1998 SS International Field Exam.pdf

1998 SS International Field Exam.pdf

1998 SS International Field Exam.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

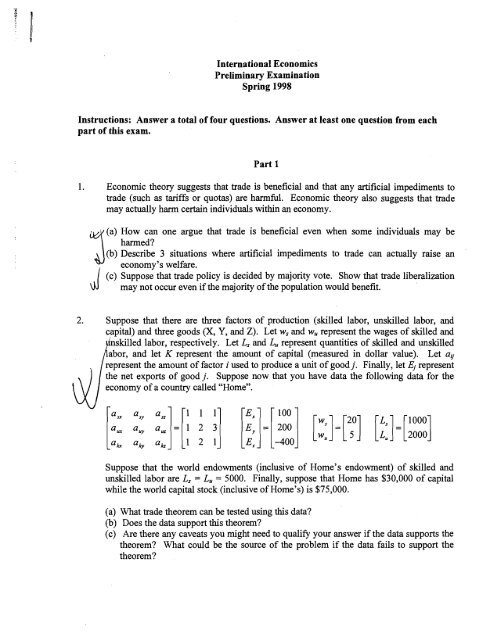

<strong>International</strong> EconomicsPreliminary <strong>Exam</strong>inationSpring <strong>1998</strong>Instructions: Answer a total of four questions. Answer at least one question from eachpart of this exam.Part 11. Economic theory suggests that trade is beneficial and that any artificial impediments totrade (such as tariffs or quotas) are harmful. Economic theory also suggests that trademay actually harm certain individuals within an economy.3(a) How can one argue that trade is beneficial even when some individuals may beharmed?(b) Describe 3 situations where artificial impediments to trade can actually raise aneconomy's welfare.(c) Suppose that trade policy is decided by majority vote. Show that trade liberalizationmay not occur even if the majority of the population would benefit.2. Suppose that there are three factors of production (skilled labor, unskilled labor, andcapital) and three goods (X, Y, and Z). Let w, and w, represent the wages of skilled andskilled labor, respectively. Let L, and L, represent quantities of skilled and unskilledabor, and let K represent the amount of capital (measured in dollar value). Let aurepresent the amount of factor i used to produce a unit of good j. Finally, let E, representthe net exports of good j. Suppose now that you have data the following data for theeconomy of a country called "Home".Suppose that the world endowments (inclusive of Home's endowment) of skilled andunskilled labor are L, = L, = 5000. Finally, suppose that Home has $30,000 of capitalwhile the world capital stock (inclusive of Home's) is $75,000.(a) What trade theorem can be tested using this data?(b) Does the data support this theorem?(c) Are there any caveats you might need to qualify your answer if the data supports thetheorem? What could be the source of the problem if the data fails to support thetheorem?

d+',,..J1 Consider the Euler equation,APart 2'! 0bJ\$ qJJwhere St is the spot exchange rate, Ft is the forward rate for a one period maturity time andB \ \I1 is the domestic price level.State all the assumptions, especially concerning expectations and risk, for equation (1)to be expressed as,Parefully state the necessary assumptions for an additional term of the form,yCo~~(Aa+~c~+~), be added to equation (2).escribe the form of other terms that could be reasonably be added to equation (2). Ineach case describe the economic theoretic motivation for these terms."The various forms of the monetary model of exchange rate determination have not beensuccessful empirically. The failure of Purchasing Power Parity has been a main factor inthis regard".Discuss the evidence for this statement.

t, Part 3IConsider a small open Rarnsey economy, populated by an infinitely-lived representativeagent. Define lifetime wealth as'Pi7 ",where r is the exogenous international real interest rate, B indicates net holdings ofclaims to foreign output, and Y represents endowment (income). Assume that utility islogarithmic, so that the consumption function takes the general formwhere 6 ~[0,1]. (Note that we are not assuming that the optimal consumption path isnecessarily constant). Finally, define the permanent levelof a variable X, as(a) Show that lifetime wealth can be expressed as a function of permanent income:(b) Using the current account identity and some algebraic manipulations, show that theoptimal current account can be written asrCA, =( -?l+rI+r(d) What are the effects on the current account of a temporary rise in income? And of apermanent and constant rise?(e) In light of your results, interpret the IMF's dictum that "a country should adjust topermanent shocks and3nance temporary shocks".r

2/ lllustrate the concepts of absolute, conditional and regional income convergence andanswer either of the following questions:!J fl(a) Explain a theoretical growth model of a closed economy, and one of an openeconomy, and show what kind of convergence, if any, each model implies.(b) Review the empirical literature on convergence, stressing both the results and theshortcomings of each paper.