Audited Annual Financial Statements 2012 - Heythrop College

Audited Annual Financial Statements 2012 - Heythrop College

Audited Annual Financial Statements 2012 - Heythrop College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

HEYTHROP COLLEGEUniversity of London<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For The Year Ended 31 July <strong>2012</strong>

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong><strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>Charity registration number: 312923Address:<strong>Heythrop</strong> <strong>College</strong>University of LondonKensington SquareLondon W8 5HNwww.heythrop.ac.ukGovernors: See list of Governors on page 4Bankers:National Westminster Plc11 The ParadeCanterburyKentCT1 2DTSolicitors:Lee Bolton Monier-Williams1 The SanctuaryWestminsterSW1P 3JTAuditors:BDO LLP2nd Floor2 City PlaceBeehive Ring RoadGatwickWest SussexRH6 0PA2

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>ContentsList of Governors 4Operating and <strong>Financial</strong> Review 5Statement on Corporate Governance and Governing Body responsibilities 14Report of the Independent Auditors to the Governing Body of <strong>Heythrop</strong> <strong>College</strong> 17<strong>Financial</strong> <strong>Statements</strong> 20Statement of Total Recognised Surpluses and Deficits 22Balance Sheet 23Cash Flow Statement 24Principal Accounting Policies 25Notes to the <strong>Financial</strong> <strong>Statements</strong> 293

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Membership of the Governing Body2011-12Ex officioNominated ExternalMembersCo-opted ExternalMembersElected InternalMembersStudent MembersPresident of the <strong>College</strong>The PrincipalNominated by the Trustees forRoman Catholic Purposes (TRCP)One member nominated jointly bythe Archdiocese of Westminsterand the Bishops’ ConferenceNominated by the UniversityMembers who may not benominated by any of thegroups or organisationsalready representedMembers of the academic staffMember of the non-academic staffPresident of <strong>Heythrop</strong>Students Union (HSU)and one other elected by HSURev Michael Holman (to 31.12.11)The Very Rev Dermot Preston (from 1.01.12)Rev Dr J Sweeney (from 1.09.11 to 31.12.11)Rev Michael Holman (from 1.01.12)Rev Dr Brendan Callaghan (from 1.09.12)Dr Christine Carpenter (from 1.09.<strong>2012</strong>)Prof Gwen Griffith-Dickson (to 31.12.11)Fr Paul Hamill (to 31.08.12)Rev Keith McMillan (from 1.09.12)Mr Andrew KennedyMr Michael Malone-Lee (Chair – to 31.08.12)Dr William Moyes (Chair - from 1.09.12)Mgr Mark O’TooleRev Prof Peter GallowayRev Brian RobertsMrs Tricia KingSir Tim ChessellsDr Trish Roberts (to 31.12.11)Prof John DaviesDr Michael Byrne (to 31.12.11)Ms Jane MakowerMgr Marcus StockMr J Horgan (from 1.09.<strong>2012</strong>)Dr Ahmad AchtarDr Fiona EllisDr Michael Kirwan (to 31.08.12)Dr Michael LacewingMr Anthony O’Mahony (from 1.09.12)Ms Kathryn Powell (to 31.08.12)Ms Gala Jackson-Coombs (to 31.08.12)Mr Ashley Doolan (from 1.09.12)Mr Barrie Nelson (to 31.08.12)Mr Alex Hackett (from 1.09.12)Secretary Clerk to the Governing Body Mrs Elizabeth Thussu4

Operating and <strong>Financial</strong> Review<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>“A place to really broaden the mind”(MA Pastoral Theology student)5

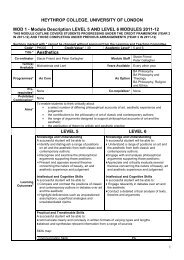

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Operating and <strong>Financial</strong> Review... continuedPERFORMANCE AGAINSTSTRATEGIC AIMSStudents and programmesIn the academic year 2011-12, the <strong>College</strong> had 905full- and part-time students, of whom 570 wereundergraduates, 290 were studying for taughtpostgraduate degrees and diplomas and 45 werestudying for research degrees. There were 51international students, including 30 studying theBachelor of Divinity as part of their training forministry. In December <strong>2012</strong>, 255 students willgraduate at a ceremony in Kensington Town Hall -144 from undergraduate programmes and 111 frompostgraduate programmes.While the <strong>College</strong>’s undergraduates arepredominantly young, full-time students, themajority of postgraduate students are older andpart-time, either working or retired and study inthe evening. Recruitment of postgraduates hasheld steady despite the less favourable economicenvironment and there has been an increase inthe proportion of full-time postgraduate students.There was also an encouraging increase in Researchdegree students registering for PhDs in 2011-12.A strategic priority for 2011-12 was to strengthen themarketing and recruitment capacity of the <strong>College</strong>and following a marketing review a new Marketingand Recruitment Manager post was establishedand an appointment made. The provision of OpenDays, sixth-form conferences and school visitswas significantly increased and events were wellattended. The Student Ambassador scheme wasdoubled to increase outreach and visits to schoolsand events, giving a well-received presentation atthe first ACCESS HE London conference on ‘Whystudy Philosophy and Theology?’Student Numbers, 2009-10 to 2011-1210009008007006005004003002001002009-102010-112011-120UG PGT PGR Total7

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Operating and <strong>Financial</strong> Review... continuedLearning, Teaching andthe Student ExperienceThe recommendations of the Themed Audit ofLearning and Teaching were taken forward in 2011-<strong>2012</strong>, leading to the introduction of more groupbasedtutorials being piloted for new studentsbeginning study in <strong>2012</strong>. In response to this andother student feedback, the <strong>College</strong> has developedan institution-wide, enriched learning programmebuilt around the curriculum of its specialist areas,creating transferable skills in team-building,conflict resolution, event and project management,developing interpersonal and organizational skillsthrough themes and topics that emerge from thecourse programmes.The implementation of the new Credit and AssessmentFramework, including levelisation for undergraduatedegrees was completed in 2011-12, providing a basisfor introducing flexible models of learning such asshort courses. A Blended and Distance-LearningProject Group was set up and identified a set of modelsto be piloted during <strong>2012</strong>-13.The <strong>College</strong> participates in the National StudentSurvey and uses the outcomes for enhancementpurposes. In <strong>2012</strong> overall satisfaction at 84% wasjust short of the sector average benchmark (85%).Teaching satisfaction, as last year, gained the highestresults, with 88% satisfaction overall and this againsurpassed the national average of 86%. Theology inparticular achieved exceptional results for teaching,reaching 100% in some areas. Learning resourcesachieved a higher satisfaction level than the nationalaverage (84% against 82%). Where scores are lowerthan average, further analysis is undertaken andaddressed by the Learning and Teaching Committee.The <strong>College</strong> works very closely with the <strong>Heythrop</strong>Students’ Union and the HSU Executive contributedsignificantly to decision-making and policy initiativesthrough their representation on <strong>College</strong> committeesand the Governing Body. In 2011-12 a second fundedsabbatical position of Vice President was approvedwhich has already significantly improved theeffectiveness of the Union and student engagement.8

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Operating and <strong>Financial</strong> Review... continuedResearch and Knowledge TransferResearch and knowledge transfer are importantaspects of the <strong>College</strong>’s academic life. <strong>Heythrop</strong>participated for the first time in the 2008 ResearchAssessment Exercise, gaining recognition for its workat an international level. Work towards a successfulsubmission in the Research Excellence Framework(REF) was a strategic priority in 2011-12 and muchhas been achieved under the leadership of the newVice Principal Academic and the REF Steering Group,with the Code of Practice approved by HEFCE andpreparation well in hand for the REF submission. Therecruitment of research students increased by 30% to44, with 9 PhDs being awarded in 2011-12.Many successful conferences and seminars havebeen hosted by <strong>Heythrop</strong>, including an internationalconference on ’The Influence of the Decalogue,held at Campion Hall, the Society’s Oxford collegein April <strong>2012</strong> as a collaboration between <strong>Heythrop</strong><strong>College</strong> and the Faculty of Theology of the Universityof Oxford, with delegates and speakers fromten countries. Following the success of the firstone, the second Power of the Word internationalconference entitled ‘Poetry and Prayer: Continuitiesand Discontinuities’ took place at Senate House,University of London, on 29-30 June <strong>2012</strong>. <strong>Heythrop</strong>academic staff were also involved in launching anew international research network on the ‘theologyof pastoral practices’ at the Catholic University ofSantiago de Chile from 26 to 29 March <strong>2012</strong> and theEuropean meeting will be held at <strong>Heythrop</strong>.The Centre for Christianity and InterreligiousDialogue organised a series of seminars and publiclectures on themes in comparative theology, anemergent discipline within Christian theology,building on classical Patristic and Scholasticengagements with Greek, Jewish and Islamicthought and finding new applications suited to thecontemporary encounter of religions. <strong>2012</strong> alsosaw the launch of Professor Michael Barnes’ newbook Interreligious Learning: Dialogue, Spiritualityand the Christian Imagination, published by theCambridge University Press, hailed as a majorcontribution to the field.Collaborative linksThe <strong>College</strong> collaborates in both teaching andresearch with institutions across Europe and the US,in particular with other Jesuit-founded Universitiesand is exploring opportunities for links with otherinternational Jesuit and Catholic Universities inAustralia and Hong Kong. Fordham University of NewYork has a base on the Kensington site and there areacademic links between the Theology Departmentsand other collaborations are being explored. In <strong>2012</strong>,the <strong>College</strong> approved a collaborative MA programmein Canon Law with the Catholic University of Leuven,with whom there are also active research links.Through the Erasmus programme the <strong>College</strong> hasextensive links in research and teaching with otheruniversities in Europe and actively promotes studentand staff mobility, with 20 students studying at<strong>Heythrop</strong> in 2011-12. In the UK, the <strong>College</strong> worksclosely with other colleges of the University ofLondon, such as SOAS and Kings <strong>College</strong>, as well aswith the Institutes of the School of Advanced Study.A resource for the ChurchThe <strong>College</strong> is a Centre for European Formation forthe Society of Jesus and is presently exploring thepossibility of re-opening the ecclesiastical faculties ofTheology and Philosophy (the “Bellarmine Institute”)which have been dormant since 1970. This wouldenable the college to offer, alongside its own degrees,ecclesiastical qualifications at bachelors, licentiate anddoctoral levels. Although there are many such facultiesacross Europe and in Ireland, there is no recogniseduniversity ecclesiastical faculty in the UK and there issignificant interest overseas in these qualifications,particularly in London. A working group has draftedstatutes and regulations for an application to be madeto Rome by the end of <strong>2012</strong>, subject to approval.Funding was granted from the Society of Jesus forfive years for three professorships in the areas ofPhilosophy, Systematic Theology and TheologicalEthics. These posts, in addition to contributing to theoverall mission of the college, will teach those whoaspire to the catholic priesthood and those who willbe charged elsewhere with the education of priestsand will be appointed to start in September 2013.9

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Operating and <strong>Financial</strong> Review... continuedLeadership and ManagementThe new Principal Fr Michael Holman, the recentProvincial of the English Province of the Societyof Jesus and former Headmaster of Wimbledon<strong>College</strong>, took up his post in January <strong>2012</strong>. Theacademic work of the <strong>College</strong> is led by the newVice-Principal-Academic, Professor Gwen Griffith-Dickson, formerly of Birkbeck <strong>College</strong> and in 2001the first woman to be appointed Gresham Professorof Divinity. Under this leadership, a new structureof academic management has been introduced and,together with the recently established AcademicPlanning Committee and Departmental Boards, thishas strengthened the planning process at <strong>College</strong>and Departmental levels. Work has been initiatedon a new academic strategy for the <strong>College</strong> in thechanged funding environment, leading to a majorportfolio review.The potential for shared services continued to beexplored with many functions of the <strong>College</strong> beingenabled through sharing services, in particular withthe University of London: these now cover email,website and VLE hosting (University of LondonComputing Centre) careers and accommodationservices, Senate House Library and Internal Auditthrough the Kingston City Group and discussions arein hand to take this further as part of a University ofLondon project.Strategic Priorities for <strong>2012</strong>-13The key risk facing the <strong>College</strong> is that of recruitmentand thus financial sustainability. The primary strategicpriority is therefore to secure the <strong>College</strong>’s long-termfuture in a highly competitive higher education sector.The objectives arising from this are:• To undertake a rigorous portfolio review thatarticulates with the developing AcademicStrategy and enhances programme provision• To maximise recruitment through marketing andimproving the student offer• To deliver a strongly improved REF submission,reflecting a strengthened research culture andresearch management• To undertake business development andfundraising activities to increase the endowmentof the <strong>College</strong>• In parallel with these specific objectives, the<strong>College</strong>’s senior management and Governorswill be undertaking a scenario planning andmodelling process to understand and respondto the challenges and opportunities facing the<strong>College</strong> in the medium to long term.Estates<strong>Heythrop</strong> <strong>College</strong> is located on a very attractive sitein Kensington Square, with its own mini-campus setin gardens. The <strong>College</strong> is fortunate to have beengranted a long-term lease from the Trustees forRoman Catholic Purposes (TRCP), who bought thesite in 2009.The <strong>College</strong> continues to work with its professionaladvisors to assess how the site can be developed tomeet the future needs of the <strong>College</strong>. A refurbishmentprogramme is currently underway and a longer termstrategy for the development of the estate is underconsideration.10

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Operating and <strong>Financial</strong> Review... continuedFINANCIAL PERFORMANCE 2011-12SurplusThe income and expenditure account records asurplus of £314k. The surplus represents 5% of totalincome, which is slightly higher than the <strong>College</strong> keyperformance indicator of 3%. The surplus is lowerthan the result achieved in the previous financialyear as the HEFCE matched funding scheme came toan end during 2011-12 and the income received fromthis source was £688k less than the prior year.IncomeIncome from the Higher Education Funding Councilduring the year totalled £1,621k including £246kof Matched Funding. The largest elements offunding from HEFCE are the recurrent grants andthese elements of funding reduced by £90k on theprior year as a result of government expenditurereductions.Income from Tuition Fees has increased by 4% sincethe prior year reflecting the increase in the levelof fees charged and an increase in the number ofstudents attending the <strong>College</strong>.Income from other sources has increased since the priorperiod. The <strong>College</strong> still receives a generous level ofsupport from the Trustees for Roman Catholic Purposeseach year and in 2011 -12 received an additional £454kdonation as well as the annual support provided to meetto the costs of Jesuit staff salaries.ExpenditureIn overall terms expenditure has reduced by £101ksince the prior year. Staff costs are £135k lowerthan the previous year but the expenditure in 2010-11 included a number of restructuring payments. Ifrestructuring payments are excluded staff costs arebroadly the same in both years.Other operating costs are 2% higher in 2011-12 thanin the previous year and these areas of expenditurecontinue to be tightly controlled by the <strong>College</strong>.Balance SheetThe <strong>College</strong> balance sheet shows that Total fundshave decreased slightly as the surplus generated islower than the accounting charge made to reflectthe use of the <strong>College</strong> site. General reserves havehowever increased as a result of the surplusachieved during the year.Fixed asset values have declined slightly sincethe previous year as there has been little capitalinvestment needed in the <strong>College</strong> estate, and thedepreciation charge has therefore exceeded thevalue of capital additions.Net current assets have increased by £397k to£1,810k, largely as a result of the cash generatedwithin the year. Within the net current asset figuresdebtors have increased reflecting the later receiptof the TRCP donations in 2011-12 and creditors havedecreased following the introduction of improvedpayment arrangements for our suppliers.Endowment assets have increased in value by £50kas a result of favourable investment performanceon the funds invested through Newton InvestmentManagers, but part of this increase has been offsetby the utilisation of the funds to meet the cost ofmaintaining the <strong>College</strong> estate.ConclusionThe financial statements record a satisfactoryfinancial performance for the year largely due to thecontinued generosity and support of the Trusteesfor Roman Catholic Purposes. The balance sheetdemonstrates that the <strong>College</strong> has a stable financialfoundation on which to build its plans for the future.11

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Operating and <strong>Financial</strong> Review... continuedPUBLIC BENEFITThe <strong>College</strong>’s important role in advancing educationand religion for the public benefit is reflected inits mission and objectives; examples of the manyachievements of the past year in providing benefit tothe public in line with these aims have been set outelsewhere in this report.<strong>Heythrop</strong>’s service to society is to educate students ina context of valuing and respecting others and theirbeliefs, to work in a society that acknowledges andunderstands diversity. The <strong>College</strong> believes that thestudy of philosophy and theology, as other humanitiessubjects, has the potential to transform the experienceof an individual, enabling them to understand theirplace in the world with deeper understanding andhumanity. These subjects promote life-changingpersonal development, teach students to engage withideas critically and independently, and equip studentswith the skills necessary to understand - and thuswork in and manage – complexity and change.The <strong>College</strong> provides resources not only for studentsbut for the wider community, not least through oneof the finest specialist libraries in the UK, built upover 400 years, which is open to all those who havea scholarly interest in the subject. The <strong>College</strong>’s‘knowledge transfer’ places resources at the serviceof many faith-based organizations and the widercommunity. The work of the Centres and Institutesduring 2011-12 has continued to contribute to thisresource through publications, seminars and events.<strong>Heythrop</strong> is a leader in the field of inter-religious andinterfaith dialogue, which informs much of its teachingprovision. The MA in Interreligious Dialogue is takenby a wide range of professionals working in the publicsector, including hospital and prison chaplains. The MAin Eastern Christianity runs public conferences on verylive issues such as the impact of current conflicts onthe Christian communities in Syria, while the ReligiousLife Institute is an internationally recognized resourcefor those living and working in religious communities.The <strong>College</strong> is committed to continuing to widen therange of students and sections of the public who maybenefit from its teaching and research. Bursaries areprovided to ensure that the financially disadvantagedare more able to take up courses of study withconfidence.Lifelong learning is a fundamental principle atthe <strong>College</strong>, which supports students to find theirvocation, whatever that may be, at any stage of theirlives. <strong>Heythrop</strong> has a rich programme of evening andpart-time study, from study days and short coursesto postgraduate and research degrees. It is alsothe lead <strong>College</strong> for Theology in the University ofLondon’s International Programme, many of whomstudy in the UK.12

Corporate Governance Statement <strong>2012</strong><strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>“...assignments cover the full span of ethicaldebates from corporate finance to advancedmedical technology.” (External examiner)14

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Corporate Governance Statement <strong>2012</strong>1. The <strong>College</strong> conducts its business in accordancewith the seven principles identified by theCommittee on Standards in Public Life(selflessness, integrity, objectivity, accountability,openness, honesty and leadership), and withinthe guidelines expressed in the Guide forMembers of HE Governing Bodies in the UK(Committee of University Chairmen, 2004).2. The <strong>College</strong> is a constituent member of theUniversity of London. It is also an independentcorporation, whose legal status derives from a royalcharter originally granted in 1971. Its objects, powersand framework of governance are set out in thecharter and its supporting statutes. New statuteswere approved by the Privy Council in March 2007and became effective from 1 August 2007.3. The <strong>College</strong> is a registered charity (no. 312923).4. The Governing Body is the executive bodyresponsible for the finance, property,investments, Health and Safety and generalbusiness of the <strong>College</strong>, and for setting thegeneral strategic direction of the institution.It has a majority of members from outside the<strong>College</strong>, from whom its Chair and Vice-chair mustbe drawn. Members also include representativesof the staff of the <strong>College</strong> and the student body.None of the members receive any payment, apartfrom the reimbursement of expenses to externalmembers, for the work they do as Governors ofthe <strong>College</strong>.5. The Governing Body is of the view that there isan adequate and ongoing process for identifying,evaluating and managing the <strong>College</strong>’s significantrisks (including business, operational andcompliance as well as financial risk), that it hasbeen in place for the year ended 31 July <strong>2012</strong> andup to the date of approval of the annual reportand accounts, that it is regularly reviewed bythe Governing Body and that it accords with theHEFCE Audit Code of Practice.6. The Governing Body meets four times a year andreceives reports and recommendations fromthe following Committees: Academic Board,Audit, Finance & General Purposes, Governance& Nominations, Remuneration and StaffingCommittees, all of which are formally constituted.7. The terms of reference and composition ofthe Audit Committee is based wholly on themodel provided in the HEFCE Audit Code. TheCommittee met on four occasions during 2011-12. The Internal Auditors conducted reviewsduring the year of core processes and systems,risk management, efficiency and effectiveness,IT, Data Quality management and ResearchManagement. The Internal Auditors submittedreports on the outcome of each review,commenting on the adequacy and effectivenessof the <strong>College</strong>’s systems of internal control andrecommendations for improvement.Responsibilities of the Governing Body8. The Governing Body is responsible for keepingproper accounting records which disclose withreasonable accuracy the financial position ofthe <strong>College</strong>, and which enable it to ensure thatthe financial statements are prepared to meetrelevant accounting standards and the additionalrequirements of the <strong>Financial</strong> Memorandumagreed with the Higher Education FundingCouncil for England.9. In causing the financial statements to beprepared, the Governing Body requires that:• suitable accounting policies are selected andapplied consistently;• judgments and estimates are made that arereasonable and prudent;• applicable accounting standards have beenfollowed, subject to any material departuresdisclosed and explained in the financialstatements;• financial statements are prepared on a goingconcern basis.15

Independent Auditors’ Report toThe Governors of <strong>Heythrop</strong> <strong>College</strong><strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>“It is the <strong>Heythrop</strong> Students’ Union’s responsibilityto ensure that you have the best possible time you17can at university.” (<strong>Heythrop</strong> Students’ Union President)

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Independent Auditors’ Report toThe Governors of <strong>Heythrop</strong> <strong>College</strong>We have audited the financial statements of <strong>Heythrop</strong><strong>College</strong> for the year ended 31 July <strong>2012</strong> whichcomprise the Income and Expenditure Account,Statement of Total Recognised Gains and Losses,the Balance Sheet for the <strong>College</strong>, the Cash FlowStatement and the related notes. The financialreporting framework that has been applied in theirpreparation is applicable law and United KingdomAccounting Standards (United Kingdom GenerallyAccepted Accounting Practice).This report is made solely to the <strong>College</strong>’s Governors,as a body, in accordance with paragraph 154 ofthe Charities Act 2011 and paragraph 124B of theEducation Reform Act 1988. Our audit work has beenundertaken so that we might state to the <strong>College</strong>’sGovernors those matters we are required to state tothem in an auditor’s report and for no other purpose.To the fullest extent permitted by law, we do notaccept or assume responsibility to anyone other thanthe <strong>College</strong> and the <strong>College</strong>’s Governors as a body, forour audit work, for this report, or for the opinions wehave formed.Respective Responsibilities of the<strong>College</strong>’s Governing Body and AuditorsAs explained more fully in the statement ofresponsibilities of the Board of Governors, themembers of the Governing Body are responsible forthe preparation of the financial statements and forbeing satisfied that they give a true and fair view.We have been appointed as auditor under section144 of the Charities Act 2011 and section 124B of theEducation Reform Act 1998 and report in accordancewith regulations made under section 154 of theCharities Act 2011 and section 124B of the EducationReform Act 1998.Our responsibility is to audit and express an opinion onthe financial statements in accordance with applicablelaw, regulatory requirements and InternationalStandards on Auditing (UK and Ireland) and the AuditCode of Practice issued by the Higher EducationFunding Council for England. Those standards requireus to comply with the Auditing Practices Board’s(APB’s) Ethical Standards for Auditors.Scope of the audit of thefinancial statementsA description of the scope of an audit of financialstatements is provided on the APB’s website atwww.frc.org.uk/apb/scope/private.cfm.In addition, we also report to you whether incomefrom funding bodies, grants and income forspecific purposes and from other restricted fundsadministered by the <strong>College</strong> has been properlyapplied only for the purposes for which it wasreceived and whether income has been appliedin accordance with the Statutes and, whereappropriate, with the <strong>Financial</strong> Memorandum withthe Higher Education Funding Council for England.18

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Income and Expenditure AccountYear Ended 31 July <strong>2012</strong>IncomeNotesYear Ended31 July <strong>2012</strong>£Year Ended31 July 2011(Restated)£Funding body grants11,621,0062,564,452Tuition fees and education contracts22,409,0812,310,640Research grants and contracts334,03526,993Other income42,724,1332,366,145Endowment and investment income558,73839,569Total income 6,846,993 7,307,799ExpenditureStaff costs63,132,1743,266,991Other operating expenses72,874,7132,824,929Depreciation526,208542,222Total expenditure 6,533,095 6,634,142Surplus on continuing operations after depreciationof tangible fixed assets, retained in General Reserve 313,898 673,657All amounts relate to continuing operations21

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Statement of Total Recognised Surpluses and DeficitsYear Ended 31 July <strong>2012</strong>NotesYear Ended31 July <strong>2012</strong>£Year Ended31 July 2011£Reported surplus on continuing operations 313,898 673,657Capital withdrawals from endowment fund14(23,297)-Unrealised surplus on revaluation of investments1450,002223,687Total recognised gains relating to the year 340,603 897,344Reconciliation of movement in reserves and endowmentsOpening reserves and endowments 5,026,679Total recognised gains for the year 340,603Closing reserves and endowments 5,367,28222

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Cash Flow StatementYear Ended 31 July <strong>2012</strong>NotesYear Ended31 July <strong>2012</strong>£Year Ended31 July 2011£Net cash inflow from operating activities 16 54,602 1,204,203Returns on investments and servicing of finance1758,73839,569Capital expenditure and financial investment18(60,771)96,148Management of liquid resources19220,893(987,401)Increase in the cash year 273,462 352,519Reconciliation of net cash flow to movement in net debtNotes31 July <strong>2012</strong>£31 July 2011£Increase in cash for the year 273,462 352,519Change in short term deposits (220,893) 987,401Change in net debt 52,569 1,339,920Net funds at 1 August 4,653,650 3,313,730Net funds at 31 July 4,706,219 4,653,65024

Principal Accounting Policies<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>“everyone involved in the course is eagerfor you to succeed.” (National Student Survey)25

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Principal Accounting PoliciesBasis of preparationThese financial statements have been prepared inaccordance with the Statement of RecommendedPractice (SORP): Accounting for Further and HigherEducation 2007 and in accordance with applicableAccounting Standards.Basis of accountingThe financial statements are prepared in accordancewith the historical cost convention.Recognition of incomeGrants received from HEFCE during the year have beenincluded in income for the year unless specificallydesignated, in which case they are recognised to theextent to which expenditure has been incurred for thedesignated purpose.Grants received in respect of the acquisition orconstruction of fixed assets are treated as deferredcapital grants. Such grants are credited to deferredcapital grants and an annual transfer made to theincome and expenditure account over the usefuleconomic life of the asset, at the same rate as thedepreciation charge on the asset for which the grantwas awarded.Income from tuition fees is recognised in the period forwhich it is received and includes all fees chargeableto students or their sponsors. Where the amountof the tuition fee is reduced, by a discount, incomereceivable is shown net of the discount. Bursaries andscholarships are accounted for gross as expenditureand not deducted from income.Income from contracts and other services rendered isincluded to the extent of the completion of the contractor service concerned.Endowment and investment income is credited to theincome and expenditure account on a receivable basis.Income from restricted endowments not expended inaccordance with the restrictions of the endowment, istransferred from the income and expenditure accountto restricted endowments. Any realised gains or lossesfrom dealing in the related assets are retained withinthe endowment in the balance sheet.Charitable donationsUnrestricted donations are recognised in theaccounts when the charitable donation has beenreceived or if, before receipt, there is sufficientevidence to provide the necessary certainty thatthe donation will be received and the value of theincoming resources can be measured with sufficientreliability.Donations with restrictions are recognised whenrelevant conditions have been met in many casesrecognition is directly related to expenditureincurred on specific purposes.Donations which are to be retained for the benefitof the institution are recognised in the statement oftotal recognised gains and losses and on the balancesheet as endowments. There are three main types:1. Unrestricted permanent endowments the donorhas specified that the fund is to be permanentlyinvested to generate an income stream for thegeneral benefit of the institution.2. Restricted expendable endowments the donor hasspecified a particular objective, and the institutioncan convert the donated sum into income.3. Restricted permanent endowments the donorhas specified that the fund is to be preservedto generate an income stream for a particularpurpose.Pension schemesRetirement benefits to employees of the <strong>College</strong> areprovided by the Universities Superannuation Scheme(USS) and the Superannuation Arrangements ofthe University of London (SAUL). USS is a definedbenefit scheme, which is externally funded andcontracted out of the State Second Pension (S2P).SAUL is a defined benefit (also known as “finalsalary”) scheme. It was established in 1976. Themembership mostly consists of clerical and manualstaff in the colleges of the University of London andassociated institutions. It is not possible to identifythe <strong>College</strong>’s share of the underlying assets andliabilities in the USS or SAUL schemes and hence,using the exemption under FRS 17, contributions tothe scheme are accounted for as if they were defined26

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Principal Accounting Policies... continuedcontribution schemes. Contributions to the schemesare charged to the income and expenditure account,so as to spread the cost of pensions over employees’working lives with the <strong>College</strong> in such a way thatthe pension cost is a substantially level percentageof current and future pensionable payroll. Thecontributions are determined by qualified actuarieson the basis of triennial valuations.Tangible fixed assetsAssets used by the <strong>College</strong>The <strong>College</strong> occupies the premises from which itoperates under a lease for which a nominal rental ispayable. The premises have been capitalised in thefinancial statements at the assessed values at thelease inception date, with a corresponding credit todeferred capital grants, and thereafter depreciatedover the period of use.Expenditure on the <strong>College</strong> premises is capitalisedto the extent that it increases the expected futurebenefits to the institution. The cost of any suchenhancements are added to the gross carrying valueof the tangible fixed asset concerned and thereafterdepreciated over the shorter of the expected usefullife, or the period to the end of the lease.Furniture and equipmentFurniture and equipment costing less than £5,000per individual item is written off to the income andexpenditure account in the period of acquisition.Other furniture and equipment is capitalised anddepreciated over its estimated useful life of between3 and 5 years.Maintenance of premisesThe cost of routine corrective maintenance ischarged to the income and expenditure account inthe period that it is incurred.InvestmentsListed investments held as fixed assets orendowment assets are stated at market value.Current asset investments, which may include listedinvestments, are stated at the lower of their cost andnet realisable value.Foreign currency translationAssets and liabilities denominated in foreigncurrencies are translated at the rates of exchangeruling at the end of the financial year, with allresulting exchange differences being taken to theincome and expenditure account in the period inwhich they arise.Reserves AccountingReserves held by the <strong>College</strong> are funds which can beused in accordance with the <strong>College</strong>’s objects and atthe discretion of the Board of Governors.TaxationThe <strong>College</strong> is a registered charity therefore withinthe meaning of section 506(1) of the Income andCorporation Taxes Act 1988 (ICTA 1988). Accordingly,the <strong>College</strong> is potentially exempt from taxation inrespect of income or capital gains received withincategories covered by section 505 of ICTA 1988 orsection 256 of the Taxation of Chargeable GainsAct 1992, to the extent that such income or gainsare applied to exclusively charitable purposes. The<strong>College</strong> receives no similar exemption in respect ofValue Added Tax.Cash flows and liquid resourcesCash flows comprise increases and decreases incash. Cash includes cash in hand, cash at bank,and deposits repayable on demand. Deposits arerepayable on demand if they are available within24 hours without penalty. No other investments,however liquid are included as cash.Liquid resources comprise government securitiesand short-term deposits with recognised banks andbuilding societies. They exclude any such assets heldas endowment asset investments.27

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Principal Accounting Policies... continuedProvisions, Contingent liabilities andcontingent assetsProvisions are recognised when the <strong>College</strong> hasa present legal or constructive obligation as aresult of a past event, it is probable that a transferof economic benefits will be required to settle theobligation and a reliable estimate can be made of theamount of the obligation.Contingent liabilities are disclosed by way of a note,when the definition of a provision is not met andincludes three scenarios: possible rather than apresent obligation; a possible rather than a probableoutflow of economic benefits; and inability tomeasure the economic outflow.Contingent assets are disclosed by way of a note,where there is a possible, rather than present, assetarising from a past event.Agency arrangementsFunds the <strong>College</strong> receives and disburses as payingagent on behalf of a funding body are excluded fromthe income and expenditure of the <strong>College</strong> where the<strong>College</strong> is exposed to minimal risk or enjoys minimaleconomic benefit related to the transaction.28

Notes to the <strong>Financial</strong> <strong>Statements</strong><strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>“There is a feeling that there is helpavailable at all times. It is a veryfriendly and secure place to study”29

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>Year Ended31 July <strong>2012</strong>Year Ended31 July 2011Notes££1 Funding body grants (Restated)Recurrent grantHigher Education Funding Council for England 1,335,151 1,425,409Specific grantsHigher Education Innovation Fund - 100,000Matched Funding Grant 245,595 933,701Deferred capital grants released in year:Equipment 13 40,260 105,3421,621,006 2,564,452The income figures for the year ended 31 July 2011 have been restated to show the Matched Fundinggrant as HEFCE income, this income was originally disclosed as “other income” in Note 4.2 Tuition fees and education contractsFull-time home and EU studentsFull-time international studentsPart-time students1,720,465254,481434,1351,626,368272,251412,0212,409,081 2,310,6403 Research grants and contractsResearch grants and contracts 34,035 26,99334,035 26,9934 Other incomeResidences, catering and conferencesOther incomeReleased from deferred capital grants1,033,3321,349,169341,632934,4311,104,928326,7862,724,133 2,366,1455 Endowment and investment incomeIncome from permanent endowmentsIncome from expendable endowmentsIncome from short-term investments22743,77314,7381,48031,0257,06458,738 39,56930

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>6 Staff costsStaff costs:SalariesSocial security costsOther pension costsNotesYear Ended31 July <strong>2012</strong>£2,658,960225,336247,878Year Ended31 July 2011£2,801,999226,409238,583Total 3,132,174 3,266,991Emoluments of the Principal:SalaryBenefitsPension contributions10,500--10,500--No staff members received remuneration of more than £100,000 during the year. Also no remuneration wasprovided to Governors for their services provided as Governors or for other services (2010 : Nil)Average staff numbers by major category: No. No.AcademicManagement & specialistOther4540-4838-85 86Included in the staff numbers above (mainly - but not only - within teaching departments) are staff who arealso diocesan priests or members of religious orders, including the Society of Jesus. These staff membersare paid by the <strong>College</strong>, but at a level below that for equivalently qualified staff who are not in religiousorders. This gives rise to a relatively low average annual salary cost for the <strong>College</strong> compared to other highereducation institutions.31

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>Year Ended31 July <strong>2012</strong>Year Ended31 July 20117 Analysis of other operating expenses by activityAcademic departmentsAcademic servicesAdministration and central servicesPremisesResidences, catering and conferencesOther expensesNotes£72,187115,216768,192859,667344,406715,045£87,448125,558815,949813,622374,679607,673Total 2,874,713 2,824,929Other operating expenses include:External auditors remuneration in respectof audit servicesExternal auditors remuneration in respectof non-audit services20,1805,80023,400032

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>LeaseholdLand andBuildingsFixtures,Fittings andEquipmentTotal8 Tangible assetsCost and valuationAt 1 August 2011Additions£23,212,173-£613,64560,771£23,825,81860,771At 31 July <strong>2012</strong> 23,212,173 674,416 23,886,589DepreciationAt 1 August 2011Charge for the year975,133384,902323,172141,3061,298,305526,208At 31 July <strong>2012</strong> 1,360,035 464,478 1,824,513Net Book ValueAt 31 July <strong>2012</strong> 21,852,138 209,938 22,062,076At 31 July 2011 22,237,040 290,473 22,527,513The valuation of the <strong>College</strong>’s leasehold interest in the premises and buildings known as 23 KensingtonSquare on an existing use basis is £18.35m. This is a professional estimate undertaken by Savills inSeptember 2009 of the value of the site to the <strong>College</strong> over the life of the lease. The lease contains severalprovisions which restrict the <strong>College</strong>’s ability to realise this value. Other provisions restrict the use of thepremises and buildings to the primary purposes of providing education, or the promotion of the RomanCatholic faith. Failure to comply with these provisions may cause clawback to arise in favour of the Religiousof the Assumption, from which the leasehold was acquired by Trustees for Roman Catholic Purposes (TRCP),and may in certain circumstances require the <strong>College</strong> to surrender the lease without receiving substantivecompensation. The governors do not believe that any relevant conditions have arisen and therefore noprovision for clawback has been made in the financial statements.The valuation of the <strong>College</strong>’s leasehold interest in 24 Kensington Square on an open market basis is £4m.The leasehold interest in 24 Kensington Square is not subject to the restrictions set out above.The <strong>College</strong> occupies the premises and buildings under a 70 year lease granted by TRCP at a peppercorn rental.33

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>Year Ended31 July <strong>2012</strong>Year Ended31 July 20119 Endowment assetsBalance at 1 AugustExpenditureIncrease in market value of investments£3,036,664(23,297)50,002£2,812,977-223,687Balance at 31 July 3,063,369 3,036,664Represented bySecuritiesCash and Securities2,864,951198,4182,749,966286,698Total endowment assets 3,063,369 3,036,664Endowment Assets are managed by both Royal London Asset Management and Newton InvestmentManagement Limited.34

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>Year Ended31 July <strong>2012</strong>Year Ended31 July 201110 DebtorsAmounts falling due within one year:DebtorsPrepayments and accrued income£609,631265,346£375,144206,465874,977 581,60911 InvestmentsDeposits maturing:1,169,797 1,390,6891,169,797 1,390,68912 Creditors : amounts falling due within one yearTrade creditorsSocial security and other taxation payableAccruals and deferred income188,46179,049690,072116,94675,706816,435957,582 1,009,08735

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>FundingCouncilOtherGrantsTotal13 Deferred capital grantsAt 1 August 2011BuildingsEquipment£-309,488£21,512,431128,774£21,512,431438,262Total 309,488 21,641,205 21,950,693Cash receivableBuildingsEquipmentTotal - - -Released to income and expenditure accountBuildingsEquipment---(40,260)--(319,286)( 22,346)--(319,286)(62,606)Total (40,260) (341,632) (381,892)At 31 July <strong>2012</strong>BuildingsEquipment-269,22821,193,145106,42821,193,145375,656Total 269,228 21,299,573 21,568,80136

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>14 EndowmentsBalances at 1 August 2011CapitalAccumulated incomeIncrease in market valueof investmentsInvestment incomeExpenditureRestrictedPermanent£RestrictedExpendable£<strong>2012</strong>Total£2011Total264,797 2,521,857 2,786,654 2,786,65426,323 223,687 250,01026,323291,120 2,745,544 3,036,664 2,812,977-227(227)50,00243,773(67,070)50,00244,000(67,297)£223,68732,502(32,502)At 31 July <strong>2012</strong> 291,120 2,772,249 3,063,369 3,036,664Represented by:CapitalAccumulated income264,79726,3232,521,857250,3922,786,654276,7152,786,654250,010291,120 2,772,249 3,063,369 3,036,664The restricted expendable endowment represents monies donated to the <strong>College</strong> by the Trustees for RomanCatholic Purposes for the repair and maintenance of the <strong>College</strong> estate.<strong>2012</strong>£15 ReservesIncome and expenditure reserveAt 1 August 20111,990,015Surplus retained for the year313,898At 31 July <strong>2012</strong> 2,303,91337

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>16 Reconciliation of surplus before tax and profit on disposalof assets to net cash inflow from operating activitiesSurplus after depreciation of tangiblefixed assets at valuation and before taxDepreciationDeferred capital grants released to incomeInvestment income(Increase) in debtorsIncrease in creditorsNotes135Year Ended31 July <strong>2012</strong>£313,898526,208(381,892)(58,738)(293,368)(51,505)Year Ended31 July 2011£673,657542,222(432,128)(39,569)441,12118,900Net cash inflow from operating activities 54,602 1,204,20317 Returns on investments and servicing of financeIncome from endowmentsOther interest received44,00014,73832,5057,06458,738 39,56918 Capital expenditure and financial investmentPayments made to acquire fixed assetsDeferred capital grants receivedNet cash outflow for capital expenditureand financial investment813(60,771) (201,535)0 297,683(60,771) 96,14819 Management of liquid resources(Increase) / Decrease deposits heldat Royal London Asset Management220,893 (987,401)220,893 (987,401)38

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>20 Analysis of changes in net FundsEndowment assetsCurrent asset investmentsCash at bank and in handNotes1411At 1st August2011£3,036,6641,390,689449,984CashFlows£-(220,893)273,462Non-CashChanges£50,002--At 31st July<strong>2012</strong>£3,086,6661,169,796723,4464,877,337 52,569 50,002 4,979,908££21 Capital and other commitmentsProvision has not been made for the followingcapital commitments at 31 July 2011:Commitments contracted for - -- -<strong>2012</strong>201139

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the Accountsfor the year ended 31 July <strong>2012</strong>Year Ended 31 July <strong>2012</strong>£22 Amounts disbursed as agentHardship fundsIncomeExcess of income over expenditure at 1 August 2011 3,904 (525)Funding Council grantsInterest earnedExpenditureDisbursed to studentsFund running costs14,415- 18,319(16,904)(1,361) (18,265)Year Ended 31 July 2011£16,354- 15,829(11,925)- (11,925)Excess of income over expenditure at 31 July 54 3,904Funding Council grants are available solely to assist students: the <strong>College</strong> acts only as paying agent.The grants and related disbursements are therefore excluded from the Income and Expenditure Account.The following bursaries were received and expended during the year and have been excluded from theincome and expenditure account:Abrahamic BursariesBalance at 1st AugustBursaries AwardedYear Ended31 July <strong>2012</strong>£--Year Ended31 July 2011£7,000(7,000)Balance unspent at 31 July - -23 Disclosure of related party transactionsFive members of the <strong>College</strong>’s Governing Body are nominated by the Trustees for Roman CatholicPurposes (“TRCP”) as shown on page 1, and during the year three members of the Governing Bodyalso served as Trustees of TRCP. The <strong>College</strong> is grateful for the substantial support it receivesfrom TRCP. TRCP have donated £2.5m to the college to help fund the maintenance of the site atKensington Square and during the year donated a further £0.759m to help fund the overall runningcosts of the <strong>College</strong>. Additionally, TRCP sponsors certain members of the Society of Jesus whoare students of the <strong>College</strong>, thereby paying the <strong>College</strong> directly for those students’ tuition fees. Adonation is usually made by TRCP to the Collge equivalent to the cost of paying members of staff whoare Jesuits, in 2011/12 this totalled £0.17m.The <strong>College</strong>’s Vice Principal - Academic is also the Director of the Lokahi Foundation, a social impactcharity. The Lokahi Foundation rents office space from the <strong>College</strong> and pays a service charge for theuse of this space.Rent and service charges are calculated on an arms length basis and in 2011-12totalled £0.03m40

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the <strong>Financial</strong> <strong>Statements</strong>24 Pension SchemesSAULThe <strong>College</strong> participates in a centralised definedbenefit scheme for all qualified employees withthe assets held in separate Trustee-administeredfunds. The <strong>College</strong> has now adopted FRS17 foraccounting for pension costs. It is not possible toidentify the <strong>College</strong>’s share of the underlying assetsand liabilities of SAUL. Therefore contributions areaccounted for as if SAUL were a defined contributionscheme and pension costs are based on the amountsactually paid (ie cash amounts) in accordance withparagraphs 8 - 12 of FRS17.SAUL is subject to triennial valuations byprofessionally qualified and independent actuaries.The last available valuation was carried out as at 31March 2011 using the projected unit credit methodin which the actuarial liability makes allowance forprojected earnings. The main assumptions used toassess the technical provisions were:Past serviceDiscount rate- pre-retirement6.8%- post-retirement4.7%General Salary increases *3.75% p.a. until 31 March 2014, 4.5% p.a. thereafterRetail Prices Index inflation (RPI)3.50% p.a.Consumer Prices Index inflation (CPI)2.80% p.a.Pension increases in payment (excess over GMP) 2.80% p.a.SAPS Normal (year of birth) tables with an ageMortality – base tablerating of +0.5 years for males and -0.4 years forfemales.Future improvements in line with CMI 2010Mortality – future improvementsprojections with a long term trend rate of 1.25% p.a.*an additional allowance is made for promotional Salary increasesThe actuarial valuation applies to SAUL as a wholeand does not identify surpluses or deficits applicableto individual employers. As a whole, the market valueof SAUL’s assets was £1,506 million representing95% of the liability for benefits after allowing forexpected future increases in salaries.Based on the strength of the Employer covenantand the Trustee’s long-term investment strategy,the Trustee and the employers agreed to maintainEmployer and Member contributions at 13% ofSalaries and 6% of Salaries respectively followingthe valuation. The above rates will be reviewed whenthe results of the next formal valuation (as at 31March 2014) are known.A comparison of SAUL’s assets and liabilitiescalculated using assumptions consistent with FRS17revealed SAUL to be in deficit at the last formalvaluation date (31 March 2011). As part of thisvaluation, the Trustee and Employer have agreedthat no additional contributions will be required toeliminate the current shortfall.The more material changes (the introduction ofa Career Average Revalued Earnings, or “CARE”,41

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the <strong>Financial</strong> <strong>Statements</strong>... continued24 Pension Schemes... continuedbenefit structure) to SAUL’s benefit structure willapply from 1 July <strong>2012</strong>. As a consequence, the costof benefit accrual is expected to fall as existing finalsalary members are replaced by new membersjoining the CARE structure. This will allow anincreasing proportion of the expected asset returnto be used to eliminate the funding shortfall. Basedon conditions as at 31 March 2011, the shortfall isexpected to be eliminated by 31 March 2021, which is10 years from the valuation date.Universities SuperannuationScheme (‘USS’)The <strong>College</strong> participates in the UniversitiesSuperannuation Scheme (USS), a defined benefitscheme which is contracted out of the State SecondPension (S2P). The assets of the scheme are heldin a separate trustee-administered fund. Becauseof the mutual nature of the scheme, the scheme’sassets are not linked to individual institutions and ascheme-wide contribution rate is set. The <strong>College</strong> istherefore exposed to actuarial risks associated withother institutions’ employees and is unable to identifyits share of the underlying assets and liabilities ofthe scheme on a consistent and reasonable basisand therefore, as required by FRS 17 “Retirementbenefits”, accounts for the scheme as if it were adefined contribution scheme. As a result, the amountcharged to the income and expenditure accountrepresents the contributions payable to the schemein respect of the accounting period.The latest actuarial valuation of the scheme wasat 31 March 2011. The valuation was carried outusing the projected unit method. The assumptionswhich have the most significant effect on theresult of the valuation are those relating to therate of return on investments (i.e. the valuationrate of interest), the rates of increase in salary andpensions and the assumed rates of mortality. Thefinancial assumptions were derived from marketyields prevailing at the valuation date. An “inflationrisk premium” adjustment was also included bydeducting 0.3% from the market-implied inflation.To calculate the technical provisions, it was assumedthat the valuation rate of interest would be 6.1% perannum, salary increases would be 4.4% per annum(plus an additional allowance for increases in salariesdue to age and promotion reflecting historic Schemeexperience, with a further cautionary reserve ontop for past service liabilities) and pensions wouldincrease by 3.4% per annum for the 3 years followingthe valuation then 2.6% per annum thereafter.Standard mortality tables were used as follows:Male members’ mortalityFemale members’ mortalityS1NA (Light) year of birth tables – No age ratingS1NA (Light) year of birth tables – rated down 1 yearUse of these mortality tables reasonably reflects the actual USS experience but also provides an element ofconservatism to allow for further improvements in mortality rates. The assumed life expectations on retirementat age 65 are:Males (females) currently aged 65Males (females) currently aged 4523.7 (25.6) years25.5 (27.6) years42

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Notes to the <strong>Financial</strong> <strong>Statements</strong>... continued24 Pension Schemes... continuedAt the valuation date, the value of the assets of thescheme was £32,433.5 million and the value of theschemes’ technical provisions was £35,343.7 millionindicating a shortfall of £2,910.2 million. The assetstherefore were sufficient to cover 92% of the benefitswhich had accrued to members after allowing forexpected future increases in earnings.The actuary also valued the scheme on a numberof other bases as at the valuation date. On thescheme’s historic gilts basis, using a valuation rateof interest in respect of past service liabilities of4.4% per annum (the expected return on gilts) thefunding level was approximately 68%. Under thePension Protected Fund regulations introduced bythe Pensions Act 2004 the Scheme was 93% funded;and on a buy-out basis (ie assuming the Schemehad discontinued on the valuation date) the assetswould have been approximately 57% of the amountnecessary to secure all the USS benefits with aninsurance company.Surpluses or deficits which arise at future valuationmay impact on the institution’s future contributioncommitment. A deficit may require additional fundingin the form of higher contribution requirements,where a surplus could, perhaps, be used to similarlyreduce contribution requirements. The sensitivitiesregarding the principal assumptions used to measurethe scheme liabilities are set out below:Assumption Change in assumption Impact on scheme liabilitiesRate of investment return Increase/decrease by 0.25% Decrease/increase by £1.6 billionRate of salary growth Increase/decrease by 0.25% Increase/decrease by £0.6 billionRate of mortalityMembers live one year longer Increase by £0.8 billionthan assumedUSS is a “last man standing” scheme so that in theevent of the insolvency of any of the participatingemployers in USS, the amount of any pension fundingshortfall (which cannot otherwise be recovered) inrespect of that employer will be spread across theremaining participant employers and reflected in thenext actuarial valuation of the scheme.The next formal triennial actuarial valuation is dueas at 31 March 2014. The contribution rate willbe reviewed as part of each valuation and may bereviewed more frequently.43

<strong>Annual</strong> Report and <strong>Financial</strong> <strong>Statements</strong>For the year ended 31 July <strong>2012</strong>Kensington Square, London W8 5HN Tel: 020 7795 6600 Fax: 020 7795 4200E-mail: enquiries@heythrop.ac.uk www.heythrop.ac.uk44