You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

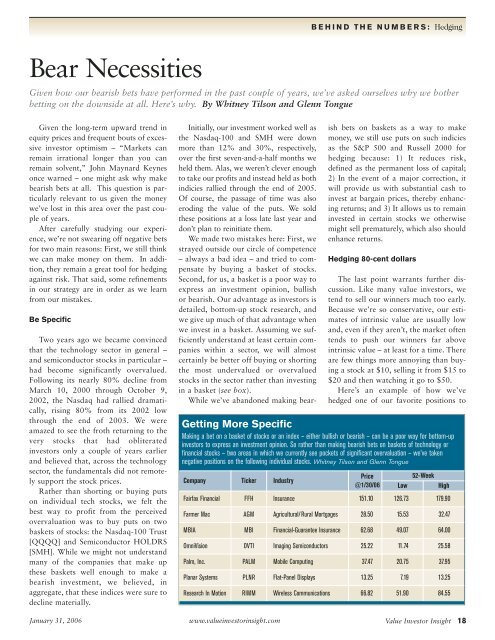

BEHIND THE NUMBERS: HedgingBear NecessitiesGiven how our bearish bets have performed in the past couple of years, we’ve asked ourselves why we botherbetting on the downside at all. Here’s why. By Whitney <strong>Tilson</strong> and Glenn TongueGiven the long-term upward trend inequity prices and frequent bouts of excessiveinvestor optimism – “Markets canremain irrational longer than you canremain solvent,” John Maynard Keynesonce warned – one might ask why makebearish bets at all. This question is particularlyrelevant to us given the moneywe’ve lost in this area over the past coupleof years.After carefully studying our experience,we’re not swearing off negative betsfor two main reasons: First, we still thinkwe can make money on them. In addition,they remain a great tool for hedgingagainst risk. That said, some refinementsin our strategy are in order as we learnfrom our mistakes.Be SpecificTwo years ago we became convincedthat the technology sector in general –and semiconductor stocks in particular –had become significantly overvalued.Following its nearly 80% decline fromMarch 10, 2000 through October 9,2002, the Nasdaq had rallied dramatically,rising 80% from its 2002 lowthrough the end of 2003. We wereamazed to see the froth returning to thevery stocks that had obliteratedinvestors only a couple of years earlierand believed that, across the technologysector, the fundamentals did not remotelysupport the stock prices.Rather than shorting or buying putson individual tech stocks, we felt thebest way to profit from the perceivedovervaluation was to buy puts on twobaskets of stocks: the Nasdaq-100 Trust[QQQQ] and Semiconductor HOLDRS[SMH]. While we might not understandmany of the companies that make upthese baskets well enough to make abearish investment, we believed, inaggregate, that these indices were sure todecline materially.Initially, our investment worked well asthe Nasdaq-100 and SMH were downmore than 12% and 30%, respectively,over the first seven-and-a-half months weheld them. Alas, we weren’t clever enoughto take our profits and instead held as bothindicies rallied through the end of 2005.Of course, the passage of time was alsoeroding the value of the puts. We soldthese positions at a loss late last year anddon’t plan to reinitiate them.We made two mistakes here: First, westrayed outside our circle of competence– always a bad idea – and tried to compensateby buying a basket of stocks.Second, for us, a basket is a poor way toexpress an investment opinion, bullishor bearish. Our advantage as investors isdetailed, bottom-up stock research, andwe give up much of that advantage whenwe invest in a basket. Assuming we sufficientlyunderstand at least certain companieswithin a sector, we will almostcertainly be better off buying or shortingthe most undervalued or overvaluedstocks in the sector rather than investingin a basket (see box).While we’ve abandoned making bearishbets on baskets as a way to makemoney, we still use puts on such indiciesas the S&P 500 and Russell 2000 forhedging because: 1) It reduces risk,defined as the permanent loss of capital;2) In the event of a major correction, itwill provide us with substantial cash toinvest at bargain prices, thereby enhancingreturns; and 3) It allows us to remaininvested in certain stocks we otherwisemight sell prematurely, which also shouldenhance returns.Hedging 80-cent dollarsThe last point warrants further discussion.Like many value investors, wetend to sell our winners much too early.Because we’re so conservative, our estimatesof intrinsic value are usually lowand, even if they aren’t, the market oftentends to push our winners far aboveintrinsic value – at least for a time. Thereare few things more annoying than buyinga stock at $10, selling it from $15 to$20 and then watching it go to $50.Here’s an example of how we’vehedged one of our favorite positions toGetting More SpecificMaking a bet on a basket of stocks or an index – either bullish or bearish – can be a poor way for bottom-upinvestors to express an investment opinion. So rather than making bearish bets on baskets of technology orfinancial stocks – two areas in which we currently see pockets of significant overvaluation – we’ve takennegative positions on the following individual stocks. Whitney <strong>Tilson</strong> and Glenn TongueCompany Ticker IndustryPrice@1/30/0652-WeekFairfax Financial FFH Insurance 151.10 126.73 179.90Farmer Mac AGM Agricultural/Rural Mortgages 28.50 15.53 32.47MBIA MBI Financial-Guarantee Insurance 62.68 49.07 64.00OmniVision OVTI Imaging Semiconductors 25.22 11.74 25.58Palm, Inc. PALM Mobile Computing 37.47 20.75 37.95Planar Systems PLNR Flat-Panel Displays 13.25 7.19 13.25Research In Motion RIMM Wireless Communications 66.82 51.90 84.55LowHighJanuary 31, 2006www.valueinvestorinsight.com<strong>Value</strong> <strong>Investor</strong> <strong>Insight</strong> 18

BEHIND THE NUMBERS: Hedgingavoid selling too soon – and why we don’tregret losing money on the hedging so far:We think McDonald’s [MCD, $35.78] iseasily worth $40 per share, based on a16x multiple of the $2.50 per share offree cash flow we think the company canearn in the not-too-distant future. Whenthe stock hit $32 in late 2004 – havingrisen steadily from a low of around $12in March 2003, when we last purchased it– it was, in our opinion, the proverbial80-cent dollar.In the past we might have sold andlocked in our gains, but this would havetriggered big taxes and, more importantly,denied us the healthy long-term compoundingwe expect from this stock overmany years to come. Instead we boughtlong-dated puts on the S&P 500, whichwe felt were very attractively priced, witha notional value proportional to ourholdings in McDonald’s. In this way, wecould hedge our McDonald’s positionagainst the possibility of a substantialmarket decline, yet still benefit from theupside of an undervalued stock that webelieved was highly likely to outperformthe S&P 500 over time.So what has happened? The S&P 500has risen, volatility has fallen and timehas elapsed, all of which have caused theS&P 500 put position to decline.Multiply this across a number of positionsand it’s easy to see how this strategylost us a lot of money.Is hedging 80-cent dollars – when theHEDGING AS INSURANCE:The fact our home didn’t burndown doesn’t mean we’re upsetwe lost 100% of our “investment”in home insurance.cost of hedging is at or near all-time lows– the wrong strategy? We don’t believeso. Buying insurance always looks wrongin hindsight when the event you insuredagainst doesn’t happen. But the fact thatour home didn’t burn down last yeardoesn’t mean we’re upset that we lost100% of our “investment” in our homeinsurancepolicy – and it doesn’t keep usfrom renewing our policy.Capital preservation is far moreimportant to us than keeping up with theS&P 500 over short time periods. We dobelieve, however, that we erred somewhatin how we sized our “insurance” policies– in essence, we took a good idea andoverdid it. All of our index put positionstended to move together, so we effectivelyhad more insurance than we needed. Thisserved us well during the down months of2005, but cost us for the year as a whole.In addition, our buying of at-the-moneyputs was, in hindsight, a mistake. We’renot trying to hedge against modest 5-10% declines, but against a much largercorrection, so we’ve recently been buying10% out-of-the-money puts. Finally, ourmacro concerns lessened our confidencein our long stock positions more thanthey should have. We’re still hedging our80-cent dollars, but at what we now thinkare more appropriate levels. VII<strong>Funds</strong> managed by Whitney <strong>Tilson</strong> andGlenn Tongue own puts on the S&P 500, Russell2000 and MBIA, and are short Fairfax Financial,Farmer Mac, MBIA, OmniVision, Palm, Inc.,Planar Systems and Research In Motion.Profit in L.A.at the 2006 <strong>Value</strong> Investing Congress West!We are assembling another high-powered group ofbrilliant, successful investors who will teach theirinvestment philosophies and techniques, as well as sharetheir very best, actionable investment ideas including:• Whitney <strong>Tilson</strong>, <strong>Value</strong> <strong>Investor</strong> <strong>Insight</strong>• John Rogers, Ariel Capital• Dan Loeb, Third Point• Jeff Ubben, <strong>Value</strong>Act Capital• J. Carlo Cannell, Cannell Capital• Bill Miller, Legg Mason• Mitch Julis, Canyon Capital Advisors• Steve Romick, First Pacific Advisors• Tom Brown, Second Curve Capital• Mohnish Pabrai, Pabrai <strong>Funds</strong>NO PANELS! Each session is taught by one of our experts – in-depth –and includes time for your questions. In addition, our experts willexplain their best and most current investment ideas in detail.Optimally scheduled between the Berkshire Hathaway andWesco annual meetings so we can all easily attend Wescotogether and learn from the incomparable Charlie Munger!Limited Attendance – Avoid Disappointment!The Congress is limited to the first 480 paid registrantson a first-come, first-served basis.REGISTER TODAY!VALUE INVESTOR INSIGHT READERSSAVE UP TO AN EXTRA $150!REGISTER ONLINE AT:http://www.valueinvestingcongress.comYour discount code is VICVIIA1January 31, 2006www.valueinvestorinsight.com<strong>Value</strong> <strong>Investor</strong> <strong>Insight</strong> 19

BEHIND THE NUMBERS: Hedging IIComing Up ShortShort selling shares two key traits with the airline industry: New players keep coming into thebusiness … and net industry profits over time are below zero. By Joseph FeshbachEditors’ Note: In our last issue (VII,January 31, 2006), Whitney <strong>Tilson</strong> andGlenn Tongue argued that bearish betsthrough short sales and put options arepotentially viable money makers and asound way to hedge risk. This prompteda response from Joseph Feshbach, whosees short-selling as a loser’s game. Giventhat Joe, along with brothers Kurt andMatt, ran the largest short-only investmentfund in the 1980s, we were eager tohear this counter argument.February 28, 2006“Investing is most intelligent when itis most businesslike,” wrote BenjaminGraham, a sentiment that WarrenBuffett has described as containingamong the nine most important wordsever uttered about investing. Given that,how would you judge an investing strategywith the following fundamental economiccharacteristics:1) Limited potential returns, butunlimited potential losses2) Skyrocketing competition3) Tax inefficiency4) Aggregate net losses over its history5) The elimination of a significantsource of income in recent years6) Risk of asset repossession atcreditors’ whimHaving spent 15 years of my careerdoing nothing but short selling – withperiods of great prosperity and other periodsof fast, painful losses – I can arguewith some authority that, as an investmentstrategy, shorting suffers from eachof these characteristics of a bad business.“I thought buying the boat would make him moreoptimistic about the future but apparently not...”www.valueinvestorinsight.comNothing in my investing career hasbeen more satisfying than identifying andprofiting from the emperor-has-noclothesopportunities we repeatedlyfound in the 1980s. But I’ve come tobelieve that the game has become sostacked against the short seller that it’sjust not worth the periodic emotional andmonetary high that comes from beingright with a bearish bet.The business of shorting has only gottentougher since my brothers and I left itin the early 1990s. Rebates on the shortcredit – a share of the interest earned onthe short-sale proceeds – used to be a significantsource of income for short sellers,but have all but disappeared due to lowinterest rates and even “negative rebates”on hard-to-borrow stocks. There are nowa few thousand hedge funds looking atthe same short opportunities, versus afew dozen 20 years ago. The tax inefficiencyis more pronounced than ever:short-sale profits are taxed at a shorttermcapital-gains rate that is approximately2.5 times the rate for long-termgains. The landscape is littered with thecarcasses of short-only funds that nevermade money, while long-term winnersare about as numerous as those in the airlineindustry.Whitney <strong>Tilson</strong> and Glenn Tongue arein good company with the poor performanceof their bearish bets. According tothe investor presentation Carl Icahn usedin launching his activist hedge fund lastyear, his returns from a mere 15 longpositions from 1996 to 2004 generated$1.5 billion in profits. Conversely, his 24short positions produced a comparativelysmall $150 million in profits, 85% ofwhich came from a single position,Conseco (a stock, by the way, that Ishorted about ten years too early!). Giventhat this period included three years of agut-wrenching bear market, even Icahnhimself must be questioning the real benefitof shorting.<strong>Value</strong> <strong>Investor</strong> <strong>Insight</strong> 20

BEHIND THE NUMBERS: Hedging IIWhitney and Glenn offer a key argumentfor making bearish bets: hedging.Specifically, they see such bets as “insurance”against their portfolio of “80-centdollars,” and take comfort in the analogythat “The fact our home didn’t burndown doesn’t mean we’re upset that welost 100% of our ‘investment’ in homeinsurance.”But any insurance only makes sense ata given cost, which I’d argue is too highwhen it comes to short-selling. Greatshort-sellers like Michael Steinhardt andEdward “Rusty” Rose have made significantprofits over the course of theircareers from shorting, but from my interactionswith each, it was always clear thattheir motives in shorting were not as“insurance,” but as a vehicle to createhigh absolute profits in every single position,in up markets or down.Are put options a better alternativethan shorting for making bearish bets?They do take away the risk of unlimitedloss and aren’t susceptible to shortsqueezes, but they suffer from two additionalmajor flaws. First, other than duringthe Internet bubble, I’ve found thatthe most overvalued and hyped stocks aresmall- or mid-caps, for which puts usuallyaren’t available or are extremely expensive.Second, puts require that you beright not only on the fundamentals, butalso on timing. Payday may arrive, butyour options may already have expired.So if making bearish bets is the costlygame I think it is, how should valueinvestors address issues of risk management,preservation of capital and periodsof underperformance? I like Icahn’sdescription of his risk-managementapproach as “fundamentally driven bythe underlying value of the companyrather than prevailing market conditions.”In other words, nothing beats gettingthe value proposition right on astock-by-stock basis as your best protectionfrom permanent capital loss. I amstill looking for and finding 50-cent dollarsand would argue that the 80-cent dollaroffers both inadequate downside protectionas well as insufficient upsidepotential. I also insist on growth as a keycomponent of the investment thesis –value accreting over time furtherenhances the risk-reward equation.Don’t worry about short-term swingsin performance. Contrary to modernportfolio theory – and as legendary valueinvestors such as Buffett and JoelGreenblatt have well articulated – portfoliovolatility and risk are not remotelysynonymous. Tweedy, Browne’s ChrisBrowne studied the long-term performanceof seven of the greatest valueinvestors in history and found that theyunder-performed market averagesbetween 28% and 40% of the time –sometimes accompanied by hair-raisingasset drawdowns – while still trouncingthe averages over long periods. My unsolicitedadvice: Embrace volatility – you’llmake more money in the long run.There will, of course, be many marketswoons to come and short selling mayhelp mitigate losses during the toughesttimes. But for my and my investors’money, the structural disadvantages ofshorting make it too un-businesslike topursue. VIIJoe Feshbach runs Joe Feshbach Partners,which invests primarily in companies facingsome type of crisis – from accounting scandalsto government investigations.Look here for insight and ideasfrom the best investors.Subscribe now and receive a full year of<strong>Value</strong> <strong>Investor</strong> <strong>Insight</strong> – includingweekly e-mail bonus content andaccess to all back issues – for only $349.That’s less than $30 per month!Subscribe Online »Mail-in Form »Fax-in Form »Want to learn more?Please visit www.valueinvestorinsight.comOr call toll-free:866-988-9060February 28, 2006www.valueinvestorinsight.com<strong>Value</strong> <strong>Investor</strong> <strong>Insight</strong> 21