Presentation - Texas Municipal Retirement System

Presentation - Texas Municipal Retirement System

Presentation - Texas Municipal Retirement System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

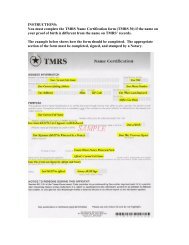

<strong>Texas</strong> <strong>Municipal</strong> <strong>Retirement</strong> <strong>System</strong><strong>Presentation</strong> to:House Pensions CommitteeDavid Gavia, Executive Director<strong>Texas</strong> <strong>Municipal</strong> <strong>Retirement</strong> <strong>System</strong>February 11, 2013

2TMRS Overview• TMRS is a voluntary statewide retirement plan thatprovides retirement, disability, and death benefits for<strong>Texas</strong> municipal employees• Established by <strong>Texas</strong> Legislature in 1947; TMRS is a “cashbalance” or “savings-based” plan• Receives no state funding and does not administer ahealth care plan• Benefits funded by mandatory employee deposits, citycontributions, and investment income• Operates by local control: Within a menu of options,each participating city controls employer costs byselecting benefit levels for its employees

3TMRS Governance• Six-member Board of Trustees appointed bythe Governor, approved by the <strong>Texas</strong> Senate• Board members are unpaid; serve staggeredsix-year terms• The Board exercises fiduciary responsibilityfor investments

4TMRS Membership• 849 cities have chosen to participate in TMRS. This numbercontinues to increase each year• Over 101,000* employees contribute to TMRS• Over 42,000* annuitants receive benefits from TMRS• Participating cities vary in size from 6,000 employees (SanAntonio non-uniformed employees) to 12 cities with just oneemployee• TMRS does not cover employees in Houston, Dallas, Ft. Worth,Austin, or El Paso, which administer their own retirementsystems• TMRS paid $873 million in benefits in 2012*, up from $810million in 2011• 86% of our member cities are either fully or partially coveredby Social Security*Preliminary as of December 31, 2012. Final figures will be released in May 2013.

5Plan Design (Cash Balance)Plan design has features from both a traditional DefinedBenefit (DB) plan and a Defined Contribution (DC) planDB FeatureAssets are centrally,professional investedEmployers bear investmentrisk, but receive interestbased on actual rate earnedOptionalDB Features*Annuity Increases (COLAs)either repeating or ad hoc*Updated Service Credits,which help protect members’benefits from inflationDC Feature**Employer sets themandatory employee depositrate***Employer sets matchingrateMember accounts receiveguaranteed 5% annualinterest creditAccount balance isannuitized at retirement andguaranteed for lifeAnnuity is based on accountbalance (deposits, interest &match), not a formula basedon average salary*May be adopted, modified or rescinded by employer**May be changed by employer after initial adoption; consent ofemployees needed to lower rate***May be changed by employer after adoption

Plan Design: Emphasizes Flexible, LocalControl of Plan CostsThe menu of benefits provides TMRS employers with over 1,400* benefitcombinations to choose from. Employers have the ability to control the fourmajor cost drivers of their plans, which are:• Employee deposit rate: 5%, 6%, or 7% (Note: Statute requires that by 2/3vote, employees must agree in order to prospectively lower deposit rate)• Employer match of contributions at retirement: 1:1; 1.5:1; or 2:1• COLAS: Adopt, change, or rescind a repeating or ad hoc COLA at either30%, 50%, or 70% of CPI• Updated Service Credit: A credit to employees at retirement that takesinto account plan changes made by the city and salary increases grantedover the course of the employee’s career. Credit may be adopted ateither 50%, 75%, or 100% of the calculated credit, and can beprospectively modified or rescinded by employer*Gabriel Roeder Smith & Company, TMRS’ Consulting Actuary6

Argo Navis J931 - Padrões de Design J2EE3 - Padrões da Camada de NegóciosSeqüência[SJC]19Melhores estratégias deimplementação• EJB Service Locator Strategy• Usa objeto EJBHome que pode ser armazenado em umcache para evitar uma pesquisa futura• JMS Queue Service Locator Strategy e JMS TopicService Locator Strategy• Retornam QueueConnectionFactory eTopicConnectionFactory usados em conexões JMS• Retornam filas (queues) e canais (topics)• Type Checked Service Locator Strategy• Realiza conversões de tipos (ex: narrow())• Web Service Locator Strategy20© 2003, Helder L. S da Rocha 3 - 10

12TMRS Assets and Performance• TMRS administers $20.6 billion* in assets, as of12/31/2012• TMRS total investment returns were:• 10.0% in 2012*, 2.4% in 2011, 9.0% in 2010, 10.2% in2009, and -1.3% in 2008• An average of 7.1%, 6.0%, and 6.3% for the 3-, 5-, and10-year periods ending 12/31/2012*, respectively• Investment Return Assumption is 7%; one of the mostconservative of any major public retirement system• Investment management fees were .086% in 2012*,among the lowest in the industry given the allocationand focus on passive investingSource: Preliminary figures as of 12/31/12. Actual figures will be available in May, 2013.

13Current and Long Term Target Asset AllocationAsset ClassCurrentAllocation(as of 12/31/2012)Long-TermTarget AssetAllocationU.S. Equities 21.6% 17.5%International Equities 21.0% 17.5%Core Fixed Income 50.4% 30%Non-Core Fixed Income 0% 10%Real Estate 1.9% 10%Real Return 4.9% 5%Absolute Return 0% 5%Private Equity 0% 5%Short-term Investments 0.2% 0%Total 100% 100%

14Previous Legislation: HB 36081 st LegislatureHB 360 (Kuempel) was the outcome of work by theAdvisory Committee and TMRS Board. The bill:• Guaranteed 5% interest credit to member accountseach year• Provided a minimum 5% discount rate in annuitypurchase rate• Provided that city accounts could receive interest at avariable rate• Enabled continuation of total return strategy andinvestment diversification

15Previous Legislation: SB 35082 nd LegislatureSB 350 (Williams) was the outcome of work by theAdvisory Committee and the TMRS Board. The bill:• Restructured TMRS’ internal accounts from three to one• Removed “leverage” against the employer account• Increased funded ratios for most cities; <strong>System</strong>-widefunded ratio increased from 75.8% in 2009 to 82.9% in2010• Reduced unfunded liabilities <strong>System</strong>-wide by $1.4 billion• Reduced employer contributions by approximately $141million

16Interim Work for the 83 rd SessionThe TMRS Advisory Committee met five times overthe interim. They studied:• Several different COLA options• Local options for increasing retirement eligibilityand delaying the implementation of COLAS• A proposal for distributing excess earnings, ifavailable (“gain sharing”)At their August meeting, the Committee declined torecommend any of the proposals to the TMRS Board forthe 83 rd Session

17TMRS in the 83 rd Regular Session• The TMRS Board decided at their September ,2012 meeting to NOT propose any legislationfor the 83 rd Session• Legislation may be proposed by other groupsand individuals

18Appendix 1Sample Benefit Calculation (Age 65)Member Account balance at retirementwith credited interest: $50,000Employer match (1:1) $50,000Total Reserves: $100,000÷ Annuity Purchase Rate (age 65) 127.6195= Retiree lifetime monthly annuity $783.58

QUESTIONS?19

20Contact InformationDavid Gavia, Executive Directordgavia@tmrs.com(512) 225-1701Dan Wattles, Director of Governmental Relationsdwattles@tmrs.com(512) 225-3713P.O. Box 149153Austin, <strong>Texas</strong> 78714-91531200 North Interstate 35Austin, <strong>Texas</strong> 78701www.tmrs.com