Group Accidental Death and Dismemberment Benefit Rider

Group Accidental Death and Dismemberment Benefit Rider

Group Accidental Death and Dismemberment Benefit Rider

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

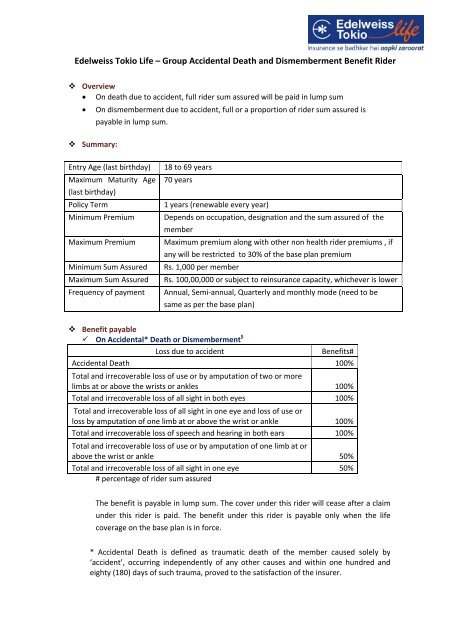

Edelweiss Tokio Life – <strong>Group</strong> <strong>Accidental</strong> <strong>Death</strong> <strong>and</strong> <strong>Dismemberment</strong> <strong>Benefit</strong> <strong>Rider</strong> Overview On death due to accident, full rider sum assured will be paid in lump sumOn dismemberment due to accident, full or a proportion of rider sum assured ispayable in lump sum. Summary:Entry Age (last birthday)Maximum Maturity Age(last birthday)Policy TermMinimum PremiumMaximum PremiumMinimum Sum AssuredMaximum Sum AssuredFrequency of payment18 to 69 years70 years1 years (renewable every year)Depends on occupation, designation <strong>and</strong> the sum assured of thememberMaximum premium along with other non health rider premiums , ifany will be restricted to 30% of the base plan premiumRs. 1,000 per memberRs. 100,00,000 or subject to reinsurance capacity, whichever is lowerAnnual, Semi-annual, Quarterly <strong>and</strong> monthly mode (need to besame as per the base plan) <strong>Benefit</strong> payable On <strong>Accidental</strong>* <strong>Death</strong> or <strong>Dismemberment</strong> $Loss due to accident<strong>Benefit</strong>s#<strong>Accidental</strong> <strong>Death</strong> 100%Total <strong>and</strong> irrecoverable loss of use or by amputation of two or morelimbs at or above the wrists or ankles 100%Total <strong>and</strong> irrecoverable loss of all sight in both eyes 100%Total <strong>and</strong> irrecoverable loss of all sight in one eye <strong>and</strong> loss of use orloss by amputation of one limb at or above the wrist or ankle 100%Total <strong>and</strong> irrecoverable loss of speech <strong>and</strong> hearing in both ears 100%Total <strong>and</strong> irrecoverable loss of use or by amputation of one limb at orabove the wrist or ankle 50%Total <strong>and</strong> irrecoverable loss of all sight in one eye 50%# percentage of rider sum assuredThe benefit is payable in lump sum. The cover under this rider will cease after a claimunder this rider is paid. The benefit under this rider is payable only when the lifecoverage on the base plan is in force.* <strong>Accidental</strong> <strong>Death</strong> is defined as traumatic death of the member caused solely by‘accident’, occurring independently of any other causes <strong>and</strong> within one hundred <strong>and</strong>eighty (180) days of such trauma, proved to the satisfaction of the insurer.

An accident is a sudden, unforeseen <strong>and</strong> involuntary event caused by external, visible<strong>and</strong> violent means.Injury means accidental physical bodily harm excluding illness or disease solely <strong>and</strong>directly caused by external, violent <strong>and</strong> visible <strong>and</strong> evident means which is verified <strong>and</strong>certified by a Medical Practitioner.Illness means a sickness or a disease or pathological condition leading to the impairmentof normal physiological function which manifests itself during the Policy Period <strong>and</strong>requires medical treatment.a. Acute condition - Acute condition is a disease, illness or injury that is likely torespond quickly to treatment which aims to return the person to his or her state ofhealth immediately before suffering the disease/illness/injury which leads to fullrecovery.b. Chronic condition - A chronic condition is defined as a disease, illness, or injurythat has one or more of the following characteristics:—it needs ongoing or long-term monitoring through consultations, examinations,check-ups, <strong>and</strong> /or tests—it needs ongoing or long-term control or relief of symptoms— it requires your rehabilitation or for you to be specially trained to cope with it—it continues indefinitely—it comes back or is likely to come back.A Medical practitioner is a person who holds a valid registration from the medicalcouncil of any State or Medical Council of India or Council for Indian Medicine or forHomeopathy set up by the Government of India or a State Government <strong>and</strong> is therebyentitled to practice medicine within its jurisdiction; <strong>and</strong> is acting within the scope <strong>and</strong>jurisdiction of his license.$ <strong>Accidental</strong> <strong>Dismemberment</strong> is defined as any amputation or irrecoverable loss of useof the limbs/sight/speech/Hearing caused solely by external, violent, unforeseeable<strong>and</strong> visible means, occurring independently of any other causes AND which occurswithin one hundred <strong>and</strong> eighty (180) days of such trauma. On SurvivalNo survival benefit is payable under this rider. Spouse Cover <strong>Benefit</strong>You have option to cover the member’s spouse.In case of death of the member, the spouse cover will continue till the end of the termfor which the premium has been paid. The spouse cover will discontinue if themember exits the group for any other reason. Non-forfeiture benefits Surrender benefitsNo surrender value will be paid.If premium is contributed by the insured members, on surrender of such policy, theindividual insured member of the group is entitled to continue the coveragesindividually for the remaining term for which premium has been paid.

Paid-up ValueNot Available TaxesThe Policyholder shall be liable to pay all applicable taxes as levied by the Governmentfrom time to time. Premium adjustment for members leaving/joining the group.Pro-rata premium for the remaining term based on rate charged to the group at thetime of quotation will be refundable to you, for members exiting during the policy yearprovided no benefit has been paid for the insured member under the policy.Similarly pro-rata premium for the remaining term based on rate charged to the groupat the time of quotation will be charged for new members joining the group. Terms <strong>and</strong> Conditions Free – look PeriodThis rider offers a 15 day free – look period. In the unlikely event that you are notsatisfied with the terms <strong>and</strong> conditions of the rider, <strong>and</strong> wish to cancel the rider, youcan do so by returning the policy to the company along with a letter requesting forcancellation within 15 days of receipt of policy. <strong>Rider</strong> premium paid by you will berefunded after deducting a proportionate risk premium for the period on cover <strong>and</strong>cost of medical expenses incurred in that connection. ExclusionsThe life assured will not be entitled to any benefits for any death caused directly orindirectly due to or caused, occasioned, accelerated or aggravated by any of thefollowing: Suicide: Suicide or attempted suicide or self inflicted injury, whether the lifeassured is medically sane or insane. Infection : <strong>Death</strong> or Disability caused or contributed to by any infection, exceptinfection caused by an external visible wound accidentally sustained Drug Abuse: Member under the influence of Alcohol or solvent abuse or use ofdrugs except under the direction of a registered medical practitioner Self-inflicted Injury: Intentional self- inflicted injury. Criminal acts: Member involvement in criminal <strong>and</strong>/or unlawful acts. War <strong>and</strong> Civil Commotion: War, invasion, hostilities, (whether war is declared ornot), civil war, rebellion, revolution or taking part in a riot or civil commotion. Nuclear Contamination: Directly or Indirectly due to Nuclear fusion, nuclearfission, nuclear waste or any radioactive or ionizing radiation. Aviation: Member participation in any flying activity, other than as a passenger ina commercially licensed aircraft. Hazardous sports <strong>and</strong> pastimes: Taking part or practicing for any hazardoussports, hobby, pursuit or any race which is not previously disclosed. Moreoverany such disclosures have to be accepted by company before the cover starts. Poison: Taking or absorbing, accidentally or otherwise, any poison. Toxic Gases: Inhaling any gas or fumes, accidentally or otherwise, except

accidentally in the course of duty. Physical Infirmity: Body or mental infirmity or any diseaseSuicide Claim provisions<strong>Benefit</strong>s under the rider will not be paid in case of suicide or attempted suicide or selfinflicted injury, whether the life assured is medically sane or insane. Grace period for non-forfeiture provisionsGrace period is same as the base plan. In case the rider premium is not paid (even ifthe base policy premium is paid), the rider will lapse. Revival or ReinstatementAs per the base plan

Prohibition of Rebate: (SECTION 41 OF INSURANCE ACT 1938) No person shall allow or offer toallow, either directly or indirectly, as an inducement to any person to take out or renew orcontinue an insurance in respect of any kind of risk relating to lives in India, any rebate of thewhole or part of the commission payable or any rebate of the premium shown on the policynor shall any person taking out or renewing or continuing a policy accept any rebate exceptone such rebate as may be allowed in accordance with the published prospectus or tables ofthe Insurer. Any person making default in complying with the provisions of this section shall bepunishable with a fine which may extend to five hundred rupees.Non Disclosure Clause: (SECTION 45 OF INSURANCE ACT 1938) No policy of life insurance shallafter the expiry of two years from the date on which it was effected, be called in question byan insurer on the ground that statement made in the proposal for insurance or in any report ofa medical officer, or referee, or friend of the insured, or in any other document leading to theissue of the policy, was inaccurate or false, unless the insurer shows that such statement wason a material matter or suppressed facts which it was material to disclose <strong>and</strong> that it wasfraudulently made by the policyholder <strong>and</strong> that the policyholder knew at the time of making itthat the statement was false or that it suppressed facts which it was material to disclose.Provided that nothing in this Section shall prevent the insurer from calling for proof of age atany time if he is entitled to do so, <strong>and</strong> no policy shall be deemed to be called in questionmerely because the terms of the policy are adjusted on subsequent proof that the age of theLife assured was incorrectly stated in the proposal.Edelweiss Tokio Life Insurance is a new generation Insurance company, set up with a start up capital ofINR 550 Crores, thereby showing our commitment to building a long term sustainable business focusedon a consumer centric approach.The company is a joint venture between Edelweiss Financial Services, one of India's leading diversifiedfinancial services companies with business straddling across Credit, Capital Markets, AssetManagement, Housing finance <strong>and</strong> Insurance <strong>and</strong> Tokio Marine Holdings Inc, one of the oldest <strong>and</strong> thebiggest Insurance companies in Japan now with presence across 39 countries around the world.As a part of the company’s corporate philosophy of customer centricity, our products have beendeveloped based on our underst<strong>and</strong>ing of Indian customers’ diverse financial needs <strong>and</strong> help themthrough all their life stages.Disclaimer: Edelweiss Tokio Life – <strong>Group</strong> <strong>Accidental</strong> <strong>Death</strong> <strong>and</strong> <strong>Dismemberment</strong> <strong>Benefit</strong> <strong>Rider</strong> is only thename of the non- participating rider <strong>and</strong> does not in any way indicate the quality of the contract, its futureprospects, or returns. Please know the associated risks <strong>and</strong> the applicable charges from your Intermediary.Tax benefits are subject to changes in the tax laws. Insurance is the subject matter of the solicitation.<strong>Rider</strong>s are optional <strong>and</strong> available at an extra cost.Reg. No.: 147UIN: 147B011V02Advt No.: Br/50/Aug 2013 ver. 2