EPRG WORKING PAPER - Electricity Policy Research Group

EPRG WORKING PAPER - Electricity Policy Research Group

EPRG WORKING PAPER - Electricity Policy Research Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

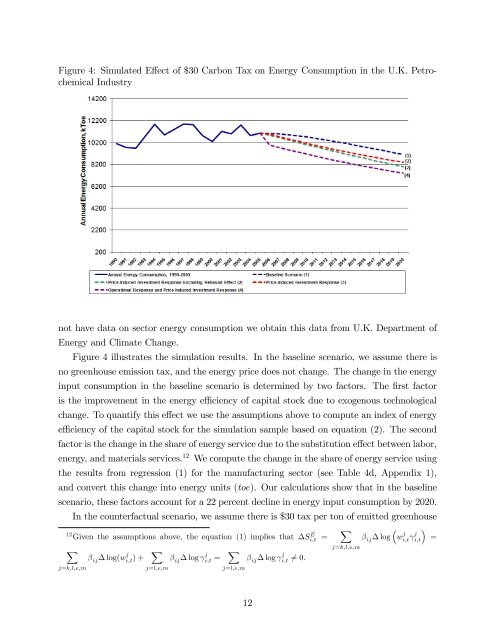

Figure 4: Simulated E¤ect of $30 Carbon Tax on Energy Consumption in the U.K. PetrochemicalIndustrynot have data on sector energy consumption we obtain this data from U.K. Department ofEnergy and Climate Change.Figure 4 illustrates the simulation results. In the baseline scenario, we assume there isno greenhouse emission tax, and the energy price does not change. The change in the energyinput consumption in the baseline scenario is determined by two factors. The …rst factoris the improvement in the energy e¢ ciency of capital stock due to exogenous technologicalchange. To quantify this e¤ect we use the assumptions above to compute an index of energye¢ ciency of the capital stock for the simulation sample based on equation (2). The secondfactor is the change in the share of energy service due to the substitution e¤ect between labor,energy, and materials services. 12 We compute the change in the share of energy service usingthe results from regression (1) for the manufacturing sector (see Table 4d, Appendix 1),and convert this change into energy units (toe). Our calculations show that in the baselinescenario, these factors account for a 22 percent decline in energy input consumption by 2020.In the counterfactual scenario, we assume there is $30 tax per ton of emitted greenhouseX 12 Given the assumptions above, the equation (1) implies that Si;t E = ij log w j i;t j i;t =Xj=k;l;e;m ij log(w j i;t ) +Xj=l;e;m ij log j i;t =Xj=l;e;m ij log j i;t 6= 0:j=k;l;e;m12