5-1yonkers_rising

5-1yonkers_rising

5-1yonkers_rising

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

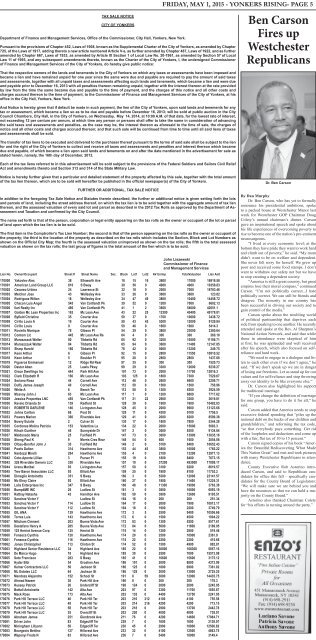

TAX SALE NOTICECITY OF YONKERSDepartment of Finance and Management Services, Office of the Commissioner, City Hall, Yonkers, New York.Pursuant to the provisions of Chapter 452, Laws of 1908, known as the Supplemental Charter of the City of Yonkers, as amended by Chapter725, of the Laws of 1917, adding thereto a new article numbered Article V-a, as further amended by Chapter 487, Laws of 1922, and as furtheramended by Chapter 667, Laws of 1933, as amended by Article IX Section 1 of Local Law No. 20-1961, as amended by Section 57 of LocalLaw 11 of 1995, and any subsequent amendments thereto, known as the Charter of the City of Yonkers, I, the undersigned Commissionerof Finance and Management Services of the City of Yonkers, do hereby give public notice:That the respective owners of the lands and tenements in the City of Yonkers on which any taxes or assessments have been imposed andbecame a lien and have remained unpaid for one year since the same were due and payable are required to pay the amount of said taxesand assessments, together with all unpaid taxes and assessments affecting such lands and tenements, which became a lien and were dueand payable prior to December 16, 2013 with all penalties thereon remaining unpaid, together with the interest thereon at the rate providedby law from the time the same became due and payable to the time of payment, and the charges of this notice and all other costs andcharges accrued thereon to the time of payment, to the Commissioner of Finance and Management Services of the City of Yonkers, at hisoffice in the City Hall, Yonkers, New York.And Notice is hereby given that if default be made in such payment, the lien of the City of Yonkers, upon said lands and tenements for anytax or assessment, which became a lien so as to be due and payable before December 16, 2013; will be sold at public auction in the CityCouncil Chambers, City Hall, in the City of Yonkers, on Wednesday, May 14, 2014, at 10:00 A.M. of that date, for the lowest rate of interest,not exceeding 12 per centum per annum, at which time any person or persons shall offer to take the same in consideration of advancingthe said taxes and assessments and penalties, as the case may be, the interest thereon as aforesaid to the time of sale, the charges ofnotice and all other costs and charges accrued thereon; and that such sale will be continued from time to time until all said liens of taxesand assessments shall be sold.The transfer of tax liens to be executed and delivered to the purchaser thereof pursuant to the terms of said sale shall be subject to the lienfor and the right of the City of Yonkers to collect and receive all taxes and assessments and penalties and interest thereon which becamedue and payable, of which became a lien upon said lands and tenements on and after the date mentioned in the advertisement for sale asstated herein, namely, the 16th day of December, 2013.Each of the tax liens referred to in this advertisement will be sold subject to the provisions of the Federal Soldiers and Sailors Civil ReliefAct and amendments thereto and Section 313 and 314 of the State Military Law.Friday, May 1, 2015 - Yonkers Rising- PAGE 5Ben CarsonFires upWestchesterRepublicansNotice is hereby further given that a particular and detailed statement of the property affected by this sale, together with the total amountof the tax lien thereon, which are to be sold will hereafter be published in the official newspaper(s) of the City of Yonkers.FURTHER OR ADDITIONAL, TAX SALE NOTICEIn addition to the foregoing Tax Sale Notice and Statutes therein described, the further or additional notice is given setting forth the lotsand parcels of land, including the street address thereof, on which the tax lien is to be sold together with the aggregate amount of tax lienthereon, and the assessed valuation of every said lot and parcel as described in the 2012 Tax Rolls as approved by the Department of Assessmentand Taxation and confirmed by the City Council.The name set forth is that of the person, corporation or legal entity appearing on the tax rolls as the owner or occupant of the lot or parcelof land upon which the tax lien is to be sold.The first item is the Comptroller’s Tax Lien Number; the second is that of the person appearing on the tax rolls as the owner or occupant ofthe property; the third is the location of the property as described on the tax rolls which includes the Section, Block and Lot Numbers asshown on the Official City Map; the fourth is the assessed valuation unimproved as shown on the tax rolls; the fifth is the total assessedvaluation as shown on the tax rolls; the last group of figures is the total amount of the lien which is to be sold.John LiszewskiCommissioner of Financeand Management ServicesLien No. Owner/Occupant Street # Street Name Sec. Block Lot1 Lot2 AV Unimp TotalValuation Lien Amt170000 Yakovlev Alex 38 Ellsworth Ave 18 15 16 3600 17000 16918.5870001 American Land Group LLC 610 S Bway 30 56 0 4900 4900 10358.8370002 Cesareo Urbino 24 Lawrence St 32 18 0 2000 7000 16783.4670003 Melchor Jose 43 Wellesley Ave 33 26 0 3600 3600 123.8270004 Rodriguez Wilton 18 Wellesley Ave 34 47 49 3800 10400 14458.7270005 Chacon Luis Angel 545 Van Cortlandt Pk 39 52 0 1200 7000 6602.1370006 Ilari Realty Inc 496 Van Cortlandt Pk 41 1 2 3600 54000 42051.170007 Golden Mc Lean Properties Inc 163 Mc Lean Ave 43 22 25 12300 40400 49178.8170008 Byfield Christina 35 Courter Ave 50 37 0 1700 10600 3438.7270009 Cirillo Louis A 19 Courter Ave 50 43 45 5300 12000 9129.8470010 Cirillo Louis 9 Courter Ave 50 46 0 1600 1600 5414.370011 Roviello Monique 78 Gibson Pl 54 29 0 3800 23000 2380.6470012 Contom Llc 445 Mc Lean Ave Re 64 4 0 300 300 360.1870013 Muraszczuk Walter 80 Tibbetts Rd 65 92 0 3200 10500 11186.7170014 Muraszczuk Walter 84 Tibbetts Rd 65 94 0 3600 11400 12147.8570015 Sharp Harold 166 Tibbetts Rd 78 42 0 5600 13200 249.7570017 Keon Arthur 6 Gibson Pl 92 15 0 2800 11550 10910.5270018 Keon Arthur 5 Boulder Pl 95 28 0 2800 2800 1437.6870019 Figueroa Emmanuel 12 Ridge Rd Rear 97 35 0 300 300 1520.7370020 Dastur Aban 25 Lewis Pkwy 99 29 0 3300 12600 9239.2770021 Grace Dwellings Inc 444 Park Hill Ave 101 73 0 2000 11700 12816.370022 Clark Elizabeth R 160 Mc Lean Ave 103 125 0 1800 7300 7529.6770024 Soriano Rosa 44 Cornell Ave 112 48 0 2600 6600 3209.7170025 Duffy James Joseph 40 Cornell Ave 112 50 0 1500 1500 750.9670026 White A 6 Beech Ter 112 58 0 1300 6300 3924.5970028 Mcavoy John J 63 Mc Lean Ave 117 1 0 1200 6800 7717.6270029 Jessica Properties LNC 455 Van Cortlandt Pk 117 21 22 2900 3300 3619.8170030 Ravelo Orlando Sr 139 Radford St 128 39 0 1900 7600 10482.0370031 ROBERTS DARLENE 146 Livingston Ave 128 45 0 2000 9600 13123.6670032 Johns Carlton 66 Post St 129 11 0 4300 9100 1756.570033 Powers Marion 360 Riverdale Ave 129 41 0 2000 8200 8599.3870034 Bowry Eulalie 2 Culver St 130 17 0 1800 7800 5344.2870035 Cordones Molina Patricio 153 Valentine La 134 22 0 2000 15000 5083.370036 Kilsch Gunther 46 Sunnyside Dr 147 2 0 3600 8300 9134.8470037 Maldonado Maria 25 Fairfield Pl 147 73 0 3000 13900 13835.1670038 Sheng Paul K 9 Morris Cres Rear 148 54 0 600 1600 2054.0670039 Ofosu-Benrfor John J 30 Fairfield Rd 149 2 0 5100 8400 10652.4370040 Powis Dalton 314 Hawthorne Ave 153 44 45 3800 10000 1765.2270041 Nardozzi Mirelli 284 Hawthorne Ave 155 4 0 2100 13200 12977.1370042 Coto-Aponte Lillian 3 Purser Pl 155 19 0 1800 8400 7673.1570043 326 Riverdale Owners LLC 330 Riverdale Ave 157 10 0 37200 493000 17009.1770044 Urena Maribel 93 Livingston Ave 157 50 0 3100 9200 8619.5770045 Trev Baron Associates LLC 93 Elliott Ave 159 25 0 1800 8100 11753.270046 Dimeglio Antoinetta 351 S Bway 160 3 0 5300 12000 23141.5770048 Mc Elroy Claire 92 Elliott Ave 160 27 0 1800 11400 11224.3170049 Laila Enterprises Inc 347 S Bway 160 48 0 11300 19000 3763.3870050 Bump4ME INC 26 Ludlow St 161 3 0 3800 10800 6093.1970051 Rattray Natasha 43 Hamilton Ave 162 59 0 3800 12600 9195.5170052 Sanchez Victor Y Ludlow St 164 16 0 200 200 251.3470053 Sanchez Victor Y 114 Ludlow St 164 17 0 2000 7900 10813.1770054 Sanchez Victor Y 112 Ludlow St 164 18 0 1900 2200 3749.7970055 GIL ANA 139 Hawthorne Ave 172 3 5 2500 9400 10556.6670056 Torres Luis 143 Hawthorne Ave 172 6 0 1500 4500 1004.2270057 Mitcham Clement 203 Buena Vista Ave 172 83 0 1300 5200 5577.6170058 Destefano Henry A 205 Buena Vista Ave 172 84 0 5000 11600 2189.0570059 125 Herriot Avenue Corp 125 Herriot St 174 14 0 1200 2800 519.4670060 Fonseca Cynthia 120 Hawthorne Ave 174 20 0 2500 10900 2361.970061 Fonseca Cynthia 116 Hawthorne Ave 174 22 0 2200 2200 415.6670062 Jones Christopher 113 Clinton St 174 52 0 1500 4900 882.8170063 Highland Senior Residence LLC 34 Highland Ave 185 22 0 30800 168300 5857.1670064 De Marco Hugo 18 Highland Ave 185 30 0 2500 7000 15573.9870065 Soto Francisco 283 S Bway 185 41 0 10600 15600 3175.1270066 Hydar Bibi 54 Groshon Ave 186 101 0 2000 8800 4373.9970067 Kelner Contractors LLC 56 Jackson St 186 125 0 1800 6900 7361.8270068 ML Estates LLC 64 Jackson St 186 129 0 2000 13000 2725.2570071 Mendoza Alejandro 152 School St 191 8 59 3800 12900 14435.7570072 Ahmad Nazeer 36 Park Hill Ave 196 8 0 300 300 178.370073 Hussey Patrick 26 Undercliff St 198 124 0 2000 2000 2245.0570074 Bottali Antoinette 142 Alta Ave 203 97 0 3300 11700 1855.6770075 Mack Rose 173 Alta Ave 203 135 0 4400 12750 2241.0570076 Park Hill Terrace LLC 40 Park Hill Ter 203 210 212 4100 4100 755.5870077 Park Hill Terrace LLC 48 Park Hill Ter 203 214 216 4200 4200 773.1570078 Park Hill Terrace LLC 58 Park Hill Ter 203 218 0 2900 13700 2442.7870079 Park Hill Terrace LLC 35 Overcliff St 203 220 0 4000 4000 738.0170080 Abraham James 251 Glenbrook Ave 211 76 0 4200 14600 17084.7170081 Driver John 83 Edgecliff Ter 229 7 0 1600 1600 2138.0770082 Miningham Lillyann 58 Edgecliff Ter 230 45 0 2900 10800 12506.8270083 Bourgeois Bettino 127 Hillcrest Ave 233 32 0 4100 12500 4863.7570084 Wapenyi Freda N 83 Hillcrest Ave 236 7 0 5400 18000 3149.4Dr. Ben CarsonBy Dan MurphyDr. Ben Carson, who has yet to formallyannounce his presidential ambitions, spoketo a packed house at Westchester Manor lastweek for Westchester GOP Chairman DougColety’s annual chairman’s dinner. Carsongave an inspirational speech and spoke abouthis life experiences of overcoming poverty torise to become one of the nation’s pre-eminentneurosurgeons.“I lived at every economic level; at thebottom they have pride they want to work hardand climb out of poverty,” he said. “My momdidn’t want to be on welfare and dependent.She never felt sorry for herself. We grew uppoor and received some food stamps. I don’twant to withdraw our safety net but we haveto stop creating a dependent society.“America is still a great country, but greatempires lose their moral compass,” continuedCarson. “I’m not politically correct...I hatepolitically correct. We can still be friends anddisagree. The minority in our country hasbeen successful in driving our society and togain control of the media.”Carson spoke about the troubling worldof political partisanship that deprives eachside from speaking to one another. He recentlyattended and spoke at the Rev. Al Sharpton’sNational Action Network, and said that whilethose in attendance were skeptical of himat first, he was applauded and well receivedafter his speech, which also focused on selfrelianceand hard work.“We need to engage in a dialogue and listento each other even if we don’t agree,” hesaid. “If we don’t speak up we are in dangerof losing our freedoms. Let us stand up for ourvalues and for self-reliance and stop throwingaway our identity to be like everyone else.”Dr. Carson also highlighted his supportfor traditional marriage.“If you change the definition of marriagefor one group, you have to do it for all,” hesaid.Carson added that America needs to stopexcessive federal spending that “piles up thenational debt on the backs of our children andgrandchildren,” and reforming the tax code,“so that everybody pays something. Get ridof the loopholes and deductions and come upwith a fair, flat tax of 10 to 15 percent.”Carson signed copies of his book “Americathe Beautiful:Rediscovering What MadeThis Nation Great” and met and took pictureswith many Westchester Republicans in attendance.County Executive Rob Astorino introducedCarson, and said to Republican candidatesfor office this fall – specifically candidatesfor the County Board of Legislators:“We will make sure we are behind you andhave the resources so that we can hold a majorityon the County Board.”Astorino also thanked Chairman Coletyfor “his efforts in turning around the party.”