Deccan Despatch (January - April 2010) - CII

Deccan Despatch (January - April 2010) - CII

Deccan Despatch (January - April 2010) - CII

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

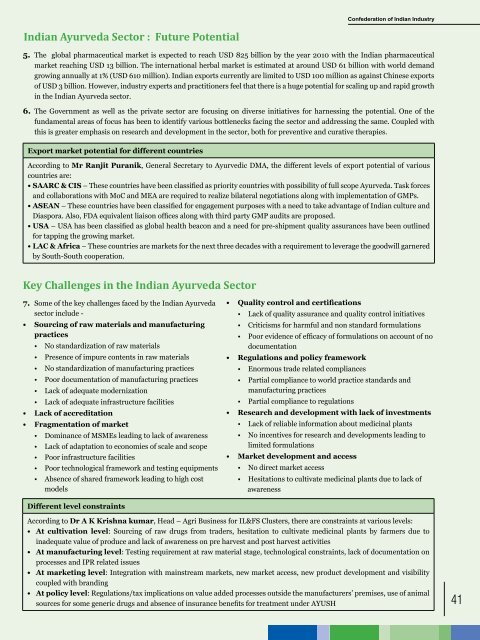

Indian Ayurveda Sector : Future Potential5. The global pharmaceutical market is expected to reach USD 825 billion by the year <strong>2010</strong> with the Indian pharmaceuticalmarket reaching USD 13 billion. The international herbal market is estimated at around USD 61 billion with world demandgrowing annually at 1% (USD 610 million). Indian exports currently are limited to USD 100 million as against Chinese exportsof USD 3 billion. However, industry experts and practitioners feel that there is a huge potential for scaling up and rapid growthin the Indian Ayurveda sector.6. The Government as well as the private sector are focusing on diverse initiatives for harnessing the potential. One of thefundamental areas of focus has been to identify various bottlenecks facing the sector and addressing the same. Coupled withthis is greater emphasis on research and development in the sector, both for preventive and curative therapies.Export market potential for different countriesAccording to Mr Ranjit Puranik, General Secretary to Ayurvedic DMA, the different levels of export potential of variouscountries are:• SAARC & CIS – These countries have been classified as priority countries with possibility of full scope Ayurveda. Task forcesand collaborations with MoC and MEA are required to realize bilateral negotiations along with implementation of GMPs.• ASEAN – These countries have been classified for engagement purposes with a need to take advantage of Indian culture andDiaspora. Also, FDA equivalent liaison offices along with third party GMP audits are proposed.• USA – USA has been classified as global health beacon and a need for pre-shipment quality assurances have been outlinedfor tapping the growing market.• LAC & Africa – These countries are markets for the next three decades with a requirement to leverage the goodwill garneredby South-South cooperation.Key Challenges in the Indian Ayurveda Sector7. Some of the key challenges faced by the Indian Ayurvedasector include -• Sourcing of raw materials and manufacturingpractices• No standardization of raw materials• Presence of impure contents in raw materials• No standardization of manufacturing practices• Poor documentation of manufacturing practices• Lack of adequate modernization• Lack of adequate infrastructure facilities• Lack of accreditation• Fragmentation of market• Dominance of MSMEs leading to lack of awareness• Lack of adaptation to economies of scale and scope• Poor infrastructure facilities• Poor technological framework and testing equipments• Absence of shared framework leading to high costmodels• Quality control and certifications• Lack of quality assurance and quality control initiatives• Criticisms for harmful and non standard formulations• Poor evidence of efficacy of formulations on account of nodocumentation• Regulations and policy framework• Enormous trade related compliances• Partial compliance to world practice standards andmanufacturing practices• Partial compliance to regulations• Research and development with lack of investments• Lack of reliable information about medicinal plants• No incentives for research and developments leading tolimited formulations• Market development and access• No direct market access• Hesitations to cultivate medicinal plants due to lack ofawarenessDifferent level constraintsAccording to Dr A K Krishna kumar, Head – Agri Business for IL&FS Clusters, there are constraints at various levels:• At cultivation level: Sourcing of raw drugs from traders, hesitation to cultivate medicinal plants by farmers due toinadequate value of produce and lack of awareness on pre harvest and post harvest activities• At manufacturing level: Testing requirement at raw material stage, technological constraints, lack of documentation onprocesses and IPR related issues• At marketing level: Integration with mainstream markets, new market access, new product development and visibilitycoupled with branding• At policy level: Regulations/tax implications on value added processes outside the manufacturers’ premises, use of animalsources for some generic drugs and absence of insurance benefits for treatment under AYUSH41