Medical Plan Side-by-Side Comparison

Medical Plan Side-by-Side Comparison

Medical Plan Side-by-Side Comparison

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

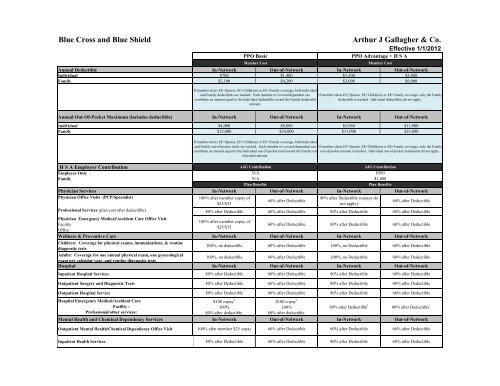

Blue Cross and Blue ShieldPPO BasicMember CostArthur J Gallagher & Co.Effective 1/1/2012PPO Advantage + H S AAnnual Deductible In-Network Out-of-Network In-Network Out-of-NetworkIndividual $700 $1,400 $1,500 $3,000Family $2,100 $4,200 $3,000 $6,000If member elects EE+Spouse, EE+Child(ren) or EE+Family coverage, both Individualand Family deductibles are tracked. Each member or covered dependent cancontribute an amount equal to the Individual deductible toward the Family deductibleamount.Member CostIf member elects EE+Spouse, EE+Child(ren) or EE+Family coverage, only the Familydeductible is tracked. Individual deductibles do not apply.Annual Out-Of-Pocket Maximum (includes deductible) In-Network Out-of-Network In-Network Out-of-NetworkIndividual $4,000 $8,000 $5,960 $11,900Family $12,000 $24,000 $11,900 $23,800H S A Employer ContributionEmployee OnlyFamilyAJG ContributionN/AN/A<strong>Plan</strong> BenefitsAJG Contribution$500$1,000<strong>Plan</strong> BenefitsPhysician Services In-Network Out-of-Network In-Network Out-of-NetworkPhysician Office Visits (PCP/Specialist)100% after member copay of80% after Deductible (copays do60% after Deductible$25/$35not apply)60% after DeductibleProfessional Services (plan cost after deductible) 80% after Deductible 60% after Deductible 80% after Deductible 60% after DeductiblePhysician Emergency <strong>Medical</strong>/Accident Care Office Visit100% after member copay ofFacility$25/$35Office60% after Deductible 80% after Deductible 60% after DeductibleWellness & Preventive Care In-Network Out-of-Network In-Network Out-of-NetworkChildren: Coverage for physical exams, immunizations, & routinediagnostic tests100%, no deductible60% after Deductible100%, no Deductible 60% after DeductibleAdults: Coverage for one annual physical exam, one gynecologicalexam per calendar year, and routine diagnostic tests100%, no deductible60% after Deductible100%, no Deductible60% after DeductibleHospital In-Network Out-of-Network In-Network Out-of-NetworkInpatient Hospital ServicesIf member elects EE+Spouse, EE+Child(ren) or EE+Family coverage, both Individualand Family out-of-pocket totals are tracked. Each member or covered dependent cancontribute an amount equal to the Individual out-of-pocket total toward the Family outof-pocketamount.80% after DeductibleIf member elects EE+Spouse, EE+Child(ren) or EE+Family coverage, only the Familyout-of-pocket amount is tracked. Individual out-of-pocket maximums do not apply.60% after Deductible 80% after Deductible60% after DeductibleOutpatient Surgery and Diagnostic Tests80% after Deductible60% after Deductible80% after Deductible60% after DeductibleOutpatient Hospital ServiceHospital Emergency <strong>Medical</strong>/Accident CareFacility :Professional/other services:80% after Deductible$100 copay 1100%80% after deductible.60% after Deductible$100 copay 1100%80% after deductible.80% after Deductible80% after Deductible 160% after Deductible80% after Deductible 1Mental Health and Chemical Dependency Services In-Network Out-of-Network In-Network Out-of-NetworkOutpatient Mental Health/Chemical Dependency Office Visit100% after member $25 copay 60% after Deductible80% after Deductible60% after DeductibleInpatient Health Services80% after Deductible60% after Deductible80% after Deductible 60% after Deductible

Blue Cross and Blue ShieldEffective 1/1/12 Medco will be the Rx vendorMember CostArthur J Gallagher & Co.Effective 1/1/2012Member CostOutpatient Prescription Drugs 2, 3 In-Network Out-of-Network In-Network Out-of-NetworkRetail 30 day supplyGenericBrand Formulary 2Brand NonFormulary 2Specialty Drugs 3Mail Order 90 day supplyGenericBrand Formulary 2Brand NonFormulary 2Specialty Drugs 320% $7 minimum30% $20 Minimum40% $40 minimumNo Coverage20% $14 minimum30% $40 Minimum40% $80 minimum20%20% $7 minimum30% $20 Minimum40% $40 minimumNo CoverageNo CoverageFull cost applied to deductible.After deductible is met, membercoinsurance applies:20% $7 minimum30% $20 minimum40% $40 minimumNo CoverageFull cost applied to deductible.After deductible is met, membercoinsurance applies:20% $14 minimum30% $40 Minimum40% $80 minimum20%Full cost applied to deductible.After deductible is met, membercoinsurance applies:20% $7 minimum30% $20 minimum40% $40 minimumNo CoverageNo CoveragePrescription Drug Annual Out of Pocket Limit Same as <strong>Medical</strong> Same as <strong>Medical</strong> Same as <strong>Medical</strong> Same as <strong>Medical</strong>1Non-emergency ER Hospital Charges are not covered.2 If you request a brand name drug and a generic equivalent is available in the same drug category, you will pay the difference in cost between the generic and brand name drug.3 <strong>Plan</strong> benefits are only available for specialty drugs obtained through Accredo, a specialty mail order pharmacy.Note: This is intended as a brief summary of benefits. The Contracts and Summary <strong>Plan</strong> Description govern in all cases. Not all covered services, exclusions and limitations are shown here.