13-14 Applicant Financial Aid Timeline

13-14 Applicant Financial Aid Timeline

13-14 Applicant Financial Aid Timeline

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

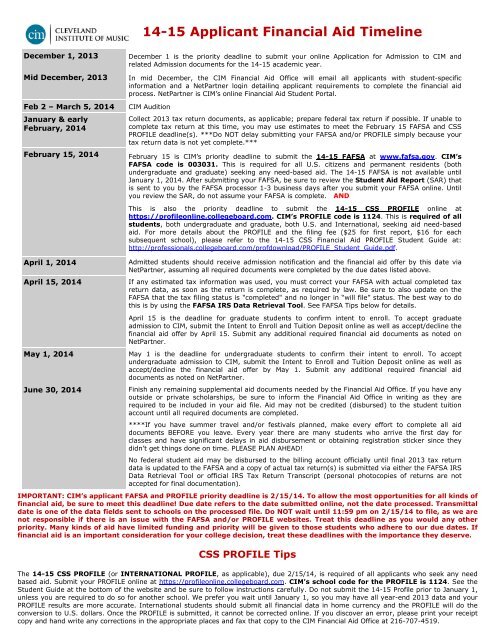

<strong>14</strong>-15 <strong>Applicant</strong> <strong>Financial</strong> <strong>Aid</strong> <strong>Timeline</strong>December 1, 20<strong>13</strong>Mid December, 20<strong>13</strong>Feb 2 – March 5, 20<strong>14</strong>January & earlyFebruary, 20<strong>14</strong>February 15, 20<strong>14</strong>December 1 is the priority deadline to submit your online Application for Admission to CIM andrelated Admission documents for the <strong>14</strong>-15 academic year.In mid December, the CIM <strong>Financial</strong> <strong>Aid</strong> Office will email all applicants with student-specificinformation and a NetPartner login detailing applicant requirements to complete the financial aidprocess. NetPartner is CIM’s online <strong>Financial</strong> <strong>Aid</strong> Student Portal.CIM AuditionCollect 20<strong>13</strong> tax return documents, as applicable; prepare federal tax return if possible. If unable tocomplete tax return at this time, you may use estimates to meet the February 15 FAFSA and CSSPROFILE deadline(s). ***Do NOT delay submitting your FAFSA and/or PROFILE simply because yourtax return data is not yet complete.***February 15 is CIM’s priority deadline to submit the <strong>14</strong>-15 FAFSA at www.fafsa.gov. CIM’sFAFSA code is 003031. This is required for all U.S. citizens and permanent residents (bothundergraduate and graduate) seeking any need-based aid. The <strong>14</strong>-15 FAFSA is not available untilJanuary 1, 20<strong>14</strong>. After submitting your FAFSA, be sure to review the Student <strong>Aid</strong> Report (SAR) thatis sent to you by the FAFSA processor 1-3 business days after you submit your FAFSA online. Untilyou review the SAR, do not assume your FAFSA is complete. ANDThis is also the priority deadline to submit the <strong>14</strong>-15 CSS PROFILE online athttps://profileonline.collegeboard.com. CIM’s PROFILE code is 1124. This is required of allstudents, both undergraduate and graduate, both U.S. and International, seeking aid need-basedaid. For more details about the PROFILE and the filing fee ($25 for first report, $16 for eachsubsequent school), please refer to the <strong>14</strong>-15 CSS <strong>Financial</strong> <strong>Aid</strong> PROFILE Student Guide at:http://professionals.collegeboard.com/profdownload/PROFILE_Student_Guide.pdf.April 1, 20<strong>14</strong>April 15, 20<strong>14</strong>May 1, 20<strong>14</strong>June 30, 20<strong>14</strong>Admitted students should receive admission notification and the financial aid offer by this date viaNetPartner, assuming all required documents were completed by the due dates listed above.If any estimated tax information was used, you must correct your FAFSA with actual completed taxreturn data, as soon as the return is complete, as required by law. Be sure to also update on theFAFSA that the tax filing status is "completed" and no longer in “will file” status. The best way to dothis is by using the FAFSA IRS Data Retrieval Tool. See FAFSA Tips below for details.April 15 is the deadline for graduate students to confirm intent to enroll. To accept graduateadmission to CIM, submit the Intent to Enroll and Tuition Deposit online as well as accept/decline thefinancial aid offer by April 15. Submit any additional required financial aid documents as noted onNetPartner.May 1 is the deadline for undergraduate students to confirm their intent to enroll. To acceptundergraduate admission to CIM, submit the Intent to Enroll and Tuition Deposit online as well asaccept/decline the financial aid offer by May 1. Submit any additional required financial aiddocuments as noted on NetPartner.Finish any remaining supplemental aid documents needed by the <strong>Financial</strong> <strong>Aid</strong> Office. If you have anyoutside or private scholarships, be sure to inform the <strong>Financial</strong> <strong>Aid</strong> Office in writing as they arerequired to be included in your aid file. <strong>Aid</strong> may not be credited (disbursed) to the student tuitionaccount until all required documents are completed.****If you have summer travel and/or festivals planned, make every effort to complete all aiddocuments BEFORE you leave. Every year there are many students who arrive the first day forclasses and have significant delays in aid disbursement or obtaining registration sticker since theydidn’t get things done on time. PLEASE PLAN AHEAD!No federal student aid may be disbursed to the billing account officially until final 20<strong>13</strong> tax returndata is updated to the FAFSA and a copy of actual tax return(s) is submitted via either the FAFSA IRSData Retrieval Tool or official IRS Tax Return Transcript (personal photocopies of returns are notaccepted for final documentation).IMPORTANT: CIM’s applicant FAFSA and PROFILE priority deadline is 2/15/<strong>14</strong>. To allow the most opportunities for all kinds offinancial aid, be sure to meet this deadline! Due date refers to the date submitted online, not the date processed. Transmittaldate is one of the data fields sent to schools on the processed file. Do NOT wait until 11:59 pm on 2/15/<strong>14</strong> to file, as we arenot responsible if there is an issue with the FAFSA and/or PROFILE websites. Treat this deadline as you would any otherpriority. Many kinds of aid have limited funding and priority will be given to those students who adhere to our due dates. Iffinancial aid is an important consideration for your college decision, treat these deadlines with the importance they deserve.CSS PROFILE TipsThe <strong>14</strong>-15 CSS PROFILE (or INTERNATIONAL PROFILE, as applicable), due 2/15/<strong>14</strong>, is required of all applicants who seek any needbased aid. Submit your PROFILE online at https://profileonline.collegeboard.com. CIM's school code for the PROFILE is 1124. See theStudent Guide at the bottom of the website and be sure to follow instructions carefully. Do not submit the <strong>14</strong>-15 Profile prior to January 1,unless you are required to do so for another school. We prefer you wait until January 1, so you may have all year-end 20<strong>13</strong> data and yourPROFILE results are more accurate. International students should submit all financial data in home currency and the PROFILE will do theconversion to U.S. dollars. Once the PROFILE is submitted, it cannot be corrected online. If you discover an error, please print your receiptcopy and hand write any corrections in the appropriate places and fax that copy to the CIM <strong>Financial</strong> <strong>Aid</strong> Office at 216-707-4519.

Free Application for Federal Student <strong>Aid</strong> (FAFSA) TipsThe <strong>14</strong>-15 FAFSA is required of all students, both undergraduate and graduate, who are U.S. citizens or permanent residentswho seek any need-based aid. CIM Scholarships take into account both financial need and merit. If a student has indicated they seekonly merit consideration for scholarship, we will waive the FAFSA and/or PROFILE requirement. However, remember the graduate studentFAFSA does not require any parental income or tax information; all graduate students are automatically classified as independent for aidpurposes, even if they are claimed as a dependent on a parent tax return or if there is parental financial support. Dependency status forfinancial aid has no correlation to dependency status for tax purposes.Note: The FAFSA is also required for any student, even those with NO need, who wish to borrow Federal Direct Stafford Loan and/or FederalDirect PLUS Loans (Parent as borrower for dependent Undergrads or Graduate). These loans are eligible to students with NO NEED, but dorequire a valid FAFSA to be on file as basic federal student aid eligibility must be confirmed. Even if you are certain you will show no need,we do recommend applying for all aid possible and submitting both the FAFSA and PROFILE.Please submit your <strong>14</strong>-15 FAFSA online at www.fafsa.gov. CIM's school code for the FAFSA is 003031. While we strongly urgeyou to submit the FAFSA online, you may order a paper form from the Department of Education by calling the Federal Student <strong>Aid</strong>Information Center (FSAIC) toll-free at 1-800-4-FED-AID (1-800-433-3243). Keep in mind, the online FAFSA processes in just a few days;paper applications will take several weeks. The <strong>14</strong>-15 FAFSA will not be available to submit until January 1, 20<strong>14</strong>. Any completed prior toJanuary 1 will not be applicable, as they are for the wrong school year. Your <strong>14</strong>-15 FAFSA is due 2/15/<strong>14</strong>.We suggest you print out the FAFSA on the Web Worksheet. You can use this handy form to collect all data ahead of time to make sureyou have all the information needed before you sit down at the computer to enter your FAFSA online. See www.fafsa.gov and the "beforebeginning the FAFSA" section. This worksheet is to assist you and should not be sent to CIM or the FAFSA processor. You will need to enterthe information from this form into the FAFSA online or via the actual <strong>14</strong>-15 paper FAFSA.Be aware! There are several scam websites with similar names that will charge you a fee to complete your FAFSA - DO NOT PAY TO HAVEYOUR FAFSA FILED! Only use the official federal site www.fafsa.gov. Not only do these scam sites charge you for what is a free process,they often submit incorrect data and it will take longer to process than if you use the correct federal site.*With the new same-sex marriage laws in place in many states, be sure to carefully read the instructions on how to report both your own dataas well as that of parent(s) (for dependent students). This terminology and reporting of data has changed from the <strong>13</strong>-<strong>14</strong> FAFSA.*A common mistake on the FAFSA relates to the following question in the “Student’s 20<strong>13</strong> Additional <strong>Financial</strong> Information” section:FAFSA QUESTION: Taxable student grant and scholarship aid reported to the IRS in your adjusted gross income. Includes AmeriCorps benefits(awards, living allowances and interest accrual payments), as well as grant and scholarship portions of fellowships and assistantships.When answering this question, do NOT simply list the full scholarship award amount you received the previous year. This answershould only include any TAXABLE amount, which would only be amounts of grant aid (school scholarship, federal/state grants,outside scholarships, etc) that EXCEED the tuition fee and other allowable IRS fees. For most students, this answer will be $0 (zero).If any non-zero amount is entered, CIM will require documentation of your tax return to confirm you did report that value as taxableincome. Generally, any grant aid that is above and beyond allowable tuition/fees and is specifically used for living expenses IStaxable.You are NOT required to have your 20<strong>13</strong> tax return(s) completed to submit your FAFSA! Yes, it is easier to do your FAFSA if yourtaxes have been prepared first, but it is not required. You may estimate 20<strong>13</strong> tax return data so you can get your FAFSA in by the deadline.If you do this, remember you are required by law to submit a FAFSA correction as soon as actual tax data is known. Do not wait untilMarch or April to do your FAFSA just because your tax return is not completed. Some types of aid have limited funding and if you are latewith any particular school’s deadline, you may lose out on aid you would have been offered, had you met the school’s priority deadline.Student <strong>Aid</strong> Report (SAR) 1-3 business days after you submit your FAFSA online, you will be emailed your processed FAFSA results, theSAR. It is VERY IMPORTANT you review this document upon receipt. Make sure all data is correct… no typos, extra zero somewhere, etc.This data is the same that is sent to the schools. The “confirmation” email you get immediately after submitting your FAFSA is NOTconfirmation it was successfully processed. The SAR is the important document.IRS Data Retrieval Tool (DRT) (see this link for the step by step process: http://www.irsdataretrievaltool.com/irs-data-retrieval-tool-step-by-stepinstructions).On February 1, 20<strong>14</strong>, students and parents who have submitted their 20<strong>13</strong> IRS tax return will be able to select the IRS DataRetrieval Tool option on the FAFSA to transfer tax information to the FAFSA. We strongly encourage you to select this option during theinitial filing, if possible, or when subsequent corrections are made to your <strong>14</strong>-15 FAFSA. This option will expedite the processing of yourfinancial aid application. All aid awarded is pending until final tax data is verified for accuracy; always update as soon as you are able.To successfully use the DRT you must:Have a 20<strong>13</strong> federal tax return filed and already processed with the IRS.Have a valid social security number.Have a Federal <strong>Aid</strong> Personal Identification Number (PIN).*You will be unable to use the DRT if:Your marital status changes after December 31, 20<strong>13</strong>.You filed married filing separately.You filed an amended return.You filed a foreign tax return.*For any of these scenarios, filers will need to request an IRS Tax Return Transcript via IRS Form 4506-T, if required forVerification by the school(s). Amended returns will require additional documentation.According to the IRS, electronically filed tax return information will be available online from the IRS site 1-3 weeks after the return has beenfiled. Data from paper tax returns will be available in 6-8 weeks. CIM will verify ALL TAX RETURN DATA on every FAFSA for studentswho are offered and accept any federal student aid. You will be required to submit your official tax return data either via the FAFSA IRSData Retrieval Tool or by submitting a Federal Tax Return Transcript from the IRS. Personal photocopies of tax returns will notbe accepted for this Verification purpose, per Federal Register, 75 FR 66832.No federal need-based aid will be disbursed for any student until the final tax return data has been corrected onthe FAFSA for student and parent(s), as applicable. No exceptions. Late tax filers may experience a delay in theprocessing of federal aid and may need to make temporary, alternate arrangements to pay any balance due.