Prospectus - Fonterra

Prospectus - Fonterra

Prospectus - Fonterra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

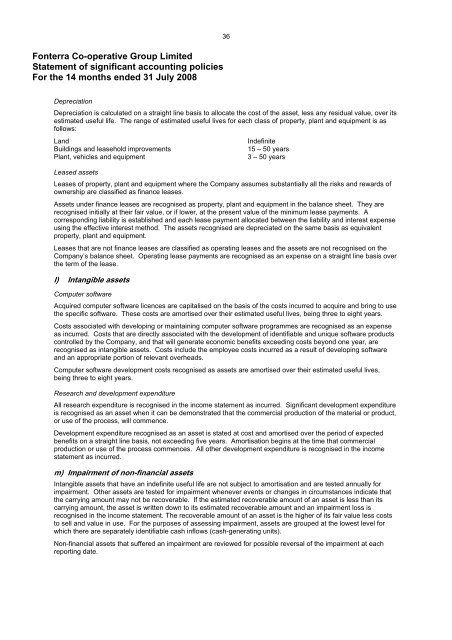

<strong>Fonterra</strong> Co-operative Group LimitedStatement of significant accounting policiesFor the 14 months ended 31 July 200836DepreciationDepreciation is calculated on a straight line basis to allocate the cost of the asset, less any residual value, over itsestimated useful life. The range of estimated useful lives for each class of property, plant and equipment is asfollows:LandBuildings and leasehold improvementsPlant, vehicles and equipmentIndefinite15 – 50 years3 – 50 yearsLeased assetsLeases of property, plant and equipment where the Company assumes substantially all the risks and rewards ofownership are classified as finance leases.Assets under finance leases are recognised as property, plant and equipment in the balance sheet. They arerecognised initially at their fair value, or if lower, at the present value of the minimum lease payments. Acorresponding liability is established and each lease payment allocated between the liability and interest expenseusing the effective interest method. The assets recognised are depreciated on the same basis as equivalentproperty, plant and equipment.Leases that are not finance leases are classified as operating leases and the assets are not recognised on theCompany’s balance sheet. Operating lease payments are recognised as an expense on a straight line basis overthe term of the lease.l) Intangible assetsComputer softwareAcquired computer software licences are capitalised on the basis of the costs incurred to acquire and bring to usethe specific software. These costs are amortised over their estimated useful lives, being three to eight years.Costs associated with developing or maintaining computer software programmes are recognised as an expenseas incurred. Costs that are directly associated with the development of identifiable and unique software productscontrolled by the Company, and that will generate economic benefits exceeding costs beyond one year, arerecognised as intangible assets. Costs include the employee costs incurred as a result of developing softwareand an appropriate portion of relevant overheads.Computer software development costs recognised as assets are amortised over their estimated useful lives,being three to eight years.Research and development expenditureAll research expenditure is recognised in the income statement as incurred. Significant development expenditureis recognised as an asset when it can be demonstrated that the commercial production of the material or product,or use of the process, will commence.Development expenditure recognised as an asset is stated at cost and amortised over the period of expectedbenefits on a straight line basis, not exceeding five years. Amortisation begins at the time that commercialproduction or use of the process commences. All other development expenditure is recognised in the incomestatement as incurred.m) Impairment of non-financial assetsIntangible assets that have an indefinite useful life are not subject to amortisation and are tested annually forimpairment. Other assets are tested for impairment whenever events or changes in circumstances indicate thatthe carrying amount may not be recoverable. If the estimated recoverable amount of an asset is less than itscarrying amount, the asset is written down to its estimated recoverable amount and an impairment loss isrecognised in the income statement. The recoverable amount of an asset is the higher of its fair value less coststo sell and value in use. For the purposes of assessing impairment, assets are grouped at the lowest level forwhich there are separately identifiable cash inflows (cash-generating units).Non-financial assets that suffered an impairment are reviewed for possible reversal of the impairment at eachreporting date.