Warmest thoughts and best wishes for a wonderful holiday season ...

Warmest thoughts and best wishes for a wonderful holiday season ...

Warmest thoughts and best wishes for a wonderful holiday season ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

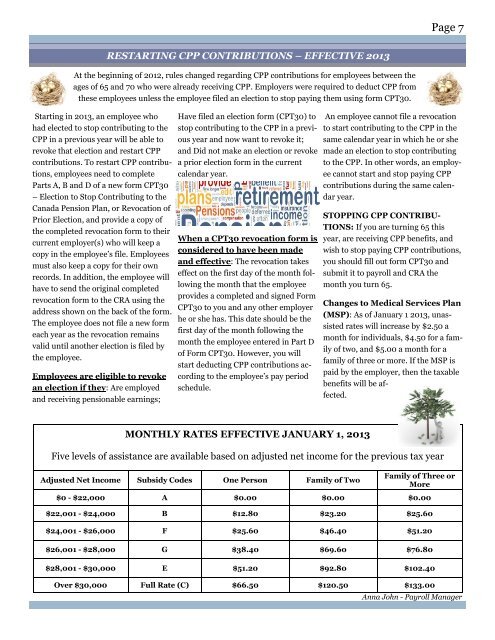

Page 7RESTARTING CPP CONTRIBUTIONS – EFFECTIVE 2013At the beginning of 2012, rules changed regarding CPP contributions <strong>for</strong> employees between theages of 65 <strong>and</strong> 70 who were already receiving CPP. Employers were required to deduct CPP fromthese employees unless the employee filed an election to stop paying them using <strong>for</strong>m CPT30.Starting in 2013, an employee whohad elected to stop contributing to theCPP in a previous year will be able torevoke that election <strong>and</strong> restart CPPcontributions. To restart CPP contributions,employees need to completeParts A, B <strong>and</strong> D of a new <strong>for</strong>m CPT30– Election to Stop Contributing to theCanada Pension Plan, or Revocation ofPrior Election, <strong>and</strong> provide a copy ofthe completed revocation <strong>for</strong>m to theircurrent employer(s) who will keep acopy in the employee’s file. Employeesmust also keep a copy <strong>for</strong> their ownrecords. In addition, the employee willhave to send the original completedrevocation <strong>for</strong>m to the CRA using theaddress shown on the back of the <strong>for</strong>m.The employee does not file a new <strong>for</strong>meach year as the revocation remainsvalid until another election is filed bythe employee.Employees are eligible to revokean election if they: Are employed<strong>and</strong> receiving pensionable earnings;Have filed an election <strong>for</strong>m (CPT30) tostop contributing to the CPP in a previousyear <strong>and</strong> now want to revoke it;<strong>and</strong> Did not make an election or revokea prior election <strong>for</strong>m in the currentcalendar year.When a CPT30 revocation <strong>for</strong>m isconsidered to have been made<strong>and</strong> effective: The revocation takeseffect on the first day of the month followingthe month that the employeeprovides a completed <strong>and</strong> signed FormCPT30 to you <strong>and</strong> any other employerhe or she has. This date should be thefirst day of the month following themonth the employee entered in Part Dof Form CPT30. However, you willstart deducting CPP contributions accordingto the employee’s pay periodschedule.An employee cannot file a revocationto start contributing to the CPP in thesame calendar year in which he or shemade an election to stop contributingto the CPP. In other words, an employeecannot start <strong>and</strong> stop paying CPPcontributions during the same calendaryear.STOPPING CPP CONTRIBU-TIONS: If you are turning 65 thisyear, are receiving CPP benefits, <strong>and</strong>wish to stop paying CPP contributions,you should fill out <strong>for</strong>m CPT30 <strong>and</strong>submit it to payroll <strong>and</strong> CRA themonth you turn 65.Changes to Medical Services Plan(MSP): As of January 1 2013, unassistedrates will increase by $2.50 amonth <strong>for</strong> individuals, $4.50 <strong>for</strong> a familyof two, <strong>and</strong> $5.00 a month <strong>for</strong> afamily of three or more. If the MSP ispaid by the employer, then the taxablebenefits will be affected.MONTHLY RATES EFFECTIVE JANUARY 1, 2013Five levels of assistance are available based on adjusted net income <strong>for</strong> the previous tax yearAdjusted Net Income Subsidy Codes One Person Family of TwoFamily of Three orMore$0 - $22,000 A $0.00 $0.00 $0.00$22,001 - $24,000 B $12.80 $23.20 $25.60$24,001 - $26,000 F $25.60 $46.40 $51.20$26,001 - $28,000 G $38.40 $69.60 $76.80$28,001 - $30,000 E $51.20 $92.80 $102.40Over $30,000 Full Rate (C) $66.50 $120.50 $133.00Anna John - Payroll Manager