Ober-Haus Real Estate Annual Market Report 2013 Poland

Ober-Haus Real Estate Annual Market Report 2013 Poland

Ober-Haus Real Estate Annual Market Report 2013 Poland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

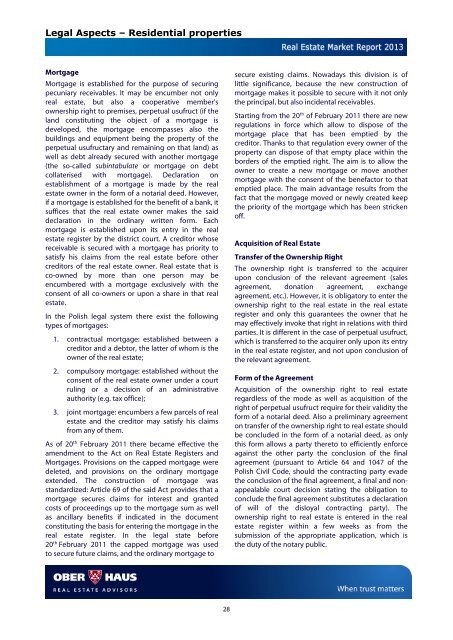

Legal Aspects – Residential propertiesMortgageMortgage is established for the purpose of securingpecuniary receivables. It may be encumber not onlyreal estate, but also a cooperative member'sownership right to premises, perpetual usufruct (if theland constituting the object of a mortgage isdeveloped, the mortgage encompasses also thebuildings and equipment being the property of theperpetual usufructary and remaining on that land) aswell as debt already secured with another mortgage(the so-called subintabulate or mortgage on debtcollaterised with mortgage). Declaration onestablishment of a mortgage is made by the realestate owner in the form of a notarial deed. However,if a mortgage is established for the benefit of a bank, itsuffices that the real estate owner makes the saiddeclaration in the ordinary written form. Eachmortgage is established upon its entry in the realestate register by the district court. A creditor whosereceivable is secured with a mortgage has priority tosatisfy his claims from the real estate before othercreditors of the real estate owner. <strong>Real</strong> estate that isco-owned by more than one person may beencumbered with a mortgage exclusively with theconsent of all co-owners or upon a share in that realestate.In the Polish legal system there exist the followingtypes of mortgages:1. contractual mortgage: established between acreditor and a debtor, the latter of whom is theowner of the real estate;2. compulsory mortgage: established without theconsent of the real estate owner under a courtruling or a decision of an administrativeauthority (e.g. tax office);3. joint mortgage: encumbers a few parcels of realestate and the creditor may satisfy his claimsfrom any of them.As of 20 th February 2011 there became effective theamendment to the Act on <strong>Real</strong> <strong>Estate</strong> Registers andMortgages. Provisions on the capped mortgage weredeleted, and provisions on the ordinary mortgageextended. The construction of mortgage wasstandardized: Article 69 of the said Act provides that amortgage secures claims for interest and grantedcosts of proceedings up to the mortgage sum as wellas ancillary benefits if indicated in the documentconstituting the basis for entering the mortgage in thereal estate register. In the legal state before20 th February 2011 the capped mortgage was usedto secure future claims, and the ordinary mortgage tosecure existing claims. Nowadays this division is oflittle significance, because the new construction ofmortgage makes it possible to secure with it not onlythe principal, but also incidental receivables.Starting from the 20 th of February 2011 there are newregulations in force which allow to dispose of themortgage place that has been emptied by thecreditor. Thanks to that regulation every owner of theproperty can dispose of that empty place within theborders of the emptied right. The aim is to allow theowner to create a new mortgage or move anothermortgage with the consent of the benefactor to thatemptied place. The main advantage results from thefact that the mortgage moved or newly created keepthe priority of the mortgage which has been strickenoff.Acquisition of <strong>Real</strong> <strong>Estate</strong>Transfer of the Ownership RightThe ownership right is transferred to the acquirerupon conclusion of the relevant agreement (salesagreement, donation agreement, exchangeagreement, etc.). However, it is obligatory to enter theownership right to the real estate in the real estateregister and only this guarantees the owner that hemay effectively invoke that right in relations with thirdparties. It is different in the case of perpetual usufruct,which is transferred to the acquirer only upon its entryin the real estate register, and not upon conclusion ofthe relevant agreement.Form of the AgreementAcquisition of the ownership right to real estateregardless of the mode as well as acquisition of theright of perpetual usufruct require for their validity theform of a notarial deed. Also a preliminary agreementon transfer of the ownership right to real estate shouldbe concluded in the form of a notarial deed, as onlythis form allows a party thereto to efficiently enforceagainst the other party the conclusion of the finalagreement (pursuant to Article 64 and 1047 of thePolish Civil Code, should the contracting party evadethe conclusion of the final agreement, a final and nonappealablecourt decision stating the obligation toconclude the final agreement substitutes a declarationof will of the disloyal contracting party). Theownership right to real estate is entered in the realestate register within a few weeks as from thesubmission of the appropriate application, which isthe duty of the notary public.28