- Page 1 and 2:

GLOBE TELECOM, INC.5 th Floor, Glob

- Page 3:

Neither the delivery of this Prospe

- Page 8 and 9:

Definition of Termscorporation duly

- Page 10 and 11:

Definition of Terms“SEC Permit”

- Page 12 and 13:

Executive Summary G-Xchange, Inc. (

- Page 14 and 15:

Executive SummaryThe Company has a

- Page 16 and 17:

Executive SummaryOther fixed line d

- Page 18 and 19:

Executive SummaryOther Developments

- Page 20 and 21:

SUMMARY OF THE OFFERINGIssuer... ..

- Page 22 and 23:

Summary of the OfferingStatus of th

- Page 24 and 25:

Risk Factors and Other Consideratio

- Page 26 and 27:

Risk Factors and Other Consideratio

- Page 28 and 29:

Risk Factors and Other Consideratio

- Page 30 and 31:

Risk Factors and Other Consideratio

- Page 32 and 33:

PHILIPPINE TAXATIONThe following is

- Page 34 and 35:

Philippine TaxationVALUE-ADDED TAXG

- Page 36 and 37:

USE OF PROCEEDSFollowing the offer

- Page 38 and 39:

Determination of Offer PriceDETERMI

- Page 40 and 41:

Plan of Distribution(BPI). Globe an

- Page 42 and 43:

Plan of DistributionPAYMENTSThe Pay

- Page 44 and 45:

Description of the Bondsinspection

- Page 46 and 47:

Description of the BondsBusiness Da

- Page 48 and 49:

Description of the Bondsi. Any gove

- Page 50 and 51:

Description of the Bondscomputing t

- Page 52 and 53:

Description of the Bondscompensatio

- Page 54 and 55:

Description of the Bonds will adver

- Page 56 and 57:

Description of the Bondsthe payment

- Page 58 and 59:

Description of the Bondsthe Trust I

- Page 60 and 61:

Description of the Bondspayment of

- Page 62 and 63:

Description of the Bondsregard to p

- Page 64 and 65:

INDEPENDENT AUDITOR AND COUNSELLEGA

- Page 66 and 67:

DESCRIPTION OF BUSINESSOverviewGlob

- Page 68 and 69:

Description of BusinessBusiness Seg

- Page 70 and 71:

Description of BusinessBrowsing rat

- Page 72 and 73:

Description of BusinessFinancial St

- Page 74 and 75:

Description of BusinessGlobe Stores

- Page 76 and 77:

Description of BusinessRecent Promo

- Page 78 and 79:

Description of BusinessData and Bro

- Page 80 and 81:

Description of BusinessToll-FreeSer

- Page 82 and 83:

Description of BusinessManagedInter

- Page 84 and 85:

Description of BusinessTen operator

- Page 86 and 87:

Description of Businessmobile and f

- Page 88 and 89:

Description of Business(In Thousand

- Page 90 and 91:

Description of BusinessTransactions

- Page 92 and 93:

Description of BusinessPixlink, Unl

- Page 94 and 95:

Description of BusinessOn June 29,

- Page 96 and 97:

Buildings and Leasehold Improvement

- Page 98 and 99:

Description of Propertiessystems in

- Page 100 and 101:

Certain Legal Proceedingstheir lawy

- Page 102 and 103:

Certain Legal ProceedingsNTC from h

- Page 104 and 105:

Market Price and Dividends on Globe

- Page 106 and 107:

Market Price and Dividends on Globe

- Page 108 and 109:

Market Price and Dividends on Globe

- Page 110 and 111:

Market Price and Dividends on Globe

- Page 112 and 113:

Management’s Discussion and Analy

- Page 114 and 115: Management’s Discussion and Analy

- Page 116 and 117: Management’s Discussion and Analy

- Page 118 and 119: Management’s Discussion and Analy

- Page 120 and 121: Management’s Discussion and Analy

- Page 122 and 123: Management’s Discussion and Analy

- Page 124 and 125: Management’s Discussion and Analy

- Page 126 and 127: Management’s Discussion and Analy

- Page 128 and 129: Management’s Discussion and Analy

- Page 130 and 131: Management’s Discussion and Analy

- Page 132 and 133: Management’s Discussion and Analy

- Page 134 and 135: Management’s Discussion and Analy

- Page 136 and 137: Management’s Discussion and Analy

- Page 138 and 139: Management’s Discussion and Analy

- Page 140 and 141: Management’s Discussion and Analy

- Page 142 and 143: Management’s Discussion and Analy

- Page 144 and 145: Management’s Discussion and Analy

- Page 146 and 147: Management’s Discussion and Analy

- Page 148 and 149: Management’s Discussion and Analy

- Page 150 and 151: Management’s Discussion and Analy

- Page 152 and 153: Management’s Discussion and Analy

- Page 154 and 155: Management’s Discussion and Analy

- Page 156 and 157: Management’s Discussion and Analy

- Page 158 and 159: Management’s Discussion and Analy

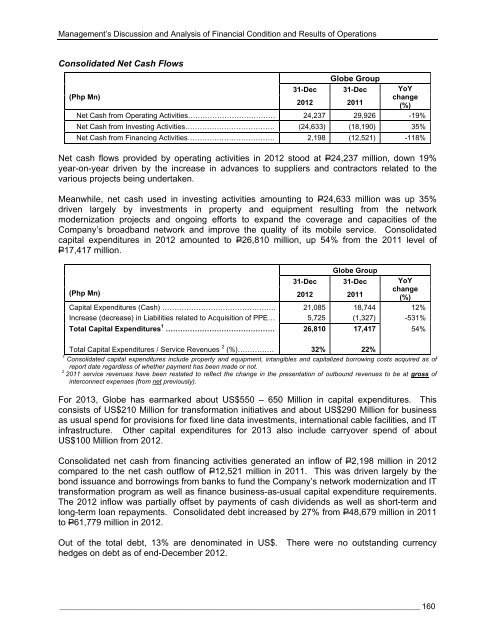

- Page 160 and 161: Management’s Discussion and Analy

- Page 162 and 163: Management’s Discussion and Analy

- Page 166 and 167: Management’s Discussion and Analy

- Page 168 and 169: Management’s Discussion and Analy

- Page 170 and 171: Management’s Discussion and Analy

- Page 172 and 173: Management’s Discussion and Analy

- Page 174 and 175: Management’s Discussion and Analy

- Page 176 and 177: Management’s Discussion and Analy

- Page 178 and 179: Management’s Discussion and Analy

- Page 180 and 181: Management’s Discussion and Analy

- Page 182 and 183: Management’s Discussion and Analy

- Page 184 and 185: Management’s Discussion and Analy

- Page 186 and 187: Management’s Discussion and Analy

- Page 188 and 189: Management’s Discussion and Analy

- Page 190 and 191: Management’s Discussion and Analy

- Page 192 and 193: Management’s Discussion and Analy

- Page 194 and 195: Management’s Discussion and Analy

- Page 196 and 197: DIRECTORS, EXECUTIVE OFFICERS ANDCO

- Page 198 and 199: Directors, Executive Officers and C

- Page 200 and 201: Directors, Executive Officers and C

- Page 202 and 203: Directors, Executive Officers and C

- Page 204 and 205: Standard ArrangementsDirectorsEXECU

- Page 206 and 207: Executive Compensationi. The Compan

- Page 208 and 209: Security Ownership of Management an

- Page 210 and 211: Description of Debtshareholders, in

- Page 212 and 213: FINANCIAL INFORMATIONThe following

- Page 215:

Globe Telecom, Inc. and Subsidiarie

- Page 219 and 220:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 221 and 222:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 223 and 224:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 225 and 226:

- 3 -Name of Subsidiary Place of In

- Page 227 and 228:

- 5 -The amendments require entitie

- Page 229 and 230:

- 7 -PAS 32, Financial Instruments:

- Page 231 and 232:

- 9 -The Globe Group offers loyalty

- Page 233 and 234:

- 11 -For all other financial instr

- Page 235 and 236:

- 13 -account in the consolidated s

- Page 237 and 238:

- 15 -Fair Value HedgesFair value h

- Page 239 and 240:

- 17 -2.7.4.2.1.1 SubscribersManage

- Page 241 and 242:

- 19 -2.7.4.3.2 Financial Liability

- Page 243 and 244:

- 21 -Transfers are made to investm

- Page 245 and 246:

- 23 -An impairment loss is recogni

- Page 247 and 248:

- 25 -Where an equity-settled award

- Page 249 and 250:

- 27 -Leases where the lessor retai

- Page 251 and 252:

- 29 -retains all the significant r

- Page 253 and 254:

- 31 -3.2.2 Allowance for impairmen

- Page 255 and 256:

- 33 -In 2012, 2011 and 2010, the G

- Page 257 and 258:

- 35 -3.2.8 Financial assets and fi

- Page 259 and 260:

- 37 -Inventories recognized as exp

- Page 261 and 262:

- 39 -TelecommunicationsEquipmentBu

- Page 263 and 264:

- 41 -9. Intangible Assets and Good

- Page 265 and 266:

- 43 -On May 10, 2011, the BOD of G

- Page 267 and 268:

- 45 -converted into new BTI shares

- Page 269 and 270:

- 47 -The interest rates and maturi

- Page 271 and 272:

- 49 -The Globe Group, in their reg

- Page 273 and 274:

- 51 -The funded status for the pen

- Page 275 and 276:

- 53 -16.5 Transactions with key ma

- Page 277 and 278:

- 55 -2011RevenuesAmount/Volume Out

- Page 279 and 280:

- 57 -17. Equity and Other Comprehe

- Page 281 and 282:

- 59 -For the Year Ended December 3

- Page 283 and 284:

- 61 -The average share prices at d

- Page 285 and 286:

- 63 -The overall expected rate of

- Page 287 and 288:

- 65 -Interest expense - net is inc

- Page 289 and 290:

- 67 -The reconciliation of the pro

- Page 291 and 292:

- 69 -In addition, total payments t

- Page 293 and 294:

- 71 -25.7 Construction Maintenance

- Page 295 and 296:

- 73 -The succeeding discussion foc

- Page 297 and 298:

- 75 -28.2.1.2 Foreign Exchange Ris

- Page 299 and 300:

- 77 -The Globe Group makes a quart

- Page 301 and 302:

- 79 -The table below provides info

- Page 303 and 304:

- 81 -28.2.3 Liquidity RiskThe Glob

- Page 305 and 306:

- 83 -20112012 2013 2014 20152016 a

- Page 307 and 308:

- 85 -The following tables present

- Page 309 and 310:

- 87 -2010Other Financial Liabiliti

- Page 311 and 312:

- 89 -2010NotionalAmountNotionalAmo

- Page 313 and 314:

- 91 -Nondeliverable ForwardsThe Gl

- Page 315 and 316:

- 93 -28.10 Categories of Financial

- Page 317 and 318:

- 95 -December 312012 2011 2010(In

- Page 319 and 320:

- 97 -2010MobileCommunicationsServi

- Page 321 and 322:

- 99 -29.2 Wireline Communications

- Page 323 and 324:

- 101 -31. Events after the Reporti

- Page 325 and 326:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 327 and 328:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 329 and 330:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 331 and 332:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 333 and 334:

- 3 -PFRS 10 establishes a single c

- Page 335 and 336:

- 5 -3. Property and EquipmentThe r

- Page 337 and 338:

- 7 -4. Intangible Assets and Goodw

- Page 339 and 340:

- 9 -As of March 31, 2013 and Decem

- Page 341 and 342:

- 11 -On February 10, 2012, the BOD

- Page 343 and 344:

- 13 -The Amendment to PAS 19 has b

- Page 345 and 346:

- 15 -upgrade and overhaul of its b

- Page 347 and 348:

- 17 -14.2 Capital and Financial Ri

- Page 349 and 350:

- 19 -14.2.1.2 Foreign Exchange Ris

- Page 351 and 352:

- 21 -comprise short-term bank depo

- Page 353 and 354:

- 23 -December 31, 2012Neither Past

- Page 355 and 356:

- 25 -March 31, 2013The following i

- Page 357 and 358:

- 27 -March 31, 2012Liabilities:Lon

- Page 359 and 360:

- 29 -The following tables present

- Page 361 and 362:

- 31 -December 31, 2012Other Financ

- Page 363 and 364:

December 31, 2012- 33 -NotionalAmou

- Page 365 and 366:

- 35 -Deliverable ForwardsThe Globe

- Page 367 and 368:

- 37 -The distinction of the result

- Page 369 and 370:

- 39 -March 31, 2013GrossamountsAmo

- Page 371 and 372:

- 41 -The Globe Group’s segment i

- Page 373 and 374:

- 43 -The reconciliation of the EBI

- Page 375 and 376:

- 45 -(EDGE), General Packet Radio

- Page 377 and 378:

RECONCILIATION OF RETAINED EARNINGS

- Page 379 and 380:

icialAsets(0ciZ(M mber31,201: sa@o

- Page 381 and 382:

5air3 op @o =o i@^ X3.9- >u "ai00OJ

- Page 383 and 384:

B01V.

- Page 385:

Guarantees of Securities of Other I