er.Z?f - AmAssurance

er.Z?f - AmAssurance

er.Z?f - AmAssurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

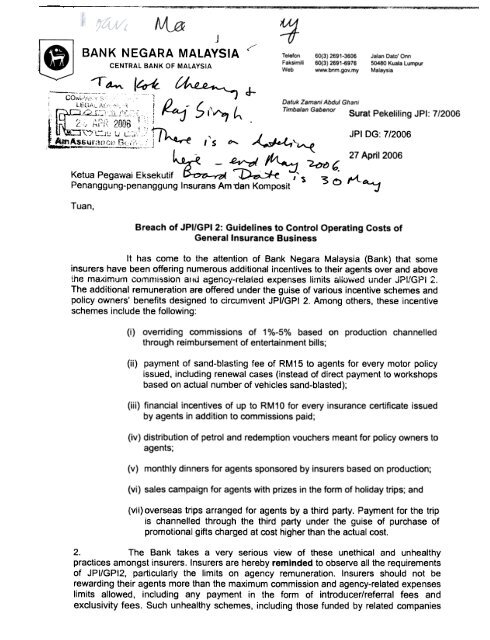

~ 27JBAN K N EGARA MALAYSIA .-CENTRAL BANK OF MALAYSIA'"'"--::--"-:':'~~ ,~ ~ -D~ -d-COlvlr;:..,'Y::; ~E/~~';.~~~):~7'.!";: -.,,! : ~-.~..~ ' '\;' I;tr.=L!-" ,,-. .,-,. '. " ~ I ~ h~' .., ,r,i, '"}on~ ~".I -,.,'~,{'I hi-", t.: U\.J .'TelefonFaksimiliWeb60{3) 2691-360660{3) 2691-6976www.bnm.gov.myJalan Data' Onn50480 Kuala LumpurMalaysiaDatuk Zamani Abdu/ GhaniTimba/an Gabenor Surat Pekeliling JPI: 7/2006,;"\""'"i '1 1 c.,,, ..\ r7~'.o...rl'.0 ~~ ,;:J,:~",,"'n;":::'::" 11 't)-.. 1 ~ , jPI DG. 7/2006~~U!':'!;:::...::.:.:.;~;;,;J , S "'~'IA.{~ _..<strong>er</strong>.Z?f,~~,Ketua Pegawai Eksekutif&;:'D ~ ('"D~* .I'~ "3 0 ,vlPenanggung-penanggung Insurans Am'dan Komposlt ~April 2006Tuan,Breach of JPI/GPI 2: Guidelines to Control Op<strong>er</strong>ating Costs ofGen<strong>er</strong>al Insurance BusinessIt has come to the attention of Bank Negara Malaysia (Bank) that someinsur<strong>er</strong>s have been off<strong>er</strong>ing num<strong>er</strong>ous additional incentives to their agents ov<strong>er</strong> and abovethe maximum commission arid agency-related expenses limits allovv"ed und<strong>er</strong> JPI/GPI L.The additional remun<strong>er</strong>ation are off<strong>er</strong>ed und<strong>er</strong> the guise of various incentive schemes andpolicy own<strong>er</strong>s' benefits designed to circumvent JPI/GPI 2. Among oth<strong>er</strong>s, these incentiveschemes include the following:(i) ov<strong>er</strong>riding commissions of 1 %-5% based on production channelledthrough reimbursement of ent<strong>er</strong>tainment bills;(ii) payment of sand-blasting fee of RM15 to agents for ev<strong>er</strong>y motor policyissued, including renewal cases (instead of direct payment to workshopsbased on actual numb<strong>er</strong> of vehicles sand-blasted);(iii) financial incentives of up to RM10 for ev<strong>er</strong>y insurance c<strong>er</strong>tificate issuedby agents in addition to commissions paid;(iv) distribution of petrol and redemption vouch<strong>er</strong>s meant for policy own<strong>er</strong>s toagents;(v) monthly dinn<strong>er</strong>s for agents sponsored by insur<strong>er</strong>s based on production;(vi) sales campaign for agents with prizes in the form of holiday trips; and(vii) ov<strong>er</strong>seas trips arranged for agents by a third party. Payment for the tripis channelled through the third party und<strong>er</strong> the guise of purchase ofpromotional gifts charged at cost high<strong>er</strong> than the actual cost.2. The Bank takes a v<strong>er</strong>y s<strong>er</strong>ious view of these unethical and unhealthypractices amongst insur<strong>er</strong>s. Insur<strong>er</strong>s are h<strong>er</strong>eby reminded to obs<strong>er</strong>ve all the requirementsof JPI/GPI2. particularly the limits on agency remun<strong>er</strong>ation. Insur<strong>er</strong>s should not b<strong>er</strong>ewarding their agents more than the maximum commission and agency-related expenseslimits allowed, including any payment in the form of introduc<strong>er</strong>/ref<strong>er</strong>ral fees andexclusivity fees. Such unhealthy schemes, including those funded by related companies

2of insur<strong>er</strong>s, are not in line with the spirit of JPI/GPI 2 and insur<strong>er</strong>s must cease theseschemes Immediately. The Bank will conduct focused examinations on insur<strong>er</strong>s from timeto time and findings of involvement in such irregular schemes will be consid<strong>er</strong>ed in theassessment of the eligibility of Board memb<strong>er</strong>s and chief executive offic<strong>er</strong>s of insur<strong>er</strong>s forreappointment by the Bank. We would like to reit<strong>er</strong>ate that the senior management team ofinsur<strong>er</strong>s cannot absolve themselves of any unhealthy schemes involving their companyincluding by reason of ignorance.3. Insur<strong>er</strong>s are required to table the contents of this circular at their next Boardof Directors' meeting. To instil great<strong>er</strong> market discipline and ensure full compliance withJPI/GPI 2, the Board is required to immediately initiate an int<strong>er</strong>nal investigation and submita report of its findings to the Bank to attest to eith<strong>er</strong> of the following:(i) the insur<strong>er</strong> is not involved in any such unhealthy schemes; or(ii) the insur<strong>er</strong> has immediately ceased such unhealthy practices with anund<strong>er</strong>taking that the insur<strong>er</strong> will not engage in such practices in thefuture.Insur<strong>er</strong>s are also required to provide to the Bank a half-yearly attestation to be signed bytwo Board memb<strong>er</strong>s and the chief executive offic<strong>er</strong> confirming full compliance of theinsur<strong>er</strong> with all the provisions of JPI/GPI 2.4. Reports on the int<strong>er</strong>nal investigations and the first attestation from the Boardshould be submitted to the following address by end-May 2006:PengarahJabatan Penyeliaan InsuransBank Negara MalaysiaTingkat 15Dataran Kewangan Darul TakafulNo.4, Jalan Sultan Sulaiman50000 Kuala Lumpur.Subsequent half-yearly attestations, commencing from the second half of 2006, should besubmitted to the same address not lat<strong>er</strong> than three weeks aft<strong>er</strong> the end of each reportingp<strong>er</strong>iod.Sekian.Yang benar,(Datuk Zamani Abdul Ghani)Timbalan Gabenor5.k.:Pengarah, Jabatan Penyeliaan InsuransPengarah, Jabatan P<strong>er</strong>bankan Islam dan Takaful