Statement of Additional Information - American Funds Mortgage Fund

Statement of Additional Information - American Funds Mortgage Fund

Statement of Additional Information - American Funds Mortgage Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

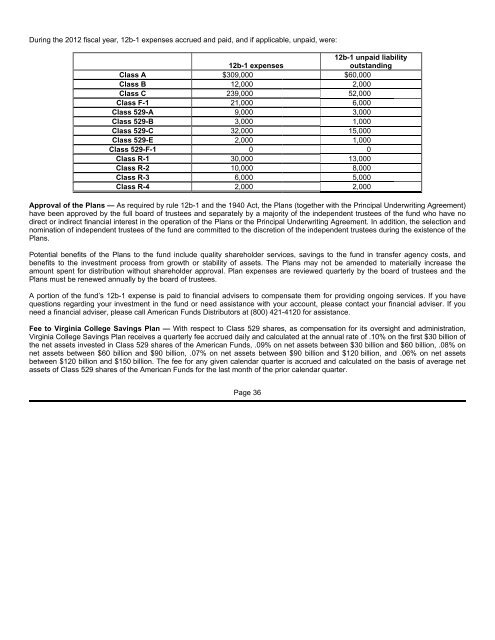

During the 2012 fiscal year, 12b-1 expenses accrued and paid, and if applicable, unpaid, were:12b-1 unpaid liability12b-1 expensesoutstandingClass A $309,000 $60,000Class B 12,000 2,000Class C 239,000 52,000Class F-1 21,000 6,000Class 529-A 9,000 3,000Class 529-B 3,000 1,000Class 529-C 32,000 15,000Class 529-E 2,000 1,000Class 529-F-1 0 0Class R-1 30,000 13,000Class R-2 10,000 8,000Class R-3 6,000 5,000Class R-4 2,000 2,000Approval <strong>of</strong> the Plans — As required by rule 12b-1 and the 1940 Act, the Plans (together with the Principal Underwriting Agreement)have been approved by the full board <strong>of</strong> trustees and separately by a majority <strong>of</strong> the independent trustees <strong>of</strong> the fund who have nodirect or indirect financial interest in the operation <strong>of</strong> the Plans or the Principal Underwriting Agreement. In addition, the selection andnomination <strong>of</strong> independent trustees <strong>of</strong> the fund are committed to the discretion <strong>of</strong> the independent trustees during the existence <strong>of</strong> thePlans.Potential benefits <strong>of</strong> the Plans to the fund include quality shareholder services, savings to the fund in transfer agency costs, andbenefits to the investment process from growth or stability <strong>of</strong> assets. The Plans may not be amended to materially increase theamount spent for distribution without shareholder approval. Plan expenses are reviewed quarterly by the board <strong>of</strong> trustees and thePlans must be renewed annually by the board <strong>of</strong> trustees.A portion <strong>of</strong> the fund’s 12b-1 expense is paid to financial advisers to compensate them for providing ongoing services. If you havequestions regarding your investment in the fund or need assistance with your account, please contact your financial adviser. If youneed a financial adviser, please call <strong>American</strong> <strong><strong>Fund</strong>s</strong> Distributors at (800) 421-4120 for assistance.Fee to Virginia College Savings Plan — With respect to Class 529 shares, as compensation for its oversight and administration,Virginia College Savings Plan receives a quarterly fee accrued daily and calculated at the annual rate <strong>of</strong> .10% on the first $30 billion <strong>of</strong>the net assets invested in Class 529 shares <strong>of</strong> the <strong>American</strong> <strong><strong>Fund</strong>s</strong>, .09% on net assets between $30 billion and $60 billion, .08% onnet assets between $60 billion and $90 billion, .07% on net assets between $90 billion and $120 billion, and .06% on net assetsbetween $120 billion and $150 billion. The fee for any given calendar quarter is accrued and calculated on the basis <strong>of</strong> average netassets <strong>of</strong> Class 529 shares <strong>of</strong> the <strong>American</strong> <strong><strong>Fund</strong>s</strong> for the last month <strong>of</strong> the prior calendar quarter.Page 36