Awraq Investments www.awraq.com Tel: 962 6 550 ... - Menafn.com

Awraq Investments www.awraq.com Tel: 962 6 550 ... - Menafn.com

Awraq Investments www.awraq.com Tel: 962 6 550 ... - Menafn.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

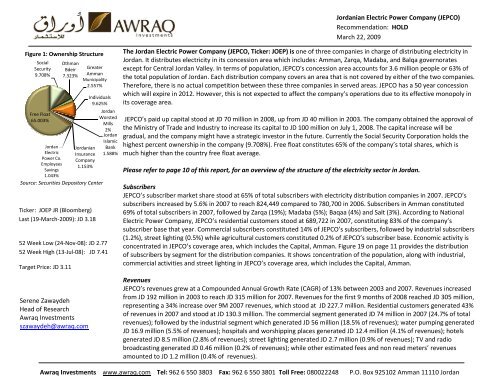

Figure 1: Ownership Structure<br />

Social<br />

Security<br />

9.708%<br />

Free Float<br />

65.003%<br />

Jordan<br />

Electric<br />

Power Co.<br />

Employees<br />

Savings<br />

1.043%<br />

Othman<br />

Bdeir<br />

7.323%<br />

Source: Securities Depository Center<br />

Ticker: JOEP JR (Bloomberg)<br />

Last (19-March-2009): JD 3.18<br />

52 Week Low (24-Nov-08): JD 2.77<br />

52 Week High (13-Jul-08): JD 7.41<br />

Target Price: JD 3.11<br />

Serene Zawaydeh<br />

Head of Research<br />

<strong>Awraq</strong> <strong>Investments</strong><br />

szawaydeh@<strong>awraq</strong>.<strong>com</strong><br />

Greater<br />

Amman<br />

Municipality<br />

2.557%<br />

Jordanian<br />

Insurance<br />

Company<br />

1.153%<br />

Individuals<br />

9.625%<br />

Jordan<br />

Worsted<br />

Mills<br />

2%<br />

Jordan<br />

Islamic<br />

Bank<br />

1.588%<br />

Jordanian Electric Power Company (JEPCO)<br />

Re<strong>com</strong>mendation: HOLD<br />

March 22, 2009<br />

The Jordan Electric Power Company (JEPCO, Ticker: JOEP) is one of three <strong>com</strong>panies in charge of distributing electricity in<br />

Jordan. It distributes electricity in its concession area which includes: Amman, Zarqa, Madaba, and Balqa governorates<br />

except for Central Jordan Valley Valley. In terms of population, opulation, JEPCO's concession area accounts for 3.6 million people or 63% of<br />

the total population of Jordan Jordan. . Each distribution <strong>com</strong>pany covers an area that is not covered by either of the two <strong>com</strong>panies.<br />

Therefore, there is no actual <strong>com</strong>petition between thes these e three <strong>com</strong>panies in served areas. JEPCO has a 50 year concession<br />

which will expire in 2012. However, this is not expected to affect the <strong>com</strong>pany’s operations due to its effective monopoly in<br />

its coverage area.<br />

JEPCO’s paid up capital stood at JD 70 mill million ion in 2008, up from JD 40 million in 2003. The <strong>com</strong>pany obtained the approval of<br />

the Ministry of Trade rade and Industry to increase its capital to JD 100 million on July 1, 2008. The capital increase will be<br />

gradual, and the <strong>com</strong>pany might have a strategic inve investor stor in the future. Currently the Social Security Corporation holds the<br />

highest percent ownership in the <strong>com</strong>pany (9.708%). Free float constitutes 65% of the <strong>com</strong>pany’s total shares, which is<br />

much higher than the country free float average.<br />

Please refer to o page 10 of this report, for an overview of the structure of the electricity sector in Jordan.<br />

Subscribers<br />

JEPCO’s EPCO’s subscriber market share stood at 65% of total subscribers with electricity distribution <strong>com</strong>panies in 2007. JEPCO’s<br />

subscribers increased by 5.6% in 2007 to reach 824,449 <strong>com</strong>pared to 780,700 in 2006. Subscribers in Amman constituted<br />

69% of total subscribers in 2007, followed by Zarqa (19%); Madaba (5%); Baqaa (4%) and Salt (3%). According to National<br />

Electric Power Company, JEPCO’s residenti residential customers stood at 689,722 in 2007, , constituting 83% of the c<strong>com</strong>pany’s<br />

subscriber base that year year. . Commercial subscribers constituted 14% of JEPCO’s subscribers, followed by industrial subscribers<br />

(1.2%), street lighting (0.5%) while agricultural customer customers constituted 0.2% 2% of JEPCO’s subscriber base. Economic activity is<br />

concentrated in JEPCO’s coverage area, which includes the Capital, Amman. Figure 19 on page 11 provides the distribution<br />

of subscribers by segment for the distribution <strong>com</strong>panies. It shows concentration of the population, along with industrial,<br />

<strong>com</strong>mercial activities and street lighting in JEPCO’s coverage area, which includes the Capital, Amman.<br />

Revenues<br />

JEPCO’s revenues grew at a Compounded Annual Growth Rate (CAGR) of 13% between 2003 and 2007. Revenues increased<br />

from JD 192 million in 2003 to reach JD 315 million for 2007. Revenues for the first 9 months of 2008 reached JD 305 million,<br />

representing a 34% increase over 9M 2007 revenues, which stood at JD 227.7 million. Residential customers generated 43%<br />

of revenues in 2007 and stood at JD 130.3 million. The <strong>com</strong>mercial segment generated JD 774<br />

million in 2007 (24.7% of total<br />

revenues); followed by the industrial segment which generated JD 56 million (18.5% of revenues); water pumping generated<br />

JD 16.9 million (5.5% of revenues revenues); hospitals and worshipping places generated JD 12.4 million (4.1% of revenues revenues); hotels<br />

generated JD 8.5 million (2.8% of revenues) revenues); street lighting generated JD 2.7 million (0.9% of revenues revenues); TV and radio<br />

broadcasting generated JD 0.46 million (0.2% of revenues); ); while other estimated fees and non read meters meters’ revenues<br />

amounted to JD 1.2 million (0.4% of revenues).<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan

Jordanian Electric Power Company (JEPCO)<br />

Cost of sales represents a primary item on the <strong>com</strong>pany’s in<strong>com</strong>e statement. This represents the cost of bought power from National Electric<br />

Power Company (NEPCO). It accounted for 80% of revenues in 2003, and 87% of revenues in the first 9 months of 2008. Other operating expenses<br />

accounted for 2.7% in the first 9 months of 2008. The gross profit margin stood at 10.3% for the first 9 months of 2008, <strong>com</strong>pared to 12.2% in 9M<br />

2007. Net profit amounted to JD 8.6 million in 2003 with a net profit margin of 4.6%. It increased to JD 11 million in 2007, with a net profit margin<br />

of 3.8%. In the first 9 months of 2008, net profit stood at JD 9 million with a net profit margin of 3%.<br />

The <strong>com</strong>pany reported preliminary revenues for 2008 of JD 426.23 million, <strong>com</strong>pared to JD 315 million in 2007. This amount represents revenues<br />

from sales of energy; investment in<strong>com</strong>e; net other revenues; non operating revenues; write down of investments; and foreign exchange gain.<br />

The <strong>com</strong>pany has a non operating revenue item of JD 7.25 million from selling land to Greater Amman Municipality.<br />

Electricity Tariffs<br />

The Electricity Regulatory Commission (ERC) sets wholesale prices that electricity <strong>com</strong>panies pay to NEPCO, and tariffs that end users pay to the<br />

distribution <strong>com</strong>panies. In line with the increase in international oil prices in 2007, the ERC increased the wholesale prices that electricity<br />

distribution <strong>com</strong>panies have to pay to NEPCO on July 1, 2007. Daytime and night time wholesale tariffs increased by 1.11 Fils/KWh, to reach 35.41<br />

and 25.36 Fils/KWh respectively. This led to an increase in the cost of purchased power for JEPCO. In the last quarter of 2007, purchased power<br />

accounted for 89% of total revenues for the quarter, <strong>com</strong>pared to 78% in 2004. Eight months later, on March 14, 2008, the ERC implemented an<br />

increase to prices that end users pay to electricity <strong>com</strong>panies. The average increase to prices for end users stood at 34% versus an average of 3.9%<br />

increase on tariffs for electricity <strong>com</strong>panies. (Please refer to the Appendix for details on tariffs.)<br />

The increase in electricity tariffs was translated into in an increase in the ratio of revenues to sold power. The ratio was 46.9 in 2003 and increased<br />

to 50.4 in 2007. The increase in usage is displayed in the increase in ratio of sold power per subscriber, which increased from 6 in 2003 to 7.3 in<br />

2007. As a result of the increase in usage and tariffs, the electricity monthly Average Revenue per User (ARPU) for all segments of users <strong>com</strong>bined<br />

increased from JD 24 in 2003 to JD 31.5 in 2007.<br />

We calculated the electricity ARPU based on revenues and the number of subscribers by segment reported by NEPCO, and the revenues by<br />

segment reported by JEPCO. The ARPU indicator is a <strong>com</strong>mon indicator in the tele<strong>com</strong> industry. Results show an increase in ARPU by segment,<br />

which is due to an increase in consumption in addition to an increase in tariffs. The agricultural segment has the highest ARPU <strong>com</strong>pared to other<br />

segments. The Ministry of Agriculture is one of JEPCO’s subscribers, and it is in charge of pumping water to customers.<br />

There is a gap between the bought power from NEPCO, and the sold power to end users. The ratio of sold power to bought power declined from<br />

89% in 2003 to 85% in 2007. In addition to losses in the system, there was an increase in electricity theft, which results in unpaid consumption of<br />

electricity. This ac<strong>com</strong>panied the increase in oil prices, which led to substitution of traditional heating based on oil products, to electric<br />

heating. The percent of lost power reached 15.2% in 2007 <strong>com</strong>pared to 12.4% in 2006. Furthermore, there is a difference in growth of bought<br />

power and sold power. Sold power readings are taken between mid of the month and the following month, while the bought power meters are<br />

taken on the first day of each month.<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[2]

Figure 2: Number of JEPCO’s Customers by Segment<br />

2003 2004 2005 2006 2007<br />

Domestic 538,839 570,180 605,638 640,594 689,722<br />

Industrial 9,082 9,345 9,706 9,957 10,230<br />

Commercial 98,279 102,794 107,919 113,770 119,010<br />

Water Pumping 970 1,040 1,074 1,250 1,340<br />

Governmental 5,762 5,998 6,489 6,864 4,147<br />

Others 7,298 7,613 7,874 8,265 -<br />

Total<br />

Source: NEPCO<br />

660,230 696,970 738,700 780,700 824,449<br />

Figure 4: Average Revenue per User by Segment<br />

ARPU (JD) 2004 2005 2006 2007<br />

Residential 13 14 15 16<br />

Commercial 47 50 55 60<br />

Industrial 348 395 419 463<br />

Water pumping 1064 992 998 1082<br />

Government, Street lighting 26 29 32 42<br />

Other customers (hospitals, religeous) 104 106 115<br />

Source: NEPCO, JEPCO, <strong>Awraq</strong> <strong>Investments</strong><br />

Figure 6: Average Sold Power per Customer (MW)<br />

2003 2004<br />

Residential and public buildings 3.06 3.22<br />

Commercial, Hotels, Broadcasting 8 9<br />

Industrial 99.30 106.79<br />

Water pumping 352 309<br />

Government, Street lighting 17.24 18.32<br />

Other customers (hospitals, religious)<br />

Source: JEPCO<br />

23 21<br />

2005 2006 2007<br />

3.30 3.61 3.65<br />

9 10 11<br />

113.08 129.99 133.81<br />

291 261 290<br />

18.47 19.64 31.99<br />

20 19<br />

397 448<br />

Jordanian Electric Power Company (JEPCO)<br />

Figure 3: Revenues by Segment<br />

Residential<br />

Revenues Commercial, Hotels, Hospitals, Religious, Broadcasting<br />

Industrial<br />

Agricultural<br />

140<br />

130<br />

Governmental, Street lighting<br />

115<br />

120 Others, unread meters<br />

99<br />

96<br />

100<br />

89<br />

79<br />

84<br />

80<br />

60<br />

67<br />

73<br />

60<br />

45 49<br />

56<br />

34 39<br />

40<br />

20<br />

12 13 13 14 17<br />

1 0.3 2 0.4<br />

2 0.7<br />

3 2.7 3 1.3<br />

-<br />

Sold Power Bought Power Sold power / Bought Power<br />

8000<br />

7000<br />

6000<br />

5000<br />

89%<br />

90%<br />

4907<br />

4396<br />

88% 6157<br />

88%<br />

5431<br />

4793 5393<br />

7113<br />

6030<br />

90%<br />

89%<br />

88%<br />

87%<br />

4000<br />

86%<br />

3000<br />

84.8%<br />

85%<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

JD Million<br />

Source: JEPCO<br />

Gigawatt Hour (GWH)<br />

2000<br />

1000<br />

0<br />

2003 2004<br />

Figure 5: Sold Power versus Bought Power<br />

Source: JEPCO<br />

2005 2006 2007<br />

2003 2004 2005 2006 2007<br />

84%<br />

83%<br />

82%<br />

[3]

Jordanian Electric Power Company (JEPCO)<br />

Balance Sheet<br />

Total assets stood at JD 421.7 million at the end of September 2008, representing a 15.6% growth over total assets for September 2007 which<br />

stood at JD 364.7 million. Total assets include subscriber contributions and rural fils contributions after depreciation. The <strong>com</strong>pany reports<br />

subscriber contributions at both sides of the balance sheets under non current assets and non current liabilities. In order to address customers’<br />

needs for electricity that is above the specific load provided by the network, subscribers pay amounts required to install assets such as: transformer<br />

stations, cables, electric poles and others. Should inventory be used for the project, the amount used moves into projects in progress. Once 80% of<br />

the project is <strong>com</strong>pleted, the amounts move into subscriber contributions, which are depreciated at 4% annually. The increase in construction<br />

activity in 2006 and 2007 was reflected in an increase in subscriber contributions assets. Subscriber contributions assets amounted to JD 63 million<br />

in 2003, constituting 25.4% of total assets, and reached JD 124 million at the end of September 2008, constituting 29.4% of total assets. Subscriber<br />

contributions are not refunded to customers.<br />

JEPCO has a liquidity challenge, as current assets do not cover current liabilities. The gap between current assets and current liabilities has been<br />

widening over the years, leading to a negative working capital. The current ratio, calculated by dividing total current assets by total current<br />

liabilities, is less than 1. It decreased from 75% in 2003 to 60% at the end of September 2008. The <strong>com</strong>pany’s current assets stood at JD 116.7<br />

million at the end of September 2008 <strong>com</strong>pared to current liabilities of JD 195 million. The quick ratio stood at 0.46 at the end of September 2008.<br />

The net working capital ratio stood at -19%; and the cash flow liquidity ratio was 25.6%.<br />

A key driver for the <strong>com</strong>pany’s excess current liabilities, is the “subscribers’ refundable deposits”. The amount is refunded to the subscribers when<br />

the service is disconnected. Taking into consideration that electricity is a vital utility with the <strong>com</strong>pany being the only distributor for electricity in its<br />

coverage area; the amounts refunded are expected to be limited if not zero. Should a subscriber disconnect the service for moving to another<br />

place, another subscriber would request reconnection of the service and deposit the amount required. Consequently, we deducted this amount<br />

from current liabilities when calculating the adjusted working capital. This had a positive impact on working capital. However, for 2007 and 9M<br />

2008, the working capital is still negative even after deduction of the refundable deposit.<br />

Cash Flow Statement<br />

Cash flow from operations reached JD 42 million for the first 9 months of 2008, <strong>com</strong>pared to JD 32 million in 2007. Cash flow from investments<br />

increased in the first 9 months of 2008, to reach JD 41 million, <strong>com</strong>pared to JD 32 million for 2007. Cash flow from financing activities amounted to<br />

JD 8.2 million in the first 9 months of 2008, versus JD 4.4 million for end of 2007.<br />

Jordan Electric Power Company has been maintaining its dividend distribution policy. The <strong>com</strong>pany distributed JD 0.12 dividends per share for 2007<br />

in addition to 6.06% as stock dividend. On March 3, 2009, the <strong>com</strong>pany announced that it will distribute cash dividends amounting to 10% of the<br />

nominal value (JD 0.10 per share) for the year 2008, in addition to 9% stock dividends. According to the <strong>com</strong>pany’s concession agreement,<br />

dividends per share including in<strong>com</strong>e tax should be between 7.5% and 16% of the nominal value. The dividend yield is 3.14% as of March 19, 2009.<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[4]

Figure 7: : JEPCO’s Revenues, Net Profit and Net Profit Margin<br />

JD Million<br />

Source: JEPCO<br />

Figure 9: Assets, Liabilities and Shareholders Equity<br />

JD million<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

Total Assets Total Liabilities Shareholders Equity<br />

500<br />

400<br />

300<br />

200<br />

100<br />

-<br />

-<br />

Source: JEPCO<br />

Total Revenues Net Profit Net Profit Margin<br />

4.6% 4.7% 4.7%<br />

186 209 232<br />

248<br />

186<br />

278<br />

297<br />

5.9%<br />

269<br />

316<br />

208 214 225<br />

62 70 82 91<br />

304<br />

3.8%<br />

9 10 11 16 12<br />

2003 2004 2005 2006 2007<br />

362<br />

305<br />

266<br />

3.0%<br />

422<br />

327<br />

96 95<br />

2003 2004 2005 2006 2007 9M 2008<br />

9<br />

9M<br />

2008<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

0.0%<br />

Jordanian Electric Power Company (JEPCO)<br />

Figure 8: JEPCO’s Quarterly Revenues and Cost of Bought Power<br />

60.8 63.0<br />

75.4 80.0 72.3 69.9<br />

51.8 52.5 60.2 57.8 63.0 85.5 87.3<br />

69.9 76.1<br />

60.4<br />

97.6<br />

88.2<br />

78.5<br />

70.1 67.4<br />

60.4<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

JD million<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Source: JEPCO<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

Source: JEPCO<br />

Revenues<br />

Q1 06 Q2 06 Q3 06 Q4 06 Q1 07 Q2 07 Q3 07 Q4 07 Q1 08 Q2 08 Q3 08<br />

Figure 10: Cash Flow<br />

Cash Flow Operating<br />

29<br />

38<br />

32<br />

Bought Power<br />

120.3<br />

Investing Financing<br />

98.8<br />

-9.9<br />

2003<br />

-10.9<br />

2004<br />

-8.3<br />

2005<br />

-11.1 11.1<br />

2006<br />

-6.6<br />

2007 9M 2008<br />

-16.4 -18.2<br />

-25.5<br />

-32.0<br />

13<br />

32<br />

4.4<br />

36<br />

-41.8<br />

8.2<br />

[5]

Figure 11: Financial Ratios<br />

Ratio Sept 08 Sept 07<br />

Current Ratio 0.60<br />

Quick Ratio 0.46<br />

Net Working Capital Ratio -19%<br />

Cash flow liquidity ratio 25.6%<br />

Return on Assets 2.7%<br />

Return on Equity 11.1%<br />

Profit Margin (9m) 3.0%<br />

Earnings Per Share (trailing 12m) 0.106 0.143<br />

Asset Turnover Ratio 78%<br />

Account Receivables Turnover Ratio 5.32<br />

Total Debt to Equity Ratio 3.44<br />

Interest Coverage Ratio 76%<br />

Subscriber Contributions / Total Assets 26.4%<br />

Subscriber refundable deposits/ Current liabilities 26.9%<br />

Source: JEPCO, <strong>Awraq</strong> <strong>Investments</strong><br />

Figure 13: Capital Expenditure<br />

Million JD<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

-<br />

Source: JEPCO<br />

19.00<br />

22.70<br />

CAPEX<br />

43.42<br />

2004 2005 2006<br />

50.36<br />

2007<br />

0.66<br />

0.56<br />

-15%<br />

40%<br />

4.2%<br />

15.4%<br />

4.4%<br />

67%<br />

5.03<br />

2.89<br />

8.82<br />

28%<br />

29.5%<br />

Jordanian Electric Power Company (JEPCO)<br />

Figure 12: Working Capital and Adjusted Working Capital<br />

9.57 7.39 7.59 3.98<br />

2003 2004 2005 2006 2007 9M 2008<br />

-22.15<br />

-27.32 -30.53<br />

-39.24 39.24<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

Millions<br />

Current Assets - Current Liabilities<br />

Current Assets - Current Liabilities Excluding Refundable Deposits<br />

20<br />

-<br />

(20)<br />

(40)<br />

(60)<br />

(80)<br />

(100)<br />

Source: JEPCO, <strong>Awraq</strong> <strong>Investments</strong><br />

-56.95<br />

-9.17 -25.72<br />

-78.17<br />

[6]

Share Price Movement<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

1-Jan-08<br />

18-Jan-08<br />

4-Feb-08<br />

21-Feb-08<br />

9-Mar-08<br />

26-Mar-08<br />

12-Apr-08<br />

29-Apr-08<br />

16-May-08<br />

2-Jun-08<br />

19-Jun-08<br />

6-Jul-08<br />

23-Jul-08<br />

9-Aug-08<br />

26-Aug-08<br />

12-Sep-08<br />

29-Sep-08<br />

16-Oct-08<br />

2-Nov-08<br />

19-Nov-08<br />

6-Dec-08<br />

23-Dec-08<br />

9-Jan-09<br />

26-Jan-09<br />

12-Feb-09<br />

1-Mar-09<br />

18-Mar-09<br />

Source: Bloomberg<br />

JOEP JR Equity Amman Stock Exchange Index<br />

6000<br />

5000<br />

4000<br />

3000<br />

2000<br />

1000<br />

0<br />

Jordanian Electric Power Company (JEPCO)<br />

JEPCO’s share price movement was the most volatile in 2008 <strong>com</strong>pared to previous years. The share price recorded its highest level on July 13,<br />

2008, closing at JD 7.41. Following the decline in regional and international stock prices as a result of the financial crisis, the share lost 63% of<br />

its highest value by November 24, 2008, closing at JD 2.77. We believe that the rise in the share price was not related to the fundamentals of<br />

the <strong>com</strong>pany, but was rather an effect of the regional boom in stock prices. The <strong>com</strong>pany’s announcement that it will be distributing dividends<br />

had a positive impact on the share price. The share closed at JD 3.17 on March 18, 2009.<br />

Figure 14: JEPCO’s Share versus Amman Stock Exchange Index<br />

Figure 15: Jordanian Electric Power Company’s Share Price<br />

Source: Bloomberg<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

JD<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Jordanian Electric Power Company<br />

Annual High and Low Prices<br />

1.77<br />

1.11<br />

2.77<br />

1.76<br />

4.06<br />

2.77<br />

3.64<br />

2.39<br />

4.15<br />

2.44<br />

7.41<br />

2.77<br />

3.21<br />

2.95<br />

2003 2004 2005 2006 2007 2008 2009<br />

[7]

JEPCO’s Potential Peers<br />

Jordanian Electric Power Company (JEPCO)<br />

The <strong>com</strong>panies we considered are: Saudi Electricity Company, Abu Dhabi National Energy Company, Qatar Electricity and Water, and Irbid District<br />

Electricity. JEPCO distributes electricity to specified regions in Jordan, and not to all the country, and it does not generate electricity. As for the other<br />

<strong>com</strong>panies:<br />

• Saudi Electricity Company (Ticker: SECO AB): Is responsible for generation, transmission, and distribution of electricity in Saudi Arabia.<br />

• Abu Dhabi National Energy Company (Ticker: TAQA) is a Global energy <strong>com</strong>pany with operations in power generation, water desalination,<br />

upstream oil/ gas, pipelines, gas storage and LNG regas. Its revenues extend outside UAE. TAQA is investment arm of Abu Dhabi Water and<br />

Electricity Authority (ADEWA), which produces, transmits, and distributes water and electricity in Abu Dhabi to more than 1.4 million customers.<br />

• Qatar Electricity and Water (Ticker: QEWS QD) Generates electricity and desalinates water. The <strong>com</strong>pany sells its electricity and water to the<br />

government<br />

• Irbid District Electricity (Ticker: IREL JR) distributes electricity in the northern part of Jordan. Its share price increased after it was acquired by<br />

Kingdom Electricity Company, a subsidiary of Jordan Dubai Capital). It has a paid up capital of JD 4 million in 2007. Its share price closed at JD<br />

7.35 on March 4, 2009.<br />

Based on the above, we excluded the P/E, P/BV, and EV/EBITDA peer analysis, due to differences in size and operation for considered possible peers<br />

with operations including electricity distribution.<br />

Figure 16: JEPCO’s Stock Price versus Peers<br />

JD, SR, AED<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1/1/2008<br />

TAQA<br />

1/22/2008<br />

2/12/2008<br />

Source: Bloomberg<br />

Saudi Electricity<br />

JEPCO<br />

3/4/2008<br />

3/25/2008<br />

4/15/2008<br />

5/6/2008<br />

5/27/2008<br />

6/17/2008<br />

7/8/2008<br />

7/29/2008<br />

8/19/2008<br />

Qatar Electricity and Water<br />

9/9/2008<br />

9/30/2008<br />

Irbid District Electricity<br />

10/21/2008<br />

11/11/2008<br />

12/2/2008<br />

12/23/2008<br />

1/13/2009<br />

2/3/2009<br />

2/24/2009<br />

3/17/2009<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

100 QR<br />

[8]

Valuation<br />

Our valuation for JEPCO is based on the Discounted Cash Flow model and the Dividend Discount Model.<br />

Jordanian Electric Power Company (JEPCO)<br />

Revenues from energy sales are expected to increase by 10% in 2009. We expect the <strong>com</strong>pany’s gross profit margin to improve along with a decline<br />

in cost of purchased power as a percent of revenues. This is due to the higher increase in tariffs to end users <strong>com</strong>pared to the increase in tariffs paid<br />

to NEPCO. The <strong>com</strong>pany’s capital is expected to be JD 80 million for 2009, and will gradually increase to reach JD 100 million in 2011.<br />

Capital expenditure stood at JD 19 million in 2004 and JD 22 million in 2005. There was a significant increase in CAPEX in 2006, along with the<br />

increase in construction projects. CAPEX reached JD 43.4 million in 2006 and JD 50.36 million in 2007. Due to the decline in real estate projects as a<br />

result of the current financial crisis, CAPEX is expected to go back to JD 25 million levels between 2009 and 2013. The <strong>com</strong>pany obtained a 3 year<br />

JD 15 million loan in 2008.<br />

The <strong>com</strong>pany had previously received a claim from the sales tax department for JD 7,343,070, with twice the amount as a fine (JD 14,686,141). The<br />

<strong>com</strong>pany objected and the case was brought to courts. So far the case is in favor of JOEP. The <strong>com</strong>pany received an adjusted sales tax claim, which is<br />

91% below the original value of the claim. The adjusted claim is JD 627,768, in addition to twice the amount as a fine (JD 1,255,536).<br />

Based on the Discounted Cash flow model, the long term fair of JOEP is JD 3.79. This is based on a cost of equity of 11%, weighted average cost of<br />

capital of 9% and terminal growth rate of 3%. The Dividend Discount Model yielded JD 1.5 per share. Applying a weight of 70% to the DCF model and<br />

30% to the DDM model, we obtained a weighted fair value of JD 3.11. This is 2.3% below the share price on March 19, 2009, which closed at JD 3.18.<br />

The share price is subject to potential dilution, given the up<strong>com</strong>ing stock dividend which is expected to be approved during the General Assembly<br />

meeting which will be held on April 29, 2009.<br />

Figure 17: Valuation<br />

Model<br />

Ke = 11%, WACC = 9%, G=3%<br />

Valuation (JD) Weight<br />

Weighted<br />

Valuation (JD)<br />

DCF 3.79 70% 2.66<br />

DDM 1.50 30% 0.45<br />

Valuation Price 3.11<br />

Date 19/3/2009<br />

JEPCO’s Share Price 3.18<br />

Valuation vs Market Price %<br />

Source: <strong>Awraq</strong> <strong>Investments</strong><br />

-2.3%<br />

Figure 18: Sensitivity Analysis<br />

Terminal Growth<br />

Rate<br />

Source: <strong>Awraq</strong> <strong>Investments</strong><br />

Based on this valuation, our re<strong>com</strong>mendation for Jordanian Electric Power Company is HOLD.<br />

Weighted Valuation (70% DCF, 30% DDM)<br />

Cost of Equity 12.0% 11.0% 10.0% 9.0%<br />

4% 3.01 3.49 4.12 5.01<br />

3% 2.73 3.11 3.60 4.25<br />

2% 3.71 2.81 3.20 3.71<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[9]

Structure of the Electricity Sector in Jordan<br />

Jordanian Electric Power Company (JEPCO)<br />

The electricity sector in Jordan is divided into three main parts: Generation, Transmission, and Distribution. Electricity generation and distribution<br />

are privatized, while transmission will be kept within the government’s control.<br />

Electricity Generation<br />

• Central Electricity Generation Company (CEGCO). The <strong>com</strong>pany was privatized on October 10, 2007. The government sold 60% of its<br />

share in the <strong>com</strong>pany to Enara, a <strong>com</strong>pany established by JD Energy & Infrastructure (JDE&I), the energy investment arm of Jordan Dubai<br />

Capital.<br />

• Samra Electric Power Generation Company (SEPGCO)<br />

• Independent Power Providers<br />

Transmission<br />

National Electric Power Company (NEPCO): Is fully owned by the government. It is responsible for building, operation and maintenance of the<br />

transmission system.<br />

Distribution<br />

Three <strong>com</strong>panies are in charge of distribution:<br />

• The Jordanian Electric Power Company (JEPCO, Ticker: JOEP JR): Distributes electricity in Amman, Zarqa, Madaba, and Balqa governorates<br />

except for Central Jordan Valley. It has a 50 year concession which ends in 2012.<br />

• Irbid District Electricity Company (IDECO, Ticker: IREL JR): Distributes electricity in Irbid, Mafraq, Jarash and Ajloun, apart from Northern<br />

Jordan Valley and eastern areas. Its 50 year concession contract will end in 2011. The government sold 55.4% of its share to Kingdom<br />

Electricity Company, a <strong>com</strong>pany established by JDE&I in partnership with Privatization Holding Company (PHC, Kuwait) and United Arab<br />

Investors (Ticker: UAIC JR).<br />

• Electricity Distribution Company (EDCO): Distributes electricity in the Southern, Eastern and Jordan Valley areas. The government sold<br />

100% of its shares to Kingdom Electricity Company. This <strong>com</strong>pany is not listed on Amman stock exchange.<br />

The distribution <strong>com</strong>panies buy energy from NEPCO. JEPCO’s purchased energy increased by 15.5% in 2007 to reach 7104 GWh that year. This<br />

represents 66% of NEPCO’s total energy sales to distribution <strong>com</strong>panies in Jordan, which amounted to 10776.8 GWh. EDCO consumed 2022 GWh<br />

(18.8% of energy sales), while IDECO consumed 1649.5GWh (15% of total energy sales). NEPCO’s sales to distribution <strong>com</strong>panies <strong>com</strong>prise 91% of<br />

total energy sales. NEPCO also sells electricity to large consumers and sells electricity to Egypt.<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[10]

Figure 19: Number of Electricity Subscribers by Type of Consumption & Distribution Companies’ Market Share (2007)<br />

Distribution Company<br />

Domestic Industrial Commercial Watar<br />

Pumping<br />

Jordanian Electric Power Company (JEPCO)<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

Street<br />

Lighting<br />

Distribution<br />

Companies<br />

National Electric Power Company NEPCO 0.007 0.003<br />

Thousands<br />

0.003 0.01<br />

Jordanian Electric Power<br />

Company<br />

JEPCO 689.72 10.23 119.01 1.34 4.15 824.45<br />

Irbid District Electricity Company IDECO<br />

244.67 3.27 31.42 1.60 1.64 282.59<br />

Electricity Distribution Company EDCO 130.90 1.38 18.30 2.74 1.13 154.46<br />

Source: NEPCO<br />

Market Share<br />

Total 1065.292 14.891 168.736 5.68 6.911 0.003 1261.513<br />

JEPCO 64.7% 68.7% 70.5% 23.6% 60.0% 65.4%<br />

IDECO 23.0% 22.0% 18.6% 28.1% 23.7% 22.4%<br />

EDCO 12.3% 9.3% 10.8% 48.3% 16.3% 12.2%<br />

Total Coverage area<br />

Amman, Zarqa,<br />

Madaba, Balqa<br />

Irbid, Mafraq, Jarash,<br />

Ajloun<br />

South, East and Jordan<br />

Valley<br />

[11]

Appendix<br />

Figure 20: JEPCO’s Tariff Changes between 2004 and 2008<br />

1/1/2004 to<br />

2/4/2004<br />

3/4/2004 to<br />

31/5/2004<br />

1/6/2004 to<br />

8/7/2005<br />

Jordanian Electric Power Company (JEPCO)<br />

9/7/2005 to<br />

13/3/2008<br />

As of<br />

14/3/2008<br />

Latest<br />

increase %<br />

Increase in prices<br />

(Fils)<br />

1 Bulk Supply Tariffs<br />

Peak Load (JD/Kw/Month) 2.40 2.40 2.40 2.40 2.40 0% 0<br />

Day energy (Fils/KWh) 31.3 31.7 31.7 34.3 45.8 34% 12<br />

Night energy (Fils/KWh) 21.2 21.7 21.7 24.3 35.8 47% 12<br />

2 Retail Tariffs<br />

Domestic (Fils/ Kwh)<br />

First Block: From 1-160Kwh/Month 31.0 31.0 31.0 31.0 32.0 3% 1<br />

a. Second Block: From 161-300Kwh/Month 55.0 57.0 57.0 59.0 71.0 20% 12<br />

Third Block: From 301-500 KWh/Month 64.0 65.0 65.0 67.0 85.0 27% 18<br />

Fourth Block: More than 500 KWh/Month<br />

Falt rate Tariff for TV and Broadcasting<br />

80.0 80.0 80.0 82.0 113.0 38% 31<br />

b. stations Fils/ KWh 60.0 60.0 60.0 61.0 86.0 41% 25<br />

c. Commercial (Fils/ KWh) 62.0 62.0 62.0 63.0 86.0 37% 23<br />

d. Small Industries (Fils/ KWh)<br />

Medium industries<br />

38.0 39.0 39.0 41.0 49.0 20% 8<br />

e.<br />

Peak load (JD/Kw/Month)<br />

Day Energy (Fils/ KWh)<br />

3.1 3.1 3.1 3.1<br />

30.0<br />

3.8<br />

46.0<br />

24%<br />

53%<br />

1<br />

16<br />

Night Energy (Fils/ KWh) 20.0 36.0 80% 16<br />

g. Water Pumping (Fils/ KWh) 38.0 38.0 38.0 40.0 41.0 3% 1<br />

Hotels (Fils / KWh) * 60.0 59.0 59.0 60.0 86.0 43% 26<br />

Peak load (JD/ KW/Month)<br />

3.1 3.1 3.8 24% 1<br />

Day Energy (Fils/ KWh) 55.0 56.0 81.0 45% 25<br />

h. Night Energy (Fils /KWh)<br />

44.0 45.0 70.0 56% 25<br />

i. Street Lighting (Fils / KWh) |** 25.0 27.0 27.0 30.0 51.0 70% 21<br />

j. Armed Forces (Fils/ KWh) 67.0 67.0 67.0 67.0 81.0 21% 14<br />

k. Ports Corporation (Fils/ Kwh) 44.6 44.6 44.6 58.0 30% 13<br />

Average<br />

Notes<br />

Monthly Minimum Charge<br />

42.5 43.0 41.6 41.1 55.4 34% 14<br />

a. Domestic (JD/ Month) 1.0 1.0 1.0 1.0 1.0 0% 0<br />

b. Other Consumers (JD / Month) 1.3 1.3 1.3 1.3 1.3 0% 0<br />

* The 5 & 4 Star Hotels can choose between 3 categories tariff or continue using the Flat rate tariff<br />

** Applied for Consumption which Exceeds the Average Level of 1988 Consumption<br />

Source: NEPCO<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[12]

Figure 21: Wholesale Electricity Tariffs paid by JEPCO to NEPCO<br />

Electric utility<br />

<strong>com</strong>panies<br />

2003<br />

9/7/2005-<br />

30/6/2007<br />

Starting<br />

1/7/2007<br />

Latest<br />

increase %<br />

Latest<br />

increase (Fils)<br />

A1: Maximum load JD/KW/month 2.40 2.40 2.40 0.0% 0.00<br />

A2: Day supply Fils/Kwh 31.40 34.30 35.41 3.2% 1.11<br />

A3: Night supply<br />

Source: JEPCO<br />

Fils/Kwh 21.40 24.25 25.36 4.6% 1.11<br />

Jordanian Electric Power Company (JEPCO)<br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[13]

Disclaimer<br />

Jordanian Electric Power Company (JEPCO)<br />

<strong>Awraq</strong> <strong>Investments</strong> and its affiliates obtain information from sources they believe to be reliable, but do not warrant its accuracy or fitness for<br />

a particular purpose, and disclaim for themselves and their information providers all liability arising from the use.<br />

The Information in this publication is provided in good faith for informational purposes only. The information provided is not offered as tax,<br />

legal, or investment advice, or an offer to buy or sell securities or otherwise. The information provided in this publication may be displayed<br />

and printed for your personal, non-<strong>com</strong>mercial use only. You may not reproduce, re-transmit, distribute, disseminate, sell, publish, broadcast,<br />

or circulate the information in any form or media to anyone, without the expressed written consent of <strong>Awraq</strong> <strong>Investments</strong>.<br />

<strong>Awraq</strong> <strong>Investments</strong> is not liable for any loss resulting from any action taken or reliance made by any person on any information or material<br />

posted by it. You should make your own inquiries and seek independent advice from relevant industry professionals before acting or relying<br />

on any information or material made available to you in this publication. You rely on this information at your own risk.<br />

<strong>Awraq</strong> <strong>Investments</strong>, its subsidiaries, parent, and/or any connected parties, may act or trade and/or enter into any transaction that maybe<br />

inconsistent or disregard any information contained herein.<br />

Source: <strong>Awraq</strong> <strong>Investments</strong><br />

<strong>Awraq</strong> <strong>Investments</strong> <strong>www</strong>.<strong>awraq</strong>.<strong>com</strong> <strong>Tel</strong>: <strong>962</strong> 6 <strong>550</strong> 3803 Fax: <strong>962</strong> 6 <strong>550</strong> 3801 Toll Free: 080022248 P.O. Box 925102 Amman 11110 Jordan<br />

[14]