Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

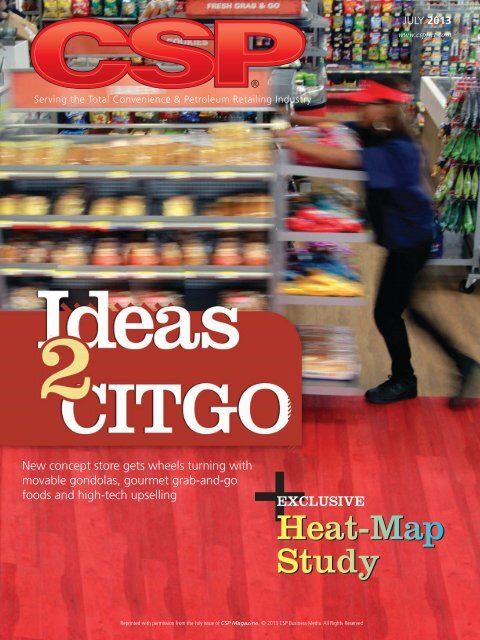

<strong>Ideas</strong>New concept store gets wheelsturning with movable gondolas,gourmet grab-and-go foodsand high-tech upsellingBy Angel Abcede || aabcede@cspnet.comPhotos by Richard Carlson2.3.1.

4.5.From shelves on wheelsto vaulted ceilings andpolyurethane signs onsliding tracks, everythingin <strong>CITGO</strong>’s new conceptstore exudes motion—the sense thatnothing’s set in stone, that everythingfrom floor plan to merchandise mixis in flux.That’s the lab mentality folkswith the Houston-based refiner andfuel supplier want its newly opened,4,500-square-foot facility to have, avibe of testing and ideation. Touchscreensurveys rate customer service. Ahappy-face scale device puts all aspectsof the store up for benchmarking andanalysis, from bathroom cleanliness toespresso barista and hot-dog condiments.“Some of our competitors are steppingaway from retail while we’re stillfocusing on the independent storeoperator. … They have to differentiatethemselves, and we want to help,” saysAlan Flagg, general manager of lightoils marketing for <strong>CITGO</strong>. “This storecreates sizzle and excitement aroundthe brand.”CSP magazine took an exclusive,firsthand look at the oil company’sRetail Concept Center just threemonths after the store’s opening,wanting a better understanding ofits intent and ultimately its potentialwhile reconnecting with a companyexperiencing what some are calling abrand rebirth.The past three years for <strong>CITGO</strong>have been exceptional. For example,fuel volume through May of this yearis up 2.4% compared with the sametime last year even as the industryexperienced falling demand, Flagg says.6.7.8.1. Alan Flagg in the Retail Concept Center2. Gondolas on wheels3. Happy-sad testing devices4. Foodservice mix of upscale and everyday5. Jonathan Watson at the recycling center and“superhero wall”6. Even more gondolas on wheels7. Upselling technology8. Outdoor seating space

<strong>CITGO</strong> bythe Numbers1 vs. 6,000The number of concept stores plannedvs. the number of stores it supplies.0 vs. 48The number of terminals most oilcompanies own today vs. how many<strong>CITGO</strong> retains.2,500 vs. 4,500The amount of square footage a typical<strong>CITGO</strong> retailer store has vs.the Concept Center.16; 102 feetby 30 feetThe number of fueling positions at theConcept Center and the dimensionsof its canopy.2 acresThe amount of land the Concept Centeris built on, enough to expand withconcepts such as car washes, officials say.$461 millionThe record dividend <strong>CITGO</strong> paid to itsparent company in the first quarter of 2013.With the capacity to produce 17 milliongallons of gasoline per day through threeU.S. refineries, <strong>CITGO</strong>, supplier of about6,000 sites East of the Rockies, posted arecord quarterly dividend of $461 millionto its parent, Petróleos de Venezuela S.A.(PDVSA), in the first quarter of 2013.“We keep innovating to fuel ourgrowth smartly,” Flagg says. For <strong>CITGO</strong>,that means a 27-state distribution footprint,charting southeast Texas, movingnorth through Chicago and into Wisconsin,jumping to New England andthen South again with densities in theCarolinas, Georgia and Florida. Amidthat broad landscape, he sees growth withnew-to-the-market customers, currentmarketers seeking to expand, operatorsready to switch brands and former customersreturning to <strong>CITGO</strong>.The Retail Concept Center is a steptoward that larger promise. It’s a nod tothe networks of independent retailersthat <strong>CITGO</strong>’s lineup of wholesale marketersmust keep vital. It’s an acknowledgmentthat the c-store channel ischanging quickly, leaving no room forthe idle or uninspired. It’s an exclamationthat for a company leashed exclusively tofuel marketers, this major oil must focusnot only on forecourt and marketing programs,but also on backcourt conceptsand solutions.“In the last two to three years, a bigpart of our message to marketers to taketo retailers is that we have to elevate ourperformance,” Flagg says. “The industryhas done a great job of raising consumerexpectations. If we’re going to play, wehave to elevate [our locations].”Sparking <strong>Ideas</strong>If elevating an entire network is the goal,<strong>CITGO</strong>’s hands-off, supply-only modelcreates a challenge. The oil company can’tforce one definitive path, or even pushbest practices down through the chain. Ithas to convince distributors who in turnmust inspire retailers one, two or threestores at a time.Put simply, this impressive store inHouston is a true one of a kind, unlikelyto be replicated. Unlike ExxonMobil’sOn the Run or Chevron’s ExtraMileretail concepts, this store will not bestamped across <strong>CITGO</strong>’s markets.<strong>CITGO</strong> is emphatic it will not dictate

to its fuel marketers the cloning of itsgroundbreaking concept.Rather, the Concept Center is CIT-GO’s path of least resistance: an unbiased,in-the-trenches laboratory for new andemerging products, concepts and tactics.And that is because, unlike its Big Oilbrethren, <strong>CITGO</strong> has no interest in owningor operating stores, or giving ordersto its field of fuel marketers and dealerson how they should run their sites.With that premise in mind, <strong>CITGO</strong>project developers, including Jim Cox,manager of retail development andoperations, and Jonathan Watson, managerof business services and paymentcards, set an agenda of specific conceptsto test in the store’s initial incarnationand another set of near-term projects.Here’s a quick rundown based on threestore-level functions:▶ Operations. These include productgondolas on wheels, store tablets foremployee applications, Web-based trainingand Web-hosted time cards.▶ Merchandising. Finding optimalpricing spreads for retail fuel postings,two-tiered pricing, commissary deli itemsand white wine sales from the beer andwine cave.▶ Marketing. A recycle center, hightechupselling and electronic signage setup to drive sales.Future projects include mobile cashregisters, day-part fuel pricing, productvending at the pump, mobile apps andsocial media.“We don’t have all the answers,” Watsonsays. “But we’ve created a forum, acatalyst for discussion and the sharing oflessons learned.”More than a dozen marketers havetoured the facility since its opening inthe spring, Watson and Cox say, with theformat sparking valuable insights.Cox freely admits that some of theirbetter ideas were unintentional. Forinstance, the wheels on all the shelvinggondolas were fitted so <strong>CITGO</strong> couldeasily move displays—partly to test newmerchandising strategies, but also for thesimple logistics of easily switching thingsaround. A marketer offered Cox therevelation that the wheels would makecleaning tile floors easier, potentially savingthe marketer hundreds in quarterlymaintenance. (Indeed, on the day of our“The challenge is ... thatyou become one of thewinners. What do youhave to do to put yourselfin that category?”visit, CSP editors changed the positioningof the store’s healthy snacks to give thearea a stronger facing from the checkoutqueue.)The store is also an opportunity formarketers and retailers to test things theycouldn’t afford to pilot otherwise. Forexample, the technology for upsellingat the site can cost $2,500 per register.“Here,” Watson says, “we can test it inan unbiased way and offer our opinion,without a retailer having to pay.”<strong>Store</strong> TourThere’s something to be said about havinga hands-on environment in whichto watch and learn. As ordinary customerscasually walk about the store, visitingmarketers and retailers can observebehavior, see state-of-the-art technologyin action, listen to concept designers andbounce around ideas.And unlike the myriad retail formats

pushed over the past three decades frommajor oil companies, <strong>CITGO</strong> has noincentive to push anything a <strong>CITGO</strong>brandedmarketer or retailer would resist.In its current iteration, the store tourstarts with a “superhero wall” for recycling,visually and literally designed topraise and encourage everyone to putpaper and plastic refuse into specifiedslots. The design is elegant and seamlesslyties to a white-sheen counter wherecustomers can eat, chill and/or rechargetheir smartphones or laptops.Opposite that wall is another graphicallythought-out wall featuring <strong>CITGO</strong>’s“Fueling Good” campaign. Companiestoday have to stand for somethingmeaningful, says Jennifer Moos, generalmanager of brand development for<strong>CITGO</strong>. As an oil company that workswith independent marketers and retailers,focusing on serving local communities isa natural fit. In its fifth year, the FuelingGood campaign promotes local heroesand how they are doing good in theirneighborhoods through events, socialmedia and commercials.“Fueling Good is more than our tagline,” Moos says. “It’s the philosophy atthe heart of our brand.”Past the Fueling Good seating area arethe restrooms, which feature touch-freesinks and hand dryers. Fixtures are boltedto the wall and raised so staff can easilyclean floors. Cox says initial customersurveys averaged cleanliness ratings inthe high 70s, which wasn’t good enough.Using reports from Happy or Not SurveyInc.’s devices, <strong>CITGO</strong> identified day-partsand specific employees to target for additionaltraining. The effort led to today’sratings of more than 90%.Back to the front of the store, pointof-sale(POS) registers have LIFT technologyfrom VeriFone, San Jose, Calif.,that features customer-facing touch[Suppliers] have todo things to help[marketers] pump up thevolume. … Everyone isrecognizing that now.”screens as well as screens for cashiers. Ascashiers scan items, a promotion or upsellopportunity appears on the customerscreens. At the same time, a scriptedmessage appears before the cashier. If acustomer agrees, the upsell gets addedto the transaction. The solution also askscustomers to rate the service, allowing forfeedback on employees.Past the snacks-and-candy set onmodular racks are more than a dozencooler doors showcased with LED lighting.Watson says people ask him howthey “get their bottles to shine,” which heattributes to that technology.Above the coolers, 4-foot-by-5-footpolyurethane panels set on movabletracks in the ceiling call attention to variousc-store categories, alongside blankcolored panels that add visual appeal. Theidea is to eventually sell the blank spacesto vendors.Many categories feature a mix ofboth value-priced and higher-endoptions, from ice cream in the coolersto chips and a special modular gondolafor gourmet grab-and-go sandwiches.The trick, depending on the category, isto provide the right local brand, whetherthat product is on the higher or lowerend, Cox says.Even its popular roller-grill stationoffers high-end Ball Park sausages alongsidea regular hot-dog selection, with aspecial condiment presentation on parwith dine-in restaurants. The condiments,says Cox, reflect a Southwesternflavor profile, determined through localconsumer studies.The tour ends with a “gold” standardcoffee offer from vendor Distant Lands,which features both richer and lighterblends but at a price point much lowerthan that of high-end coffee shops; it isbacked by a story via flat-screen TV ofhow the beans were picked, roasted anddistributed. Again, the idea is to raise thequality of the c-store offer and engagethe consumer, while not alienating theregular coffee drinker.That brings the tour back to the register,where a trained barista mans thestore’s espresso area. Cox readily admitsthat its separation from the coffee barcreated a communication gap, becausesome customers don’t know the espressooption exists until they walk up to it. Butfor logistical purposes, the barista is alsoa cashier. Cox insists the format can eventuallywork, because espresso customersare not necessarily coffee-bar patrons.“The overlap is very small,” he says.Real World?For all the study and effort, findings fromthe Concept Center still represent onestore, in one demographic in Houston—specifically, a mixed, middle-income areawith commuters from more affluent suburbsdriving to the Energy Corridor’scorporate complexes.Other factors question how the Concepttransfers to real life. For instance,the Fort <strong>My</strong>ers, Fla.-based distributor ofthe store’s fresh Gourmet Classics packagedsandwiches could probably reachstores in <strong>CITGO</strong>’s Southern region, butnot farther out. Who solves the problembeyond that perimeter?Nor do concrete details exist on how

marketers and eventually independentretailers access specific programs; thereare only generalities about the potentialdiscounts they may receive by choosing aConcept Center vendor. So exactly how<strong>CITGO</strong>’s influence or potential buyingpower would affect retailers is still in development.Flagg agrees that retailers must considerthe many steps necessary for taking ideasfrom concept to reality, but he believes thatthe larger message of facilitating changeis critical. “There’s going to be winnersand losers, survivors and those who don’tsurvive as consolidation continues anddemands and expectations rise,” he says.“The challenge if you’re in a growingarea or a depressed area is that you becomeone of the winners. What do you have to doto put yourself in that category?”For Mark Maddox, vice president ofbranded marketing for distributor CaryOil Co., Cary, N.C., the Concept Center is amessage of partnership, that a fuel supplieris willing to put the time and resources intodeveloping a full-blown learning facility.<strong>CITGO</strong> declined to discuss how much itinvested, but creating a research and showroomfacility meant the final price tag wasmore than what a typical store of that sizewould cost, officials say.Maddox says it means Cary, a multibrandeddistributor supplying about500 branded stores, is ready to invest inits retailers, hinting at potential financialsupport and having created an in-houseconsultant position to facilitate retailimprovement and change.Any facility sitting on the right realestate, having the right ingress and egress,square footage and other minimal featurescan be successful, Maddox believes. “We’rewilling to bet on retailers who want toinvest the time, energy and capital,” he says.Lending has freed up since the tightfisteddays of the late 2000s, and new facesFueling Good is morethan our tag line. It’s thephilosophy at the heartof our brand.”are coming into the retail ranks with capital,be it bank-borrowed, family-backedor independently financed, Maddox says.“If you can identify people who arewilling and able, many of them just wanta trusted adviser,” he says. “If you have afuel supplier saying, ‘We’ll build a conceptstore and we’ll help you,’ that’s a powerfulmessage.”Building TrustThere’s no doubt that <strong>CITGO</strong> has spentmany years, even decades, building trustamong its distributors. So much so that<strong>CITGO</strong> repeatedly has captured PMAA’sSupplier Cup, in large part because itdid not run direct operations, funnelingnearly every gallon sold through its jobber/wholesalernetwork.“From 1995 to about 2005, supplierswere hands-on with their plans forc-stores and how they should be set upand run,” says Dan Gilligan, president ofArlington, Va.-based PMAA. Opting notto single out any particular supplier, hesays oil companies in general are changingthe character of their assistance,moving from command-and-control toadvisory positions.But <strong>CITGO</strong> from the get-go, as it were,was always focused on partnership andsupply, going to great lengths to emphasizehow the Concept Center is only a singletest and in no way a step toward buildingits own chain.Over the years, it also developed areputation of varying its contracts to bettersupport marketers in the field. “We wantto avoid being cookie-cutter,” says Flagg.“A lot of majors dropped their lines in thesand [with volume minimums], but we’vebuilt our success on being flexible withcustomers, understanding markets and,yes, recognizing higher quality standardsbut knowing they’re not the same in everymarket.”Maintaining trust over the years hasbeen a focus for the company. “Trust is abig deal in our business,” Flagg says. “Wewant to offer good business, business thatwe can sustain going forward.” In 2006,<strong>CITGO</strong> made the decision to pull out of10 Midwest states, deciding it was betteroff basing its supply around its threerefineries (one each in Illinois, Louisianaand Texas) and network of companyownedterminals.In the years since, the U.S.-run <strong>CITGO</strong>had flown under the radar, becoming oneof Venezuela’s greatest assets, according toTom Kloza, chief oil analyst for GasBuddyand OPIS, Gaithersburg, Md. It has doneso by staying independent.“The tendency is to believe thatPDVSA just wanted to force-feed itscrude [to <strong>CITGO</strong>]. That’s not the case,”Kloza says. <strong>CITGO</strong> is “diversified in whatthey run, taking advantage of NorthDakota [supply] … Eagle Ford shale. …They’re the beneficiaries of some of thecheapest sweet crude.”Its supply-chain flexibility is an

important tool,especially as pressuresbuild for fuelbrands to retainand grow theirdistributor base.One such pressurecomes from renewableidentificationnumbers (RINs),or what refinershave to pay for if they don’t sell the proper amount of environmentallyregulated product. For many, that means selling asmuch branded product as possible, Kloza says.It’s a pressure all refiners feel, with many creating new fuelrelatedprograms such as gas-for-groceries loyalty offers, all inan effort to differentiate themselves and grow a distributor base.<strong>CITGO</strong> also has a loyalty strategy, offering the choice of fourproviders and up to $2,000 in startup assistance.Flagg agrees that <strong>CITGO</strong> is positioned to remain competitivein the current market environment, including RINs, andthat competing fuelsuppliers are doingall they can to buildtheir businesses. Hestill believes in thecompany’s currentstrategies—eventhe retention of itsnetwork of ownedand operated terminals.Kloza says thecompany is ananomaly in thatcompetitors havesold off those assets. Again, Flagg says the company believes inits current go-to-market tactics and has the profits to prove it.Fuel suppliers “need loyal marketers,” Kloza says. “They haveto do things to help them pump up the volume and help themprosper. Everyone is recognizing that now.”Brand RebirthFor <strong>CITGO</strong>, the introspection occurred back in 2006 with itsmarket retrenchment, a jettisoning that initially cast somedoubts on <strong>CITGO</strong>’s long-term viability as a prominent brandbut ultimately fine-tuned the company’s current market strategy.“That’s when we realized what we could do best, what we weregood at,” Flagg says.Discussions from that time on focused on the future andhow to re-energize the brand. As a result, its Centennial Imagedebuted three years ago, bringing to market a cleaner, bolderlook. “We’ve heard of 3% to 5% to 7% lifts in volume [for marketers],depending on who you talk to,” Flagg says.That momentum led to the building of the Concept Center,the result of brainstorming sessions during its marketer councilmeetings. Participants deemed the idea “brilliant,” with corporateeventually giving it the green light. Building began last year, andthe facility opened in March.With many oil companies having completed their retail exits,efforts to help but not command retailers are going to keepcoming, predicts Gilligan of PMAA.“Branded fuel suppliers are doing everything they can tomake retail outlets more efficient and attractive,” he says. “So ifthey can come up with designs implemented in an affordableway that helps the c-store owner and independent retailer, they’lldo it in a heartbeat.”■