exams sat between 1 September 2013 - 31 December 2014

exams sat between 1 September 2013 - 31 December 2014

exams sat between 1 September 2013 - 31 December 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

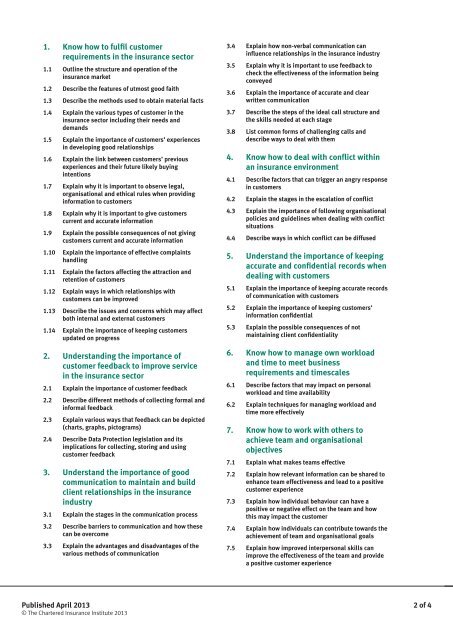

1. Know how to fulfil customerrequirements in the insurance sector1.1 Outline the structure and operation of theinsurance market1.2 Describe the features of utmost good faith1.3 Describe the methods used to obtain material facts1.4 Explain the various types of customer in theinsurance sector including their needs anddemands1.5 Explain the importance of customers’ experiencesin developing good relationships1.6 Explain the link <strong>between</strong> customers’ previousexperiences and their future likely buyingintentions1.7 Explain why it is important to observe legal,organi<strong>sat</strong>ional and ethical rules when providinginformation to customers1.8 Explain why it is important to give customerscurrent and accurate information1.9 Explain the possible consequences of not givingcustomers current and accurate information1.10 Explain the importance of effective complaintshandling1.11 Explain the factors affecting the attraction andretention of customers1.12 Explain ways in which relationships withcustomers can be improved1.13 Describe the issues and concerns which may affectboth internal and external customers1.14 Explain the importance of keeping customersupdated on progress2. Understanding the importance ofcustomer feedback to improve servicein the insurance sector2.1 Explain the importance of customer feedback2.2 Describe different methods of collecting formal andinformal feedback2.3 Explain various ways that feedback can be depicted(charts, graphs, pictograms)2.4 Describe Data Protection legislation and itsimplications for collecting, storing and usingcustomer feedback3. Understand the importance of goodcommunication to maintain and buildclient relationships in the insuranceindustry3.1 Explain the stages in the communication process3.2 Describe barriers to communication and how thesecan be overcome3.3 Explain the advantages and disadvantages of thevarious methods of communication3.4 Explain how non-verbal communication caninfluence relationships in the insurance industry3.5 Explain why it is important to use feedback tocheck the effectiveness of the information beingconveyed3.6 Explain the importance of accurate and clearwritten communication3.7 Describe the steps of the ideal call structure andthe skills needed at each stage3.8 List common forms of challenging calls anddescribe ways to deal with them4. Know how to deal with conflict withinan insurance environment4.1 Describe factors that can trigger an angry responsein customers4.2 Explain the stages in the escalation of conflict4.3 Explain the importance of following organi<strong>sat</strong>ionalpolicies and guidelines when dealing with conflictsituations4.4 Describe ways in which conflict can be diffused5. Understand the importance of keepingaccurate and confidential records whendealing with customers5.1 Explain the importance of keeping accurate recordsof communication with customers5.2 Explain the importance of keeping customers’information confidential5.3 Explain the possible consequences of notmaintaining client confidentiality6. Know how to manage own workloadand time to meet businessrequirements and timescales6.1 Describe factors that may impact on personalworkload and time availability6.2 Explain techniques for managing workload andtime more effectively7. Know how to work with others toachieve team and organi<strong>sat</strong>ionalobjectives7.1 Explain what makes teams effective7.2 Explain how relevant information can be shared toenhance team effectiveness and lead to a positivecustomer experience7.3 Explain how individual behaviour can have apositive or negative effect on the team and howthis may impact the customer7.4 Explain how individuals can contribute towards theachievement of team and organi<strong>sat</strong>ional goals7.5 Explain how improved interpersonal skills canimprove the effectiveness of the team and providea positive customer experiencePublished April <strong>2013</strong> 2 of 4© The Chartered Insurance Institute <strong>2013</strong>