Annual Report 2012 - The Cyprus Development Bank

Annual Report 2012 - The Cyprus Development Bank

Annual Report 2012 - The Cyprus Development Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

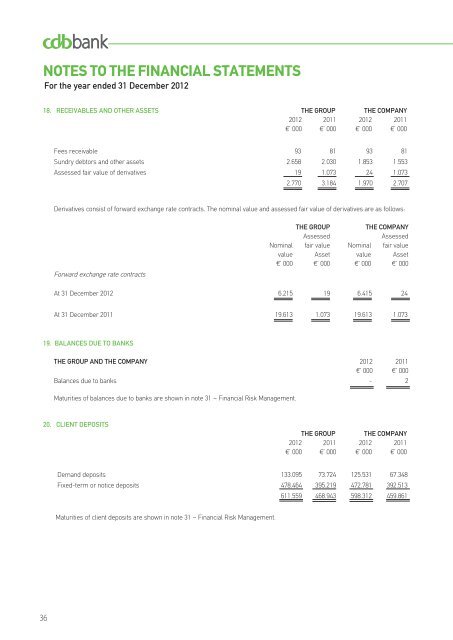

NOTES TO THE FINANCIAL STATEMENTSFor the year ended 31 December <strong>2012</strong>18. RECEIVABLES AND OTHER ASSETS THE GROUP THE COMPANY<strong>2012</strong> 2011 <strong>2012</strong> 2011€’ 000 €’ 000 €’ 000 €’ 000Fees receivable 93 81 93 81Sundry debtors and other assets 2.658 2.030 1.853 1.553Assessed fair value of derivatives 19 1.073 24 1.0732.770 3.184 1.970 2.707Derivatives consist of forward exchange rate contracts. <strong>The</strong> nominal value and assessed fair value of derivatives are as follows:Forward exchange rate contractsTHE GROUPTHE COMPANYAssessedAssessedNominal fair value Nominal fair valuevalue Asset value Asset€’ 000 €’ 000 €’ 000 €’ 000At 31 December <strong>2012</strong> 6.215 19 6.415 24At 31 December 2011 19.613 1.073 19.613 1.07319. BALANCES DUE TO BANKSTHE GROUP AND THE COMPANY <strong>2012</strong> 2011€’ 000 €’ 000Balances due to banks - 2Maturities of balances due to banks are shown in note 31 – Financial Risk Management.20. CLIENT DEPOSITSTHE GROUP THE COMPANY<strong>2012</strong> 2011 <strong>2012</strong> 2011€’ 000 €’ 000 €’ 000 €’ 000Demand deposits 133.095 73.724 125.531 67.348Fixed-term or notice deposits 478.464 395.219 472.781 392.513611.559 468.943 598.312 459.861Maturities of client deposits are shown in note 31 – Financial Risk Management.36