Employee Employee + 1 Employee + Family$11.19 $16.16$28.99$12.22$17.33 $30.92$12.33 $20.62$36.99*NO Medicare2012/2013 Premium Rates Adopted: May 15, 2012Rate sheet reflects premium rates for all early retirees; does not include life insurance

105CodeRetireew/MedicareRetiree & SpouseBoth w/Medicare1 w/Medicare1 non-MedicareFamily + 3 Or Morew/MedicareFamily + 2w/MedicareFamily + 1w/Medicare41 $ 563.29 $ 857.98 $ 1,051.83 $ 1,189.90 $ 1,421.27 $ 1,612.15CodeRetireew/MedicareRetiree & SpouseBoth w/MedicareFamily + 3w/MedicareFamily + 4w/Medicare47 $ 628.61 $ 1,226.12 $ 1,823.83 $ 2,062.00OPTIONMonthly Premium RatesPreferred Provider Option (PPO)* Rates effective through December 31, 2012Option IRetirees with MedicareMedicare Supplemental ** Rates effective July 1, 2012Anthem Assurance 1Retirees with MedicareDental Premium Rates effective July 1, 2012Dental(no orthodontia)RETIREES with MedicareMEDICAL, DENTAL & VISION2012/2013Delta Dental Plan of Ca.Dental(with orthodontia)Employee Employee + One Employee + Family Employee Employee + One Employee + FamilyLOW $46.94 $86.65 $138.97 $47.96 $90.02 $154.76MEDIUM $50.53 $93.84 $151.59 $51.58 $97.21 $167.42HIGH $55.94 $102.85 $167.86 $56.98 $106.23 $183.66OPTIONABCEmployee$11.19$12.22$12.33Vision Premium Rates effective July 1, 2012Vision Service Plan (VSP)Employee + 1$16.16$17.33$20.62Employee + Family$28.99$30.92$36.992012/2013 Premium Rates Adopted: May 15, 2012** Note: The above Option I with Medicare rates in effect until January 1, 2013 - per CMS rules.the above Option I rates will change January 1, 2013; rates to be determined** Note: Medicare supplemental plan is full-insured product of AnthemRate sheet reflects premium rates for all retirees with Medicare