IA PPO $3000 100/50 STANDARD - Health Alliance

IA PPO $3000 100/50 STANDARD - Health Alliance

IA PPO $3000 100/50 STANDARD - Health Alliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

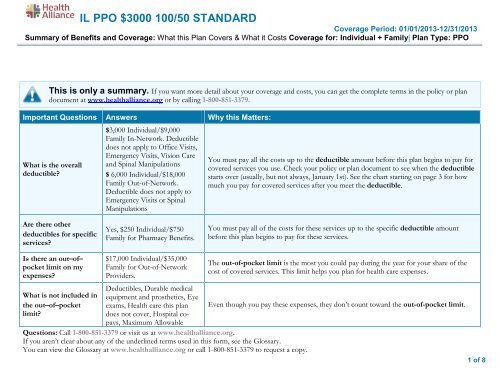

IL <strong>PPO</strong> <strong>$3000</strong> <strong>100</strong>/<strong>50</strong> <strong>STANDARD</strong>Coverage Period: 01/01/2013-12/31/2013Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual + Family| Plan Type: <strong>PPO</strong>This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plandocument at www.healthalliance.org or by calling 1-800-851-3379.Important Questions Answers Why this Matters:What is the overalldeductible?$3,000 Individual/$9,000Family In-Network. Deductibledoes not apply to Office Visits,Emergency Visits, Vision Careand Spinal Manipulations$ 6,000 Individual/$18,000Family Out-of-Network.Deductible does not apply toEmergency Visits or SpinalManipulationsYou must pay all the costs up to the deductible amount before this plan begins to pay forcovered services you use. Check your policy or plan document to see when the deductiblestarts over (usually, but not always, January 1st). See the chart starting on page 3 for howmuch you pay for covered services after you meet the deductible.Are there otherdeductibles for specificservices?Yes, $2<strong>50</strong> Individual/$7<strong>50</strong>Family for Pharmacy Benefits.You must pay all of the costs for these services up to the specific deductible amountbefore this plan begins to pay for these services.Is there an out–of–pocket limit on myexpenses?What is not included inthe out–of–pocketlimit?$17,000 Individual/$35,000Family for Out-of-NetworkProviders.Deductibles, Durable medicalequipment and prosthetics, Eyeexams, <strong>Health</strong> care this plandoes not cover, Hospital copays,Maximum AllowableQuestions: Call 1-800-851-3379 or visit us at www.healthalliance.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.healthalliance.org or call 1-800-851-3379 to request a copy.The out-of-pocket limit is the most you could pay during the year for your share of thecost of covered services. This limit helps you plan for health care expenses.Even though you pay these expenses, they don’t count toward the out-of-pocket limit.1 of 8

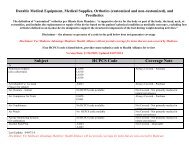

Other Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for theseservices.)• Bariatric surgery• Chiropractic care• Routine eye care (Adult)• Routine foot careYour Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keep healthcoverage. Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than the premium you paywhile covered under the plan. Other limitations on your rights to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-800-851-3379. You may also contact your state insurance department, theU.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of <strong>Health</strong> andHuman Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. Forquestions about your rights, this notice, or assistance, you can contact: <strong>Health</strong> <strong>Alliance</strong> at 1-800-851-3379. You may also contact the Department ofLabor’s Employee Benefits Security Administration at 1-866-444-EBSA(3272) or www.dol.gov/ebsa/healthreform or the Illinois Department ofInsurance at 1-877-8<strong>50</strong>-4740 or www.ins.state.il.us.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al 1-800-851-3379.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-851-3379.Chinese ( 中 文 ): 如 果 需 要 中 文 的 帮 助 , 请 拨 打 这 个 号 码 1-800-851-3379.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-800-851-3379.––––––––––––––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next page.––––––––––––––––––––––6 of 8

About these CoverageExamples:These examples show how this plan might covermedical care in given situations. Use theseexamples to see, in general, how much financialprotection a sample patient might get if they arecovered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from theseexamples, and the cost ofthat care will also bedifferent.See the next page forimportant information aboutthese examples.Having a baby(normal delivery)• Amount owed to providers: $7,540• Plan pays $3240• Patient pays $ 4300Sample care costs:Hospital charges (mother) $2,700Routine obstetric care $2,<strong>100</strong>Hospital charges (baby)$900Anesthesia $900Laboratory tests $<strong>50</strong>0Prescriptions $200Radiology $200Vaccines, other preventive $40Total $7,540Patient pays:Deductibles <strong>$3000</strong>Copays $900Coinsurance $200Limits or exclusions $200Total $4300Managing type 2 diabetes(routine maintenance ofa well-controlled condition)• Amount owed to providers: $5,400• Plan pays $ 3320• Patient pays $ 2080Sample care costs:Prescriptions $2900Medical Equipment and Supplies $1300Office Visits and Procedures $700$300EducationLaboratory tests$<strong>100</strong>Vaccines, other preventive $<strong>100</strong>Total $5,400Patient pays:Deductibles $2000Copays $0Coinsurance $0Limits or exclusions $80Total $20807 of 8

Questions and answers about the Coverage Examples:What are some of theassumptions behind theCoverage Examples?• Costs don’t include premiums.• Sample care costs are based on nationalaverages supplied by the U.S.Department of <strong>Health</strong> and HumanServices, and aren’t specific to aparticular geographic area or health plan.• The patient’s condition was not anexcluded or preexisting condition.• All services and treatments started andended in the same coverage period.• There are no other medical expenses forany member covered under this plan.• Out-of-pocket expenses are based onlyon treating the condition in the example.• The patient received all care from innetworkproviders. If the patient hadreceived care from out-of-networkproviders, costs would have been higher.What does a Coverage Exampleshow?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up. Italso helps you see what expenses might be leftup to you to pay because the service ortreatment isn’t covered or payment is limited.Does the Coverage Examplepredict my own care needs? No. Treatments shown are just examples.The care you would receive for thiscondition could be different based on yourdoctor’s advice, your age, how serious yourcondition is, and many other factors.Does the Coverage Examplepredict my future expenses?No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition. Theyare for comparative purposes only. Yourown costs will be different depending onthe care you receive, the prices yourproviders charge, and the reimbursementCan I use Coverage Examplesto compare plans?Yes. When you look at the Summary ofBenefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the“Patient Pays” box in each example. Thesmaller that number, the more coveragethe plan provides.Are there other costs I shouldconsider when comparingplans?Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium, the more you’ll pay in out-ofpocketcosts, such as copayments,deductibles, and coinsurance. Youshould also consider contributions toaccounts such as health savings accounts(HSAs), flexible spending arrangements(FSAs) or health reimbursement accounts(HRAs) that help you pay out-of-pocketexpenses.your health plan allows.Questions: Call 1-800-851-3379 or visit us at www.healthalliance.org. 8 of 8If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.healthalliance.org or call 1-800-851-3379 to request a copy.