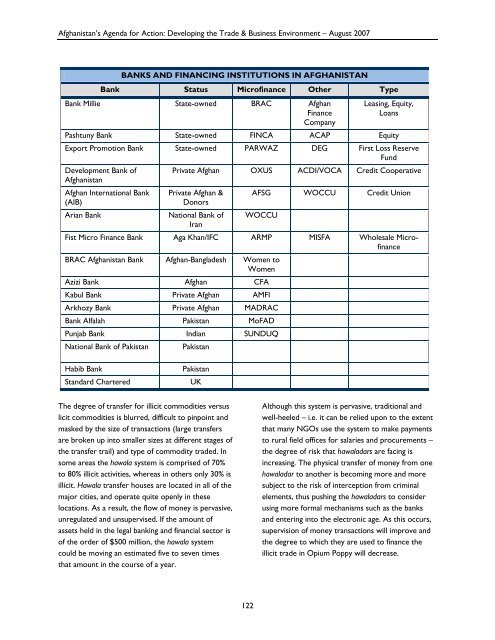

Afghanistan’s <strong>Agenda</strong> <strong>for</strong> <strong>Action</strong>: Developing the Trade & Business Environment – August 2007cumbersome. However, the laws do not reach as far asregulating international trade financing, or providing <strong>for</strong>insurance <strong>for</strong> financing transactions. Nevertheless,there appears to be a rather free flow of money acrossborders.Financial service organizations (bank and non-bank) arerequired to be registered and licensed with the CentralBank, and are subject to the rules and laws affectingfinancial crimes (source of origin and investigation onlarge transfer sums, greater than $10,000 or anysuspicious transaction). However, implementation islacking, even though tribunals are being established todeal with these situations. Nevertheless, once again, thein<strong>for</strong>mal hawala system operates outside the control ofthis mechanism. Penalties <strong>for</strong> violations are stipulated,including revoking bank or operating licenses whennecessary. Other prosecutorial techniques are justbeing <strong>for</strong>mulated. In spite of the lack of effectiveregulatory control, the exchange rate has been stablesince the new central government has taken control,and hovers around 50 Afghanis (Afs) to the U.S. Dollar.SWIFT is installed and working. 168 Credit insurance isnot available in general, but both OPIC (U.S. OverseasPrivate Investment Corporation) and the MultilateralInvestment Guarantee Agency (MIGA) of theInternational Monetary Fund (the IMF investmentinsurance arm) are operating in Afghanistan withsignificant portfolios. An Export Credit Institution isone of the operating state-owned banks.Implementing InstitutionsInvestments can be 100% <strong>for</strong>eign owned. There are norestrictions on transferring or converting funds intofreely usable currency at a legal market rate. There isno dual exchange rate, currency controls, capitalcontrols nor any other restrictions on the flow of fundsabroad. Access to <strong>for</strong>eign exchange is not restricted,and in<strong>for</strong>mal <strong>for</strong>eign exchange markets exist in majorcities and markets <strong>for</strong> Pounds Sterling, Dollars, andEuros. There is no delay on remitting investmentreturns, and there is no limitation on inflow andoutflow of funds from profits, debt service, capitalgains, returns on intellectual property or imported 169168U.S. Treasury Questionnaire, U.S. Embassy, Kabul (2006).inputs, provided taxes have been paid, and anti-moneylaundering rules have been followed. 169A. Banking and Financing InstitutionsThe list of banks and financing institutions registered tooperate in Afghanistan are presented below. There is aCentral Bank, three state-owned banks (although it hasbeen said that the Export Promotion Bank has beenclosed or merged with another state-owned bank),eight private commercial Afghan Banks, plus fivebranches of international banks. There are also 13microfinance institutions. n addition there is a leasingcompany (AFC), a new equity fund on the horizon(ACAP), and a couple of cooperatives and credit unionsbeing <strong>for</strong>med (ACDI/VOCA, WOCCU and MISFA).This table is followed by a chart describing the types offinancing instruments that are available in the country.The hawala system is extensive and larger in size, butoperates outside the registry.B. The Hawala SystemThe hawala money transfer system operates outsidethe legal banking and financing system. It is a traditionalsystem that transfers and exchanges money throughoutthe region and reaches all over the world throughfamily and traditional ethnic, religious and collegialrelationships. Payments can be made in one place andcollections in another within and throughout thecountry as well as from just about any place in theworld in the time it takes to communicate thetransaction. Hawaladars generally have the liquidity totransfer and pay out millions of dollars in singletransactions. It is the system of choice to fund the illicitopium Poppy production and trade network. Yet it, inand of itself, is not illicit. In some areas the systemfinances illicit trade at the production stage, makesillegal money transfers outside the country, and thenpurchases licit commodities <strong>for</strong> import back into thecountry.See U.S. Department of Commerce, Doing Business inAfghanistan: A Country Commercial Guide <strong>for</strong> U.S.Companies, (February, 2006).121

Afghanistan’s <strong>Agenda</strong> <strong>for</strong> <strong>Action</strong>: Developing the Trade & Business Environment – August 2007BANKS AND FINANCING INSTITUTIONS IN AFGHANISTANBank Status Microfinance Other TypeBank Millie State-owned BRAC AfghanFinanceCompanyLeasing, Equity,LoansPashtuny Bank State-owned FINCA ACAP EquityExport Promotion Bank State-owned PARWAZ DEG First Loss ReserveFundDevelopment Bank of Private Afghan OXUS ACDI/VOCA Credit CooperativeAfghanistanAfghan International Bank Private Afghan & AFSG WOCCU Credit Union(AIB)DonorsArian BankNational Bank of WOCCUIranFist Micro Finance Bank Aga Khan/IFC ARMP MISFA Wholesale MicrofinanceBRAC Afghanistan Bank Afghan-Bangladesh Women toWomenAzizi Bank Afghan CFAKabul Bank Private Afghan AMFIArkhozy Bank Private Afghan MADRACBank Alfalah Pakistan MoFADPunjab Bank Indian SUNDUQNational Bank of Pakistan PakistanHabib BankStandard CharteredPakistanUKThe degree of transfer <strong>for</strong> illicit commodities versuslicit commodities is blurred, difficult to pinpoint andmasked by the size of transactions (large transfersare broken up into smaller sizes at different stages ofthe transfer trail) and type of commodity traded. Insome areas the hawala system is comprised of 70%to 80% illicit activities, whereas in others only 30% isillicit. Hawala transfer houses are located in all of themajor cities, and operate quite openly in theselocations. As a result, the flow of money is pervasive,unregulated and unsupervised. If the amount ofassets held in the legal banking and financial sector isof the order of $500 million, the hawala systemcould be moving an estimated five to seven timesthat amount in the course of a year.Although this system is pervasive, traditional andwell-heeled – i.e. it can be relied upon to the extentthat many NGOs use the system to make paymentsto rural field offices <strong>for</strong> salaries and procurements –the degree of risk that hawaladars are facing isincreasing. The physical transfer of money from onehawaladar to another is becoming more and moresubject to the risk of interception from criminalelements, thus pushing the hawaladars to considerusing more <strong>for</strong>mal mechanisms such as the banksand entering into the electronic age. As this occurs,supervision of money transactions will improve andthe degree to which they are used to finance theillicit trade in Opium Poppy will decrease.122