Delivering Financial Inclusion Services to Rural Citizens through the ...

Delivering Financial Inclusion Services to Rural Citizens through the ...

Delivering Financial Inclusion Services to Rural Citizens through the ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

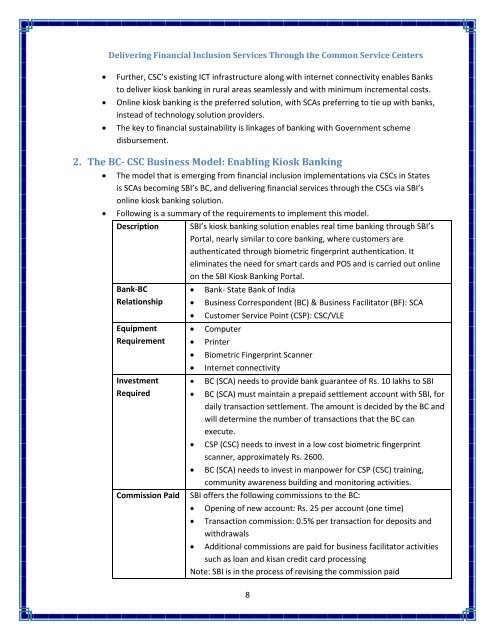

<strong>Delivering</strong> <strong>Financial</strong> <strong>Inclusion</strong> <strong>Services</strong> Through <strong>the</strong> Common Service CentersFur<strong>the</strong>r, CSC’s existing ICT infrastructure along with internet connectivity enables Banks<strong>to</strong> deliver kiosk banking in rural areas seamlessly and with minimum incremental costs.Online kiosk banking is <strong>the</strong> preferred solution, with SCAs preferring <strong>to</strong> tie up with banks,instead of technology solution providers.The key <strong>to</strong> financial sustainability is linkages of banking with Government schemedisbursement.2. The BC- CSC Business Model: Enabling Kiosk Banking The model that is emerging from financial inclusion implementations via CSCs in Statesis SCAs becoming SBI’s BC, and delivering financial services <strong>through</strong> <strong>the</strong> CSCs via SBI’sonline kiosk banking solution.Following is a summary of <strong>the</strong> requirements <strong>to</strong> implement this model.DescriptionBank-BCRelationshipEquipmentRequirementInvestmentRequiredCommission PaidSBI’s kiosk banking solution enables real time banking <strong>through</strong> SBI’sPortal, nearly similar <strong>to</strong> core banking, where cus<strong>to</strong>mers areau<strong>the</strong>nticated <strong>through</strong> biometric fingerprint au<strong>the</strong>ntication. Iteliminates <strong>the</strong> need for smart cards and POS and is carried out onlineon <strong>the</strong> SBI Kiosk Banking Portal.Bank- State Bank of IndiaBusiness Correspondent (BC) & Business Facilita<strong>to</strong>r (BF): SCACus<strong>to</strong>mer Service Point (CSP): CSC/VLEComputerPrinterBiometric Fingerprint ScannerInternet connectivityBC (SCA) needs <strong>to</strong> provide bank guarantee of Rs. 10 lakhs <strong>to</strong> SBIBC (SCA) must maintain a prepaid settlement account with SBI, fordaily transaction settlement. The amount is decided by <strong>the</strong> BC andwill determine <strong>the</strong> number of transactions that <strong>the</strong> BC canexecute.CSP (CSC) needs <strong>to</strong> invest in a low cost biometric fingerprintscanner, approximately Rs. 2600.BC (SCA) needs <strong>to</strong> invest in manpower for CSP (CSC) training,community awareness building and moni<strong>to</strong>ring activities.SBI offers <strong>the</strong> following commissions <strong>to</strong> <strong>the</strong> BC:Opening of new account: Rs. 25 per account (one time)Transaction commission: 0.5% per transaction for deposits andwithdrawals Additional commissions are paid for business facilita<strong>to</strong>r activitiessuch as loan and kisan credit card processingNote: SBI is in <strong>the</strong> process of revising <strong>the</strong> commission paid8