Delivering Financial Inclusion Services to Rural Citizens through the ...

Delivering Financial Inclusion Services to Rural Citizens through the ...

Delivering Financial Inclusion Services to Rural Citizens through the ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

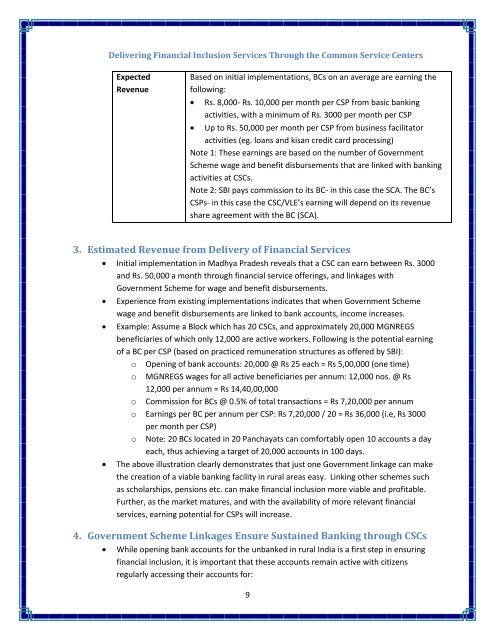

<strong>Delivering</strong> <strong>Financial</strong> <strong>Inclusion</strong> <strong>Services</strong> Through <strong>the</strong> Common Service CentersExpectedRevenueBased on initial implementations, BCs on an average are earning <strong>the</strong>following:Rs. 8,000- Rs. 10,000 per month per CSP from basic bankingactivities, with a minimum of Rs. 3000 per month per CSP Up <strong>to</strong> Rs. 50,000 per month per CSP from business facilita<strong>to</strong>ractivities (eg. loans and kisan credit card processing)Note 1: These earnings are based on <strong>the</strong> number of GovernmentScheme wage and benefit disbursements that are linked with bankingactivities at CSCs.Note 2: SBI pays commission <strong>to</strong> its BC- in this case <strong>the</strong> SCA. The BC’sCSPs- in this case <strong>the</strong> CSC/VLE’s earning will depend on its revenueshare agreement with <strong>the</strong> BC (SCA).3. Estimated Revenue from Delivery of <strong>Financial</strong> <strong>Services</strong> Initial implementation in Madhya Pradesh reveals that a CSC can earn between Rs. 3000and Rs. 50,000 a month <strong>through</strong> financial service offerings, and linkages withGovernment Scheme for wage and benefit disbursements.Experience from existing implementations indicates that when Government Schemewage and benefit disbursements are linked <strong>to</strong> bank accounts, income increases.Example: Assume a Block which has 20 CSCs, and approximately 20,000 MGNREGSbeneficiaries of which only 12,000 are active workers. Following is <strong>the</strong> potential earningof a BC per CSP (based on practiced remuneration structures as offered by SBI):o Opening of bank accounts: 20,000 @ Rs 25 each = Rs 5,00,000 (one time)o MGNREGS wages for all active beneficiaries per annum: 12,000 nos. @ Rs12,000 per annum = Rs 14,40,00,000o Commission for BCs @ 0.5% of <strong>to</strong>tal transactions = Rs 7,20,000 per annumo Earnings per BC per annum per CSP: Rs 7,20,000 / 20 = Rs 36,000 (i.e, Rs 3000per month per CSP)o Note: 20 BCs located in 20 Panchayats can comfortably open 10 accounts a dayeach, thus achieving a target of 20,000 accounts in 100 days.The above illustration clearly demonstrates that just one Government linkage can make<strong>the</strong> creation of a viable banking facility in rural areas easy. Linking o<strong>the</strong>r schemes suchas scholarships, pensions etc. can make financial inclusion more viable and profitable.Fur<strong>the</strong>r, as <strong>the</strong> market matures, and with <strong>the</strong> availability of more relevant financialservices, earning potential for CSPs will increase.4. Government Scheme Linkages Ensure Sustained Banking <strong>through</strong> CSCs While opening bank accounts for <strong>the</strong> unbanked in rural India is a first step in ensuringfinancial inclusion, it is important that <strong>the</strong>se accounts remain active with citizensregularly accessing <strong>the</strong>ir accounts for:9