100 Underwriting Management - The Malaysian Insurance Institute

100 Underwriting Management - The Malaysian Insurance Institute

100 Underwriting Management - The Malaysian Insurance Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

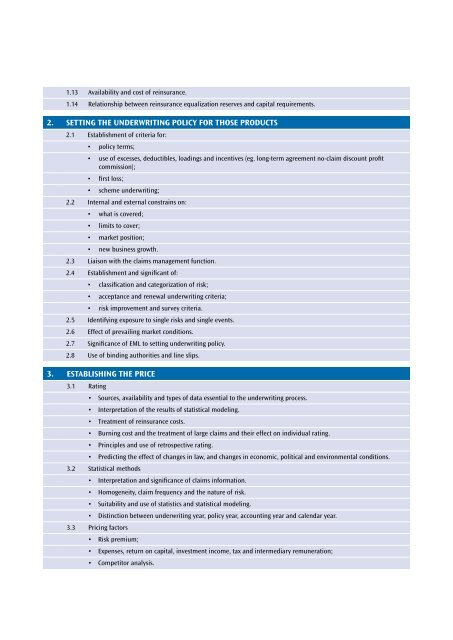

1.13 Availability and cost of reinsurance.1.14 Relationship between reinsurance equalization reserves and capital requirements.2. SETTING THE UNDERWRITING POLICY FOR THOSE PRODUCTS2.1 Establishment of criteria for:• policy terms;• use of excesses, deductibles, loadings and incentives (eg. long-term agreement no-claim discount profitcommission);• first loss;• scheme underwriting;2.2 Internal and external constrains on:• what is covered;• limits to cover;• market position;• new business growth.2.3 Liaison with the claims management function.2.4 Establishment and significant of:• classification and categorization of risk;• acceptance and renewal underwriting criteria;• risk improvement and survey criteria.2.5 Identifying exposure to single risks and single events.2.6 Effect of prevailing market conditions.2.7 Significance of EML to setting underwriting policy.2.8 Use of binding authorities and line slips.3. ESTABLISHING THE PRICE3.1 Rating• Sources, availability and types of data essential to the underwriting process.• Interpretation of the results of statistical modeling.• Treatment of reinsurance costs.• Burning cost and the treatment of large claims and their effect on individual rating.• Principles and use of retrospective rating.• Predicting the effect of changes in law, and changes in economic, political and environmental conditions.3.2 Statistical methods• Interpretation and significance of claims information.• Homogeneity, claim frequency and the nature of risk.• Suitability and use of statistics and statistical modeling.• Distinction between underwriting year, policy year, accounting year and calendar year.3.3 Pricing factors• Risk premium;• Expenses, return on capital, investment income, tax and intermediary remuneration;• Competitor analysis.