THE JOINT TRAVEL REGULATIONS - Office of the General Counsel

THE JOINT TRAVEL REGULATIONS - Office of the General Counsel

THE JOINT TRAVEL REGULATIONS - Office of the General Counsel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

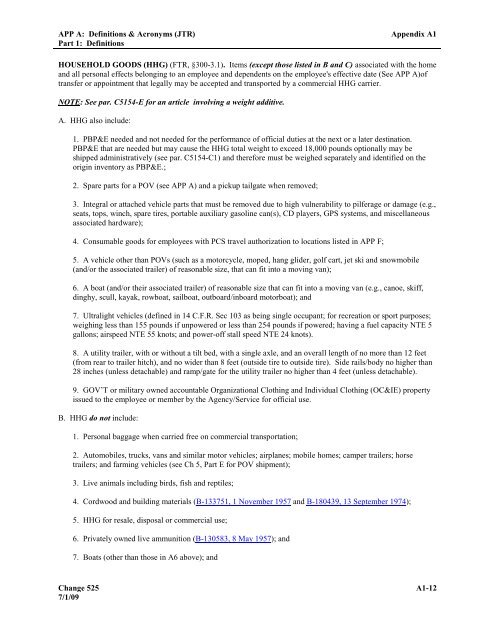

APP A: Definitions & Acronyms (JTR)<br />

Part 1: Definitions<br />

Appendix A1<br />

HOUSEHOLD GOODS (HHG) (FTR, §300-3.1). Items (except those listed in B and C) associated with <strong>the</strong> home<br />

and all personal effects belonging to an employee and dependents on <strong>the</strong> employee's effective date (See APP A)<strong>of</strong><br />

transfer or appointment that legally may be accepted and transported by a commercial HHG carrier.<br />

NOTE:<br />

See par. C5154-E for an article involving a weight additive.<br />

A. HHG also include:<br />

1. PBP&E needed and not needed for <strong>the</strong> performance <strong>of</strong> <strong>of</strong>ficial duties at <strong>the</strong> next or a later destination.<br />

PBP&E that are needed but may cause <strong>the</strong> HHG total weight to exceed 18,000 pounds optionally may be<br />

shipped administratively (see par. C5154-C1) and <strong>the</strong>refore must be weighed separately and identified on <strong>the</strong><br />

origin inventory as PBP&E.;<br />

2. Spare parts for a POV (see APP A) and a pickup tailgate when removed;<br />

3. Integral or attached vehicle parts that must be removed due to high vulnerability to pilferage or damage (e.g.,<br />

seats, tops, winch, spare tires, portable auxiliary gasoline can(s), CD players, GPS systems, and miscellaneous<br />

associated hardware);<br />

4. Consumable goods for employees with PCS travel authorization to locations listed in APP F;<br />

5. A vehicle o<strong>the</strong>r than POVs (such as a motorcycle, moped, hang glider, golf cart, jet ski and snowmobile<br />

(and/or <strong>the</strong> associated trailer) <strong>of</strong> reasonable size, that can fit into a moving van);<br />

6. A boat (and/or <strong>the</strong>ir associated trailer) <strong>of</strong> reasonable size that can fit into a moving van (e.g., canoe, skiff,<br />

dinghy, scull, kayak, rowboat, sailboat, outboard/inboard motorboat); and<br />

7. Ultralight vehicles (defined in 14 C.F.R. Sec 103 as being single occupant; for recreation or sport purposes;<br />

weighing less than 155 pounds if unpowered or less than 254 pounds if powered; having a fuel capacity NTE 5<br />

gallons; airspeed NTE 55 knots; and power-<strong>of</strong>f stall speed NTE 24 knots).<br />

8. A utility trailer, with or without a tilt bed, with a single axle, and an overall length <strong>of</strong> no more than 12 feet<br />

(from rear to trailer hitch), and no wider than 8 feet (outside tire to outside tire). Side rails/body no higher than<br />

28 inches (unless detachable) and ramp/gate for <strong>the</strong> utility trailer no higher than 4 feet (unless detachable).<br />

9. GOV’T or military owned accountable Organizational Clothing and Individual Clothing (OC&IE) property<br />

issued to <strong>the</strong> employee or member by <strong>the</strong> Agency/Service for <strong>of</strong>ficial use.<br />

B. HHG do not include:<br />

1. Personal baggage when carried free on commercial transportation;<br />

2. Automobiles, trucks, vans and similar motor vehicles; airplanes; mobile homes; camper trailers; horse<br />

trailers; and farming vehicles (see Ch 5, Part E for POV shipment);<br />

3. Live animals including birds, fish and reptiles;<br />

4. Cordwood and building materials ( B-133751, 1 November 1957 and B-180439, 13 September 1974);<br />

5. HHG for resale, disposal or commercial use;<br />

6. Privately owned live ammunition (B-130583, 8 May 1957); and<br />

7. Boats (o<strong>the</strong>r than those in A6 above); and<br />

Change 525 A1-12<br />

7/1/09