Products and Solutions Guide - Federal Home Loan Bank of Boston

Products and Solutions Guide - Federal Home Loan Bank of Boston

Products and Solutions Guide - Federal Home Loan Bank of Boston

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

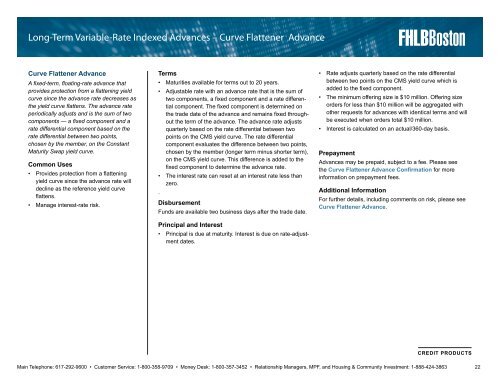

Long-Term Variable-Rate Indexed Advances – Curve Flattener AdvanceCurve Flattener AdvanceA fixed-term, floating-rate advance thatprovides protection from a flattening yieldcurve since the advance rate decreases asthe yield curve flattens. The advance rateperiodically adjusts <strong>and</strong> is the sum <strong>of</strong> twocomponents — a fixed component <strong>and</strong> arate differential component based on therate differential between two points,chosen by the member, on the ConstantMaturity Swap yield curve.Common Uses• Provides protection from a flatteningyield curve since the advance rate willdecline as the reference yield curveflattens.• Manage interest-rate risk.Terms• Maturities available for terms out to 20 years.• Adjustable rate with an advance rate that is the sum <strong>of</strong>two components, a fixed component <strong>and</strong> a rate differentialcomponent. The fixed component is determined onthe trade date <strong>of</strong> the advance <strong>and</strong> remains fixed throughoutthe term <strong>of</strong> the advance. The advance rate adjustsquarterly based on the rate differential between twopoints on the CMS yield curve. The rate differentialcomponent evaluates the difference between two points,chosen by the member (longer term minus shorter term),on the CMS yield curve. This difference is added to thefixed component to determine the advance rate.• The interest rate can reset at an interest rate less thanzero..DisbursementFunds are available two business days after the trade date.Principal <strong>and</strong> Interest• Principal is due at maturity. Interest is due on rate-adjustmentdates.• Rate adjusts quarterly based on the rate differentialbetween two points on the CMS yield curve which isadded to the fixed component.• The minimum <strong>of</strong>fering size is $10 million. Offering sizeorders for less than $10 million will be aggregated withother requests for advances with identical terms <strong>and</strong> willbe executed when orders total $10 million.• Interest is calculated on an actual/360-day basis.PrepaymentAdvances may be prepaid, subject to a fee. Please seethe Curve Flattener Advance Confirmation for moreinformation on prepayment fees.Additional InformationFor further details, including comments on risk, please seeCurve Flattener Advance.credit productsMain Telephone: 617-292-9600 • Customer Service: 1-800-358-9709 • Money Desk: 1-800-357-3452 • Relationship Managers, MPF, <strong>and</strong> Housing & Community Investment: 1-888-424-3863 22